Let us make in-depth study of the instruments, expansion to cure recession or depression, role in controlling inflation and monetarist view of monetary policy.

Instruments or Tools of Monetary Policy:

The central bank of a country has the responsibility of controlling the volume and direction of credit in the country.

Bank credit has become these days an important constituent of the money supply in the country. The volume and direction of bank credit has, therefore, an important bearing on the level of economic activity.

Excessive credit will tend to generate inflationary pressures in the economy, while deficiency of credit supply may tend to cause depression or deflation. Lack of the availability of cheap credit may also hinder economic development of a country. At times of depression, there is a need to expand credit and at times of boom there is need to contract credit.

ADVERTISEMENTS:

For promoting economic development, expansion of cheap credit (credit at low rates of interest) is desirable. In order to prevent booms and depressions (i.e., to maintain economic stability) and to promote economic growth, central bank seeks to control credit in accordance with the needs of the situation:

Broadly speaking, there are two types of methods of controlling credit:

(1) Quantitative or General Methods:

These instruments seek to change the total quantity of credit in general.

ADVERTISEMENTS:

These are three in number:

(i) Changing the bank rate and repo rate

(ii) Undertaking open market operations;

(iii) Changing the cash reserve ratio.

ADVERTISEMENTS:

(2) Qualitative or Selective Control Methods:

These tools aim at changing the volume of a specific type of credit. In other words, the selective control methods affect the use of credit for particular purposes.

We discuss below these methods in detail:

Bank Rate Policy:

Bank rate is the minimum rate at which the central bank of a country provides loans to the commercial banks of the country. Bank rate is also called discount rate because in the earlier days central bank used to provide finance to the commercial banks by rediscounting bills of exchange.

Through changes in the bank rate, the central bank can influence the creation of credit by the commercial banks. Bank credit these days is an important component of the supply of money in the economy. Changes in money supply affect aggregate demand and thereby output and prices. For instance, when the central bank raises the bank rate, the cost of borrowings by the commercial banks from the central bank would rise.

This would discourage the commercial banks to borrow from the central bank. Further, when the bank rate is raised, the commercial banks also raise their lending rates. When the lending rates of interest charged by the commercial banks are higher, businessmen and industrialists would feel discouraged to borrow from commercial banks.

This would tend to contract bank credit and hence would result in the reduction of money supply in the economy. The reduction in the supply of money would reduce aggregate demand or money expenditure. This would reduce prices and check inflation in the economy. Thus when the economy is gripped by inflation or rising prices, the bank rate is generally raised to contract credit creation by the banks.

On the other hand, when there is recession or depression in the economy, the bank rate is lowered to overcome it. A fall in the bank rate will cause the reduction in lending interest rates of the commercial banks. With credit or loans from banks becoming cheaper, businessmen would borrow more from the commercial banks for investment and other purposes. This would lead to the increase in aggregate demand for goods and services and help in overcoming recession and bringing about recovery of the economy.

If a country permits the free flow of funds in and out of the country, then the changes in the bank rate will also have an effect on the external flows. For instance, as said above, when the bank rate is raised all interest rates in the market would also generally rise. With the rise in the deposit rates of interest of the banks, funds from outside would be attracted to the banks of the country.

ADVERTISEMENTS:

Further, with the rise in deposit rates, outflow of funds from the banks to the other countries would be prevented. Therefore, these effects on the capital flows of the rise in bank rate will have a favourable effect on the balance of payments of the country as it will help to meet the current account deficit of the country.

At present in India we are facing a huge current account deficit in our balance of payments as our import bill of crudes oil, petroleum products and gold have gone up while our exports have slowed down.

Capital outflows create a lot of problems. When foreign capital is withdrawn from our debt and equity markets, not only our stock market crashes but also they raise the demand for US dollars to send abroad. As a result of increase in demand for dollars, the exchange rate of rupee per US dollar falls, that is, Indian rupee depreciates.

Depreciation of a currency is generally considered as desirable as it tends to raise exports and reduce imports. However, because our demand for imports is inelastic, the prices rise as a result of depreciation, but the volume of imports remains unaffected. The rise in prices of imports therefore contributes to inflation in the economy and worsens it further. To prevent this rate of interest must be kept high.

ADVERTISEMENTS:

It is important to note that the changes in bank rate affect the credit creation by banks through altering the cost of credit. Changes in the cost of credit affect borrowings by the commercial banks from the central bank and also affect the demand for credit by businessmen from the commercial banks.

Repo Rate in India:

However, changes in bank rate as a tool of monetary policy in India have been quite limited. Before 1991, bank rate remained unchanged at 10 per cent in the whole decade of 1981-1991. This was because prior to 1991, interest rates charged by banks were administered by the Reserve Bank and therefore could not be used as a reference rate by the banks for the purpose of fixing their lending rates.

In the post-reform period from July 1991, to control inflationary pressures in the Indian economy bank rate was raised from 10 per cent to 11 per cent. However, since then bank rate has been rarely used. This is for two reasons. The bank rate is meant for a longer intermediate period for regulating interest rates charged by the banks from their customers and thereby influences the cost of credit.

ADVERTISEMENTS:

However, in the Indian context what was needed was to regulate liquidity of the banks for a very short period, even on daily basis. Second even now when lending rates of interest have been freed from control by RBI, there is not much refinance being made available at the bank rate and therefore the banks can ignore it as a reference in setting their own lending rates.

