Read this article to learn about the quantity theory of money and its assumptions.

Concept of Quantity Theory of Money :

Quantity Theory of Money is referred as the Transactions Approach.

Jean Bodin, a social philosopher of 16th century France, is generally considered as the chief originator of the quantity theory of money. His statement of the theory was quite simple, even crude. But by 20th century, the theory had received sophisticated treatment at the hands of Fisher, Pigou and Keynes. Bodin believed that the main cause of the rise in price was an increase in the quantity of money— gold and silver.

Classical explanation for charges in the value of money is embodied in the quantity theory of money. In its earliest form the theory was presented by Davanzal in 1588. The latter classical economists like Ricardo, David Hume and J.S. Mill adopted this version of the quantity theory with their own refinements and improvements. According to Hume, price level is regarded as a function of the quantity of money [P = f (m)].

ADVERTISEMENTS:

The pure quantity theory of money as given by David Hume no doubt established functional relationship between P and M, it did not, however, mean that changes in P were proportional to changes in M. In Hume’s version it was realized that in a dynamic society with growing population and improving technology, output has a tendency to increase and so also the velocity of money.

Thus, there was no scope for assuming the P changes in direct proportion to M. Subject to this limitation, P was supposed to change in a fairly dependable way as a result of changes in M; for example, an increase in the quantity of money would cause an increase in the price level.

According to J.S. Mill’s version, “the value of money, other things being the same varies inversely as its quantity, every increase of quantity lowers the value and every diminution raising it in a ratio exactly equivalent.”

Prof. Taussig states the theory thus:

ADVERTISEMENTS:

“Double the quantity of money and other things being equal, prices will be twice as high as before and the value of money one-half. Half the quantity of money and other things being equal, prices will be one-half of what they were before and the value of money double.”

Prof. Robertson says, “Given the conditions of demand for money, the reaction between its value and the quantity of it available is of this peculiar kind, the larger the number of units available, the smaller in exactly the same proportion, is the value of each unit.” However, the latest version of the old classical quantity theory of money is given by an American Economist. Prof. Irving Fisher.

Prof. Fisher’s version of the quantity theory of money is based upon an essential function of money as a medium of exchange. Money is needed not for its own sake but to exchange goods and services. Money is something which gives ready command over things and is passed on, sooner or later, in the purchase of real goods. According to this theory, the purchasing power of money depends upon the quantity of money relatively to the amount of things to be purchased.

Thus, if the quantity of money is large in relation to the goods that are to be exchanged for it, the general prices will be high and the value of money low. Hence, “Other things remaining the same, if the quantity of money is doubled, the value of money is halved; and alternatively, if the quantity of money is halved, the value of money is doubled.”

ADVERTISEMENTS:

The relation, therefore, between the quantity of money and price is direct. According to the strict or rigid version of the theory there is a proportionate change in the price level as a result of certain changes in the quantity of money. According to not-so- strict or broad version of the quantity theory of money, there is no doubt that price level changes as a result of changes in the quantity of money, but this change is not direct and proportionate.

According to Prof. Fisher, “Other things remaining unchanged, as the quantity of money in circulation increases, the price level also increases in direct proportion and the value of money decreases and vice versa.” Fisher points out that in a country, during any given period of time, the total amount of money (MV) will be equal to the total value of all goods and services bought and sold (PT).

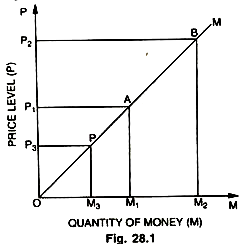

Stating the direct relationship between P and M, Fisher says, “One of the normal effects of an increase in the quantity of the money is an exactly proportional increase in the general level of prices…….. we find nothing to interfere with the truth of the quantity theory that variations in money (M) produce normally proportional changes in prices.” The quantity theory of money showing a direct and proportional relationship between P and M is shown in the Fig. 28.1.

In this diagram the quantity of money in circulation (M) is shown along OM and the price level P along OP. When M is equal to OM1, price is OP1; when M increases from OM1 to OM2, price level also rises from OP1 to OP2. Conversely, when M decreases from OM1 to OM2 price level also decreases from OP1 to OP3. After joining the points P, A, B and M we get a curve PM, which shows the relationship between changes in M and P.

The Quantity Theory takes money just like any other commodity, whose value is determined by its demand and supply. Let us study in detail both these determinants.

Supply of Money (MV):

The supply of money at any moment is the total quantity of money in existence at that moment. Money includes not only coins and bank-notes but also bank deposits (only current deposits on which cheques can be drawn should be counted). The quantity of money, therefore, consists of the amount of money which people have (call it M) and the number of times this money changes hands (the velocity of circulation of money, call it V). The velocity of money comes in when we want to know the supply of money over a period of time, say for instance, a year.

Money has wings, coins, banknotes, and bank deposits move round with great speed, not staying in one person’s pocket or purse for more than a few days. Thus, the total quantity, of money, at any moment, is denoted by Ml and over period of time by MV.

