The following article will guide you about how is excess capacity created in a monopolistic competition.

One of the characteristics of monopolistic competition, as distinguished from perfect competition, is the existence of excess capacity. Excess capacity refers to a long-run departure from the ideal output. It is that output “associated with minimum long-run average cost.” Excess capacity has been defined as “the difference between ideal output and the output actually attained in long-run equilibrium.”

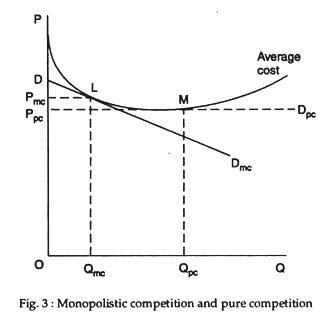

The average cost curve is normally U-shaped, as shown in Fig. 3, on the ground that both very small and very large outputs are difficult and expensive to produce. As W.J. Baumol put it, “Even economies of large scale apply only up to a point, beyond which administrative accosts and diminishing returns, because of the presence of scarce (bottleneck) inputs, are generally expected to raise the unit costs of product.”

If this is so, the point of tangency L between the U-shaped average cost curve and the downward sloping demand curve will occur at a point which is to the left of the minimum point of the AC curve (M). This is in direct contrast with the equilibrium of the competitive firm whose long-run position would have been M. In pure competition the demand curve is horizontal and can be tangent to the U-shaped AC curve as the lowest point of the latter. Hence, the output of the firm under monopolistic competition must be smaller, and its average cost and price higher than it would be under pure competition.

ADVERTISEMENTS:

Thus, from the point of view of the economy as a whole, competitive arrangement appears to be superior to that under monopolistic competition. So from society’s point of view there is need for some sort of amalgamation of business firm. Fig. 3 shows that, by becoming larger, firms can reduce their unit costs from what they are at point L.

Thus, while firms can enjoy excess profits in the short run over long periods, their numbers increase and the rise in cost (since prices do not fall) lead to the development of excess productive capacity. “It may develop over long periods with impunity, prices always covering costs and may become permanent and normal through a failure of price competition to function. The result is high price and waste.”

These vices are attributable to the existence of monopolistic element in an otherwise competitive market. Hence, the accepted view is that monopolistic competition is more like monopoly than perfect competition.

ADVERTISEMENTS:

For example, if some of the firms are eliminated, the total output will remain unchanged (instead of 12 firms producing 500 units each we can reduce the number of firms to 3, each producing 2,000 units and so keep the total output at 6,000). But each of the firms will, as a result of its expression, have lower unit costs.

Thus, if the same output is produced at lower unit costs there must be a net overall saving to the community (if unit costs are reduced from Rs. 8 to Rs. 6, the total cost to the firms producing the 6,000 total product, in our example, will be reduced from Rs. 48,000 to Rs. 36,000— a net gain to society of Rs. 12,000 with no reduction in output. This result has been called by Chamberlin the excess capacity theorem of monopolistic competition.