However, the need for influencing the lending rates of banks and liquidity of the Indian banks was very much needed. Therefore, for this purpose in 1997 RBI introduced under its liquidity adjustment facility, a rate of interest called repo rate. Under repo rate system bank could get overnight short term loans from the RBI to meet their needs of liquidity if they arise.

Through repo system RBI buys securities from the banks and thereby provide loans to them, the rate of interest at which the RBI lends overnight funds to the banks against securities is called repo ratio. Repo rate is short-run interest rate and bank rate is the long-term interest rate at which banks could borrow from the RBI.

The introduction of repo rate helps the Reserve Bank to increase the liquidity of the banks by purchasing from them Government securities and meeting their needs for liquidity when they arise. There is also reverse repo mechanism in which the banks park their surplus funds with the RBI on which they earn interest.

The interest rate which RBI pays to the banks for the funds they keep with it for the short term under this scheme is called reverse repo rate. Through reverse repo system, the RBI mops up liquidity from the banking system.

Repo refers to agreement for a transaction between RBI and banks through which RBI supplies funds immediately against Government securities and simultaneously banks agree to repurchase the same or similar securities after a specified time which may be one day to 14 days.

ADVERTISEMENTS:

Through reverse repo, RBI mops up liquidity from the banking system by selling them securities when it finds that there, is excess liquidity in the system which may create inflationary pressures. Under the repo agreement banks can get short-term loans from RBI against the securities to meet the needs of liquidity when they arise.

Thus, Repo and Reverse Repo operations are useful tool of short-run liquidity management by RBI. Repo and Reverse Repo operations should not be confused with open market operations as. the latter involve sale and purchase sale and purchase of Government securities in the market for a longer intermediate period and not for one day or few days. Besides, on Repo and Reverse Repo rates of interest are fixed by RBI white in open market operations rate of interest varies and depends on demand and supply conditions of funds.

As a tool of monetary policy when Reserve Bank of India wants to check inflation, it raises the repo rate. When the commercial banks find that borrowing from the RBI has become costly and if they have not much excess reserves with them they will raise their lending rates.

At higher lending rates businessmen will be discouraged for taking loans from the banks to finance their investment projects. Likewise, persons who want loans for building or purchasing houses and cars will also be discouraged to get loans from the banks. This will result in contraction of credit which will tend to lower aggregate demand and thereby help in controlling inflation.

On the other hand, when there are recessionary conditions in the economy, the RBI lowers the repo rate. With fall in the repo rate the banks can borrow from the banks at lower short term rate of interest. In turn they lower their lending rates to businessmen for investment and to the consumers who seek home loans and car loans.

This raises investment and consumption demand which through the operation of multiplier helps to raise the level of income and employment. As a result, the economy is lifted out of recession. Such a situation prevailed in India in 2007-09 when following the global financial crisis resulted in the decline of our exports landing the Indian economy into recession.

ADVERTISEMENTS:

The RBI lowered its repo rate from 9 per cent to 4.5 per cent during a period from Oct. 2008 to March 2009. This helped to raise investment and consumption demand which led to recovery of the Indian economy in 2009-10 and 2010-11.

Limitations of Bank Rate and Repo Rate Policy:

Bank rate policy does not have always the desired effect on investment, output and prices. There are certain conditions which must be met for the successful working of the bank rate policy.

These conditions are:

(1) All other rates should follow the bank rate in its movement so that bank credit should expand or contract as desired. This will not happen if the commercial banks have considerable reserves of their own at their disposal and, therefore, their dependence on borrowed funds from the central bank may be very less.

Further, for the changes in the bank rate to cause changes in all other interest rates in the market, a well-organised money market is needed. If well-organised money market does not exist as is the case in India where indigenous bankers contribute a good part of the money market, changes in the bank rate would not be followed by the appropriate changes in all rates.

ADVERTISEMENTS:

(2) The second important condition for the successful working of the bank rate policy is the responsiveness of businessmen to the changes in the lending rates of interest. If businessmen and investors reduce their borrowings when the bank rate and hence the lending rates of commercial banks are raised, and increase their borrowings for investment when the bank rate and lending rates of the banks are reduced, the changes in the bank rate will have the effect, predicted in the bank rate theory.

However, empirical studies conducted recently have shown that rate of interest does not exercise a strong influence on borrowings for investment and other purposes. When there is inflationary situation in the economy, the rate of interest will have to be raised very high in order to have desirable effects.

Similarly, the response of investment to the fall in the rate of interest is never vigorous. Demand by businessmen for credit for investment purposes from the banks depends on the economic situation prevailing in the economy.

When the economy is gripped by severe depression and consequently prospects for making profits are bleak, businessmen would be reluctant to borrow for investment even though the lending rates of interest have been lowered considerably to induce them to borrow. It has been aptly remarked that ‘you can bring the horse to water but you cannot make it drink’.

The present belief is that bank rate policy will play only a subsidiary role in the monetary control. The bank rate or repo rate at the best could check a boom and inflation but could not bring about a recovery if the country was suffering from recession or depression.

Thus it has much greater potential effectiveness if it is desired to arrest credit expansion than when it is sought to stimulate credit. But used in conjunction with other instruments it can still play a useful role. The bank rate and repo rate have the value as a signal. If the traditions are that a signal must be obeyed, the bank rate and repo rate policy can fulfill its purpose since it will be in keeping with respectable conduct.

Open Market Operations:

ADVERTISEMENTS:

Open market operations are another important instrument of credit control, especially in the developed countries. The term open market operations mean the purchase and sale of securities by the central bank of the country. The theory of open market operations is like this: The sale of securities by the central bank leads to the contraction of credit and the purchase thereof to credit expansion.

