In this article we will discuss about:- 1. Meaning of Monetary Policy 2. Objectives of Monetary Policy 3. Ultimate Versus Intermediate Targets 4. Limited Scope 5. Role in Developing Countries 6. Role in Promoting Faster Economic Growth 7. Targets.

Meaning of Monetary Policy:

Monetary policy is concerned with the changes in the supply of money and credit. It refers to the policy measures undertaken by the government or the central bank to influence the availability, cost and use of money and credit with the help of monetary techniques to achieve specific objectives. Monetary policy aims at influencing the economic activity in the economy mainly through two major variables, i.e., (a) money or credit supply, and (b) the rate of interest.

The techniques of monetary policy are the same as the techniques of credit control at the disposal of the central bank. Various techniques of monetary policy, thus, include bank rate, open market operations, variable cash reserve requirements, selective credit controls. R.P. Kent defines monetary policy as the management of the expansion and contraction of the volume of money in circulation for the explicit purpose of attaining a specific objective such as full employment.

ADVERTISEMENTS:

According to A. J. Shapiro, “Monetary Policy is the exercise of the central bank’s control over the money supply as an instrument for achieving the objectives of economic policy.” In the words of D.C. Rowan, “The monetary policy is defined as discretionary action undertaken by the authorities designed to influence (a) the supply of money, (b) cost of money or rate of interest and (c) the availability of money.”

Monetary policy is not an end in itself, but a means to an end. It involves the management of money and credit for the furtherance of the general economic policy of the government to achieve the predetermined objectives. There have been varying objectives of monetary policy in different countries in different times and in different economic conditions.

Different objectives clash with each other and there is a problem of selecting a right objective for the monetary policy of a country. The proper objective of the monetary policy is to be selected by the monetary authority keeping in view the specific conditions and requirements of the economy.

Objectives of Monetary Policy:

The goals of monetary policy refer to its objectives such as reasonable price stability, high employment and faster rate of economic growth. The targets of monetary policy refer to such variables as the supply of bank credit, interest rate and the supply of money.

ADVERTISEMENTS:

These are to be changed by using the instruments of monetary policy for attaining the objectives (goals). The instruments of monetary policy are variation in the bank rate, the repo rate and other interest rates, open market operations (OMOs), selective credit controls and variations in reserve ratio (VRR). [The targets are to be changed by using the instruments to achieve the objectives.]

Four most important objectives of monetary policy are the following:

1. Stabilising the Business Cycle:

Monetary policy has an important effect on both actual GDP and potential GDP. Industrially advanced countries rely on monetary policy to stabilise the economy by controlling business. But it becomes impotent in deep recessions.

Keynes pointed out that monetary policy loses its effectiveness during economic downturn for two reasons:

ADVERTISEMENTS:

(i) The existence of liquidity trap situation (i.e., infinite elasticity of demand for money) and

(ii) Low interest elasticity of (autonomous) investment.

2. Reasonable Price Stability:

Price stability is perhaps the most important goal which can be pursued most effectively by using monetary policy. In a developing country like India the acceleration of investment activity in the face of a fall in agricultural output creates excessive pressure on prices. The food inflation in India is a proof of this. In such a situation, monetary policy has much to contribute to short-run price stability.

Due to various changes in the structure of the economy in a developing country like India some degree of inflation is inevitable. And mild inflation or a functional rise in prices is desirable to give necessary incentive to producers and investors. As P. A. Samuelson put it, mild inflation at the rate of 3% to 4% per annum lubricates the wheels of trade and industry and promotes faster economic growth.

Price stability is also important for improving a country’s balance of payments. In the opinion of C. Rangarajan, “The increasing openness of the economy, the need to service external debt and the necessity to improve the share of our exports in a highly competitive external environment require that the domestic price level is not allowed to rise unduly”. This is more so in view of the fact that India’s major trading partners have achieved notable success in recent years in achieving price stability.

3. Faster Economic Growth:

Monetary policy can promote faster economic growth by making credit cheaper and more readily available. Industry and agriculture require two types of credit—short-term credit to meet working capital needs and long-term credit to meet fixed capital needs.

The need for these two types of credit can be met through commercial banks and development banks. Easy availability of credit at low rates of interest stimulates investment or expansion of society’s production capacity. This in its turn, enables the economy to grow faster than before.

