Let us make in-depth study of the causes, effects, cure, impact on Indian economy and measures of depreciation of rupee in 2013.

Causes, Effects and Cure of Depreciation:

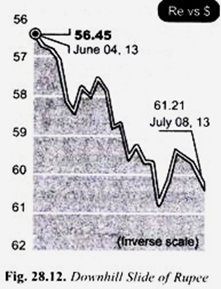

From May 22, 2013 the value of Indian rupee was Rs.55.48 to a US dollar and within fifteen days it fell to Rs. 57.07 to a US dollar.

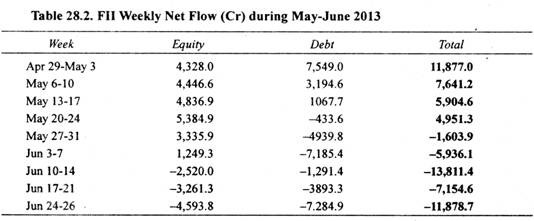

Its slide went on as a result of surge in dollar demand from imports and capital outflows by FIIs pulling out the debt market that resulted in fall in value of rupee to t 60.72 on June 26, 2013, that is, around 6 per cent in single month of June.

Though RBI had a foreign exchange reserve of $ 291 billion, it tried to stem the slide of rupee through sale of some US dollars from its foreign exchange reserves but failed to stabilise the exchange rate of rupee because capital outflows gathered momentum as will be seen from the Table 28.2 given above.

The RBI was selling dollars at Rs. 59.90 to a US dollar but such was the pressure on the rupee by FIIs pulling out capital from the debt and equity markets and demand for dollars by the corporates, oil firms that rupee slipped below Rs. 60 to Rs. 60.73 to a dollar on June 20,2013. This made imperative for the RBI to take more tough measures to check the fall in the value of rupee. Capital Outflows from India and Unwinding of Quantitative Easing.

It is worth noting that capital outflows by FIIs were triggered by the announcement by Ben Bernanke, the governor of the US Reserve System, that since the US economy had shown the signs of recovery from recession as shown by the decline in unemployment rate to 7.6 percent in April 2013, as against its peak level of 10 per cent in December 2010 it would start soon start unwinding of the stimulus in the form of quantitative easing (QE) that was being pursued by it.

At present under the Quantitative Easing Policy (QE) the US Reserve System was pumping in 85 billion dollars per month by purchasing government and other bonds to provide stimulus to the US economy and now it will soon unwind this stimulus in a phased manner and to begin with it will reduce buying of bonds to 65 billion dollars per month. Ben Bernanke’s statement immediately prompted FIIs to pull out swiftly from first debt market and then equity market to send dollars to safe haven of the US where they expected to earn higher returns as a result of revival of the US economy.

These large capital outflows coupled with the increased demand for dollars by the Indian importers such as oil firms, corporate companies and banks increased pressure on dollars resulting in rupee depreciation despite efforts made by the RBI to stabilize the value of rupee by selling US dollars from its foreign exchange reserves through public sector banks.

However, the RBI could not sell sufficient dollars to stem the downward slide of the rupee as it also needed dollars to meet the current account deficit that had reached 6.7 per cent of ODP in December quarter of the year 2012-13 and 4.8 per cent of GDP for the whole year 2012-13.

The vicious circle came into operation. The weakening of rupee further hit the debt and equity markets as the worried foreign investors saw their returns from investment in India being eroded who had already pulled out away around S 6 billion in June 2013 continued this process in July 2013 as well.

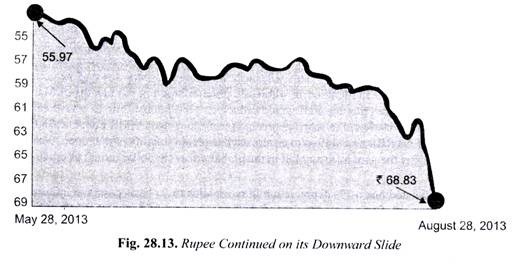

These outflows of dollars were bound to weaken the rupee further and on July 8, 2013, the rupee fell to a very low level of Rs. 61.21 to a dollar. The RBI which was initially slower in response to fast depreciation of rupee started taking tough measures to stem further slide of rupee.

ADVERTISEMENTS:

However, the process of depreciation continued despite raising customs duty on imports of gold and imposing various restrictions on outflows of foreign exchange. The value of rupee depreciated to a record low level of t 68.83 on Aug. 28, 2013.

