Let us study about Market. After reading this article you will learn about: 1. Meaning of the Term ‘Market’ 2. Classification of Market 3. Criteria for Classification.

Meaning of the Term ‘Market’:

In ordinary sense, market means a place where goods are bought and sold. But, to an economist, the term ‘market’ does not refer to a place. In economics, market refers to a group of buyers and sellers dealing in a particular commodity (e.g., gold market, oil market, car market, fruit market, etc.).

A market is thus a trading zone where buyers and sellers are in such close contact that a single price for commodities of uniform quantity prevails. A market is created whenever sellers of a good or service are brought into contact with the buyers and a means of exchange is made.

The medium of exchange may be money or goods itself (i.e., barter). Whatever the medium of exchange, exchange agreements between buyers and sellers are reached through the operation of the forces of demand and supply.

ADVERTISEMENTS:

Market, in economics, may thus be defined as any process of exchange between buyers and sellers. Thus, a market is an arrangement or an institution that enables buyers and sellers to get information and to do business or arrange exchange of goods with each other. Pindyck and Rubin-Feld say that “A market is a collection of buyers and sellers that interact, resulting in the possibility of exchange.”

Classification of Market:

Broadly, a market is classified into product market where goods are transacted, and a factor market where inputs are bought and sold. A goods market exists for both durable and nondurable and perishable goods.

A. According to the extent of area covered, a market is classified into local, national, and international. In a local market, perishable goods are transacted. A uniform price prevails over the local market.

There are some goods bought and sold almost at the same price (barring taxes) all over the country the markets for these commodities are national. Gold market is international in character in the sense that buyers and sellers all over the world come in contact with each other.

ADVERTISEMENTS:

B. Marshall has classified market in accordance with the time period.

He considers four kinds of market:

(i) The very short period market

(ii) The short period market

ADVERTISEMENTS:

(iii) The long period market

(iv) The very long period market.

It is to be remembered that the ‘period’ is not a calendar time. Above all, it depends on the nature of business and the nature of the commodity. A particular business may not have a long run view.

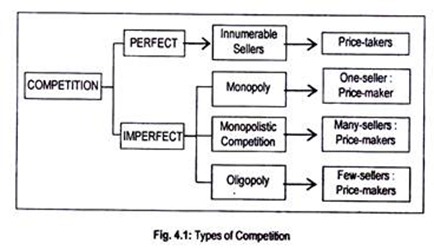

C:Market may be perfect or imperfect. In a perfect market quite a large number of firms compete in the supply of a single product. But in an imperfect competition, number of sellers may not necessarily be large. Markets can also be classified according to the nature of the competition among buyers and sellers. We may have pure or perfect competition, monopoly, monopolistic competition, oligopoly, etc.

Differences between these four markets classified on the basis of degree of competition can be presented in a tabular form (Fig. 4.1).

Perfect competition is characterized by the following main features:

(i) There are large numbers of sellers

(ii) Sellers and buyers are price-takers

(iii) Products produced are homogeneous

ADVERTISEMENTS:

(iv) There is freedom of entry and exit.

Monopoly market exists when

(i) There exists only one seller producing a commodity that has no close substitutes in the market

ADVERTISEMENTS:

(ii) The monopolist behaves as a price-maker

(iii) Entry is completely blocked.

Monopolistic competition is an admixture of both perfect competition and monopoly. It combines the features of these markets. In this sense, monopolistic competition is a realistic market. Perfect competition and monopoly, in the true sense, are not found in reality.

Monopolistic competition has the following characteristics:

ADVERTISEMENTS:

(i) There exist several or many sellers

(ii) Sellers sell differentiated products, that is, product of one seller is a fairly close substitute for those of other sellers

(iii) Sellers have some influence over the price of their products

(iv) There is freedom of entry and exit

An oligopoly market has the following attributes:

(i) There exists small number of sellers

ADVERTISEMENTS:

(ii) Sellers may sell homogeneous or differentiated products

(iii) Each oligopoly seller considers the effect of his action (namely, price) on other rival sellers (thus, sellers recognize their interdependence)

(iv) Entry is restricted

In other words, if any of the features of perfect competition are found to be absent then the market is to be called an imperfect one.

There are several forms of imperfect competition:

Monopoly, monopolistic competition, and oligopoly.

ADVERTISEMENTS:

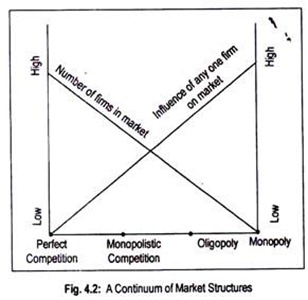

Market structures thus range from the theoretical extremes of perfect competition and monopoly. In practice, we focus on the levels of market imperfection lying between these extremes. We have chosen two parameters—the number of firms in a market and the influence of any one firm on the market—to identify different markets (Fig. 4.2).