4. Exchange Rate Stability:

In an ‘open economy’—that is, one whose borders are open to goods, services, and financial flows— the exchange-rate system is also a central part of monetary policy. In order to prevent large depreciation or appreciation of the rupee in terms of the US dollar and other foreign currencies under the present system of floating exchange rate the central bank has to adopt suitable monetary measures. India by the Reserve

Conflicts among Objectives:

ADVERTISEMENTS:

In the long run there is no conflict between the first two objectives, viz., price stability and economic growth. In fact, price stability is a means to achieve faster economic growth. In the context of the Indian economy C. Rangarajan writes, “It is price stability which provides the appropriate environment under which growth can occur and social justice can be ensured.”

However, in the short run there is a trade-off between price stability and economic growth. Faster economic growth is achieved by increasing-the availability of credit at a lower rate of interest. This amounts to an increase in the money supply.

But an increase in the money supply and the consequent rise in consumer demand tends to generate a high rate of inflation. This raises the question of what is the minimum acceptable rate of inflation which does not act as a growth-retarding factor. The question still remains unanswered.

There is also a conflict between exchange rate stability and economic growth. If the rupee depreciates in terms of the dollar, then RBI has to tighten its monetary screws, i.e., it has to raise the interest rate and reduce excess liquidity of banks (from which loans are made).

ADVERTISEMENTS:

On the other hand in order to promote faster economic growth the RBI has to lower interest rate and make more credit available for encouraging private investment. Thus the RBI often faces a dilemma situation.

Ultimate Versus Intermediate Targets:

The ultimate target over which the central bank of a country wants to exercise control are three major macroeconomic variables such as the rate (level) of employment, the general price level (or the rate of inflation) and the rate of growth of the economy which is measured by the annual rate of increase of real GDP.

Now the question is how effectively does the RBI act on such targets? The truth is that RBI is not in a position to act on them directly. The main reason for this is its imperfect monitoring of the operation of the economy. This is attributable to lack of adequate, necessary and timely information about the key variables.

So what does the RBI do then? It has no other option but to control intermediate targets exert indirect influence on the ultimate targets and, of course, in a predictable manner. Important intermediate targets are the three money supply concepts (aggregates), viz., M1, M2 or M3 and, of course, the interest rate.

ADVERTISEMENTS:

While the RBI seeks to control the rate of inflation by controlling the money supply, it exerts influence on economic growth by altering the interest rate structures which alter the incentives to invest in physical capital as opposed to that in financial (liquid) assets.

The RBI’s mode of operation as far as intermediate targeting on monetary aggregate is concerned is simple. At the start of each quarter, the Bank fixes the rate of growth of the money supply which, it thinks, is quite consistent with its ultimate target, viz., reasonable price level stability and faster economic growth.

The RBI takes decision on the basis of data on past performance as also forecast about the next quarter or over a full financial year. The RBI makes an appropriate choice of its policy action with a view to meeting this fixed target. At the start of the next quarter, the RBI makes a review of its money supply target and adjust it appropriately on the basis of actual experience of the past.

In 1998, the RBI made a sudden switch from a money supply targeting to a list of certain broad policy indicators. In spite of this broad monetary aggregate (mainly M,) is now perhaps*the most important of its policy stance.

There are two reasons for this:

ADVERTISEMENTS:

(i) Correct Prediction of Inflation:

In India the rate of inflation is measured by the wholesale price index (WPI). And in the intermediate run (covering a period of 3 to 5 years), M3 is fairly accurate predictor of inflation.

(ii) Transparency:

Most people in India have a fairly good idea of money supply targeting. With money supply targeting, the policy stance of the RBI is quite transparent and performs a signaling function. It gives a clear signal to the public and policymakers. The control of inflation depends much on the RBI’s credibility reputation is a big factor here.

If the RBI does exactly what it announces people will believe in the RBI’s commitment to achieve price stability by keeping the growth of the money supply within a target range? This is perhaps the best way to achieve anti-inflationary credibility by keeping people’s inflationary expectations at a low level. Interest rate targeting is not that effective as an anti-inflationary measure.

