Monopoly is known as a great social evil because the monopolist charges high price.

Monopolist does not produce at full capacity and resorts to price discrimination.

Under this system, there is no rival competitor, and sells lesser output but earns more profit. It increases inequality of income. Thus, many steps are suggested regulating monopoly. There are three methods of controlling monopoly.

These are:

ADVERTISEMENTS:

1. By regulation through taxation.

2. By regulation of conditions of monopoly, as in case of natural and regulated monopolies (MC pricing).

3. By anti-monopoly laws and policies to prevent unfair price discrimination amongst different consumers (Peak load pricing).

Let us discuss all the three methods:

1. Regulations through Taxation:

Imposition of tax:

The Govt. can regulate monopoly through taxation. Govt. can levy a tax per unit of output (Specific Tax) or impose a lump sum tax irrespective to its output.

ADVERTISEMENTS:

1st Case: Imposition of a Specific Tax:

Specific taxes are commodity taxes like excise duty and sales tax. Excise duty are levied on production while sale tax on sales.

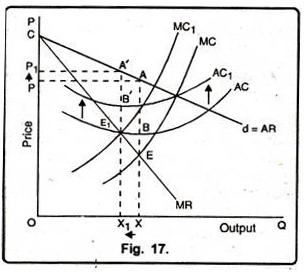

Generally, specific tax is similar to a variable cost. The effect of specific tax is show n in Figure 17; where

Point E = This is the equilibrium point before the tax is imposed. The firm produces OX units and sells at price OP. Firm cams profit of AB per unit.

AC1= After government levies a specific tax on the firm, the AC increases as shown by higher AC curve AC1.

MC1= The new MC curve after specific tax is levied

Point E1 = After tax the firm is in equilibrium at point “E1 where MR = MC1. The firm sells OX units at price OP1. The profits earned are A’B’ per unit.

The effects of a specific tax are stated below:

1. Output sold reduces.

2. Price charged increases; consumers have to share the burden of the specific tax.

3. Profit reduces.

4. To what extent, the monopolist will shift the burden of a per unit tax to the consumer. It depends on the elasticity of his supply and demand for his product.

ADVERTISEMENTS:

2nd Case: Imposition of Lump Sum Tax:

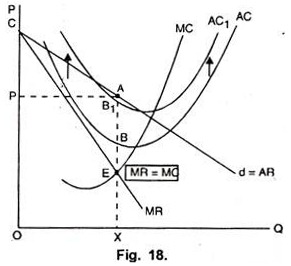

Sometimes, the government levies a lump sum tax on monopolists. A tax such as a profit

tax or license fee are imposed on a firm regardless of its level of output. It is treated as a fixed cost and hence, docs not enter the monopolist’s MC. The effect of lump sum tax is illustrated in fig. 18.

Where:

ADVERTISEMENTS:

Point E = It is the equilibrium point where MR = MC before lump sum tax is levied. The firm sells OX units at price OP. Profits are earned which are AB per unit.

AC1 = since the lump sum tax is levied on the firm irrespective of its output, its AC curve will shift upwards by the amount of the tax. AC is the new AC curve and MC curve remains the same.

Point E = The equilibrium point, after tax is levied, is the same i.e., point E. There is no difference in equilibrium price and output. But the profit has fallen from AB per unit to AB1 per unit. The effects of lump sum tax are;

(i) Output sold remains unchanged

ADVERTISEMENTS:

(ii) Price remains unchanged

(iii) Profit reduces

(iv) Incidence of a lump sum tax is completely on the sellers and the buyers will escape from the burden.

2. Marginal Cost Pricing or Price Regulation or Regulated Monopoly:

The term “public utilities” is applied to such essential services such as water supply, power supply, passenger transport facilities, communication facilities and railway facility. These services should be made available to the society at reasonable prices. Most public utility firms are natural monopolies and are also called as regulated monopolies.

Government and public authorities run these monopolies directly or impose price ceilings, which are not too low from monopoly price. This saves the consumers from having to pay high monopoly prices. This limits monopoly power. The questions that arise are What should be the fair price of natural monopolies? Should it be equal to MC or AC? How can their prices be regulated?

ADVERTISEMENTS:

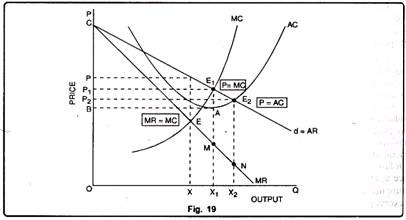

Fig. 19 illustrates the three pricing principles: the MC pricing, the AC pricing and the profit maximising pricing.

Profit-Maximising Price:

It is given by OP price which is determined by point E where MR = MC. The monopolist wants to sell OX units at price OP. The monopolist earns profit. The objective of government is to set a maximum price below the monopoly price OP.