When the central bank sells securities in the open market, it receives payment in the form of a cheque on one of commercial banks. If the purchaser is a bank, the cheque is drawn against the purchasing bank. In both cases the result is the same. The cash balance of the bank in question, which it keeps with the central bank, is to that extent reduced.

With the reduction of its cash, the commercial bank has to reduce its lending. Thus, credit contracts. When the central bank purchases securities, it pays through cheques drawn on itself. This increases the cash balance of the commercial banks and enables them to expand credit. ‘Take care of the legal tender money and credit will take care of itself is the maxim.

The open market operations method is sometimes adopted to make the bank rate or repo rate policy effective. If the member-banks do not raise lending rates following the rise in the bank rate due to surplus funds available with them, the central bank can withdraw such surplus funds by the sale of securities and thus compel the member-banks to raise their rates.

Scarcity of funds in the market compels the banks directly or indirectly to borrow from the central bank through rediscounting of bills. If the bank rate or repo rate is high, the market rate of interest cannot remain low.

It may be noted that to check inflation the RBI sells government securities to the banks through open market operations and receive in return cash from them. This reduces the cash reserves with the banks and thus reducing their liquidity. This causes contraction of credit which help in fighting inflation.

On the other hand, when RBI faces recessionary problem in the economy it will seek to expand credit or money supply in the economy. This can be done through open market operations by buying securities from the open market. With this purchase of securities from the market the RBI pays cash funds to the banks and thus raise their cash reserves or liquidity.

Against this increase in cash reserves, banks are able to create credit or bank deposits through providing loans by a multiple of the increase in their cash reserves depending on the value of deposit multiplier.

Limitations of the Open Market Operations:

It is obvious that this method will succeed only if certain conditions are satisfied.

The limitations are discussed below:

(1) According to the theory of open market operations, when the central bank purchases securities, the cash reserves of the member-banks will be increased and, conversely, the cash reserves will be decreased when the central bank sells securities. This, however, may not happen.

The sale of securities may be offset by return of notes from circulation and hoards. The purchase of securities, on the other hand, may be accompanied by a withdrawal of notes for increased currency requirements or for hoarding. In both the cases, therefore, the cash reserves of the member-banks may remain unaffected.

(2) But even if the cash reserves of the member-banks are increased or decreased, the banks may not expand or contract credit accordingly. The percentage of cash to credit is not rigidly fixed and can vary within quite wide limits. The banks will expand and contract credit according to the prevailing economic and political circumstances and not merely with reference to their cash reserves.

(3) The third condition is that when the commercial bank’s cash balances increase, the demand for loans and advances should increase too and vice versa. This may not happen. Owing to economic or political uncertainty, even cheap money rate may not attract borrowers. Conversely when trade is good and prospects of profits bright, entrepreneurs would borrow even at high rates of interest.

(4) Finally, the circulation of bank credit should have a constant velocity. But the velocity of bank deposits is rarely constant. It increases in periods of rising business activity and decreases in periods of depression. Thus, a policy of contracting credit may be neutralized by increased velocity of circulation, and vice versa.

Open market operations as an instrument of credit control have proved to be quite successful in regulating the availability of credit in developed countries. This is for two reasons. First, when the central bank purchases or buys securities, the reserves of the commercial banks automatically expand or contract.

The changes in the reserves of the banks directly affect their capacity to lend. Unlike in the case of instrument of bank rate, the success of the market operations does not depend on the attitude or responsiveness of the commercial banks; their capacity to provide credit is affected automatically. Secondly, the open market operations can be managed in a way that the cash reserves of the banks increase or decrease to the desired extent.

Since for the success of market operations it is necessary that there should be broad and active market in short and long-term government securities, and such markets exist only in the U.S.A. and Great Britain and other developed countries, this method of credit control has been most effectively used in these countries.

Open market operations which did not play a significant role as an instrument of credit control in India in the past has now become an important tool and are being used extensively by RBI. This is because market for Government securities in India has now become quite wide and there is excess liquidity in the banking system.

General public do not buy more than a fraction of government securities. It is generally banks and other financial institutions that buy or sell government securities. When there is excess liquidity in the banking system, banks are willingly invest in Government securities more than the statutory limits.

Changing the Cash Reserve Ratio (CRR):

Another method to vary the quantity of credit is to change the cash reserve ratio. By law, banks have to keep a certain amount of cash money with themselves as reserves against the deposits. If the legal minimum cash reserve ratio, for example, is 10%, the bank will have to keep Rs. 2,000 as reserves against the deposits of Rs. 20,000. The central bank of a country has the authority to vary the cash reserve ratio.

If now the central bank increases the cash reserve ratio from 10% to 20%, then the reserves of Rs. 2,000 could support only deposits of Rs. 10,000 and therefore the banks having reserves of Rs. 2,000 will have to reduce their deposits from Rs. 20,000 to Rs. 10,000. That means the contraction of credit.

On the other hand, if the central bank reduces the cash reserve ratio from 20% to 10%, then the reserves of Rs. 2,000 could support the deposits of Rs. 20,000. Therefore, the banks having reserves of Rs. 2,000 can increase their deposits, i.e., expand credit to Rs. 20,000. To sum up, increase in the legal cash reserve ratio leads to the contraction of credit and decrease in the legal reserve ratio leads to the expansion of credit.

An increase in the legal cash reserve ratio will succeed in contracting credit only when banks have no excess reserves. If banks are holding excess reserves, the increase in the legal reserve ratio will not bring about the contraction of credit. On the other hand, the reduction in the cash reserve ratio will have the desired effect of expanding credit only if the borrowers respond favourably.