Limited Scope of Monetary Policy in Developing Countries:

Monetary policy influences economic activity in two ways:

ADVERTISEMENTS:

1. Directly through Money Supply:

Money supply is directly related to the level of economic activity. An increase in money supply increases economic activity by enabling people to purchase more goods and services, and vice versa.

2. Indirectly through Rate of Interest:

A change in money supply influences economic activity through its impact on rate of interest and investment. Increase in money supply reduces the rate of interest, which in turn, increases investment, and hence promotes economic activity, and vice versa.

The monetary policy in an economy works through two main economic variables, i.e., money supply and the rate of interest. The efficient working of the monetary policy, however, requires the fulfillment of three basic conditions- (a) The country must have highly organised, economically independent and efficiently functioning money and capital markets which enable the monetary authority to make changes in money supply and the rate of interest as and when needed, (b) Interest rates can be regulated both by administrative controls and by market forces so that consistency and uniformity exists in interest rates of different sectors of the economy, (c) There exists a direct link between interest rates, investment and output so that a reduction in the interest rate (for example) leads to an increase in investment and an expansion in output without any restriction.

The developed countries largely satisfy all the necessary prerequisites for the efficient functioning of the monetary policy, whereas the developing or underdeveloped economies normally lack these requirements.

ADVERTISEMENTS:

The monetary policy has the limited scope in the underdeveloped countries because of the following reasons:

(i) There exists a large non-monetised sector in most of the underdeveloped countries which act as a great hurdle in the successful working of the monetary policy.

(ii) Small-sized and unorganised money market and limited array of financial assets in underdeveloped countries also hinder the effectiveness of monetary policy.

(iii) In most of the underdeveloped countries, total money supply mainly consists of currency in circulation and bank money forms a very small portion of it. This limits the operation of central bank’s monetary policy which basically works through its impact on bank money.

(iv) The growth of nonbank financial institutions also restricts the effective implementation of monetary policy because these institutions fall outside the direct control of the central bank.

(v) In the underdeveloped countries (e.g., in Libya), many commercial banks possess high level of liquidity (i.e, funds in cash form). In these cases, the changes in monetary policy cannot significantly influence the credit policies of such banks.

ADVERTISEMENTS:

(vi) Foreign-based commercial banks can easily neutralise the restrictive effects of tight monetary policy because these banks can replenish their resources by selling foreign assets and can also receive help from international capital market.

(vii) The scope of monetary policy is also limited by the structural and institutional realities of the underdeveloped countries, weak linkage between interest rate, investment and output, particularly due to structural supply rigidities.

When investment is increased as a result of a fall in the rate of interest, increased investment may not expand output due to the structural supply constraints, such as inadequate management, lack of essential intermediate products, bureaucratic rigidities, licensing restrictions, lack of interdependence within the industrial sector. Thus, higher investment, instead of increasing output, may generate inflationary pressures by raising prices.

Role of Monetary Policy in Developing Countries:

The monetary policy in a developing economy will have to be quite different from that of a developed economy mainly due to different economic conditions and requirements of the two types of economies. A developed country may adopt full employment or price stabilisation or exchange stability as a goal of the monetary policy.

But in a developing or underdeveloped country, economic growth is the primary and basic necessity. Thus, in a developing economy the monetary policy should aim at promoting economic growth. The monetary authority of a developing economy can play a vital role by adopting such a monetary policy which creates conditions necessary for rapid economic growth.

Monetary policy can serve the following developmental requirements of developing economies:

1. Developmental Role:

In a developing economy, the monetary policy can play a significant role in accelerating economic development by influencing the supply and uses of credit, controlling inflation, and maintaining balance of payment.

Once development gains momentum, effective monetary policy can help in meeting the requirements of expanding trade and population by providing elastic supply of credit.

2. Creation and Expansion of Financial Institutions:

The primary aim of the monetary policy in a developing economy must be to improve its currency and credit system. More banks and financial institutions should be set up, particularly in those areas which lack these facilities.

The extension of commercial banks and setting up of other financial institutions like saving banks, cooperative saving societies, mutual societies, etc. will help in increasing credit facilities, mobilising voluntary savings of the people, and channelising them into productive uses.

It is also the responsibility of the monetary authority to ensure that the funds of the institutions are diverted into priority sectors or industries as per requirements of be development plan of the country.

