Let us make an in-depth study of the definition, credit creation and principles of commercial banks.

Definition:

According to Collins Reference Dictionary of Economics (1988), a bank is “an authorised deposit-taking institution which receives deposits of money from the public or other institutions and fulfills its obligation to return that money to the depositor when an instrument (for example, a cheque) is drawn upon it.”

Commercial banks are institutions which make their profits from lending otherwise unemployed deposits to those wishing to borrow, and charging, usually, for services performed for customers.

Credit Creation by the Banking System:

Bank lending is important not only because it finances a great deal of spending but also because it adds to the country’s stock of money in the form of bank deposits. Bank deposits are obviously created when customers pay money into their accounts. Less obviously, banks themselves cause deposits to be created by their own lending activities. The process by which bank loans create deposits is known as credit creation. It is, in fact, the main way in which the country’s supply of money has grown.

Two Classes of Deposits:

ADVERTISEMENTS:

A bank deposit may come into existence in two ways:

(i) A customer may deposit cash in the bank. Such deposits are known as actual deposits,

(ii) A bank may sanction a loan to a customer but, instead of paying out the money immediately, may open an account in his name, crediting him with the amount of the loan and allowing him to withdraw money according to his requirement by cheque or otherwise. Such deposits are known as created deposits.

The Process:

The process of credit creation depends on a few simple facts first, money deposited in banks is mostly lent out; secondly, money lent is spent by the borrowers; thirdly, money spent is received by shops or other businesses and will sooner or later be put back into bank accounts as new deposits. These new deposits begin a further round of lending, spending, more deposits, and so on.

ADVERTISEMENTS:

Prima facie, commercial banks accept deposits of money from the general public. A certain proportion of this money is retained by the banks to meet day-to-day withdrawals (the reserve-asset ratio). The remaining portion of the money is used to make loans or is invested. When a bank lends money it creates additional deposits in favour of borrowers.

The amount of additional (new) deposits the banking system as a whole can create depends on the magnitude of the reserve-asset ratio (or liquidity ratio). The banking system here refers to a network of commercial banks and other banking institutions engaged in the transmission of money and the provision of loan and credit facilities.

In general, the value of money deposited in a bank far exceeds the amount of cash (notes and coins) being withdrawn. Cash transactions are a relatively small proportion of total transactions. Suppose the ratio is 10%. Economists refer to this as a ‘Liquidity Ratio’, and it means that for every Rs. 100 deposited; only Rs. 10 is likely to be demanded in the form of cash.

The rest will be transferred using cheques and credit cards, and these transactions do not involve any ‘real’ money changing hands. This liquidity ratio enables banks to be profitable because it enables them to lend money to borrowers at interest. The lower the liquidity ratio, the greater the ability of banks to lend, and to increase the supply of money.

ADVERTISEMENTS:

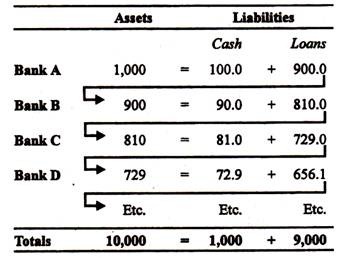

Table 20.1: Bank Credit Multiplier

While each individual bank lends less than the cash it receives, the bank system as a whole lends more than it has in cash. An initial deposit of Rs. 1,000 has created liabilities of Rs. 10,000 of which Rs. 1,000 are cash deposits and Rs. 9,000 are loans. These are matched by Rs. 1,000 of liquid assets (cash) and Rs. 9,000 of ‘promises to repay’ (contracts to repay loans, which are less liquid).

Note that most banks can reduce their liquidity ratios (LRs) because they have other assets in reserve — such as government bonds, stocks and shares, and buildings— which could be ‘liquidated’ in an emergency.

The relationship between the LR and the bank credit multiplier is:

BCM = 1/LR.

So if the LR is 10%, or 1/10, then BCM = 10. This means that a deposit of Re. 1 can create liabilities of Rs. 10, of which Rs. 9 are loans, and Re. 1 is cash.

Here total deposits have risen by Rs. 10,000 or ten times the extra cash deposited, so maintaining the 10% reserve ratio. If the ratio were 20% (one-fifth of deposits), the multiple

of credit expansion would be 5 and total deposits would increase by Rs. 5,000 in our example.

