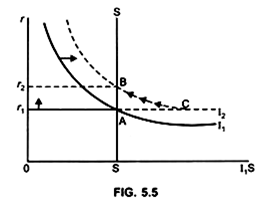

Increase in investment when saving is independent of the interest rate:

Investment demand may increase either due to (a) technological innovation (b) decrease in personal income taxes (for those who invest in new capital).

Due to increase in investment demand, at a given interest rate the investment curve will shift to the right from I1 to I2 (Fig. 5.5).

As saving that is, the supply of loanable funds is fixed, an increase in investment implies that the demand for loanable funds will increase.

ADVERTISEMENTS:

... At the given interest rate (r1): I > S

r1c > r1 A

As a result, the economy moves up on the investment curve till I = S. This is attained at point B (shown by movement from points C to B) (Fig. 5.5). Interest rate will increase from r1 to r2

ADVERTISEMENTS:

at new interest rate (r2): I2=S at point B.

However, the investment remains unchanged, therefore there is no crowding out.

Exception:

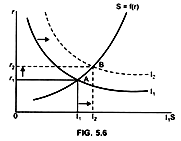

Increase in Investment when saving depends on the interest rate:

ADVERTISEMENTS:

If-saving increases due to the increase in interest rate the saving curve will slope upwards. (Fig. 5.6) This is because interest rate is the return on saving. Greater the return (r), more will be the saving.

Initially I = S at point A

... equilibrium point → A

Equilibrium interest rate – r1

If investment increases from I1 to I2

Interest rate increases from r1 to r2

Due to increase in interest rate saving will increase, which in turn will lead to an increase in investment. Thus, there will be no crowding out.