3. Effective Central Banking:

To meet the developmental needs the central bank of an underdeveloped country must function effectively to control and regulate the volume of credit through various monetary instruments, like bank rate, open market operations, cash-reserve ratio etc. Greater and more effective credit controls will influence the allocation of resources by diverting savings from speculative and unproductive activities to productive uses.

4. Integration of Organised and Unorganised Money Market:

Most underdeveloped countries are characterized by dual monetary system in which a small but highly organised money market on the one hand and large but unorganised money market on the other hand operate simultaneously.

The unorganised money market remains outside the control of the central bank. By adopting effective measures, the monetary authority should integrate the unorganised and organised sectors of the money market.

5. Developing Banking Habits:

The monetary authority of a less developed country should take appropriate measures to increase the proportion of bank money in the total money supply of the country. This requires increase in the bank deposits by developing the banking habits of the people and popularising the use of credit instruments (e.g, cheques, drafts, etc.).

6. Monetisation of Economy:

An underdeveloped country is also marked by the existence of large non-monetised sector. In this sector, all transactions are made through barter system and changes in money supply and the rate of interest do not influence the economic activity at all. The monetary authority should take measures to monetise this non-monetised sector and bring it under its control.

7. Integrated Interest Rate Structure:

In an underdeveloped economy, there is absence of an integrated interest rate structure. There is wide disparity of interest rates prevailing in the different sectors of the economy and these rates do not respond to the changes in the bank rate, thus making the monetary policy ineffective.

The monetary authority should take effective steps to integrate the interest rate structure of the economy. Moreover, a suitable interest rate structure should be developed which not only encourages savings and investment in the country but also discourages speculative and unproductive loans.

8. Debt Management:

Debt management is another function of monetary policy in a developing country. Debt management aims at- (a) deciding proper timing and issuing of government bonds, (b) stabilising their prices, and (c) minimising the cost of servicing public debt.

The monetary authority should conduct the debt management in such a manner that conditions are created “in which public borrowing can increase from year to year and on a big scale without giving any jolt to the system. And this must be on cheap rates to keep the burden of the debt low.”

However, the success of debt management requires the existence of a well- developed money and capital market along with a variety of short- term and long-term securities.

9. Maintaining Equilibrium in Balance of Payments:

The monetary policy in a developing economy should also solve the problem of adverse balance of payments. Such a problem generally arises in the initial stages of economic development when the import of machinery, raw material, etc., increase considerably, but the export may not increase to the same extent.

The monetary authority should adopt direct foreign exchange controls and other measures to correct the adverse balance of payments.

10. Controlling Inflationary Pressures:

Developing economies are highly sensitive to inflationary pressures. Large expenditures on developmental schemes increase aggregate demand. But, output of consumer’s goods does not increase in the same proportion. This leads to inflationary rise in prices.

Thus, the monetary policy in a developing economy should serve to control inflationary tendencies by increasing savings by the people, checking expansion of credit by the banking system, and discouraging deficit financing by the government.

11. Long-Term Loans for Industrial Development:

Monetary policy can promote industrial development in the underdeveloped countries by promoting facilities of medium-term and long-term loans to tire manufacturing units. The monetary authority should induce these banks to grant long-term loans to the industrial units by providing rediscounting facilities. Other development financial institutions also provide long-term productive loans.

12. Reforming Rural Credit System:

Rural credit system is defective and rural credit facilities are deficient in the under-developed countries. Small cultivators are poor, have no finance of their own, and are largely dependent on loans from village money lenders and traders who generally exploit the helplessness, ignorance and necessity of these poor borrowers.

The monetary authority can play an important role in providing both short-term and long term credit to the small arrangements, such as the establishment of cooperative credit societies, agricultural banks etc.

Conclusion:

It is true that monetary policy in a developing economy can play a positive role in facilitating the process of economic development by influencing the supply and use of credit through well- developed credit institutions, checking inflation, maintaining balance of payments equilibrium, providing loan facilities to industrial and agricultural sectors, and so on.

But it must be clearly borne in mind that the role of monetary policy in economic development is secondary and indirect, and not primary and direct. The fundamental problem of underdeveloped countries is that of inadequate saving which cannot be solved merely by creating financial institutions. The growth of saving basically depends upon the increase in productive capacity and income of the country.