The process described above takes place in the banking system as a whole. A particular bank in the system cannot, when it receives a cash deposit of say Rs. 1,000, lend ten times this amount or Rs. 10,000.

ADVERTISEMENTS:

From the example given above it is apparent that, in a country with a developed banking system, the total loans and advances are many times large than the total cash reserves. An individual banker (following prudent policy) may lend only from the money which he has received but the lending activities of a large number of banks automatically create more loans than the cash in their hand. Thus the banking system, as a whole, can create credit. Increase of credit means an increase in the money supply of the country because the money lying in a credit account can be used for making payments (by cheque or otherwise).

The Principles of Commercial Banking:

Commercial banks work with short-term funds. Their working capital consists mainly of moneys deposited by customers and with drawable by them on demand or on short notice. If a bank lends such moneys for long periods or keeps them ‘blocked’ in any other way, it will be unable to meet the demands of its depositors for withdrawal of cash, and will be forced to go into liquidation.

Fractional Reserves:

Every bank operates on the principle that all its depositors will not withdraw their cash at a time. Good bankers can anticipate what percentage of the total deposits will, on average, be withdrawn during a particular period. The banker keeps sufficient cash in hand to meet the expected withdrawals (called the cash reserve) and lends out the rest.

The cash reserve is intended to meet average withdrawals in normal times. If, for any reason, a disturbance or panic occurs, the depositor will withdraw more than the average. If large withdrawals occur, there is said to be a “run” on the bank. In such cases the bank must secure money by converting the assets held by it into cash immediately. Assets which can be quickly converted into cash are called liquid assets. A commercial bank must keep in hand sufficient liquid assets. This is known as the Liquidity Principle.

Banking as a Business:

ADVERTISEMENTS:

Banking is a business like any other business. Like other businesses, commercial banks operate with the aim of making a profit. Income is earned by investing and lending the money deposited by people with the bank.

The characteristics which separates a bank from other financial institutions is that its indebtedness is money. A bank’s services may be for sale. However, bank money remains entirely a matter of confidence in the ability of a bank to convert its indebtedness into legal tender whenever a customer requires it.

Most banks are commercial institutions which must seek to earn a return on the capital they employ, i.e., they must aim at making a profit. In fact, banking is a business like any other business. On the other hand, it is the apparent soundness of a bank which concerns its customers and, therefore, influence its ability to expand its business and make a profit. These two concepts of profitability and soundness are not in themselves conflicting but the pursuit of both does involve a bank in a conflict of interests.

A customer usually judges the soundness of a bank by a variety of standards a bank must be making some profit or its continued existence will be in doubt; a bank must always meet its obligations on demand, i.e., when convenient to the customer; the point of overriding importance is the ability to pay cash or demand and it is the necessity of being able to do this that conflicts with the aim of making a profit on the capital employed.

Liquidity and Profitability:

ADVERTISEMENTS:

In order to be able to meet demands for cash as and when they are made, a bank must not only arrange to have sufficient cash available but it must also distribute its assets in such a way that some of them can be readily converted into cash. Thus the bank’s cash reserves can be reinforced quickly in the event of heavy drawings on them.

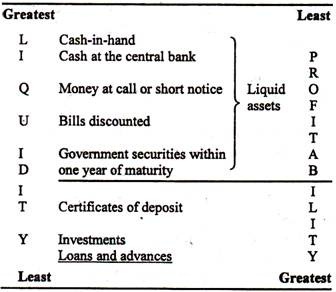

Assets which are readily convertible into cash are called liquid assets, the most liquid being cash itself. The shorter the length of a loan the more liquid and the less profitable will it be; the more liquid because it will soon mature and be repayable in cash; the less profitable because, other things being equal, the rate of interest varies directly with the loss of liquidity experienced by the lender.

Thus a bank faces something of a dilemma in trying to secure both liquidity and profitability. It satisfies these apparently incompatible requirements in the way it distributes its assets. These assets have been arranged in the following table with the most liquid but least profitable ones at the top, and the least liquid but most profitable towards the bottom.

Table 20.2: Financial assets of commercial banks