We said that the long-run equilibrium of the firm is defined by the point of tangency of the demand curve to the LAC curve. At this point MC = MR and AC = P, but P > MC, while in pure competition we have the long-run equilibrium condition MC = MR = AC = P.

As a consequence of the different equilibrium conditions price will be higher and output will be lower in monopolistic competition as compared with the perfectly competitive model.

Profits, however, will be just normal in the long run in both models. In monopolistic competition there will be too many firms in the industry, each producing an output less than optimal, that is, at a cost higher than the minimum.

This is due to the fact that the tangency of AC and demand occurs necessarily at the falling part of the LAC, that is, at a point where LAC has not reached its minimum level. Consequently production costs will be higher than in pure competition. Furthermore, in monopolistic competition firms incur selling costs which are not present in pure competition, and this is another reason for the total cost (and price) to be higher.

ADVERTISEMENTS:

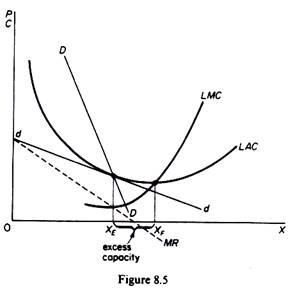

Monopolistic competition has been attacked on the grounds that it leads to ‘too many, too small’ firms, each working with ‘excess capacity’, as measured by the difference between the ‘ideal’ output XF corresponding to the minimum cost level on the LAC curve and the output actually attained in long-run equilibrium XE (figure 8.5).

The term ‘excess capacity’ is misleading in this case. One should really talk of firms working at suboptimal scales having unexhausted economies of scale. There is a misallocation of resources in the long run because the firm in a monopolistically competitive market does not employ enough of the economy’s resources to reach minimum average cost. Chamberlin has argued that the criticism of excess capacity and misallocation of resources is valid only if one assumes that the demand curve of the individual firm is horizontal.

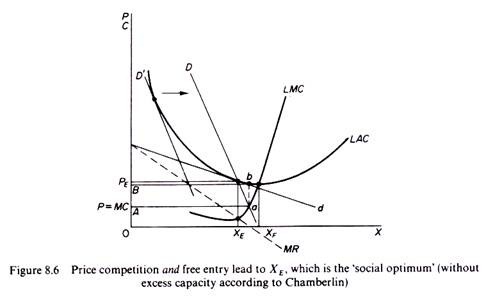

Chamberlin argues that if the demand is downward- sloping and firms enter into active price competition while entry is free in the industry, then, Chamberlin argues, XF cannot be considered as the socially optimal level of output. Consumers desire variety of products: product differentiation reflects the desires of consumers who are willing to pay the higher price in order to have choice among differentiated products.

ADVERTISEMENTS:

The higher cost, resulting from producing to the left of the minimum average cost, is thus socially acceptable. Consequently the difference between actual output XE and minimum cost output XF (figure 8.6) is not a measure of excess capacity but rather a measure of the ‘social cost’ of producing and offering to the consumer greater variety. The output XE, is a ‘sort of ideal’ for a market in which product is differentiated. Chamberlin’s argument is based on the assumptions of active price competition and free entry.

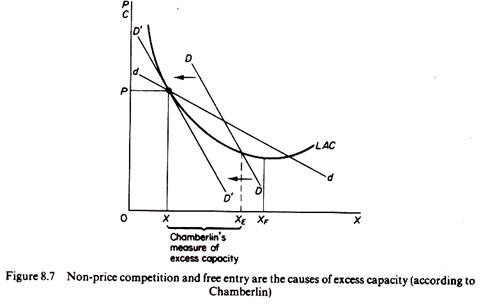

Under these circumstances Chamberlin (and later Harrod) argues that the equilibrium output will be very close to the minimum cost output, because firms will be competing along their individual dd curves which are very elastic. However if firms avoid price competition and instead enter into non-price competition, there will be excess capacity in each firm and insufficient productive capacity in the industry, that is, unexhausted economies of scale for the firm and the industry.

Chamberlin seems to argue that excess capacity (restriction of output) and higher prices are the result of non-price competition coupled with free entry. In this event the firm ignores its dd curve (since no price adjustments are made) and concern itself only with its market share. In other words, DD becomes the relevant demand curve of the firm. In this event long-run equilibrium is reached only after entry has shifted the DD curve to a position of tangency with the LAC curve. According to Chamberlin excess capacity is the difference between X and XE, the latter being the ‘ideal’ level of output in a differentiated market (figure 8.7).

From the point of view of social welfare monopolistic competition suffers from the fact that price is higher than the MC. Socially output should be increased until price equals MC. However, this is impossible since all firms would have to produce at a loss in the long run: the LRMC intersects the DD curve below the LAC (at point a in figure 8.6) so that any policy aiming at the equalization of P and MC would imply a loss of ab per unit of output in the long run.

Thus if firms were coerced to produce a level of output at which P = MC, the firm would close down in the long run. In summary, if the market is monopolistically competitive the output is lower than society would ‘ideally’ like it to be (that is, price is higher than MC); but the socially desired P = MC cannot be achieved without destroying the whole private enterprise system.