Financial institutions only provide facilities to encourage savings and smoothen the process of economic development; they are not the primary movers of economic development. A.S. Meier and Baldwin put it, “The currency and credit system must be responsive to the stimuli of development, but monetary and financial institutions in themselves cannot be expected to be the primary and active movers of development in a direct sense.”

The Role of Monetary Policy in Promoting Faster Economic Growth:

Economic growth refers to a sustainable or a continuous increase in national and per capita incomes. This occurs when there is an increase in an economy’s capital stock through an increased investment. As a result there is expansion of the economy’s production capacity. This enables the economy to produce more goods and services every year.

In truth, faster economic growth can be attained by an economy largely if not entirely, by increasing the rate of saving and investment.

How this can be achieved by using monetary policy may now be discussed:

1. Increasing the Rate of Saving:

If monetary policy is to promote economic growth, it has to raise the rate of saving. In a developing country like India, the central bank should raise the rate of interest to a reasonable level to induce people to save more. So larger and larger volume of resources will be available for investment (particularly in fixed assets).

In times of inflation the nominal rate of interest has to be raised so that the real rate of interest remains constant. In fact in order to mobilise more and more saving through the banking system for investment purposes, it is absolutely essential to maintain reasonable price stability so that people have less incentive to buy gold, real estate or goods for hoarding and speculation. If due to excessive rise in price the real rate of interest becomes negative, people will have less incentive to save.

However, the rate of interest affects only people’s desire to save. But their capacity to save depends, apart from income, on the existence of banks and other financial institutions. So the governments of developing countries should build a strong financial infrastructure by setting up banks, post offices, insurance companies, stock exchanges, mutual funds, and pension funds mainly in rural areas where the majority of the people live.

2. Monetary Policy and Investment:

Even if the rate of interest is very low, private enterprises may not be willing to make new investment in time of depression due to lack of profitable business opportunities.

This, of course, is Keynes’s view. But in normal times an increase in the supply of money due to an increase in bank credit leads to an increased investment. In addition in a developing country public (government) investment plays an important role in economic development. So monetary policy should also make adequate funds available for public investment.

(a) Monetary Policy and Public Investment:

The monetary policy of a developing country like India has to be such as to ensure that a large portion of deposits mobilised by banks is invested in government and other approved securities so as to enable the government to finance its planned investment. Infrastructure building is so important for economic development.

So public investment has to be made to set up power plants, build roads, highways and ports. Such investment promotes industrial development directly and indirectly (by establishing backward and forward linkages). As a result there is a tremendous increase in demand for industrial products.

Each industry purchases inputs from other industries and sells its products to both households and other businesses. The operation of multiplier stimulates private investment further. Thus public investment on social overhead capital will crowd in, rather than crowd out, private investment. Moreover, construction of irrigation dams promotes agricultural growth by raising both production and productivity.

In India, a new tool of monetary control has been introduced for taking out large resources from the banking sector for financing public investment, viz., statutory liquidity ratio (SLR). Now in addition to keeping cash reserves commercial banks are to keep a minimum portion of their total demand and time deposits in some specified liquid assets, mainly in government and other approved securities’.

(b) Monetary Policy and Private Investment:

Since both large-scale and medium-size industries require funds for investment in fixed capital, working capital as also for holding inventories (of both finished goods and raw materials) monetary policy has also to ensure that the need for bank credit for investment and production in the private sector is fully satisfied.

Adequate bank credit is necessary for two purposes:

(i) To utilise the existing production capacities in the private sector and

(ii) To create additional capacity.

Banks must also provide adequate credit to meet the minimum working capital needs of agriculture and industry.

(c) Allocation of Investment Funds:

The mobilisation of savings is not enough. Savings are to be utilised for productive investment. So monetary policy should be discriminatory in nature. It should restrict the flow of credit in unproductive sectors and wasteful activities which are inimical to economic growth. At the same time it should direct the flow of credit in productive channels.

So there is need for much stricter application of selecting credit control (SCC) mainly with a view to influencing the pattern of investment. SCC also helps the process of development indirectly by checking price rise and thus avoiding the distortion created by double digit inflation. However, it has to be supported by proper credit rationing.

