Let us make an in-depth study of the Keynes’s Investment Multiplier:- 1. Meaning and Development of the Concept 2. Relationship between the Multiplier and the MPC 3. Working of the Multiplier 4. Reverse Operation of the Multiplier 5. Limitations and Qualifications of the Investment Multiplier 6. Multiplier Assumptions 7. Importance of the Concept of Multiplier and Others.

Meaning and Development of the Concept:

The concept of ‘Multiplier’ occupies an important place in Keynesian theory of income output and employment. It is an important tool of income propagation and business cycle analysis. Keynes believed that an initial increment in investment increase the final increase in investment and the final increase in aggregate income Keynes gave the name of ‘Investment Multiplier’, also called ‘Income Multiplier’ by others.

The idea of multiplier originated in an explanation of the favourable effects of investment on total employment buy it has become part and parcel of the Keynesian theory’ of income and employment. Keynes adopted the notion of multiplier, an idea borrowed from R.F. Kahn, for income analysis. R.F. Kahn had, through multiplier, traced the effect of an increase in investment on employment on employment.

Keynes converted this into an income multiplier designed to show the relationship of a small increase in investment to cause a much larger increase in income. The multiplier mechanism suggested that heavy spending-by government, business or consumers- would have a salutary impact on the expansion of national income.

ADVERTISEMENTS:

It is very closely connected with the concept of Marginal Propensity to Consume. It is considered as one of Keynes’ path-breaking contributions. As a matter of fact, Keynes’ investment multiplier is a modification of Kahn’s ’employment multiplier’.

Keynes’ multiplier is the ratio of the total change in income to the initial change in investment. In other words, it is the ratio expressing the quantitative relationship between the increase in national income and the increase in investment which induces the rise in income.

Arithmetically, this relationship is expressed as:

∆Y=K.∆ I

ADVERTISEMENTS:

where ∆ (delta) stands for increases or changes, Y for national income, K for Multiplier and/for investment. Therefore, we get K-∆Y/∆I, i.e., K (multiplier) is equal to the ratio of the increase in income to the increase in investment which is responsible for the rise in income. Thus, if investment in the economy increases by Rs. 1 crore and the national income rises by Rs. 3 crores as a result, then the multiplier is 3.

Relationship between the Multiplier and the MPC:

The value of multiplier is, in fact, determined by the marginal propensity to consume. The multiplier is large or small according as the marginal propensity to consume is large or small. Theoretically, the values of the multiplier can range all the way from one to infinity. It can never be one because consumption always increases when income increases (i.e., MPC, is never zero).

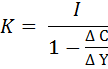

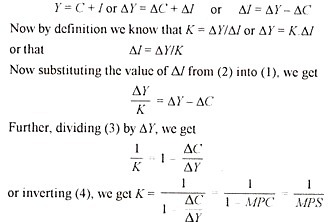

Further, multiplier can never be equal to infinity if Keynes’ assumption of the MPC being less than unity is valid. Actual value of the multiplier varies from 2 to 4, according to the different estimates made from time to time. The general formula which Keynes had written for the multiplier is:

where K stands for multiplier and (1 – ∆C/∆Y) for the marginal propensity to save. In other words, the multiplier is the reciprocal of the marginal propensity to save. This formula for the calculation of the value of multiplier is derived as follows.

From this formula we can compute the various values of the multiplier corresponding to various ‘MPCs as follows:

Working of the Multiplier:

Multiplier is the mechanism through which income gets propagated as a result of added investment. How a new investment brings about a multiple increase in income by increasing consumption, is clear from the following example. This example gives us what may be described as a ‘motion picture’ of income propagation under certain assumptions. Assuming the marginal propensity to consume as 1/2, let us suppose further that there is an investment of Rs. 20 crores in public works. The MPC being 1/2 (multiplier) will be 2 [1/1 ½].

An investment of Rs. 20 crores will increase the total income by Rs. 40 crores. When an original investment of Rs. 20 crores is made, half of it will be spent on consumption by the income recipients (because MPC = y , Rs. 10 crores out of Rs. 20 crores will be spent on consumption in the first round).

In the second round, income shall increase by Rs. 10 crores ; in the third round, income shall expand by Rs. 5 crores ; in the fourth by Rs. 2.5 crores in fifth by Rs. 1.25 crores ; and so on, till it has increased to Rs. 40 crores i.e., 2 times the original investment. Thus, we note that there is an infinite geometric series of the descending variety, viz. Rs. 20 cr. + Rs. 10 cr. + Rs. 5 Cr. +2.5 Cr. + Rs. 1.25 cr……. and soon, adding up to Rs. 40 crores. We see that the multiplier is equal to the ratio of the increase in income to the increase in investment, i.e., Rs. 40 cr. + 20 cr. = 2. In this way, multiplier is having the value 2.