As a result of reduction in the cash reserve ratio, the availability to lend by the banks increases and the banks tend to make more credit available to borrowers, or to make it available at lower rates. Now, if the borrowers for one reason or another do not respond favourably, i.e., are not prepared to borrow, credit will not be expanded.

Reserve Bank of India has often used this monetary tool to influence the availability of bank credit depending the conditions prevailing in the Indian economy. For example, when there was recessionary conditions in the Indian economy following the global financial crises in 2007-09, RBI over several stages sharply reduced the cash reserve ratio (CRR) to overcome recession and bring about recovery.

With the reduction in cash reserve ratio, a lot of cash reserves were released for the banks which was used by the banks to provide more loans to businessmen for investment purposes and to individuals for buying houses, cars and scooters, This led to the increase a in aggregate demand in the economy which helped in recovery of the Indian economy.

On the other hand, when during 2011-12 and 2012-13, a serious problem of inflation (i. e., rise in general price level) prevailed in the Indian economy, Reserve Bank of Indian raised the cash reserve ratio (CRR). As a result, banks had to keep more cash reserves with the RBI resulting in decline in the credit availability of the banks.

This helped to curtail consumption and investment demand in the economy due to lack of credit. This increase in cash-reserve ratio for the banks helped a lot in reducing aggregate demand in the economy and bringing about fall in the WPI inflation rate to around 5 per cent in April 2013.

Selective Credit Controls:

The methods of credit control described above are known as quantitative or general methods as they are meant to control the availability of credit in general. Thus, bank rate policy, open market operations and variations in cash reserves ratio expand or contract the availability of credit for all purposes.

On the other hand, selective credit controls are meant to regulate the flow of credit for particular or specific purposes. Whereas, the general credit controls seek to regulate the total available quantity of credit (through changes in the high powered money) and the cost of credit, the selective credit control seek to change the distribution or allocation of credit between its various uses.

The selective credit controls have both the positive and negative aspects. In its positive aspect, measures are taken to stimulate the greater flow greater flow of credit to some particular sectors considered as important. Thus in India, agriculture, small and marginal farmers, small artisans, small-scale industries are the priority sectors to which greater flow of bank credit has been sought to be encouraged by the Reserve Bank of India. In its negative aspect, several measures are taken to restrict the credit flowing into some specific activities or sectors which are regarded as undesirable or harmful from the social point of view.

The selective credit controls generally used are:

(1) Changes in the minimum margin for lending by banks against the stocks of specific goods kept or against other types of securities.

(2) The fixation of maximum limit or ceiling on advances to individual borrowers against stocks of particular sensitive commodities.

(3) The fixation of minimum discriminatory rates of interest chargeable on credit for particular purposes.

(4) Prohibition of the discounting of bills of exchange involving sale of sensitive commodities.

The selective credit controls originated in U.S.A. to regulate the flow of bank credit to the stock market (i.e., the market for shares). They were also used to restrict the volume of credit available for purchasing durable consumer goods during the period of the Second War.

However, in India, the selective credit controls are being used by the Reserve Bank to prevent speculative hoarding of commodities so as to check the rise in prices of these commodities. The selective credit controls in India are being used in the case of food grains, oilseeds, vegetable oils, cotton, sugar, gur and khandsari.

Though, all the above techniques of selective credit control are used, in India it is the first technique, namely, the changes in the minimum margin against stocks of commodities or other securities that has been mostly used. It may be noted that the central bank of a country has the power to vary the minimum margin requirements against the security of stocks of commodities.

While lending advances to businessmen, the commercial banks leave a margin of the value of stock kept as security to be financed by the businessmen from their own sources and lend funds to them equal to the remaining amount of the value of the stock. This minimum requirement of the value of the stock left to be financed by the borrowers themselves is known as margin.

Suppose the margin fixed for a stock of particular commodity is 60 per cent. In this case the businessmen can borrow up to the value of 40 per cent of the stock of that commodity while the 60 per cent of the value of stock will be financed by the businessmen themselves.

Now, if the bank raises the margin to 70 per cent, then businessmen can borrow from the bank to the extent of 30 per cent of the value of the stock of that commodity. This will lead to the contraction of credit for holding the stock of the commodity by the businessmen.

If the businessmen are not able to finance the holding of 10 per cent extra stock of the commodity, they will be forced to sell that in the market and thus raising market supply of the commodity. This will lower the prices of the commodity, other things remaining the same.

In developed countries, the selective credit controls are generally used to prevent excessive speculation in share market. In the share market, the buyers purchase a good amount of shares by making a small payment and the remaining value of shares are paid by brokers through borrowing from the banks against the shares thus purchased.

When the central bank raises the margin, the buyers of shares have to pay a larger sum of money for the shares purchased and as a result bank credit contracts and the speculative activity in the stock market is discouraged.

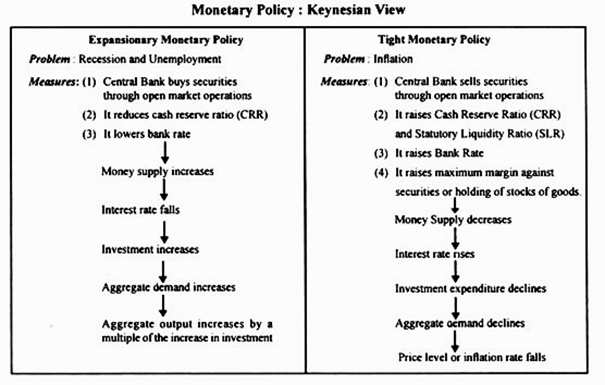

We shall explain how the above various tools can be used for formulating a proper monetary policy to influence levels of aggregate output, employment and prices in the economy. In times of recession or depression, expansionary monetary policy or what is also called easy money policy is adopted which raises aggregate demand and thus stimulates the economy.