In addition, measures such as lengthening the periods of repayment of loans, lowering of margin requirements, provision of rediscounting facilities at rates below the market rates, interest and provision of special loans to entrepreneurs setting up labour-intensive industries in backward areas are to be adopted for promoting faster industrial growth.

Monetary policy should provide the necessary incentives to channelise saving in the desired direction. This is supposed to widen the horizons of development in accordance with the pre-determined goals of planning.

Targets for Monetary Policy:

Conditions of a Good Target:

In order to become a good target for monetary policy a variable should satisfy the following conditions:

1. Measurability:

The target variable should be easily measurable with little or no time lag. To meet this condition, accurate and reliable data must be available. The data should also conform to the theoretical definitions of the target variables.

2. Attainability:

The monetary authority should be able to attain its targeted goals, otherwise, setting the targets will be an exercise in futility. The targets which are unattainable are not practical. A target will be attainable when- (a) it is rapidly affected by policy instruments; and (b) there are no or very little non-policy influences on it.

3. Relatedness to Goal Variables:

The target variable should be closely related to the higher level goal variables and this relation should be well understood and reliably estimable. For example, even if the monetary authority is able to attain the interest rates target, all is in vain if the interest rates do not affect the ultimate goals of employment. The price level, the rate of economic growth, and the balance of payments.

Superiority of Target Variables:

There are three main variables used as monetary targets. They are- money supply, bank credit and interest rates. Which of these variables is superior and chosen as target variable depends upon how far it satisfies the three criteria of measurability, attainability and relatedness to ultimate goals.

In spite of certain conceptual and practical difficulties in the measurement of target variables, all the three variables satisfy equally well the criterion of measurability and can be estimated with reasonable accuracy. As regard the condition of attainability, both money supply and bank credit meet equally well this condition, whereas interest rates do not fulfill it satisfactorily.

All the interest rates in the market do not change together and equi-proportionately. Interest rates are also not affected by the policy instruments as rapidly as other target variables are. Moreover, non-policy factors greatly influence the interest rates.

As regards the fulfillment of the criterion of relatedness to goal variables, the economists differ sharply. The Keynesians recommend interest rate as appropriate target variable, while the monetarists prescribe money supply. Practical central bankers, on the other side, consider bank credit as a better target variable.

Economists are not in agreement as to which one is the best target variable:

(i) On the basis of the criteria of measurability and attainability, both money supply and bank credit are better target variables than interest rates.

(ii) As between money supply and bank credit, money supply is definitely superior because there exists weak theoretical and empirical evidence in support of close causal link between credit and higher goals variables.

(iii) Money supply is much more easily influenced by policy instruments than interest rates and the weight of policy factors is heavier than non- policy factors on money supply variable.

(iv) Empirically also, the relation between money supply and the level of economic activity (and thus other goal variables) is stable and calculable. The same cannot be said about interest rates.

Recently, Benjamin Friedman, a Harvard economist, has suggested that the best intermediate target would be a combination of a credit variable target and a monetary growth target. Such a system, according to him, would draw on a more diverse and hence more reliable information base for the signals that govern the systematic response of monetary policy to emerging developments.

Under such a system, the central bank would select one monetary aggregate and total net credit, specify growth rate together for both and carry out open market operations aimed at achieving both targets. A deviation in either target from its respective target range would require a change in open market operations.

Impossibility of Simultaneous Targeting of Money Supply and Interest Rate:

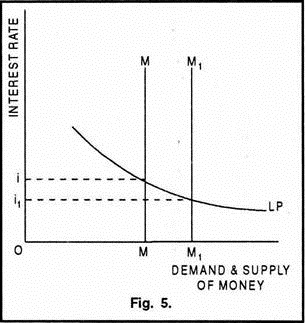

It is to be carefully noted that the targets of money supply and interest rate pose a problem of mutually exclusivity. The monetary authority can select an interest rate or a money supply target, but not both. In Figure-5, for example, the monetary authority cannot choose both Oi interest rate, and OM1 money supply.

If it chooses Oi interest rate, it must accept OM money supply and if it chooses OM1 money supply, it must allow the interest rate to fall to Oi1. Thus, it is clear that money supply and interest rate targets cannot be pursued simultaneously.

