Let us make in-depth study of the financing of budget deficit through printing money.

Resource Mobilisation through Money Financing of Budget Deficit:

The government can mobilize resources for economic growth by financing its budget deficit through printing high powered money.

This is therefore called money financing of budget deficit. It is important to note that in the old or earlier terminology printing of new money to finance the budget deficit was called deficit financing. It is now called money financing of budget deficit for mobilizing resources by the government. The printing of money to raise revenue by the government is also called seignior-age.

When government finances its budget deficit through printing money, money supply in the economy increases. There are two views regarding the effect of increase in money supply on inflation. According to the Keynesean view, when money supply is increased in times of depression when both productive capacity and labour are lying idle due to deficiency of aggregate demand, price level is not likely to rise much and the effect of increase in money supply is to raise output or income.

ADVERTISEMENTS:

The increase in real income, given the rate of taxation will bring about increase in revenue from taxation, which will tend to reduce budget deficit in the short run. However, if the economy is operating at or near full employment, printing money to finance the deficit will cause inflation.

Printing money to raise revenue for financing the budget deficit which causes inflation is like an inflation tax. This is because the government is able to get resources through printed money which causes inflation and reduces the real value of the holdings of money by the public.

Let us first explain the Keynesian model with a fixed price level when the economy is in recession due to demand deficiency and a lot of unemployment of resources prevails. The tax function can be written as

T = t(Y)

ADVERTISEMENTS:

where t is the rate of tax and Y is real income and T is the total tax revenue. If G is government expenditure, then budget deficit (BD) is given by

BD = G – t(Y) …(i)

If G – t(Y) = 0, budget deficit will be zero and therefore the budget will be balanced one. If G – t(Y) > 0 there will be budget deficit.

If the Government finances its deficit through money creation, then the short-run macro equilibrium can be written as

ADVERTISEMENTS:

Y = Y (G, M) … (ii)

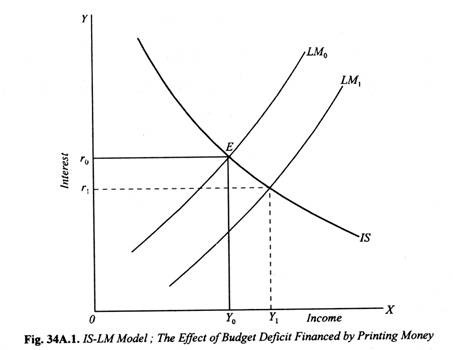

The short run equilibrium in simple IS-LM model is shown rated in Fig. 34A. 1 where IS and LM curves intersect at point E and determine equilibrium income Y0 and equilibrium interest rate r0. Suppose in this equilibrium the government has a budget deficit so that G – t(Y) > 0. Further, government finances this budget deficit through creating high powered money.

As a result, money supply in the economy increases and LM curve shifts to the right to the new position LM1With this, as will be seen from the figure, level of equilibrium income increases to Y1 and rate of interest falls to r,. Since we are assuming an economy with a depression, increase in demand brought about by expansion in money supply will not cause any rise in price level.

In the above model of an economy representing the period of recession price level remains unchanged as more money is created to finance budget deficit. In an important contribution. Fischer and Easterly explain the condition for non-inflationary printing of money.

They write, “the amount of revenue that the government can expect to obtain from the printing of money is determined by the demand for base or high-powered money in the economy, the real rate of growth of the economy and the elasticity of demand for real balances with respect to inflation and income”.

Further, assuming income elasticity of demand equal to unity and currency to GNP ratio equal to 13, they conclude that “for every one percentage point that GNP increases, the government can obtain 0.13 percentage points of GNP in revenue through the printing of money that just meets the increased demand for real balances. With an annual economic growth rate of 6.5 per cent of GNP the government should be able to obtain nearly 0.9 per cent of GNP for financing the budget deficit through the non-inflationary printing of money, increasing the high powered money stock at an annual rate of 6.5 per cent”. If rate of growth of money exceeds this and, given a stable demand function for currency, inflation will result.

Printed Money and the Inflation Tax:

It follows from above that if the economy is operating at full-employment level of GNP or growth rate of money due to persistent budget deficits over time is in excess of rate of growth of GNP, inflation will come about. It has been pointed out by some economists that inflationary financing through the creation of high powered money is an alternative to explicit taxation.

Though in most of the industrialized economies (including the United States) the creation of high-powered money or inflationary financing of budget deficits is only a minor source of revenue, in other countries (including India), the creation of high-powered money has been a significant source of raising revenue to finance government expenditure.

ADVERTISEMENTS:

Before March 1997, in India the creation of money to finance the budget deficit was called ‘deficit financing’ which has been a significant source of revenue for the Central Government in the sixties, seventies and eighties of the last century.

Though, it is not entirely correct that financing government expenditure through creation of high- powered money necessarily leads to inflation, though traditionally every creation of high-powered money or deficit financing has been called inflationary.

Why is the creation of high powered money that causes inflation is called inflation tax and is an alternative to explicit taxation as a source of financing government expenditure. When government uses printed money to finance its deficit year after year, it uses it to pay for the goods and services it buys.

Thus in this process the government get the resources to buy goods and services and as a result, money balances with the people increase a part of which they will save and the rest they will also spend on goods and services.

ADVERTISEMENTS:

However, due to inflation real value of money balances held by the people decreases. That is, with their given money balances, people can buy fewer goods and services due to inflation. Thus when the government finances its budget deficit through creation of new high powered money and in the process causes inflation, the purchasing power of old money balances held by the public falls.

