The IS-LM model finds the value of income and interest rate which simultaneously clears the goods and money market.

The interest rate and the income level should be such that both the markets are in equilibrium. The IS-LM shows the interaction between the goods and the money market.

The model finds the value of income and the interest rate which simultaneously clears the goods and the money market. It appears that the equilibrium income level cannot be determined without first knowing the rate of interest and the interest rate cannot be determined without first knowing the income level.

Therefore, a simultaneous solution is required to find the equilibrium level of income and the interest rate. This is done through the Hicksian IS-LM framework.

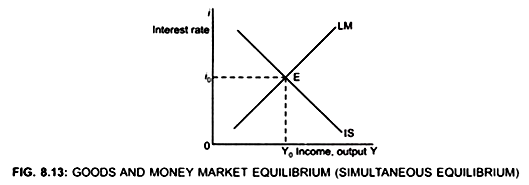

Although LM curve shows several interest rate consistent with monetary equilibrium and IS curve shows several interest rate consistent with product market equilibrium but there is only one income level and interest rate at which both product and money market is in equilibrium. This is at point E. Since at point E (Fig. 8.13).

(i) Actual expenditure = Planned expenditure

Or

ADVERTISEMENTS:

I = S

and (ii) Demand for real balance = Supply of real balance,

that is: IS = LM

Therefore, at point E both the goods and money market are in equilibrium.

ADVERTISEMENTS:

Equilibrium level of income → Y0 (given the exogenous variable M/P , G, TR)

Interest rate → i0

Thus, unless both the market reach equilibrium simultaneously, general equilibrium cannot be attained. Thus, the two markets are interlinked through the variables investment and interest rate where Investment is product market variable which determines real output (income) and the interest rate is money market variable which is determined by demand and supply of money.