Monopoly: Meaning, Definitions, Features and Criticism!

Meaning:

The word monopoly has been derived from the combination of two words i.e., ‘Mono’ and ‘Poly’. Mono refers to a single and poly to control.

In this way, monopoly refers to a market situation in which there is only one seller of a commodity.

There are no close substitutes for the commodity it produces and there are barriers to entry. The single producer may be in the form of individual owner or a single partnership or a joint stock company. In other words, under monopoly there is no difference between firm and industry.

ADVERTISEMENTS:

Monopolist has full control over the supply of commodity. Having control over the supply of the commodity he possesses the market power to set the price. Thus, as a single seller, monopolist may be a king without a crown. If there is to be monopoly, the cross elasticity of demand between the product of the monopolist and the product of any other seller must be very small.

Definitions:

“Pure monopoly is represented by a market situation in which there is a single seller of a product for which there are no substitutes; this single seller is unaffected by and does not affect the prices and outputs of other products sold in the economy.” Bilas

“Monopoly is a market situation in which there is a single seller. There are no close substitutes of the commodity it produces, there are barriers to entry”. -Koutsoyiannis

“Under pure monopoly there is a single seller in the market. The monopolist demand is market demand. The monopolist is a price-maker. Pure monopoly suggests no substitute situation”. -A. J. Braff

ADVERTISEMENTS:

“A pure monopoly exists when there is only one producer in the market. There are no dire competitions.” -Ferguson

“Pure or absolute monopoly exists when a single firm is the sole producer for a product for which there are no close substitutes.” -McConnel

Features:

We may state the features of monopoly as:

1. One Seller and Large Number of Buyers:

The monopolist’s firm is the only firm; it is an industry. But the number of buyers is assumed to be large.

2. No Close Substitutes:

ADVERTISEMENTS:

There shall not be any close substitutes for the product sold by the monopolist. The cross elasticity of demand between the product of the monopolist and others must be negligible or zero.

3. Difficulty of Entry of New Firms:

There are either natural or artificial restrictions on the entry of firms into the industry, even when the firm is making abnormal profits.

4. Monopoly is also an Industry:

Under monopoly there is only one firm which constitutes the industry. Difference between firm and industry comes to an end.

5. Price Maker:

Under monopoly, monopolist has full control over the supply of the commodity. But due to large number of buyers, demand of any one buyer constitutes an infinitely small part of the total demand. Therefore, buyers have to pay the price fixed by the monopolist.

Nature of Demand and Revenue under Monopoly:

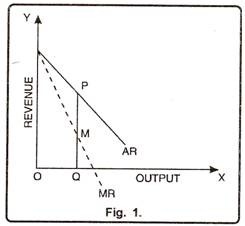

Under monopoly, it becomes essential to understand the nature of demand curve facing a monopolist. In a monopoly situation, there is no difference between firm and industry. Therefore, under monopoly, firm’s demand curve constitutes the industry’s demand curve. Since the demand curve of the consumer slopes downward from left to right, the monopolist faces a downward sloping demand curve. It means, if the monopolist reduces the price of the product, demand of that product will increase and vice- versa. (Fig. 1).

In Fig. 1 average revenue curve of the monopolist slopes downward from left to right. Marginal revenue (MR) also falls and slopes downward from left to right. MR curve is below AR curve showing that at OQ output, average revenue (= Price) is PQ where as marginal revenue is MQ. That way AR > MR or PQ > MQ.

Costs under Monopoly:

Under monopoly, shape of cost curves is similar to the one under perfect competition. Fixed costs curve is parallel to OX-axis whereas average fixed cost is rectangular hyperbola. Moreover, average variable cost, marginal cost and average cost curves are of U-shape. Under monopoly, marginal cost curve is not the supply curve. Price is higher than marginal cost. Here, it is of immense use to quote that a monopolist is not obliged to sell a given amount of a commodity at a given price.

Monopoly Equilibrium and Laws of Costs:

The decision regarding the determination of equilibrium price in the long run depends on the elasticity of demand and effect of law of costs on monopoly price determination.

ADVERTISEMENTS:

1. Nature of Elasticity of Demand:

If the demand is inelastic, the monopolist will fix high price of his product. Inelastic demand refers to the situation in which consumers must have to buy the commodity what-so-ever may be the price. On the other hand, if demand is elastic, the monopolist will fix low price per unit.

2. Effects of Laws of Costs:

The monopolist also takes into consideration laws of costs while determining the prices. In the long run, output may be produced under law of diminishing costs, increasing costs and constant costs.

