According to Sayers, “Bank is not only the privilege of money but also in an important sense manufacturer of money”.

Bank receives deposits. Bank through multiplication of loans and advances can multiply its deposits. The process is called multiple expansion of bank deposits.

In modern time, the banking habits are to be developed that the actual cash withdrawal from the deposit account are very small. Banker by experience knows that the people will withdraw only a certain percentage of their total deposits. The banks after keeping a certain percentage of the total deposits in cash, lend the rest.

An additional supply of money is created. Thus, loans cause an increase in the total amount of money supply.

ADVERTISEMENTS:

For instance:

I. Mr. X has Rs. 2000 in form of currency.

He deposits Rs. 2000 in Bank A.

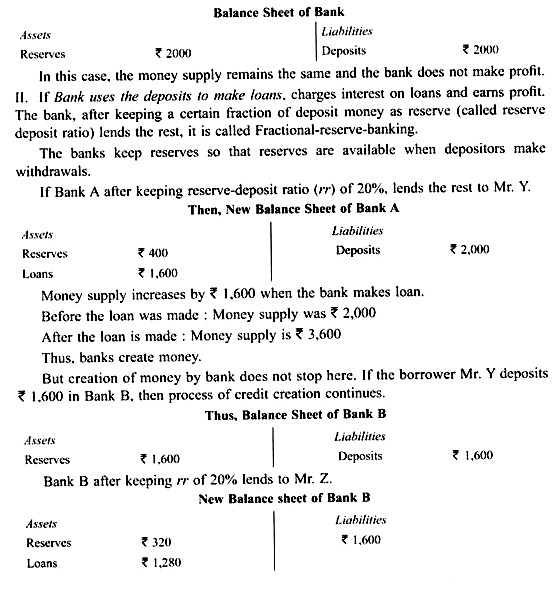

The deposits which bank has received but not yet lent out are called reserves because of the assumption that if the entire money is held as deposit and no loans are made, it will not affect the money supply. This is called Hundred-per cent-reserve banking. In this case, balance sheet of bank will be:

Thus, Bank B has created money = Rs. 1,280

Total Money supply has increased to Rs. 4,880 (3,600 of bank A + 1,280 of Bank B)

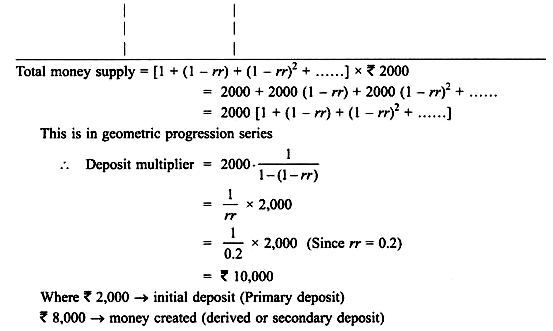

The process goes on and on. With each deposit and loan more money is created. Although this process continues forever, it does not create an infinite amount of money.

Total money supply = Rs. 10,000

ADVERTISEMENTS:

Original deposit = Rs. 2,000

Let rr denote the reserve deposit ratio which is 20% i.e., 0.2

First bank A lending = (1 –rr) x Rs.2000 = Rs. 1600 [2,000 (1 – 0.2)]

Second bank B lending = (1 – rr)2 x Rs. 2,000 = Rs. 1,280

Limitation:

1. Although bank creates money, it does not create wealth. When a bank gives loans, it gives the borrowers the ability to make transactions and therefore increases the money supply. Since the borrowers undertake debt obligations to the bank, the loan does not make them wealthier. Thus, the creation of money by the bank increases the liquidity of the economy, but not its wealth.

2. If there is inadequate demand for bank credit, the value of rr will increase because people are keeping more cash reserves. Therefore, withdrawal will be more.

Result:

ADVERTISEMENTS:

rr will increase and thus the lending capacity of bank will decrease.

... multiplier will decrease and the value of multiplier will decrease below the maximum value.

3. If there is no currency drain then all money will be deposited with the bank and the reserve will increase. Only cash drain in form of reserve deposit ratio will take place.

Note:

ADVERTISEMENTS:

(1) Demand Deposit Multiplier = 1/cr + rr

(2) Bank Credit Multiplier = 1 – rr/cr + rr

(3) Money Multiplier = 1+cr/cr + rr