Possible Failure of Market:

In his book, Wealth of Nations (published in 1776), Adam Smith explained the ‘beauty’ of the ‘market economy’. In a market economy, guided by the motive of self-interest, individual decisions collectively determine economy’s allocation of scarce resources through free markets for the social good.

Operation of demand-and-supply forces, through perfectly competitive market, results in optimal allocation of resources. That is why it is said that a perfect market leads to social efficiency and maximum social welfare. But, in the real world, perfect competition is not so ‘perfect’ as it appears at first.

Unless demand and supply reflect, respectively, all the benefits and all the costs of producing and consuming a product, the prices determined in perfect competition may not necessarily be ‘perfect’ or ‘right’ ones. If so, perfect competition cannot ensure maximum social welfare. Or markets fail to achieve social efficiency. Economists call this ‘market failure’.

By ‘market failure’ we mean that the best attainable or efficient outcomes are not achieved. Market failure is a situation in which the market solution (i.e., unhindered or free play of market forces) does not lead to a social optimum or maximum welfare.

ADVERTISEMENTS:

In ordinary sense, market failure means that prices fail to provide the proper signals to economic agents—consumers and producers— so that the market does not operate in the traditional way. Government intervention is desirable to improve the efficiency of the market.

There are at least four possible failures of the market of which the most important ones are – Externalities and Public Good.

1. Externalities:

The presence of externalities is one of the significant phenomena of the modern urban society. Examples abound: air pollution, sound pollution, greenhouse gas emissions, traffic congestion, acid rain, and so on. The study of externalities has become an important area of discussion of ‘environmental economics’.

An externality arises when an economic activity generates beneficial or harmful effects on some other person who is not a party to the activity. Beneficial externalities or positive externalities are often termed external economies, and harmful or negative externalities are called external diseconomies.

ADVERTISEMENTS:

Such externalities (both economies and diseconomies) can arise either in production or in consumption. It may be pointed out that one of the key features of externality is that it ‘takes two to tango’ (said by W. J. Baumol). This means that there are two parties in any external effect and when one of the parties is removed, such external effect will disappear.

People affected by any kind of pollution blame the polluter. An externality is thus a side- effect of production and consumption. Such side-effect may be good or bad. These good and bad effects are called external benefits and external costs.

When the municipal corporation spreads DDT in a locality to stop mosquito menace, not only is the malaria patients benefitted but it also ensures that other members of the locality will remain free from the disease. Since other people gain from it there occurs external benefits. An external cost—bad side- effect—occurs when a chemical factory emits toxic gas in a locality— thereby polluting the atmosphere.

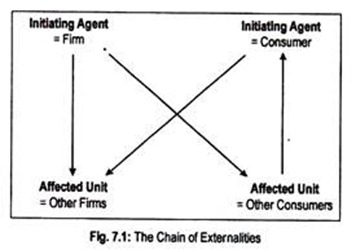

Anyway, such positive and negative externalities or third-party effects or neighbourhood effects can arise between firms, between consumers, and between consumers and producers. This can be illustrated in terms of Fig. 7.1. The arrows in the diagram show that the initiating agent may be a producer or a consumer.

Suppose, a chemical firm has taken up an expansion programme. This demands construction of an additional factory building. If building material suppliers of the locality are allowed to do business, it will result in a positive production externality benefitting other units.

But a chemical industry usually emits toxic elements that may go into the fishing pond of the locality. This will definitely reduce the profitability of the fishermen since toxic discharge affects pond fishes adversely. This is a case of negative production externality between producers.

Let us now look at the externalities in consumption. Expansion programme of the chemical industry is expected to provide jobs to local boys. This is the positive production externality between producers and consumers. At the same time, the toxic discharge of the chemical industry pollutes the atmosphere of the locality leading to various health problems like asthma and chest congestion.

These are the negative production externalities harming other consumers. A positive externality generates net external benefits and a negative externality produces net external costs. Anyway, externalities have side-effects or spill-over effects or neighbourhood effects or third-party effects— because parties other than the two primary participants (producer and consumer) in the transaction are affected.

From the above-noted externality-led chain effects or third-party effects, we can classify these third-party effects or spill-over effects under four headings:

(a) Production on Production:

If the action of one firm provides reciprocal benefits to some other firms then a positive externality in production arises. A motor training school in a locality gives driving lessons to would-be drivers against money payment.

After successful training they get absorbed in companies and factories. However, companies do not incur any expenditures towards such driving training lesson. Thus, costs of these companies are reduced. This means that SMC is less than private MC.

A negative externality would result if the motor training school, in the name of imparting driving lessons, engages more cars and lorries, thereby overcrowding the roads. This will adversely affect movements of goods from their factories to other places— leading to an increase in costs. This means that SMC exceeds private MC.

ADVERTISEMENTS:

(b) Production on Consumption:

A positive production externality benefitting consumers may arise if the prospect of jobs of local people in the motor training school improves so that the living standards also improve. A negative production externality harming consumers arises when the motor training school creates noise pollution in the area.