On the other hand, in times of inflation and excessive expansion, contractionary monetary policy or what is also called tight money policy is adopted to control inflation and achieve price stability through reducing aggregate demand in the economy. We discuss below both these policies.

Expansionary Monetary Policy to Cure Recession or Depression:

When the economy is faced with recession or involuntary cyclical unemployment, which comes about due to fall in aggregate demand, the central bank intervenes to cure such a situation. Central Bank takes steps to expand the money supply in the economy and/or lower the rate of interest with a view to increase the aggregate demand which will help in stimulating the economy.

The following three monetary policy measures are adopted as a part of an expansionary monetary policy to cure recession and to establish the equilibrium of national income at full-employment level of output:

1. The central bank undertakes open market operations and buys securities in the open market. Buying of securities by the central bank from the public, chiefly from commercial banks will lead to an increase in reserves of the banks or amount of currency with the general public.

With greater reserves, commercial banks can issue more credit to the investors and businessmen for undertaking more investment. More private investment will cause aggregate demand curve to shift upward. Thus’ buying of securities will have an expansionary effect.

2. The Central Bank may lower the bank rate or (what is also called discount rate,) or repo rate which are the rate of interest charged by the central bank a of country on its loans to commercial banks. At a lower bank rate, the commercial banks will be induced to borrow more from the central bank and will be able to issue more credit at the lower rate of interest to businessmen and investors.

This will not only make credit cheaper but also increase the availability of credit or money supply in the economy. The expansion in credit or money supply will increase the investment demand which will tend to raise aggregate output and income.

3. Thirdly, the central bank may reduce the Cash Reserve Ratio (CRR) to be kept by the commercial banks. In countries like India, this is a more effective and direct way of expanding credit and increasing money supply in the economy by the central bank. With lower reserve requirements, a large amount of funds is released for providing loans to businessmen and investors.

As a result, credit expands and investment increases in the economy which has an expansionary effect on output and employment. In April 1996, when Reserve Bank lowered the CRR from 14 per cent to 13 per cent, it was estimated that this would release funds equal to Rs. 5,000 crores for the banks and thereby would significantly increase their lending capacity.

Similar to the Cash Reserve Ratio (CRR), in India there is another monetary instrument, namely, Statutory Liquidity Ratio (SLR) used by the Reserve Bank to change the lending capacity and therefore credit availability in the economy. According to Statutory Liquidity Ratio, in addition to the Cash Reserve Ratio (CRR) banks have to keep a certain minimum proportion of their deposits in the form of some specified liquid assets such as Government securities.

To increase the lendable resources of the banks, Reserve Bank can lower this Statutory Liquidity Ratio (SLR). Thus, when Reserve Bank of India lowers statutory liquidity ratio (SLR), the credit availability for the private sector will increase.

It may be noted that the use of all the above tools of monetary policy leads to an increase in reserves or liquid resources with the banks. Such reserves are the basis on which banks expand their credit by lending, the increase in reserves raises the money supply in the economy. Thus, appropriate monetary policy at times of recession or depression can increase the availability of credit and also lower the cost of credit. This leads to more private investment spending which has an expansionary effect on the economy.

How Expansionary Monetary Policy Works: Keynesian View:

Now, it is important to understand how expansionary monetary policy works to cause increase in output and employment and thus help the economy to recover from recession. In the Keynes’ theory rate of interest is determined by the demand for and supply of money.

According to Keynesian theory, expansion in money supply causes the rate of interest to fall. And this fall in the rate of interest will encourage businessmen to borrow more for investment spending. As is well known, rate of interest is the opportunity cost of funds invested for purchasing capital goods.

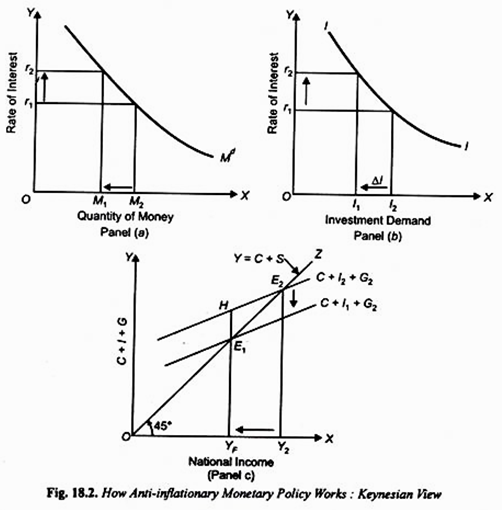

As rate of interest falls, it becomes profitable to invest more in producing or buying capital goods. Thus, fall in the rate of interest raises the investment expenditure which is an important component of aggregate demand. The increase in aggregate demand causes expansion in aggregate output, national income and employment. How, according to Keynesian view, expansion in money supply can help to cure recession is illustrated in Fig. 18.1.

In panel (a) of Fig. 18.1 it will be seen that when as a result of some measures taken by the central bank, the money supply increases from M1 to M2 the rate of interest falls from r1 to r2. It will be seen from panel (b) that with this fall in rate of interest, investment increases from I1 to I2.