Marginal Cost Pricing:

If the regulating authority decides to set the price of natural monopolies according to MC pricing i.e., where P = MC then it occurs at point E1, the monopolist’s demand curve becomes P1 E1d. The monopolist can sell any output up to X1 at the regulated price of P1; output greater than X1 will be sold at declining prices as shown by E1d portion of the demand curve.

The demand curve facing the monopolist has ‘a kink’ at point E; due to MC pricing rule. The corresponding marginal revenue curve is given by P1E1MN. P1E1 is the segment corresponding to P1 E1 portion of the demand curve.

MN corresponds to E1d portion of the demand curve. The kink at point E1 on the demand curve causes E1M discontinuity or vertical section of the MR curve. The monopolist sells X1 units at price P1 and earns profit. The profit earned is E1A per unit or total profit shown by the shaded rectangle P1E1AB.

Average Cost Pricing:

The regulating authority can set an even lower price equal to AC rule i.e., P = AC. This occurs at point E2. The monopolist sells OX2 units of output at priceOP2. The monopolist earns normal profits which are included in the cost structure. The economist’s opinion differs regarding whether this return is a ‘fair’ return or not. Any wrong judgment will lead to long term inefficient allocation of resources and losses. The monopolist will never increase output beyond X2, in which case he would incur losses.

ADVERTISEMENTS:

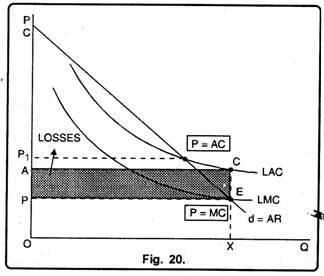

Since natural monopolies benefit from economies of scale, LMC is likely to be less than LAC in the relevant range of output. In that ease, the MC pricing can lead to losses to the monopolist. Fig. 19 explains an ease when MC pricing leads to losses.

In Figure 20 we see that the MC Price is OP which is determined by point E where P = MC. The monopolist sells OX units at price OP. He incurs loss of CE per unit or total loss shown by the shaded rectangle ACEP. The monopolist wills produce in the long-run if it is subsidized by the government out of general taxation. The other solution is to follow AC pricing rule and set the price at OP1, where P = AC. This will ensure normal profits to the monopolist or excess profit is zero.

In this situation, it is difficult to decide which pricing rule, the MC or the AC gives fair return on the monopolist’s capital investment. The monopolist always try to include as many assets in its capital base as possible in order to be able to sell at higher prices.

3. Peak Load Pricing:

This is a case of price discrimination peak and off-peak supplies at different prices. Some examples are, electricity has different demand curves at different times during the day. When demand is more, it is called peak period, when less the off-peak period. Hotels at hill stations have peak period in summer and off-peak period in monsoon. Demand for woolens is more in winter (peak period) and less in summer (off- peak period). The traffic rush on roads is more after office hours.

Weekend rush to amusement parks is another example of peak period. Hence, whenever the demand for a good is not the same in the two time periods and the cost to produce also differs, it is beneficial for the monopolist to charge different prices in the two periods The cost is higher in peak period because resources are pushed much harder to produce more in peak period.

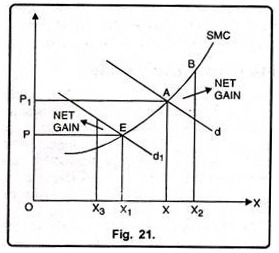

Figure 21, shows how the discriminating monopolist charges different price of electricity in peak and off-peak period. The price in each period will be fixed where SMC cuts the demand curve.

Above figure 21 is the evidence of the following results:

d and d1 = d is the demand curve facing the monopolist in the peak period and d1 is the demand curve in the off-peak period

OP1 = This is the peak-load pricing. With this price, consumers will purchase OX units in the peak hour.

OP = This is the off-peak period pricing. Consumers will purchase OX1 in the off-peak period. Consumers will make efforts to be more economical in their consumption of electricity in the peak period.

Advantages of Peak Load Pricing (Over Uniform Pricing):

The advantages of peak load pricing are stated below:

ADVERTISEMENTS:

1. It ensures efficient distribution of the use of electricity between the peak and off-peak periods. Net gain occurs when electricity is used lesser in the peak-period and more in the off-peak period. The efficiency gains from peak load pricing largely depend on the ability and willingness of electricity consumers to reduce its use in the peak-period.

2. While choosing the scale of operation, when we turn from short-run to long-run, the electric supply company must keep in mind the capacity needed to meet the peak period demand. It saves cost and adds to efficiency gain from peak load pricing.

Disadvantages of Peak Load Pricing:

Peak load pricing have the following disadvantages:

1. Such businesses whose electricity demand is mainly in the peak period and who find it difficult to shift its use to the off-peak period will be harmed as they have to pay higher prices.

2. Peak load pricing necessitates the installation of different types of meters for peak period and off-peak period consumption of electricity.