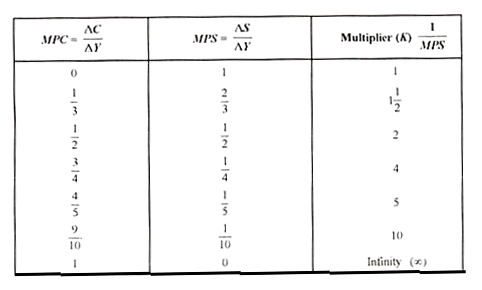

It may, however, be noted that the whole process of income expansion is spread over time as income does not increase to Rs. 40 crores all at once in a single jump. Keynes, however, did not give much importance to time lags involved in the process of income generation. The multiplier effects of investment on income are shown below in the form of a diagram.

ADVERTISEMENTS:

In this figure, consumption curve CC is drawn according to the MPC being less than one. E1Y1 gives us the equilibrium level of income since C +1 curve intersects the 40° line at the point E1. Let us suppose that for one reason or the other, investment rise from C + I to C + I + ∆I. The new curve C +1 + ∆I, intersects the 45° line at E2. E2Y2 gives us the new level of income at Y1Y2. This is greater than the vertical distance between C +I and C + I + ∆I curves.

Reverse Operation of the Multiplier:

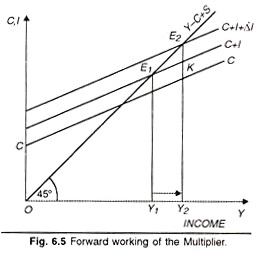

Multiplier is a double-edged weapon. It works in the backward direction as much as in the forward direction. The process of income propagation through the multiplier docs not work in the forward direction only. It is a double edged weapon. It works to decrease income in the case of a fall in income as quickly as it increases income in case of a rise in income. It works in the reverse direction or forward direction depending upon the direction of the initial change in investment.

We can illustrate the reverse operation of the multiplier graphically. Let us assume that MPC = 0.5. Suppose, investment decreases by Rs. 20 crores, there will be a reduction in income to the extent of Rs. 40 crorcs (MPC = ½ and K=2). The higher the MPC the greater the value of the multiplier and the greater the cumulative decline in income.

ADVERTISEMENTS:

In other words, a community with a high propensity to save is affected less by the reverse operation of the multiplier than the one with a low propensity to save. A high multiplier would cause greater jerks and shocking declines of income whenever investment falls. But there is one redeeming feature in the MPC being less than one the multiplier is not infinite. Otherwise there would not have been a limit to the fall in income with a decline in investment.

In figure 6.6, the initial equilibrium is shown at point E1 with a level of income OY1. Let investment fall by ∆I so that the total expenditure curve conies down by the distance ∆I(E1K). The new expenditure line C + I = ∆I intersects the 45° line at the point E2 and the level of income falls to OY2. The decrease in income is more than the decrease in investment. Just as consumers do not spend the full increment of income on consumption, similarly they do not curtail expenditure on consumption by the full extent of the decrement of income. The reverse operation of multiplier is shown in the diagram given below.

Limitations and Qualifications of the Investment Multiplier:

1. Availability of Desired Consumer Goods:

The process of income generation is workable subject to the availability of consumer goods. If, with a rise in income the desired types of consumer goods are available in sufficient quantity, the process of income generation would be working and multiplier will have a high value. If, however, there is a shortage of consumption goods, income recipients will not be able to spend the additions to their income on consumption resulting in a decline in the MPC and hence the value of the multiplier. The value of multiplier is, thus, limited by the availability of consumption goods.

2. Maintenance of Investment:

In order to achieve a sustained rise in the income level and a high value of the increments in investment are repeated in regular time intervals then and only then can the national income be raised to multiplier level and kept or maintained there. One injection of new investment will raise the income to the multiplier level, but as soon as the multiplier effect has worked itself out, other things remaining the same, income will fall back to its original level. Only a containing and steady injection of investment will raise national income and having raised it will keep it there.

ADVERTISEMENTS:

Maintenance of investment, therefore, is essential for maintenance of income at the higher level. Extract how does the process work in the cases of once- over investment injection and a continuing investment? The process can be nicely illustrated with the help of the diagrams (Figures 6.7 and 6.8).