Now, in panel (c), it is shown how the increase in investment expenditure from I1 to I2 shifts the aggregate demand curve (C + I1 + G) upward so that the new aggregate demand curve C + I2 + G intersects the 40° line at point E2 and thus establishes equilibrium at full-employment output level YF.

It may be noted that with the given increase in investment how much aggregate output or national income will increase depends on the size of income multiplier which is determined by marginal propensity to consume. The greater the size of multiplier, the greater the impact of increment in investment on expansion of output and income.

From above, it is clear that monetary policy can play an important role in stimulating the economy and ensuring stability at full-employment level. But it is worth mentioning that there are several weak links in the full chain of increase in money supply achieving a significant expansion in economic activity.

In fact, Keynes himself was of the view that in times of depression, monetary policy would be ineffective in reviving the economy and therefore he laid stress on the adoption of fiscal policy to overcome depression.

The first weak link in the above argument of expansionary monetary policy relates to the elasticity of money-demand (i.e., liquidity preference) curve Md in panel (a) of Fig. 18.1. If demand for money curve Md is nearly flat (i.e., highly elastic), the increase in money supply by the central bank will not greatly affect the rate of interest and consequently further steps of significant expansion in investment and aggregate demand will not be realized.

Besides, even if money demand curve is elastic and, therefore, expansion of money supply lowers the rate of interest significantly, the investment may not rise much. This is because if the investment demand curve is steep or inelastic, that is, investment is not sensitive to the changes in rate of interest, the fall in the rate of interest will fail to cause any significant increase in investment. As a result, aggregate demand curve will not change much and expansionary effect on output and employment will not be realized.

Further, the effect of increase in investment on output and employment depends on the size of multiplier. If there are several leakages in the multiplier process, even increase in investment may not bring about much change in output and employment. Thus, because of several weak links in the process or chain of expansion in money supply bringing about expansion, Keynes remarked that there are many a slip between the cup and the lip.

Therefore, for all these reasons (especially because of the liquidity trap in the demand for money curve at lower rates of interest), Keynes was of the view that monetary policy is not an effective instrument in bringing about revival of the economy from the depressed state.

It may however be noted that modern Keynesians do not share the pessimistic view of the effectiveness of monetary policy. They think that liquidity preference curve is not flat and further that investment demand is fairly sensitive to the changes in the rates of interest. Therefore, modern Keynesians equally advocate for the adoption of discretionary monetary policy as for the discretionary fiscal policy to get rid of recession.

Tight Monetary Policy to Control Inflation:

When aggregate demand rises sharply due to large consumption and investment expenditure or more importantly, due to the large increase in Government expenditure relative to its revenue resulting in huge budget deficits, a demand-pull inflation occurs in the economy. Besides, when there is too much creation of money for one reason or the other, it generates inflationary pressures in the economy.

To check the demand-pull inflation which has been a major problem in India and several other countries in recent years, the adoption of contractionary monetary policy which is popularly called tight monetary policy is called for. Note that tight or restrictive money policy is one which reduces the availability of credit and also rises its cost.

The following monetary measures which constitute tight money policy are generally adopted to control inflation:

1. The Central Bank sells the Government securities to the banks, other depository institutions and the general public through open market operations. This action will reduce the reserves with the banks and liquid funds with the general public.

With less reserves with the banks, their lending capacity will be reduced. Therefore, they will have to reduce their demand deposits by refraining from giving new loans as old loans are paid back. As a result, money supply in the economy will shrink.

2. The bank rate may also be raised which will discourage the banks to take loans from the central bank. This will tend to reduce their liquidity and also induce them to raise their own lending rates. Thus this will reduce the availability of credit and also raise its cost. This will lead to the reduction in investment spending and help in reducing inflationary pressures.

It may be noted that in India changes in bank rate have not been generally used to bring stability in the economy. It is the instruments of repo rate and reverse rate changes that have often used to fight inflation and recessionary situation. Repo rate is the interest rate at which Reserve Bank of India lends funds to the commercial banks for a short period of time.

To control inflation repo rate is raised. Hike in repo rate raises the cost of funds for the banks which, if they do not have excess reserves or enough liquidity, would raise their lending rates.

The rise in lending rates of banks which will raise the borrowing costs for businessmen will lead to the reduction in demand for bank credit and thus lower investment and consumption demand. The opposite happens when to fight recession the RBI lowers repo rate and thus reducing lending rate for the banks.

3. The most important anti-inflationary measure is the raising of statutory Cash Reserve Ratio (CRR). Rise in cash reserve ratio (CRR) reduces cash reserves of banks. To meet the new higher reserve requirements, banks will reduce their lending, that is, credit availability.

This will have a direct effect on the contraction of money supply in the economy and help in controlling demand pull inflation. Besides Cash Reserve Ratio (CRR), the Statutory Liquidity Ratio (SLR) can also be increased through which excess reserves of the banks are mopped up resulting in contraction in credit.

4. Fourthly, an important anti-inflationary measure is the use of qualitative credit control, namely, raising of minimum margins for obtaining loans from banks against the stocks of sensitive commodities such as food-grains, oilseeds, cotton, sugar, vegetable oil.

As a result of this measure, businessmen themselves will have to finance to a greater extent the holding of inventories of goods and will be able to get less credit from banks. This selective credit control has been extensively used in India to control inflationary pressures.

How the Tight Monetary Policy Works: Keynesian View:

It is important to understand how tight monetary policy works to check inflation. As explained above, tight monetary policy seeks to reduce the money supply through contraction of credit in the economy and also raising the cost of credit, that is, lending rates of interest. The reduction in money supply itself raises the rate of interest.