Choosing an Appropriate Target:

In actual practice, whether the monetary authority should choose interest rate target or money supply target depends upon the source of instability in the economy. If the source of instability is in the commodity market, i.e., variations in private and public spending or variations in the IS curve, then money supply target should be set and pursued.

On the contrary, if the source of instability in the economy is in the money market, i.e., unstable demand or supply of money, or variations in the LM curve, then the interest rate target will be selected.

These two cases are discussed below in detail:

1. Instability of IS Curve:

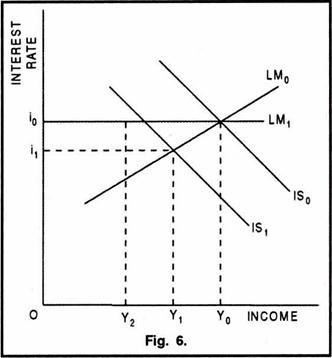

Instability in the IS curve can arise- (a) because of destabilising fiscal policy adopted by the government (i.e., changes in public spending), or (b) because of variations in consumption function or investment function (i.e., changes in the private spending). Given the money market conditions (i.e., given the LM0 curve in Figure-6), a fall in spending will cause the IS curve to shift to the left from IS0 to IS1.

This will reduce the rate of interest from Oi0 to Oi1 and the income level from OY0 to OY1. Using the strategy of stabilizing the money supply, the monetary authority is induced to increase the money supply, thus shifting the LM curve to the right.

This will cause income to rise above OY1 back towards the target level OY0, although the interest rate is further reduced. Thus, if the LM curve is stable, then an unstable IS curve causes the level of income to fluctuate between OY1 and OY0, when a money supply target is followed.

This implies that money supply targeting will be stabilising or countercyclical; that is, increasing money supply during recession will increase income and reduce rate of interest, and reducing money supply during inflation will reduce income and raise rate of interest.

On the other hand, using the strategy of setting the interest- rate target means keeping the desired rate of interest at a particular level, say Oi0. In this case, the LM curve becomes horizontal at i0 (i.e., LM1 curve in Figure-6). The money supply must be adjusted to maintain Oi0 level of interest rate. In this process, the national income will fluctuate between Y2 and Y0. Since Y2 Y0 > Y1 Y0, a money stock target is more stabilizing than an interest rate target.

This further implies that changes in the money supply to maintain a constant interest rate will be pro-cyclical when the IS curve is unstable. During recession, when IS curve shifts from IS0 to IS1, the interest rate falls from i0 to i1 and income level falls from Y0 to Y1. The monetary authority would be prompted to decrease money supply to achieve the equilibrium level where LM curve intersects IS curve and the interest rate is raised to the desired Oi0 level.

This will, however, further reduce the income level from OY1 to OY2. Thus, when IS curve is unstable, setting the interest rate target by changing money supply will be destabilising and inappropriate. The monetary authority would be prompted to decrease money supply during recession to restrict interest rate from falling and to increase money supply during inflation to keep interest rate down.

2. Instability of LM Curve:

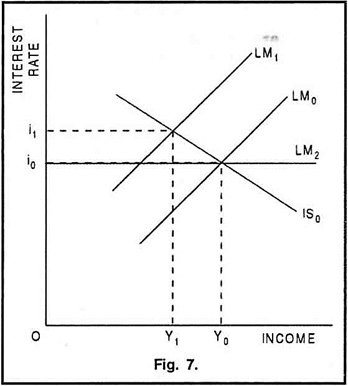

Instability in the LM curve arises mainly due to unstable demand for money in the money market which causes shifts in the LM curve. In a situation of stable IS curve and unstable LM curve, the strategy of constant money supply will cause the national income to fluctuate between Y0 and Y1 in Figure 7.

With the increase in demand for money, the LM curve will shift from LM0 to LM1. The effect of this shift is to reduce income from OY0 to OY1 and raise the rate of interest from Oi0 to Oi1. Moreover, pursuing constant money supply target will be pro-cyclical. Increase in the rate of interest induces an increase in money supply. In such condition, constant money stock-policy will require that the monetary authority should reduce money supply.