Widening of Current Account Deficit:

Besides capital outflows, widening current account deficit (CAD) is a basic factor that is responsible for large depreciation of rupee. Two factors have been blamed for widening of current account deficit (CAD). One important factor is the import of gold. India is one of the largest consumers of gold. The gold is demanded for making of jewellery, for sale to the public for consumption.

The second reason for import of gold is investment in it by the people as a hedge against inflation and for investment purposes was more in 2012-13 and 2013-14 because of high rate of inflation that prevailed in these years. For imports of gold the importers of gold have to buy dollars from the market.

The crude oil is other major import which causes a large increase in demand for dollars. India imports crude oil for more than 75 per cent of its requirements. The current account deficit rose to 6.7 per of GDP in December of 2012-13 quarter which was above the RBI comfort level of 2.5%. In the fourth quarter of 2012-13, CAD fell to 3.6 per cent but for the whole year it was quite high at 4.8 per cent.

This shattered the confidence of foreign investors about capability of India to finance its current account deficit. This also caused slowdown in capital inflows and therefore contributed to further weakening of rupee.

At a time when the currency of a country is depreciating and economic growth is sluggish (the rate of economic growth was 5% in 2012-13, the lowest in a decade), foreign investors were wary of investing in India since every dollar they would bring in India for investment their earnings from it will be eroded by further depreciation of rupee against US dollar when they repatriate their earnings out of India. Thus a sort of vicious circle was set in as the value of rupee falls. FIIs tried to pull out their money and that in turn made the rupee dip further. This can be offset only by stable capital inflows through FDI or longer-term overseas borrowing.

How Depreciation of Rupee Hurts the Indian Economy:

A weak Indian rupee will make imports costlier. Normally, economic theory suggests this should lead to increase in exports and curtailing of imports. However, given the fact that some of India’s imports such as crude oil are price inelastic, the imports of these commodities do not decline with the rise in their prices in terms of rupees.

The imports of crude oil, gold, electronic goods, iron, coal, edible oils and various industrial raw materials which India imports will become expensive and put inflationary pressures on the economy. This will push WPI inflation back above 5 per cent mark reached in March 2013.

The moderation in wholesale price inflation in the months of March and April 2013 had raised hopes that the RBI would reduce its repo interest rate to revive economic growth in the country. However, the sharp depreciation of rupee against US dollar dashed these hopes as the focus of the RBI now shifted to ensure exchange rate stability of the rupee. Weakening of rupee will also offset the gain from any fall in the global prices (in dollar terms) of crude oil and other commodities.

ADVERTISEMENTS:

It has been estimated that a 1% depreciation in rupee adds to 15 basis points to inflation (100 basis points = 1 per cent). So far since the May end to the last week of August 2013 there has been around 18 per cent depreciation in value of rupee which means rise in inflation rate will rise by 270 basis points that is, by 2.7 per cent. Given the around 5% rate of inflation in May end, this means inflation in August 2013 will have risen by about 2.7 per cent if there is no lag in adjustment of prices to changes in import cost.

Since in practice there is a time lag between rise in import cost and adjustment of prices, inflation will rise to the above estimates, after two or three months.

Besides, rise in import costs of crude oil and fertilizers will raise government expenditure if government does not pass on additional rise in prices to consumers by raising prices of crude oil and fertilizers to consumers. The increase in expenditure on subsidies will lead to the increase in fiscal deficit which is planned to be reduced to 4 per cent in 2014-15.

It follows from above that the weaker rupee will add to inflationary pressures in the economy, widen the fiscal deficit and slowdown the capital inflows.

ADVERTISEMENTS:

Depreciation of rupee will not only hurt the Indian economy as a whole but will adversely affect some individual industries and services. First, prices of laptops, tablets, desktops and smart phones would go up by anywhere between 5 and 12 per cent by the end of September 2013 as the imported components of these products have become costlier due to depreciation of rupee.

Besides, prices of cars and other automobiles which were raised a few months earlier will go up further if further depreciation of rupee is not checked. Further, due to rise in air fares as a result of depreciation of rupee foreign travels will become expensive which will impact vacation budget in peak summer. Besides, it will hit getting foreign education by the Indians because studying abroad will become more expensive as fees, cost of living and other expenses will increase.

