The following points highlight the effects of three types of taxes on the equilibrium of the monopolist.

Effect of Taxes on the Equilibrium of the Monopolist Type # 1. Imposition of a Lump-Sum tax:

In this case we need not distinguish between the short-run and the long-run because, in general, the monopolist always realizes some excess profits — both in the short-run and in the long-run.

Under these conditions, the imposition of a lump-sum tax will’ reduce the excess profits of the monopolist because it will increase his total fixed cost However, the MC curve of the monopolist will not be affected, and, hence, the equilibrium in the monopoly market will remain the same even in the buy-run, if the lump-sum tax does not exceed the supernormal profits of the monopolist.

Effect of Taxes on the Equilibrium of the Monopolist Type # 2. Imposition of Profit Tax:

The effects of taxes on the monopoly profits are the same as in the case of a lump-sum tax The profits tax reduces the monopoly profits, but the equilibrium of the market is not affected so long as the tax does not exceed the normal profits of the monopolist, since, in this case the monopolist will not cover his total costs and will close down.

Effect of Taxes on the Equilibrium of the Monopolist Type # 3. Imposition of Specific Tax:

ADVERTISEMENTS:

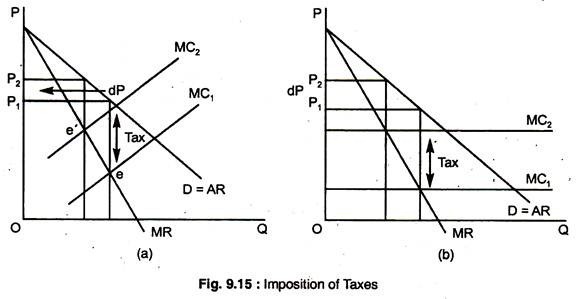

The effects of a specific tax on the output of the monopolist are broadly the same as those in a purely competitive market. The imposition of the specific tax will shift the MC curve of the monopolist upwards which will change the equilibrium; in the new equilibrium position (e’), the price will be higher and the quantity smaller as compared with the initial equilibrium.

This is the same prediction as with the model of perfect competition.

The change in the price of the monopolist may be smaller, equal or greater than the specific tax, as in the case of pure competition as Fig. 9.15 shows:

Firstly, if the MC of the monopolist has a positive slope, the increase in price will be smaller than the specific tax, as in the case of pure competition. The monopolist will pass to the consumer part of the specific tax.

Secondly, if the MC is horizontal, the monopolist will raise the price, but not by the full amount of the tax.

Even when his MC curve is initially elastic, the monopolist will bear some amount of the specific tax.

Thirdly, the examination of the conditions under which the monopolist can pass the whole tax to the consumer by charging a suitably higher price will not be discussed here because of space constraint.