The Demand for Money (PT):

ADVERTISEMENTS:

The demand for money arises from the fact that the goods and services have to be exchanged for it. The demand for money is essentially the demand for transaction purposes. Money is not demanded for its own sake but for the sake of things that if helps to buy. The demand for money is equal to the total value of all goods and services transacted. We estimate the total value of all goods and services by multiplying the total amount of things (T) by the average price level (P). In Fisher’s equation the total value of goods and services bought and sold (demand for money) is denoted by PT. So that, the volume of money (MV) = total value of all goods and services (PT).

Thus, MV = PT or P = MV/T

where P is the price level, M the quantity of money, V the velocity of money and T the total volume of goods and services transacted. Prof. Fisher further extended the equation so as to include bank deposits (M’) and their velocity (V) in the total supply of money. Thus,

P= MV + M’V’ /T

ADVERTISEMENTS:

where M’ stands for bank deposits and V for the velocity of circulation of bank deposits. Fisher’s introduction of M’ and V was appropriate because it brought into prominence the use of bank money or credit money as a convenient means of payment instead of cash. Moreover, it expanded the concept of the money supply to include bank demand deposits.

According to Prof. Fisher, other things remaining the same, i.e., if V, M’ V’ and T remain constant, then P will change in direct proportion to M, i.e., if M is doubled, P will also be doubled and value of money halved and vice versa. Suppose in a community there is a five-rupee note (M) and only a quintal of wheat (T). Then, other things (V, V’ M’, T) remaining the same, P = M/T i. e, 5 /1

Now, suppose the quantity of money increases to Rs. 10, other things remaining the same, price of wheat will be Rs. 10 per quintal, i.e., with the doubling of the quantity of money (from Rs. 5 to Rs. 10 other things remaining constant), price level also increased to Rs. 10 per quintal. Similarly, when the quantity of money falls to Rs. 2 other things remaining unchanged, the price of wheat will be Rs. 2 per quintal.

Thus, we find that the quantity theory of money, as given by Prof. Fisher, establishes a direct and proportionate relationship between the changes in the quantity of money and the resultant price level, Fisher established a direct and proportional relation between the quantity of money and price level. According to him, “One of the normal effects of an increase in the quantity of money is an exactly proportional increase in the general level of prices.

ADVERTISEMENTS:

We find nothing to interfere with the truth of the quantity theory that variations in money (M) produce normally proportional changes in prices.” According to Prof. Taussig, “Double the quantity of money, other things being equal, prices will be twice as high as before, and the value of money one-half, the quantity of money, other things being equal, price will be one-half of what they were before and value of the money double.”

Assumptions of the Theory:

1. The quantity theory of money is based on certain assumptions—”other things remaining the same”. It assumes that V is constant and is not affected by the changes in the quantity of money (M) or the price level (P). Velocity of money (V) depends upon population, trade activities, habits of the people, interest rate, facilities for investment etc. It is assumed that these factors have nothing to do with the changes in the value of money. The quantity theorists ignored the velocity of money because they were concerned with what Keynes calls transaction and precautionary motives for holding money.

As long as we hold money for these purposes, the amount of money held may remain stable but, as soon as we introduce the speculative motive for holding money, we have to admit the possibility of a change in the velocity of money.

2. Further, the theory is based on the assumption that the volume of goods and services (T) remains constant. It (T) depends upon a natural resources, climatic conditions, techniques of production, productivity of labour, transportation etc. All these factors, it is assumed, have nothing to do with the changes in the quantity of money. Hence, T remains constant. The assumption that total volume of goods and services (T) remains constant is based on another assumption that there exists full employment; it means that idle resources are not available to expand production of goods and services to be exchanged for money.

3. The quantity theorists further assume that price is a passive factor. Price is changed or affected by other factors in the equation but does not affect or cause changes in those factors. The relation between P and other factors in the equation is one-sided in as much as P is determined by other elements in the equation, but it does not determine them, Prof. Fisher says, “The price level is normally the one absolutely passive element in the equation of exchange. It is controlled solely by other elements but exerts no control over them.”

4. Prof. Fisher assumes a long period of time and considers V and T to be constant over a long period. In the short period of transition, there can be a change in other variable like T or V. But, when this short period or the period of transition is over, other variables will become constant so that a change in M or V will be followed by a proportionate change in P. Fisher was careful to qualify the proportional relationship suggested by the equation of exchange between changes in the quantity of money and change in the price level.

ADVERTISEMENTS:

In short, Fisher’s quantity theory does not claim that V or V’ never change, as many critics have claimed. Fisher did accept that given a rise in the money supply, other changes taking place simultaneously might affect V or T and thus break the proportional relationship between changes in M and changes in P. However, the impact of M by itself on P. holding everything else constant is strictly proportional.

5. Other assumptions of Fisher’s theory arc a highly monetized economic system in which all transactions take place through money; money alone and only acts as a medium of exchange and no part of it is hoarded by people; the theory further assumes that money price relationship, as suggested by Fisher, is a long run phenomenon.