In India the durable consumer goods will become costlier as the prices of their imported components will go up as a result of rupee depreciation. Some companies such as LG, Samsung, Bluestar have already announced a hike in the prices of their products ranging between 2.5 per cent and 7.5 per cent. Other foreign companies will also raise their prices.

However, most adverse effect of depreciation will be on prices of fuel (crude oil). Petrol and diesel prices have already been raised substantially. If slide of rupee further continues, there will be still more burden on households. Not only prices of car will go up but prices of its components will also rise.

ADVERTISEMENTS:

The rise in prices of petrol, diesel and components will raise the running costs of cars. This may reduce the demand for cars. To conclude the impact of depreciation, the WPI inflation that had eased in March and April 2013 will go up due to depreciation. Inflation as measured by consumer price index (CPI) or what is called retail inflation which is already around 10 per cent is likely to rise further.

RBI has cautioned about inflation pressures in the economy and is unlikely to ease its monetary policy in near future against the backdrop of challenging economic scenario. The RBI had said in its June 2013 policy review that going forward, inflation outlook would be determined by suppressed inflation being released through revisions of administered prices, including the minimum support prices (MSP) of agricultural product as well as the recent depreciation of the rupee. Consumer price inflation is still very high at about 10% YOY basis and you can expect further pressure on food prices as well. WPI inflation will definitely go above 7%.

Measures To Stem the Slide of Rupee:

When value of a rupee fell to Rs. 61.21 to a dollar on July 8, 2013, the RBI took tough steps to stem the further slide of rupee. Reserve Bank pushed up short-term rates in the money markets which would choke speculators and attract dollars into India. According to these measures, the RBI has limited its lending of overnight funds to all banks to Rs. 75,000 crore and for an individual bank overnight lending by it has been restricted to 5% of its deposits.

If banks need more funds they would have to pay higher penal interest rate of marginal standing facility (MSF) which too has been raised to 10.25%. As the current overnight borrowing by the banks was to the tune of’ 93000 crore its immediate effect was raising of cost of overnight borrowing by the banks from the RBI.

This in turn was expected to translate into higher cost of short-term borrowing by the companies which might cross 10 per cent. Besides, the market which was expecting cut in repo rate of interest in view of the fact that headline WPI inflation rate had fallen below 5 per cent in May and June 2013 was now seen as unlikely to happen. It maybe noted that market perception of likely tapering off US quantitative easing (QE) had triggered outflows of portfolio investment from India, particularly from the debt market.

Second measure that the RBI took was to announce that it would sell bonds worth 22,000 crore every week. This would suck out rupee currency from the market thereby reducing liquidity in the market. The higher rate of interest and less liquidity in the banking system was expected to curb speculation in foreign exchange, especially in dollars which was contributing to depreciation of rupee. As a result of this measure bond prices were expected to fall sharply as investors were expecting better returns from them.

ADVERTISEMENTS:

Thirdly, in tandem with the above measures bank rate which is a rate of interest for a long term borrowing was raised by RBI from 8.25% to 10.25%. As a result of the above measures it was expected that speculation in dollars would be curbed and there will be rise in the value of the rupee that had sharply depreciated in the last six weeks.

Countries with large current account deficits, such as India, have been particularly affected despite their relatively promising economic fundamentals. The exchange rate pressure also evidences that the demand for foreign currency has increased vis-a-vis that of the rupee in part because of the improving domestic liquidity situation.

RBI measures will have wider implications on the economy as cost of funds would go up. But the measures were likely to be relaxed if the rupee stabilizes. Bankers said RBI’s observation shows that it is convinced that some of the pressure on the rupee is because of speculation. The main motivation appears to be to make the rupee more attractive vis-a-vis investments in the dollar. The measures will benefit the rupee which will gain as foreign institutional investors see an opportunity to invest in short-term debt. But at the same time this could have longer-term ramifications for the Indian economy.

Since the problem of sharp depreciation of rupee in the months of June and July 2013, the RBI shifted its focus to stabilise the exchange rate of rupee. In its 30th July review of credit policy the RBI kept its policy rate unchanged, that is, it did not reduce its repo rate of interest.