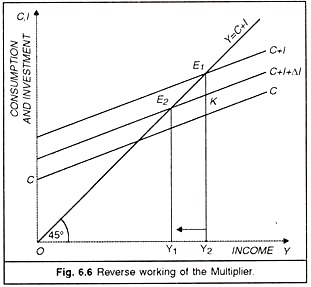

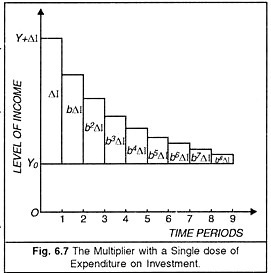

Figure 6.7 traces out the path of income when MPC = 0.75. If we increase investment by ∆I, it raises the increase in income level by ∆1 over the initial level of Y0 in the first period. This increase in income is represented by the length of the bar of period 2 which is 3/4th of the bar for Period I (b ∆ I), As this increment in income is added to the income stream, it further induces increased investment expenditures of the order of the length of the bar for Period 3 which is 3/4 of the bar for Period 2 (b2 ∆ I). In this way, every next period, the income level goes on diminishing till it is reduced to its original position of Y0.

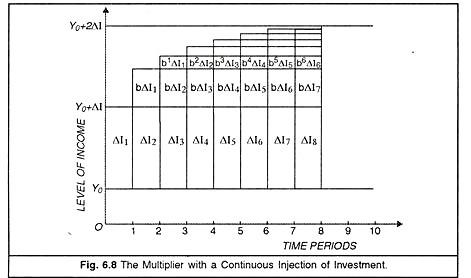

Now, if the injection of investment is continued over all time periods, then? The multiplier raises the income level according to its strength and keeps it there for the periods for which the investment continues to be repeated. Let us assume that MPC = 0.50 and an injection of ∆I is repeated over the successive periods of time. If the initial level of income is Y0, the level will be raised to Y0 + ∆I in the first period. As people’s income increases by ∆I they respond half of it (MPC = b = ½ ) which increases the income level by b∆I in the second period over and above the level Y0 + ∆I.

The income level continues to be raised up in every period by half the increment in income in the previous period but the successive additions to income go on diminishing; gradually the income level approaches its new equilibrium position Y0 + 2 ∆I.

3. No Considerations of Profit:

Multiplier includes any type of investment (public or private) but it specially applies to loan-financed public investment because. by nature, it is autonomous, i.e., it is free from the motive of profit (as is usually not the case in private investment). Since a steady injection is necessary for the multiplier to have sustained effects on income and employment during depression periods, considerations other than profit are essential to attain the unhampered operation of the multiplier.

4. Multiplier Period:

ADVERTISEMENTS:

Multiplier period presents another important qualification to the simple working of the multiplier; lapse of time between successive expenditures on consumption may be called the multiplier period. In other words, it is the period during which the receipt of new income includes secondary expenditures on consumption. It has been seen that there is a time lag (interval) between the receipt of income and the spending of it, and also between the spending and its reappearance as income.

Consumers receive additional income but do not re-spend it immediately. The lag, however, is fairly short. If we want to know the effect of an increase in investment on the national income, we have to turn to the multiplier period. The greater the length of this period, the fewer is the secondary expenditures on consumption and the smaller is value of multiplier and vice-versa.

5. Direction of Net Investment:

It is clear that whenever we speak of the multiplier effect on income as a result of changes in investment, we always mean net investment. It, therefore, follows that we must be sure that any act of investment in one sector of the economy is not offset by a decline in investment in some other sector of the economy. This is called “crowding out” of investment. If this happens the multiplier effects would be impaired because a decline in investment in some other sector may result in greater decline of national income. Therefore, the direction of net investment becomes very important in determining the value of multiplier.

6. Full-Employment Ceiling:

The working of the multiplier is further restricted by the limitation provided by the full employment ceiling. The output, income and employment will expand as a result of multiplier as long as there are unemployed resources in the economy and full employment level is not reached. But once the full employment level has been attained, output and employment will stop expanding, however high the MPC may be. The multiplier will then work to increase price level only.

7. Effect of Induced Consumption on Investment:

(Acceleration Effect). Multiplier is concerned with the effects of original investment on consumption and on investment and hence on income. It does not deal with the subsequent effect of increased consumption on investment.