A brief description of these laws has been given as under:

Increasing Costs:

ADVERTISEMENTS:

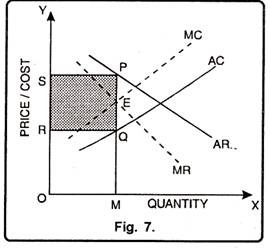

If the monopolist produces the commodity under the law of Diminishing Returns or Increasing costs, he will get the maximum profit at point E where marginal revenue is equal to marginal cost. This is indicated in Fig. 7. Here he produces OM units of the commodity and gets PM as the price. His monopoly profit is represented by the shaded area PQRS. No other alternative will give him this much of profit and hence this is the best position for him provided he produces goods under the Law of Increasing Costs.

Diminishing Costs:

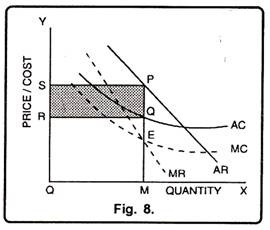

The same approach will be applicable under the Law of Increasing Returns or Diminishing Cost as explained in Fig. 8. Here AC and MC are falling. The MC and MR are equal at point E. accordingly; the monopolist will produce OM units of commodity and sell the same at PM Price. His net monopoly revenue will be PQRS indicated by shaded area.

Constant Costs:

ADVERTISEMENTS:

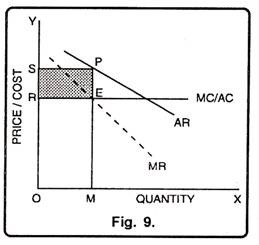

The determination of monopoly price under constant costs can be shown with the help of Fig. 9. In the diagram, the AC curve will be a horizontal line running parallel to OX and for all the levels of output AC will be equal to MC. AR and MR represent the average revenue curve and marginal revenue curve respectively. The equilibrium between MC and MR is brought at point E when the output is OM. Thus, the monopolist will produce OM and will sell it at PM Price. The monopoly profit will, therefore, be equal to PERS which is represented by the shaded area.

Misconceptions Concerning Monopoly Pricing:

Our analysis explodes some popular fallacies concerning the behavior of monopolies.

1. Monopolist is Interested in Maximum Profits and not in Maximum Price:

Because monopolist can manipulate output and price so it is often alleged that a monopolist “will charge the highest price he can get”. It is generally believed that prices under free competition are lower than under monopoly. This is clearly a misguided assertion. Under certain conditions, things may be altogether different. As explained in the previous table and diagram, there are many prices above the one he charges but the monopolist shuns them for the simple reason that they entail a smaller than maximum profits.

2. Maximum Total Profits and not Maximum Profit per Unit:

ADVERTISEMENTS:

The monopolist seeks maximum total profits, not maximum per unit profits. The profits per units may be higher at higher price but the total profits will be higher at lower price. It is; therefore, better to sell more at a lower price than to sell less at a higher price.

3. Economies of Scale:

The monopolist may enjoy certain economies like a better and cheaper utilization of by-products, cheaper raw material, better and cheaper methods of production, lower cost of advertisement and so on than under free competition. Evidently, the monopolist may be able to charge prices lower than under free competition.

4. Law of Increasing Returns:

If the commodity is produced under the Law of Increasing Returns, the monopolist may be producing more at lower costs and selling at lower prices. This policy may help him to earn higher total revenue. The consumer may also buy larger output at lower prices.

Multiplied Plant Monopoly:

Under monopoly, multiple plants are a situation where a monopolist produces in two or more plants. Each plant has different cost structure. In this situation, multi plant monopoly takes two decisions.

They are:

(i) To decide the amount of output to be produced and the price at which it will be sold to maximize profits.

ADVERTISEMENTS:

(ii) To decide the allocation of production between different plants.

Assumptions:

The multi-plant monopoly is based on following assumptions:

(i) There are two plants X and Y.

(ii) Plant X is more efficient than Y plant

(iii) Cost structure of both plants is different.

(iv) The monopolist knows the market demand curve and corresponding MR curve.

ADVERTISEMENTS:

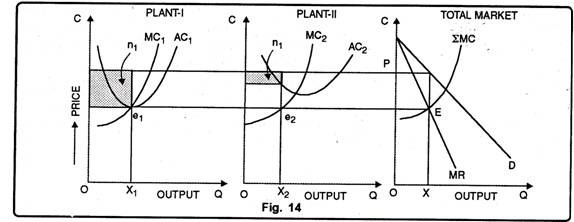

The multiple plant monopoly can be illustrated with the help of Fig. 14.