In 30th July review repo rate was retained at 7.25 and CRR at 4%. The RBI thought that lowering of repo interest rate would offset the impact of its earlier measures aimed at reducing liquidity in the banking system to curb speculation on exchange rate of rupee. However, keeping the repo interest rate at a high level was impeding economic growth and the pro-growth lobby including our Finance Minister

Mr. R Chidambaram wanted reduction in repo rate of interest to spur economic growth. The RBI governor was of the view that for checking inflation and achieving price stability was its main objective and that lowering of repo rate of interest would give a push to inflation which badly affects the poor. He rightly pointed out that in the short run some sacrifice of growth is inevitable to achieve price stability.

ADVERTISEMENTS:

To check the weakening of rupee the RBI made limited and subtle intervention by selling dollars through public sector banks from its foreign exchange reserves to reduce volatility of rupee. At time it succeeded in preventing further slide of rupee through sale of dollars from its foreign exchange reserves.

As a result of the measures taken by RBI, the value of rupee remained in the range of Rs. 59 to Rs. 60 to a US dollar in June 2013, except on some days the value of rupee fell even below Rs. 61 to a dollar. However, in August 2013, the situation worsened and the value of rupee fell even below Rs. 68 to a dollar. On August 28 the rupee hit its record low of Rs. 68.83 to a US dollar. However, intervention by RBI brought it to around ? 65 to a dollar a in a few days time and in a months’ time to around Rs. 62 to a dollar.

The other step adopted by RBI is that the exporters who benefit from rupee depreciation have been asked not to hold on to their foreign exchange earnings but bring in their dollar earnings within nine months of shipping or executing orders instead of 12 months.

This would accelerate dollar flows into India and push up the rupee. It is because of sale of dollars by the exporters that leads to increase in the supply of dollars and keeps the exchange rate of rupee within limits though daily fluctuations in the exchange rate of rupee can continue.

Opening Special Window:

RBI has also decided to open a special window to sell US dollars for the companies importing crude oil and to the government for importing defence equipment. This would reduce market demand for US dollars and help in checking high volatility in the exchange rate of rupee.

Tightening Gold Imports:

Another important measure the RBI has taken to make gold imports for domestic consumption tougher. The RBI has announced that 20% of imports of gold by businessmen must be imported in the form of jewellery. This would reduce imports of gold as only a very small portion of gold imports is exported now in the form of jewellery.

ADVERTISEMENTS:

If any importer of gold fails to export 20%. of its imports of gold, he would be debarred from importing any more gold. This would have a dual effect. On the one hand, 20% export condition will lower imports of gold and, on the other hand, it would encourage the exports of gold jewellery.

Both the government and the RBI have been targeting gold imports to reduce the current account deficit which is the basic factor responsible for sharp depreciation of rupee. Gold, which accounts for more than half of the deficit, has been at the receiving end of the regulators, with the finance minister P Chidambaram raising import duties to 8% from 6% on August 13, 201. Import duty on gold was further raised to 10 per cent. Further import duty on silver was also raised to 10% as against 6% earlier. Furthermore, RBI had made bank funding tough by insisting on near cash payments for any gold import for local needs.

Of the 970 tonnes of gold imported last year, only 70 tonnes were exported. Now, the industry has to follow the 80: 20 ratio. The government wants to bring down gold import to .500 tonne and raise exports of gold jewellery to 100 tonnes.

Auction of Rs. 22,000 crore of Government Bonds. As an additional measure to check volatility in the rupee, on August 8, the RBI announced that it would make out-of-turn auction of22000 crore of government bonds every Monday to suck out liquidity from money market. This would make rupee scarce and therefore would limit the room for traders to speculate on the rupee.

Record Payment of Surplus by RBI as Dividend to the Government:

In its board meeting held on August 8 the RBI announced that it would transfer a record surplus of Rs. 33,010 crore to the government soon in 2013-14, an increase of 106% over X 15,010 crore in the previous year. The RBI is owned by the central government and therefore its earnings, which RBI calls dividend of the government, go to the government.

The RBI generates its surplus largely from intervention in foreign exchange and money markets. RBI’s profits are usually the highest during period of highest volatility in rupee. The transfer of such a huge amount of Rs. 33,010 crore soon will help the government to contain its fiscal deficit to 4.8 per cent of GDP in 2013-14 which will promote confidence of foreign investors so that they invest in India and not pull out funds for investment in the US. It is evident from above that the foreign exchange rate of rupee is now quite flexible. It changes as market conditions of demand for and supply of foreign exchange change.