The higher interest rate reduces investment spending which results in lowering of aggregate demand curve (C + I + G). The decrease in aggregate demand tends to restrain demand pull inflation. How tight money policy helps in checking inflation is graphically shown in Fig. 18.2. Let us assume that full-employment level of national income is YF as depicted in panel (c) of Fig. 18.2.

Now, if due to a large budget deficit and excessive creation of money supply, aggregate demand curve shifts to C + I2 + G2; inflationary gap of E1H comes to exist at full-employment level. That is, the sum of consumption expenditure, private investment spending and Government expenditure exceeds the full-employment level of output by E1H.

This creates a demand-pull inflation causing rise in prices. Though with aggregate demand curve C + I2 + G2 equilibrium reaches at point E2 and as a result national income increases but only in money terms; real income or output level remaining constant at OYF.

Now, it will be seen from panel (a) that if tight money policy succeeds in reducing money supply from M2 to M, the rate of interest will rise from r1 to rr Panel (b) of Fig. 18.2 shows that at a higher interest rate r2, private investment falls from I2 to I1. This reduction in investment expenditure shifts aggregate demand curve C + I2 + G2 downward to C + I1 + G1 and in this way inflationary gap is closed and equilibrium at full-employment output level YF is once again established.

In our figure it has been assumed that contraction of money supply from M2 to M1 and as a result rise in rate of interest from r1 to r2 is sufficient to reduce investment expenditure equal to I2 – I1 which is equal to inflationary gap and in this way macroeconomic equilibrium without any inflationary pressure is established at output level YF.

It should be further remembered that in our analysis of the successful working of the tight monetary policy it is assumed that demand for money curve (i.e., liquidity preference curve) is fairly steep so as to push up the rate of interest from r1 to r2 and further that investment demand curve II in panel (b) of Fig. 18.2 is fairly elastic so that rise in rate of interest from r1 to r2 is sufficient to reduce investment by I2 – I1 or ∆I.

If these conditions regarding the slopes of the money demand curve and investment demand curve represent the real world situation, then tight monetary policy will succeed in controlling inflation and ensuring price stability.

To sum up, Keynesian view of how expansionary and contractionary (tight) monetary policies work to achieve the twin goals of price stability and equilibrium at full-employment level of output is shown in the accompanying box.

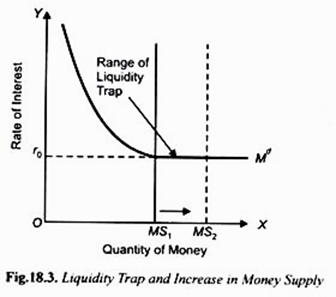

Liquidity Trap and Ineffectiveness of Monetary Policy:

Keynes and his early followers doubted the effectiveness of monetary policy in pulling the economy out of depression. They therefore emphasized the role of fiscal policy for fighting severe recession. According to Keynes and his followers, during severe recession people have a high elastic demand for money at low rates of interest.

At low rate of interest banks -hold on to whatever money reserves they happen to get and the people in general also hold on to whatever money they spare. According to Keynes, demand for money or what he calls liquidity preference is determined mainly by transactions and speculative motives.

Whereas transactions demand for money is determined by the level of national income, the speculative demand for money depends on the expectations regarding future rates of interest. During depression, current rate of interest may fall so low that most of the people expect the interest rate to rise in future and therefore they hold on to their money for the present.

This makes the demand for money absolutely elastic at a low rate of interest as is shown in Fig. 18.3. It will be seen from Fig. 18.3 that at the low rate of interest r0 demand curve for money Md is absolutely elastic showing people demand or hold on to all the increases in money supply beyond Md for speculative purposes and not invest in bonds.

Under these circumstances the economy is said to have fallen in a liquidity trap. A liquidity trap occurs when under conditions of depression the economy finds itself in a situation where people hold all the increments in the stock of money so that demand for money becomes absolutely elastic and therefore money demand curve Md takes a horizontal shape.

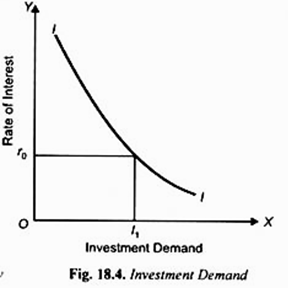

Suppose during a recession, stock of money is equal to MS1 and money demand curve is given by Md. The interaction between these two determines r0 rate of interest. Further that suppose, to pull the economy out of recession, the stock of money supply is expanded to MS2. A glance at Fig. 18.3 reveals that expansion in money supply from MS1 to MS2 does not lower the rate of interest as the economy is operating in the range of liquidity tap.

Now, Fig. 18.4 shows that with the rate of interest remaining unchanged at r0, the level of investment does not rise. With level of investment remaining the same, there is no increase in aggregate demand and the economy remains in a state of depression. Thus, under these circumstances Keynes and his early followers contended that expansionary monetary policy did not help the economy in staging a recovery from recession.

It may, however, he noted that the concept of liquidity trap is not supported by empirical studies. The empirical studies show that demand for money (liquidity preference) never becomes flat and instead it falls throughout.

Therefore, modern Keynesians and other economists now believe that monetary policy can play a useful role in stabilising the economy at full-employment level. However, as shall be discussed below, it is the monetarists led by Friedman who do not favour discretionary monetary policy to check cyclical instability.