In Fig. 14, we get:

SMC = horizontal summation of MQ and MC2 i.e. SMC = MC1 + MC2 at point E = MR = SMC.

Here, monopolist will sell OX output at price OP to get maximum profit. At point e1 and e2 = By extending point E leftwards to cut MQ at e1 and MC2 at e2 > producer decides the allocation of production of OX units between plant 1 and plant 2. In short, from point e1, we draw perpendicular to the X-axis. It gives O1 as the level of output produced by plant 1. Again OX2 is the level of output produced by plant 2 and OX = OX1 + OX2

.’. Total profit = Total profit is the sum of the two shaded rectangles shown by a and n2.

Labour Exploitation under Monopoly:

Monopolistic exploitation of labour can be discussed under:

ADVERTISEMENTS:

(i) Exploitation of labour by a monopoly firm, and

(ii) Exploitation of labour under monopolistic competition.

(1) Exploitation of Labour by a Monopoly Firm:

The fact that market demand curve for labour by a monopoly firm in product market is based on MRPC rather than on its VMPL leads to monopolistic exploitation of labour. There is exploitation because labour is paid wages equal to its MRP which is lower than its VMP.

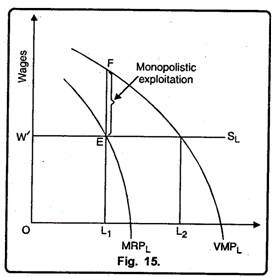

According to Joan Robinson, a productive factor is exploited if it is paid a price less than the value of its marginal product (VMP). Robinson’s analysis of monopolistic exploitation of labour (a variable factor) by an individual monopoly firm is illustrated in Fig. 15.

It is shown in Fig. 15, the MRP1 and S1 curves, a profit maximizing monopolist will employ OL) units of labour determined by point E and pay wage OW (= EL1). But, under perfect competition in the product market, VMP1 is the relevant labour demand curve. Therefore, OL1 units of Labour would be demanded at wages FL1 or else, the employment will be OL2.

Thus, the difference between monopoly wage rate (FL1) and competitive wage rate (EL1), i.e., FL1 – EL1 = EF) is the extent of monopolistic exploitation of labour. The monopolist restricts employment of labour to OL1 units where as the perfectly competitive firm would have employed OL2 units of labour. The lower level of employment by a monopolist also result in the loss of output.

(ii) Exploitation of Labour under Monopolistic Competition:

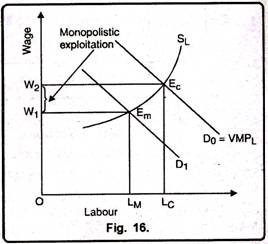

Figure 16 describes the exploitation of labour under monopolistic competition at the market level. In this figure, curve D1 represents the market demand curve for labour by the monopolistic firms; curve D0 represents the market demand curve for labour by the perfectly competitive firms, and curve S1, represents the market supply curve of labour. Under monopoly, labour market will be in equilibrium at point Em wage rate will be OW1.

Under monopolistic competitions, equilibrium wage rate will be at OW2 and employment OL1 units of labour. Obviously, imperfect competition in the product market causes wage rate to be lower than the value of marginal product (VMPL) as is the case in a perfectly competitive product market. Thus, according to Joan Robinson, OW2 – OW1 = W2 – W1 is the extent of exploitation under monopolistic competition.

Criticism:

This monopolistic exploitation of labor can be criticized on the ground that lower wage payment is inevitable because of divergence between MRPL and VMPL. The MRPL is lower than VMP1, (at all levels of employment) not because of monopoly powers of the monopolistic sellers but because of product differentiation. Product differentiation creates brand loyalty which makes the demand curve slope downward to the right.

In case of a downward sloping demand curve, there is bound to be a diversion between price (AR) and the marginal revenue (MR), marginal revenue being lower than the price. Since all the firms, whether in perfect or in imperfect market, attempt at profit maximization, monopolistic firm will have to pay labour a wage rates that equal MRPL .

Therefore, the difference between OW2 and OW1 cannot be considered as exploitation. The difference arises due to the market conditions. However, if product differentiation is excessive and commodities are imposed on the consumers by the monopolistic sellers, then the argument of monopolistic exploitation may be acceptable.