ADVERTISEMENTS:

The value of the multiplier would be greater and achieved earlier if both the effects were to be taken into account [ i.e., of investment on consumption (Multiplier) and of consumption on investment Acceleration)]. But Keynes multiplier is concerned with the effects of investment on consumption alone and to that extent its working is restricted. In practice, multiplier works along with accelerator.

These limitations and qualifications of Keynes’ investment (income) multiplier show how imperfect and simplified the treatment of the process of income-generation was at the hands of Keynes. The simplicity of Keynes’ treatment of the multiplier raised certain doubts in the minds of some writers. As George J. Stigler has remarked, “The multiplier is the fuzziest part of his (Keynes’) General Theory.” Since then investment multiplier has been the main concept with the improvement of which economists have been preoccupied.

Multiplier Assumptions:

Since we are to examine the concept of Keynes’ multiplier in detail further, it will be helpful to remember the assumptions underlying it.

These are:

(i) That there is no change in the marginal propensity to consume during the adjustment process.

(ii) That there is no induced investment (i.e., accelerator is not operating).

ADVERTISEMENTS:

(iii) That the new, higher level of investment is maintained long enough for the completion of the adjustment process.

(iv) That the output of consumer goods is responsive to effective demand for these goods.

Importance of the Concept of Multiplier:

The introduction of multiplier analysis in income theory is one of Keynes’ path-breaking contributions in as much as it has not only enriched economic analysis but also profoundly affected economic policies. Impressed by the theoretical contribution made by the concept of Income Multiplier, Harris has remarked: “It is true that Lord Keynes did not discover the multiplier that honour belongs to Mr. R.F. Kahn. But he gave it the role it plays to-day, by transforming it from an instrument for the analysis of ‘road-building’ into one for the analysis of ‘income building’. From his own and subsequent work, we now have a theory, or at least its sound beginning, of income generation and preparation, which has magnificent sweep and simplicity. It set a fresh wind blowing through the structure of economic thought.” From the foregoing qualifications and limitations it should never be concluded that the simple concept of multiplier was of little use.

Firstly, it established the immense importance of investment as the major dynamic element in the economy. Not only did it indicate the direct creation of employment, it also revealed that income was generated throughout the system, the process working like a stone causing ripples in a lake.

Secondly on the side of practical economic policy, it is of the utmost importance because the case for public investment has all the more been strengthened by the introduction of this concept. “Investment Dollars are high powered Dollars. It tells us that a small increment in investment, leads to a large increase in investment and employment.

Thirdly, “knowledge of multiplier is of vital importance for studying the course of business-cycle and for its accurate forecasting and control.” Further, it is a useful analytical tool for following suitable employment policies.

Leakages in the Process of Working of Multiplier:

1. Saving:

Saving constitutes the most important form of leakage to the process of income propagation. If the whole of the increment in income was to be spent on consumption (i.e., if MPC were one), then “once-for-all” increase in investment would go on creating additional consumption so that full employment would be sure. This is not the case in actual practice, because a part of the increased income is not spent on consumption but saved.

ADVERTISEMENTS:

It ‘peters out’ of the income stream, thereby limiting the value of the multiplier. It fact, the whole of saving forms a sort of leakage and higher the propensity to save, the lower is the value of multiplier. Further, for various reasons these savings may not be invested and may be hoarded.

2. Debt Cancellation:

It has been observed that part of the income received by the people in the economy may be used for paying off old debts to the banks and individuals who may, in turn, fail to spend. As such consumption is not stimulated and the value of the multiplier is thereby reduced.

3. Imports:

If the increased demand for consumer goods is met by imports from other countries, part of the increased income as a result of the increased investment will go to increase income in foreign countries at least in the short period. It is argued that in the long period, the increased income in the foreign countries will go to increase the demand for the country’s exports and thus will have beneficial effects on the income of the country importing goods. But this may not be the case, as it presupposes free trade. In this way imports constitute an important leakage.

4. Price Inflation:

Price inflation constitutes another important leakage from the income stream of an economy. As long as there is unemployment of resources, increase in investment will have expansionary effects. But once full employment or near full employment of the resources has been attained, increase in investment will raise prices and the costs of the factors of production, because at this level the factors of production become scarce.

Fresh competition ensues between the consumer-goods industries and investment-goods industries for securing the scarce resources even at higher prices. Thus, as a result of price inflation a major part of the increased income is dissipated. The simple multiplier of Keynes presumes the same price level to prevail over the period of working of the multiplier.

5. Hoarding:

Hoarding or the tendency of the people to hold idle cash balances forms another leakage. If people have high liquidity preference and a tendency to keep idle cash balances they diminish their expenditure on consumption in the economy thereby restricting the value of the multiplier.