Monetary Policy: Monetarist View:

Though most of the modern economists regard both fiscal and monetary policies as important tools for stabilising the economy, there is a group of economists known as monetarists led by Friedman who think that changes in money supply are the key determinants in the level of economic activity and the price level.

They contend that demand curve for money is quite steep and the investment demand curve is quite elastic so that when there is a change in money supply, it significantly affects the investment demand and therefore the equilibrium level of nominal income.

However, surprisingly enough, the most monetarists do not advocate the use of discretionary monetary policy, namely, an expansionary or easy money policy, to lift the economy out of recession and tight monetary policy to check inflationary boom and thereby correct the downs’ and ups’ of the business cycles.

In fact, Friedman, the chief exponent of monetarism, contends that, historically, far from stabilising the economy, discretionary changes in money supply or rates of interest have a destabilizing effect on the economy. On the basis of his study of monetary history of United States, he contends that faulty decisions regarding changes in money supply, made by the monetary authorities, are responsible for a lot of instability that prevailed during the period of his study.

Thus, according to monetarists, it is not the presence of certain inherent destabilizing factors in a free-market economy but the monetary mismanagement by the discretionary monetary policies which is the root cause of economic instability that has been existing in the free market economies.

Sources of Monetary Mismanagement:

According to monetarists, there are two important sources of monetary mismanagement:

(1) Variable time lags concerning the effect of money supply on the nominal income and

(2) Treating interest rate as the target of monetary policy for influencing investment demand for stabilising the economy. We examine below both these sources of monetary mismanagement.

1. Variable Time Lags:

First, there is a problem of variable longtime-lags that occur for changes in money supply to bring about desirable effect on nominal income. From his empirical studies Friedman concludes that it takes six months to two years for the changes in money supply to produce a significant effect on nominal income.

Monetarists argue that since it is extremely difficult to know the time-lag involved in a specific monetary policy measure adopted to tackle the problem, it is impossible to determine when a particular policy measure should be taken and which policy measure, expansionary or tight, is suitable under the given situation.

In fact, according to the monetarists, in view of the uncertainty about the exact duration of time-lags involved, the use of discretionary monetary policy to stabilise the economy may backfire and further intensify the cyclical instability.

For example, if expansionary monetary policy is adopted because the various economic indicators show the situation of mild recession, then, due to the time-lags involved, say six to eight months, for the policy to yield results, the economic situation might change and become reverse during that period and become one of mild inflationary situation. Expansionary monetary policy which produces the effect after 6 to 8 months may, therefore, actually intensify the inflationary situation.

2. Interest Rate as a Wrong Target Variable:

The second source of money mismanagement is the wrong target variable chosen by the monetary authorities. Monetarists have asserted that monetary authorities have tried to control the interest rates to stabilise the economy. It has been argued that Central Bank cannot simultaneously stabilise both the interest rate and money supply.

By controlling the interest rate it has actually destabilized the economy. For example, if the economy is recovering from recession and is presently approaching full employment with aggregate demand, output, employment and prices all registering a rise, the transactions demand for money will increase.

This increase in transactions demand for money will cause the rate of interest to rise. But if the monetary authorities have chosen to stabilise the interest rate, they would adopt tight monetary policy to prevent the interest rate from going up. But the tight money supply to check the rate of interest from rising will lower the aggregate demand when the economy is recovering from recession, and will again cause the recessionary situation.

Thus an attempt by the Central Bank to stabilise the interest rate will make the economy unstable. Similarly, when the economy is going into recession, it will result in lowering aggregate output and prices. This fall in aggregate output and prices will cause a decline in the transactions demand for money.

And the decrease in transactions demand will lead to the fall in interest rate. To prevent this fall in interest rate, if money supply is increased, it will generate inflationary pressures in the economy. Thus, steps taken to stabilise the interest rate cause instability in the economy rather than removing it.

Monetary Rule: Monetary Policy Prescription:

From the above analysis it follows that monetarists are not in favour of stabilising the interest rate, they advocate for the adoption of a rule rather than pursuing discretionary monetary policy to stabilise the economy. They prescribe a rule for the growth of the money supply to achieve economic growth with stability.

According to the monetary rule suggested by Friedman, money supply should be allowed to grow at the rate equal to the rate of growth of output. If the economy is expected to grow annually at the rate of 3, 4 or 5 per cent, money supply should also grow at this rate. The growth of output of an economy will absorb the extra money supply created as per this rule, without generating inflationary or recessionary conditions, and will thus ensure stability in the economy.

To quote Ritter and Silber, “Such a rule would eliminate the major cause of instability in the economy—the capricious and unpredictable impact of counter cyclical monetary policy. As long as the money supply grows at a constant rate each year, be it 3, 4 or 5 per cent, any decline into recession will be temporary. The liquidity provided by a constantly growing money supply will cause the aggregate demand to expand. Similarly, if the supply of money does not rise at more than average rate, any inflationary increase in spending will burn itself out for lack of fuel.”

Monetary rule has been criticised by the Keynesian economists. They have argued that monetary rule will have a destabilizing effect. Given that the velocity of money (V) is unstable or variable, increase in money supply (M), according to this rule, may not ensure growth of aggregate demand (which, according to monetarist theory, is equal to MV) equal to the rate of growth of output in a year which is difficult to predict.

Thus, money supply increase may sometimes exceed the growth of output and sometimes fall short of it and as a result may cause sometimes demand-pull inflation and sometimes necessary conditions. Thus, according to Keynesian economists, policy of monetary rule does not guarantee economic stability and it may itself create economic instability.