(c) Consumption on Production:

ADVERTISEMENTS:

This is a case when a person’s consumption has an effect on production—favourably and unfavourably. Positive externalities in this category are theoretically possible; but, in practice, they are of little significance. Negative externalities arise from the overcrowding and congestion caused by the plying of more cars than the road condition permits. This leads to an increase in costs of transporting goods of many firms.

(d) Consumption on Consumption:

This is a case when a person’s consumption has both favourable and unfavourable effect on consumption of other members of the society. Positive externalities would arise if a man listens to news or songs on a radio set that is not owned by him. Negative externalities would arise if noisy radios tuned in by someone else hamper the study of students preparing for examination.

2. Public Good:

When there are externalities, the market fails to achieve social efficiency. Free market cannot work efficiently when the government provides a category of goods—called public good. If at all public goods are to be produced under competitive conditions, there will be a situation of underproduction or no production of such good.

ADVERTISEMENTS:

Defence, health, education, etc., fall in this category public of good as contrasted to private good like car, computer, clothes and food, etc. Benefits from the former good flow to all members of the society, while private good go, broadly, to them who pay for them.

Unlike private good, one does not find any market for public good. Good whose benefits are enjoyed by the public but does not cost anything extra to them are called public good.

Definition of Public Good:

Let us start with a broad definition of public good:

“Anything that government provides” may be called public good. To serve our purpose, we use a narrow definition.

An extreme case of positive externality is public good. Thus, the concept of externality enters into the definition of a public good. Benefits are internal if the good in question is a private one; no third-party effect or spill-over effect arises out of a private good.

ADVERTISEMENTS:

Whenever an individual purchases a car or a washing machine or other commodities, he or members of his family receive benefits from consuming it. But in case of defence or police arrangements, all citizens can benefit from it; benefits are thus external to all. Whenever such goods are produced no individual can be excluded from enjoying its services—even if no price is paid for it.

Consider fire protection—a good provided by the government. When a fire breaks out in a house, the fire brigade personnel help in dousing the fire so that it does not spread to the entire locality. As a result, everyone’s house is protected even without paying anything for the service received. In other words; every member of the locality is a free- rider.

As far as public goods are concerned there is an incentive to ride free for all citizens. It is difficult to preclude anyone from using a public good, those who do not enjoy benefits from the good have an incentive to avoid paying for them, and those who enjoy it also have an incentive to “free ride”.

Users of such goods are tempted to become free-riders:

People who accept benefits without paying their share of the cost of providing those benefits. Because of (positive) externalities, there is a free-rider aspect of a public good. Private goods do not have any free-rider problem.

On the basis of this definition, we now point out two essential characteristics of public good:

ADVERTISEMENTS:

(i) Features of Public Good:

(a) Non-Rivalry:

Public good is non-rival if its consumption by ‘A’ does not reduce consumption by another individual, ‘B’. Consider the malaria eradication programme. Whenever such programme is undertaken it is meant for all—since the benefits from such programme accrue not to any individual but to all members of a society.

Provisioning of such good to additional people does not involve any additional cost. On the other hand, a private good is rival in the sense that consumption of it by anyone will reduce consumption by another. Whenever a car- owner purchases petrol for driving his car, the other individual gets less of it.

In the words of Pindyck and Rubin-Feld:

ADVERTISEMENTS:

“Goods that are rival must be allocated among individuals. Goods that are non-rival can be made available to everyone without affecting any individual’s opportunity for consuming them.”

(b) Non-Excludability:

Public good is nonexclusive in the sense that once it is supplied to individual A, other individuals cannot be excluded from consuming it—whether they like it or not.

Thieves cannot be excluded from using the street light even if they like darkness. But exclusion is possible in case of private good. Once a commodity is purchased by A, it then excludes another from buying it. Or if A does not pay any price for private good, he is excluded.

Public good, being non-excludable, is available even without paying any price for them. In fact, there is no incentive to pay for public good since people get free benefits from public good. This is known as “free-rider problem”.

Because of these characteristics of public goods (non-rivalry and non-excludability), free market does not provide such goods. If these goods are to be produced at all, they should be provided only by the government. For convenience, let us assume that all goods produced in the public sector are public goods.

ADVERTISEMENTS:

However, there are some goods which are consumed by everyone, if it is provided. No one can reject it when it is consumed—such as carbon emission from a car. This feature, i.e., non-reject-ability, is the peculiarity of ‘public bad’.

Public Good and Socially Efficient Output:

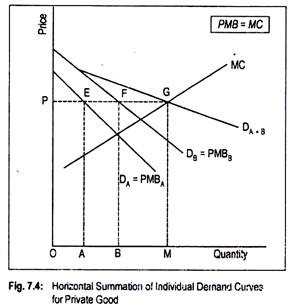

An optimal quantity of a private good is available when demand or PMB equals supply or MC. For public good, output will be expanded to the point where SMB = SMC. But a market demand curve obtained through horizontal summation of all individual demand curves does not reflect SMB in the case of public good. This is because of the fact that public good is consumed jointly whose benefits cannot be isolated.