If the number of firms in any market is too high (too low), and if the influence of any one firm on the market is virtually nil (or too high), the market is said to be a perfectly competitive one (monopoly). Monopolistic competition and oligopoly lie between these market forms.

Criteria for the Classification of Markets:

Three criteria for the classification of markets are often suggested.

These are:

(i) Substitutability of products criterion

ADVERTISEMENTS:

(ii) Interdependence criterion

(iii) Ease of entry criterion

The first criterion takes into account the existence and closeness of substitutes while the second criterion takes into account the reactions of competitive sellers. This criterion is closely related to the number of firms within the industry and the degree of product differentiation. The last criterion is the condition of entry which takes into account the ‘ease of entry’ in various markets.

Now we will classify markets in accordance with the three criteria mentioned above:

(a) Product Substitutability Criterion:

This first important criterion is the product substitutability criterion which is measured by the cross price elasticity of demand for the product. The cross price elasticity of demand measures the degree of responsiveness of quantity demanded for a product to a change in the prices of related goods.

The coefficient of cross price elasticity of demand is positive for substitute goods and negative for complementary goods. Thus, greater the degree of substitution the greater is the value of cross- elasticity of demand. Under perfect competition, products are perfect substitutes and, hence, the coefficient of cross, price elasticity of demand is infinite. In monopoly, there is no rival product or substitute product.

ADVERTISEMENTS:

So, the coefficient of price elasticity of demand is zero. As, under monopolistic competition, sellers sell differentiated but closely related products, the coefficient of price elasticity of demand is greater than zero but less than infinity. On the other hand, if the value of cross price elasticity of demand is greater than zero but less than infinity, the market for the product becomes an oligopolistic one.

(b) Interdependence Criterion:

The second criterion is the interdependence criterion which is closely related to the number of firms in the industry and the degree of product differentiation.

Perfect competition is characterized by innumerable number of firms in the industry and homogeneous or identical products. Price-output decisions of a competitive firm are not in any way affected by the price-output decisions of another firm. Thus, there is no rivalry among producers.

No question of interdependence arises in the monopoly market. Despite the existence of closely related products in monopolistic competition, each firm sets its price-output decisions independently. Under oligopoly, each firm takes into account the actions and reactions of rival sellers.

(c) Ease of Entry Criterion:

Let us now explain the ‘condition of entry’ which is expressed by the following notations:

E = Pa – Pc/Pc

E stands for the condition of entry, Pc is the price under perfect competition, and Pa is the actual price charged by firms. It is obvious that if the Value of E is reduced to zero (i.e., there is no barrier to entry into the market), the market is said to be a perfectly competitive one and monopolistically competitive one. Under monopoly, entry is blockaded.

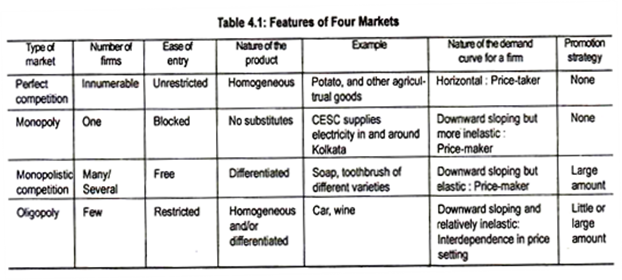

In a tabular form, features of different markets have been portrayed here (Table 4.1).

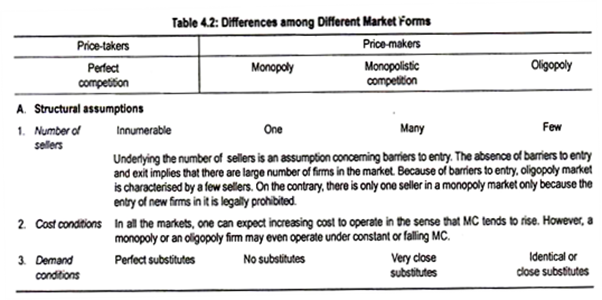

Thus, we find that there are four basic forms of market:

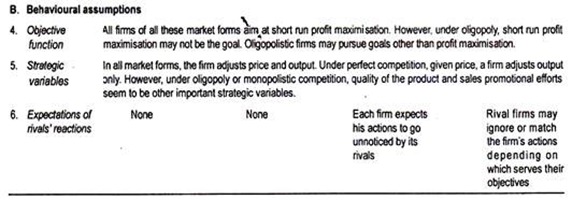

Perfect competition, monopoly, monopolistic competition, and oligopoly. In perfect competition, firms behave as price-takers, while, in the last three forms of market, firms act as price- makers. Anyway, we can show the differences among these market forms in terms of enduring structural and behavioural assumptions (Table 4.2).