6. Purchase of old Stocks and Securities:

Sometimes, people purchase old stocks and securities with the newly created income rather than spend it on increased consumption. Some of them purchase new insurance policies. This expenditure in not immediately go to investment. The time gap between S and I is larger. Thus this type of financial investment severely restricts the value of the multiplier.

All these factors constitute potential leakages from the income stream resulting from an expansion of new investment. The new income, under such circumstances, does not give rise to secondary consumption expenditures as much as it should. It is, therefore, highly desirable that to have the desired results of multiplier, these leakages should be plugged. To the extent these leakages from the income stream can be controlled through public policy, the original increase in investment will have greater multiplier effects.

Criticism against the Concept of Multiplier:

1. Extremely Simplified Assumptions:

Criticism is levelled that Keynes’ theory of multiplier rests on the simple assumption of increases in consumption as a result of increases in income and, further, on the MPC being less than one. Actual studies show that the relationship between income and consumption is not so simple as was presumed by Keynes, nor is consumption the function of income alone.

2. Limitations and Qualifications:

Multiplier depends upon a large number of limitations and qualifications like the availability of consumer goods, maintenance of investment, direction of investment, multiplier period. It takes no account of the effect of induced consumption on investment, besides completely overlooking the time-element.

3. Neglected the Acceleration Effects:

Keynes’ logical theory of the multiplier takes into consideration the effects of increases in consumption as a result of increases in income, but it lakes no account of the effects of increase in consumption on investment (induced investment). On this ground alone, the theory has been severely criticised by D.H. Robertson, R.M. Goodwin and A.P. Lerner. These writers rightly grudge the undue importance and attention given to the multiplier, which they feel, in a way, is too bad.

4. A Mechanical Concept Superfluous to General Theory:

“Since the concept, often seems like nothing but a cheap jack way of getting something for nothing and appears to carry with it a spurious numerical accuracy.” Prof. A.G. Hart has insisted, no doubt correctly, that the multiplier concept is a useless ‘fifth wheel’. It adds nothing to the ideas or results already implied in the use of consumption function. Therefore, monetarists writers have given no placer to multiplier in their analysis of income and output fluctuations.

5. A Static and Tautological Concept:

Haberler with some justice accused Keynes of dealing in tautology when he discussed the multiplier. Tautology is the act of defining something as necessarily true, and then proclaiming as a discovery the ‘truth’ of the relationship made inevitable by the definition Hazlitt has also criticised the concept of multiplier rather bitterly.’ He calls it ‘strange concept’, a myth, much ado about nothing. He asks: “what reasons is there to suppose that there is such a thing as the multiplier?” He doubts if there could be any precise or mechanical relationship between social income, consumption, investment and extent of employment.

He called it a worthless toy made familiar by monetary cranks. According to Prof. Hutt “the conventional multiplier apparatus is rubbish and that it should be expunged from the textbooks.”

The main points of criticism against the concept of multiplier as given by Keynes can be summarised. They are that:

(i) It assumes an instantaneous relationship between income, consumption and investment; it is a timeless phenomenon;

(ii) It is of static nature which is unsuited to the changing process of the dynamic world, it fails to reckon the influence of time lags and its results are obtained only under static conditions;

(iii) That it ignores the influence of induced consumption on induced investment i.e., there is a relationship between the demand for capital goods and the demand for consumption goods, i.e., the demand for capital goods is a ‘derived demand’.

(iv) Further, its sole emphasis on consumption is also not proper. It would be more realistic to speak of a ‘marginal propensity to spend’ rather than to consume.

(v) Again, Haberler feels that this multiplier theory is an unverified hypothesis because Keynes offers no adequate proof except for a number of vague observations.

(vi) Prof. L.R. Klein has pointed out that empirical studies in respect of the behaviour of aggregate consumption in relation to aggregate income, show that actual trends in spending have a much more complicated relationship which may be non-linear and the common assumption of linear relation between aggregate consumption and aggregate income is open to question.

Nevertheless, the multiplier idea has been widely used and a whole body of literature has grown up which employs this concept. A strong defence has been put up by writers like Harrod. Hansen and Samuelson who have tried to deal with the criticism and made the whole analysis dynamic.

In the words of S.E. Harris, we may sum up the position as follows: “On the discussion of the multiplier, many economists went on fishing expeditions, though they had many bites yet they did not catch any large fish. Indeed, they have added much to Keynes’ relatively simple and unverified presentation.”