Let us assume a two-person economy, A and B, whose demand curves for a private good X are represented by curves DA and DB, respectively. At OP price, A demands OA while B demands OB. The market demand curve, DA+B, is obtained by adding A’s and B’s demands together at each price.

In other words, DA+B curves is the horizontal summation of DA and DB curves. At OP price, market demand is OM (= OA + OB). This is shown in Fig. 7.4. Since AE = BF = MG, it follows that the PMB of individuals A and B would equal the MC at the equilibrium allocation.

In Fig. 7.5, we have drawn the total market, demand curve, D = ∑PMB = SMB, by summing vertically the individual demand curves for A and B, labelled as DA and DB. This is because of the fact that both the individuals consume the same amount (OM) of public good at a uniform price (OP).

Marginal benefit for OM unit of public good accurse to the extent of NM to A and NR to B. Thus, the total SMB is MT = MN + NR. Since public goods are non-rival by nature, total demand curve D or the total SMB curve is derived by the vertical summation of all individual demands. The price that the society will pay for OM unit of a public good is OP (= OPA + OPB).

The efficiency condition for a public good is SMB = ∑PMB = SMC. Socially efficient output of a public good is now given by the intersection of the SMC curve with the SMB curve. The optimal output is OM.

However, this efficient solution is incomplete since it is very difficult to estimate SMB for all individuals as well as SMCs.

Further, public good is non-exclusive because there is no way to provide the public good without benefitting everyone. Obviously, beneficiaries of public goods do not find any incentive to pay for it. Thus, people act as free-riders—which prevents efficient provisioning of public goods.

Fig. 7.5 can now be used to demonstrate why public good results in market failure. Each individual pays an amount equal to his marginal benefit for OM—socially optimal provision of public goods. But, individuals may not behave in this way. It may happen that A can enjoy public good assuming that B will purchase.

That means A wants to be a free-rider. A hopes that he gets social good for nothing. As a result, no one will be able to determine that OM is the socially optimal level of output that maximizes social welfare. Because of the free-rider aspect of public good, everyone has an incentive to depend on other members of the society, rather than provide them for themselves.

Such behaviour causes delay in investment decisions. It is the government that takes up provisioning of such good. Since people are unwilling to share the cost of public good, those must be subsidized or provided by the governments if they are to be produced efficiently.

Consequences of Market Failure:

Freely operating price mechanism under perfect competition determines an economy’s decision of WHAT, HOW and FOR WHOM to produce. There is no central authority to set prices. It is argued by the fathers of the price mechanism that decentralized decision-making is more efficient.

They believe that price changes, the motive of profit- maximization, and, above all, self-interest of decision-making units, etc.,—all interact to channel resources away from unproductive to more profitable and productive lines of production. This means that market works, market is efficient, and market is good.

But, unfortunately, markets do not work efficiently. As far as allocational efficiency is concerned, markets fail. Hence the name ‘market failure’. It is an outcome that results in economic inefficiency. Market failure means any market performance that is judged to be less good than the best attainable outcome.

Market failure is analysed in terms of two distinct circumstances:

First is the allocational efficiency of society’s scarce resources. Second is the failure of the market system to achieve social goals like equal distribution of income and price stability.

(a) Failure to Achieve Efficiency:

Competitive markets lead to inefficient outcomes for at least four basic reasons:

Externalities, public good, monopoly power, and incomplete information.

In all these cases of market failure, market prices do not exist or do not reflect the true value of what they are pricing. These four phenomena can reduce the efficiency of private market performance.

(b) Failure to Achieve Social Goals:

Markets always do not perform well in promoting various social goals. Assuming that it can generate reasonably efficient outcomes in large number of cases other than the four mentioned above, it ignores the equity objective of resource allocation. In other words, the market system fails to achieve an ‘equitable’ distribution of income.

In a market economy, it is said that an economy’s total output is distributed inefficiently in the sense that people with higher incomes have more ‘votes’ in their favour than those who belong to the low income group. Obviously, scarce resources are diverted to the production of goods consumed mostly by the rich people. Thus, the free market cannot ensure social justice.

Rather, it widens inequality in the distribution of income and wealth. Actually, concerns over equity demand governmental intervention. However, any effort at improving equity adversely affects efficient allocation of resources. Thus, there is a conflict between ‘efficiency’ and ‘equity’. Attainment of one goal means deviation from the other goal.

Again, free market may lead to macro-economic failures. A market may get stuck in a state of massive unemployment when production and consumption decisions get out of line. Aggregate demand falls short of aggregate supply. This results in the piling of unsold goods causing further cut in production and, hence, further increase in unemployment.

Finally, free market also fails to achieve stability in general price level. Cyclical fluctuations in output and income cause instability in price level.

Thus, efficient allocation of resources, equitable distribution of income and stabilization in general price level may not be attained in a free market, even if government intervenes. Of course, government intervention is justified for correcting these market failures.