This will cause the LM carve to shift further from LM1 to the left, rate of interest to rise further above Oi1, and the income level to fall further below OY1. Thus, in a situation of unstable LM curve and stable IS curve, setting a constant money supply target will be destabilising and inappropriate.

It will require decrease in money supply, causing interest rate to rise and income level to fall, every time the demand for money rises during recession, and increase in money supply, causing interest rate to fall and income level to rise, every time the demand for money falls during inflation.

In contrast, the policy of targeting interest rate at Oi0 means that the LM curve becomes horizontal at i0 (i. e., LM2 curve in Figure-7). This will leave the level of income unaltered at OY0 which corresponds to the point of intersection of IS0 and LM2. The interest rate target will be stabilizing and counter- cyclical. It will induce the monetary authority to increase the money supply when the demand for money increases during recession, and to decrease the money supply when the demand for money falls during inflation.

Thus, the general conclusion is that the question as to which target is better is an empirical question. If IS is more stable than LM, setting an interest rate target is appropriate. If, on the other hand, LM is more stable than IS, setting a monetary aggregate target is appropriate.

Monetary Targeting in India:

Recently, the need for pursuing monetary target has been widely recognised and seriously discussed in India. In 1982, the Reserve Bank of India appointed a committee, with Prof. Sukhmoy Chakravarty as its chairman, with the objective of reviewing the working of monetary system in the country.

In its report, submitted in 1985, the Committee, among other things, laid stress on the desirability of developing monetary targets at the aggregate level for securing an acceptable and orderly pattern of monetary growth.

The Committee has emphasised the need to pursue price stability as the broad objective of the monetary policy consistent with the other socio-economic goals embodied in the Five Year Plans. For achieving this objective, money supply (M3) should be regulated in the framework of monetary targeting in terms of a range, with feedback and necessary support from an appropriate interest rate policy.

The range of money supply target should be determined on the basis of three considerations:

(a) Anticipated rise in the real output;

(b) Observed income elasticity of demand for money; and

(c) Acceptable rise in prices.

For example, if anticipated real output growth rate is 5%, the income elasticity of demand for borrowed money is 2% and the acceptable rise in prices is 4%, the target for monetary expansion may be set at 14% (i.e., 5 x 2 + 4 = 14) for the year.

This procedure is an improvised version of the Friedman rule for monetary targeting. It is based on the two implicit assumptions- (a) there exists close relationship between money and prices; and (b) rational expectations operate efficiently in the country.

The Committee felt that the targets set for the year might need to be revised upwards or downwards during the year to accommodate the impact of developments in the real sector of the economy. Therefore, the Committee recommended for setting of overall monetary targets to be made in the light of emerging trends of output and prices.

The Government of India has accepted the recommendations. It has also carried out an exercise, on an experimental basis operationally meaningful targets and monitor them. In developing this exercise, several technical problems were faced. These problems related to- (a) the choice of candidate variables, (b) volatility of these variables, and (c) their seasonal variations.

For a meaningful target, the variable should satisfy the following criteria- (a) It must be able to control aggregate fiscal and monetary outcomes; (b) It must make it feasible to predict the full year’s outcome on the basis of current information.

On the basis of these criteria, three monetary variables have been selected for early warning signals with respect to growth of overall liquidity in the economy. They are- (a) Aggregate Monetary Resources (M3); (b) Net Reserve Bank Credit to Central Government (NRCCG); and (c) Net Bank Credit to Central Government (NBCG).

Relative significance of these variables is as follows:

(i) NRCCG is a key component of the stock of reserve money. Although volatile, the research has indicated that the changes in NRCCG may have been the single most important explanation of year- to-year changes in money supply in the economy.

(ii) NBCG has the virtue of including the full recourse to bank borrowing by government. Being less volatile than NRCCG, it also provides a better indicator of within year trends.

(iii) M3 is the appropriate indicator of the degree of overall liquidity of the economy because it exerts substantial influence on the rate of inflation in the economy.

Even if the problems connected with the choice of the best money supply target is resolved, the effectiveness and efficiency of monetary targeting is based on the theories of monetarism and rational expectations which are yet to be proved. Increasing money supply at the target rate does not mean that inflation in the country is automatically controlled. It is also not realistic to assume the operation of rational expectations.