Read this article to learn about the speculative demand for money and its relation with rate of interest!

(a) Speculative demand for money (MSd):

It is demand for money as ‘store of wealth.’ Wealth can be held (stored) in the form of landed property, bonds, money, bullion, etc.

For the sake of simplicity, all forms of assets except money may be clubbed in a single category called bonds. Thus, according to Keynes there are two types of assets, i.e., money and bonds.

How to make best use of both considering if we deposit cash in saving bank account, we earn interest and if we purchase bonds, we get monetary return on it. People compare rate of return on bond with rate of interest on bank deposits. It is speculation about future changes (rise/fall) in interest rate and bond prices that the resulting demand for money is called ‘speculative demand for money’. Clearly, the aim is to make money (monetary gain) out of money.

ADVERTISEMENTS:

Relationship between bond price and interest rate: Price of a bond is inversely related to market rate of interest. How? Suppose, Rs 1,000 bond yields fixed return of 10% per annum which means the bond has fixed annual Income of Rs 100. Let us assume that the rate of interest in saving bank account falls from Rs 10% to 8%. The question is how much money kept in bank will fetch interest of Rs 100 (equal to return from bond) after one year?

Suppose, X is the amount, then the amount will be X × 8/100 = 100 or X = Rs1,250. Clearly, Rs 1,250 kept in saving bank account will give the same return (i.e., Rs 100) as Rs 1,000 invested in bond. Naturally, people will prefer to buy bond than to deposit cash in bank. Competition among buyers will push up the price of Rs 1,000 bond (face value) to 1,250. Hence, conclusion is obvious.

With fall in the market rate of interest (i.e., bank deposit interest) price of bond rises and vice versa. In other words, price of bond is inversely related to market rate of interest. Mind, speculation about changes (rise/fall) in interest rate and bond prices gives rise to speculative demand for money.

(b) Relationship between speculative demand for money and rate of interest:

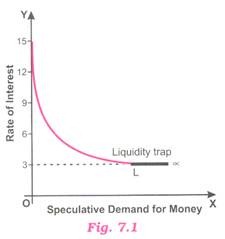

Speculative demand for money is inversely related to the rate of interest, i.e., higher the rate of Interest, smaller wall be speculative demand for money and vice versa. Therefore, curve of speculative demand for money is downward sloping to the right as shown in the following Fig. 7.1.

ADVERTISEMENTS:

There are two situations:

(i) If market rate of interest is very high and everyone expects it to fall in the future (i.e., rise in price of bond) thereby anticipating capital gain from bond holding, people will convert their money into bonds. Thus, speculative demand for money is low.

In Fig. 7.1 at a very high rate of Interest, say, 15%, people convert their entire money holding into bonds indicating speculative demand for money to be zero. (Remember, rise in bond price means gain to the bond-holder—similar to gain of a property dealer when price of property rises. Such a gain occurring from rising price of bond is called Capital Gain).

(ii) On the contrary, if the rate of interest is low and people expect it to rise in future (i.e., fall in price of bond) anticipating capital loss from bond holding, people convert their bonds into money in order to avoid future capital loss. They hold up money balance thinking that income from nonmonetary assets like bond will be low and so the cost of money holding will also be low.

ADVERTISEMENTS:

Thus, speculative demand for money becomes very high so much so that when the rate of interest declines to minimum, say, 3% in the Fig. 7.1, speculative demand for money becomes infinite (perfectly elastic). This pushes the economy into liquidity trap and the speculative demand curve becomes flat as shown in the above figure.

Total demand for money (Md) consists of transaction demand (including precautionary demand) for money (MTd) as a function of income and speculative (or asset) demand for money (MTd) as a function of rate of interest.

Symbolically:

Md = MTd + MSd