Hence inflation caused by creation of new money is like a tax on holding money. Though, apparently people do not pay inflation tax, but since their old money balances can buy fewer goods and services due to inflation they in fact bear the burden of inflation in terms of decline in their purchasing power.

To conclude in the words of Dombusch and Fischer, “Inflation acts just like a tax because people are forced to spend less than their income and pay the difference to the government in exchange for extra money.” The government thus can spend more resources, and the public less just as if the government had raised taxes to finance extra spending. When the government finances its deficit by issuing new printed money which the public adds to its holdings of nominal balances to maintain the real value of money balances constant we say the government is financing itself through the inflation tax.

We can even estimate the revenue raised through inflation tax as under:

ADVERTISEMENTS:

Inflation tax revenue = Inflation tax × real monetary base

Note that monetary base is the amount of the high powered money. It may be mentioned that in the eighties of the last century the inflation rate due to excess creation of high powered money in the Latin American Countries was very high and therefore the revenue raised through inflation tax was very high. In fact some Latin American countries experienced hyper inflation. Thus, during 1983- 1988 average annual inflation rate in Argentina was 359 per cent, in Bolivia 1,797 per cent, Brazil 341 per cent, Mexico 87 percent and Peru 382 per cent.

Inflation Tax Revenue:

In the Latin American countries, the governments raised large revenues due to high inflation rates caused by creation of large amount of printed money due to budget deficits year after year. From the above equation it is evident that inflation tax revenue of the government depends on the inflation rate and real money base.

When the inflation rate is zero, inflation tax revenue obtained by the government will also be zero. As the inflation rate rises, the revenue obtained by the government through inflation tax increases. But as the inflation rate rises, the people tend to reduce their holdings of the real money balances as the purchasing power of money holdings declines.

As a result, as the inflation rate rises the public holds less currency and banks hold less excess reserves with them. With this the real money balances with the public and banks decline so much that inflation tax revenue collected by the government declines after a point.

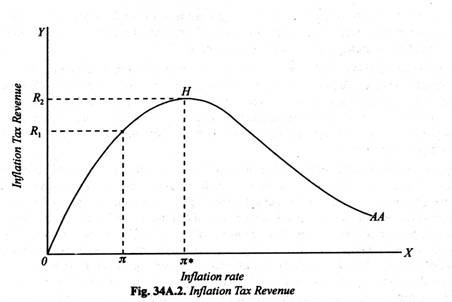

The change in the tax revenue received by the government as the inflation rate rises is shown by AA curve in Figure 34A.2. Initially, in the economy there is no budget deficit and therefore no printing of money, inflation rate is zero, inflation tax revenue received by the government is also zero and the economy’s situation lies at the point of origin.

ADVERTISEMENTS:

Now suppose the government reduces taxes, keeping its expenditure constant, budget deficit emerges which is financed by printing high powered money and suppose the resulting inflation rate is n at which the government collects tax revenue equal to OR1 But as the inflation rate further rises as a result of increase in printed money, the tax revenue collected increases until inflation rate π* is reached.

At inflation rate π* brought about by a certain amount of increase in printed money, the tax revenue collected by the government is OR2. Beyond this growth in pointed money and rise in inflation rate greater than π*, tax revenue collected declines because real money balances with the public and banks decline. Thus OR2 is the maximum of tax revenue raised by the government through inflation tax and the corresponding inflation rate is π*.

In the developed industrialized countries where the real money base is relatively small, the government collects a small amount of inflation tax revenue. For example, in the United States where money base is only about 6 per cent of GDP the government raises revenue through inflation tax equal to only 0.3 per cent of GDP. corresponding to 5 per cent rate of inflation.

However, some developing countries such as Argentina, Brazil, Mexico, Peru have collected 3.5 per cent to 5.2 per cent of their GDP as inflation tax revenue. But for this they had to pay a heavy price in terms of a very high rate of inflation.

Dornbusch, Fischer and Starts righty comments, “In countries in which the banking system is less developed and in which people hold large amounts of currency, the government obtains more revenue from inflation and is more likely to give much weight to the revenue aspects of inflation in setting policy. Under conditions of high inflation in which the conventional tax system breaks down, the inflation tax revenue may be the government’s last resort to keep paying its bills. But whenever the inflation tax is used on a large scale, inflation invariably becomes extreme”.

Evaluation of Inflation Tax Revenue:

ADVERTISEMENTS:

The above view of inflation tax revenue is based on the assumption that every increase in printed money causes inflation. In our view this is not correct. When the economy is working much below its full production capacity due to deficiency of aggregate demand as it happens at times of recession or depression, then more printed money can be created by the government to finance, its projects.

The increase in demand resulting from this will help in fuller utilisation of idle production capacity and will also generate employment for unemployed labour. This will not lead to inflation as output of goods and services will increase in this case to meet the increased demand.

This case was analyzed by J.M. Keynes who advocated for the adoption of budget deficit to overcome depression and financing it through printed money without causing inflation. It is only when there exists full employment in the economy that financing government expenditure through printed money causes inflation.

Similarly, in developing countries like India where growth in GDP is taking place annually and also the economy is getting more monetized, the demand for money is increasing. Besides, a lot of resources are unutilized or underutilized in the Indian economy. Therefore, a reasonable amount of printed money can be created, which before 1997 was called deficit financing, to finance the investment expenditure of the government without causing inflation.

Therefore, it is not true that the use of printed money for financing government expenditure necessarily leads to inflation. It all depends on whether or not newly printed money is used for productive purposes which generates higher growth in GDP. In our view in a developing economy such as ours, a fine balance needs to be strike between how much resources have to be raised through taxation, borrowing (i.e. debt financing) and newly created money (i.e. money financing).