Let us learn about the Marginal Productivity (MP) Theory of Distribution. After reading this article you will learn about: 1. Meaning of Marginal Productivity (MP) Theory of Distribution 2. Assumptions of Marginal Productivity (MP) Theory of Distribution 3. Criticisms.

Meaning of Marginal Productivity (MP) Theory of Distribution:

MP theory of distribution is used to determine the price of an input. For simplicity’s sake, we want to determine the price of labour, i.e., wage rate. Anyway, this theory can be applied in the determination of any input.

The origin of the MP theory is rather obscure. However, J. B. Clark, an American economist, is greatly responsible for the popularization of this theory in the late 1890s and early twentieth century. Jevons, Walras, Wicksteed, Marshall, Hicks, etc., have also given their own marginal productivity theories of distribution. In certain respects, each version is somewhat different.

Seeing different versions of MP theory of distribution, Joseph Schumpeter, also an American economist remarked that there are as many marginal productivity theories as there are economists. Anyway, here we are concerned with the Clarkian presentation of the theory.

ADVERTISEMENTS:

Clark’s Version:

J. B. Clark’s MP theory of distribution states that price of any input is determined according to the marginal product of that input. Thus, the price of labour—the wage rate—is determined by the volume of marginal product, or to be more specific, the value of marginal physical product (VMP). Assuming a perfectly elastic supply of labour, wage of labour is determined in accordance with the VMPL.

Since product market is characterized by perfect competition, VMPL becomes equal to MRPL. Thus, the wage of labour tends to become equal to VMPL= MRPL. A competitive profit- maximizing firm will go on employing labour until wage equals VMPL = MRPL, i.e., W = VMPL = MRPL. This is the essence of the Clarkian version of the MP theory of distribution.

Assumptions of Marginal Productivity (MP) Theory of Distribution:

Before presenting his theory, Clark made some simplifying assumptions abstracting from the real world. He assumed a completely static society where population, stock of capital, and techniques of production are constant.

ADVERTISEMENTS:

Following are the important assumptions of this theory:

i. Perfect competition exists both in product market and in input market. As a result, price of the product and price of the input are given.

ii. Every unit of input is homogeneous and easily substitutable.

iii. Inputs are perfectly mobile.

ADVERTISEMENTS:

iv. There exists full employment of resources.

v. Employer can measure the marginal product of an input in advance.

vi. Law of variable proportions operates.

vii. Firm hires input with the objective of profit maximization.

vii. If all inputs are paid according to their marginal products, total product would be exhausted—there would be neither surplus nor deficit.

Perfect competition in input market implies that neither input seller nor the input buyer can influence the price of an input. At a given price, any amount of the input may be supplied. As a result, price of any input becomes equal to its average cost and marginal cost, i.e., P = AC = MC. This means that the input supply curve must be perfectly elastic.

For the sake of analysis, we assume labour as the variable input. So VMPL = MRPL curve is the labour demand curve. SL = ACL = MCL curve is the supply curve of labour.

Diagrammatic Representation of the Theory:

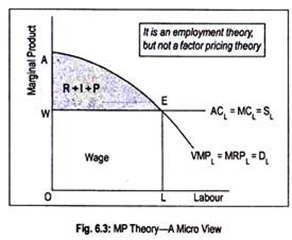

In Fig. 6.3, units of labour are measured on the horizontal axis and the price of labour, i.e., wage rate or marginal product is measured on the vertical axis. Negative sloping labour demand curve (VMPL = MRPL = DL) intersects the perfectly elastic labour supply curve (ACL = MCL = SL) at point E.

Point E is the equilibrium point because, at the going wage rate OW, the firm employs labour till wage rate equals VMPL = MRPL. In other words, the firm maximizes profit by employing OL amount of labour at the wage rate OW. In fact, OW (= LE) is the marginal product of labour. Thus wage of labour is determined by VMPL = MRPL.

ADVERTISEMENTS:

OL is the profit-maximizing level of employment because, at the ruling wage rate OW, the firm will not be able to maximize profit if it employs more than OL or it stops employment short of OL. If the firm hires less than OL units of labour at the wage rate OW, it means VMPL = MRPL> OW. So, it will be wise on the part of the firm to go on employing more labour until VMPL = MRPL = ACL = MCL.

Further, if the firm employs more than OL units of labour at the wage rate OW, VMPL = MRPL falls short of OW. This means that the marginal cost of labour is higher. So the firm will cut short employment until VMPL = MRPL = ACL = MCL is reached. So, the profit- maximizing firm should employ OL units of labour at the wage rate OW.

Labour, in this case, is the variable input while other cooperating inputs, say, land, capital and organization, are the fixed inputs. Total output is, thus, the area under the VMPL = MRPL curve.

ADVERTISEMENTS:

Out of this total output, OAEL, the firm pays OWEL as wages and the rest (i.e., WAE) is being paid as the rewards of the other inputs in the form of rent, interest, and profit (R + I + P). Thus, payment made in accordance with the marginal product exhausts the total product —there is neither surplus nor deficit.

However, this interpretation of the MP theory fails to determine the price of an input because input price is given or pre-determined. At a given wage rate OW, for an individual firm or industry, how many units of labour are employed can be known from this MP theory.

In fact, what we have determined is the level of employment, given the wage rate. Thus, from the micro point of view, Clark’s theory is a theory of employment, rather than a theory of input price determination.

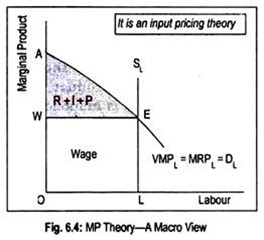

From a society’s point of view, what is predetermined is the level of employment rather than the reward of an input. This is shown in Fig. 6.4 where we have drawn a perfectly inelastic supply curve of labour. This means that, in the economy, OL amount of labour is available. The supply of labour intersects the VMPL = MRPL = DL curve at point E.

ADVERTISEMENTS:

Thus, E is the equilibrium point. Equilibrium wage rate determined is OW—the marginal product of OL units of labour.

Out of the total product OAEL, OWEL will be paid as wages and WAE will be paid as rent, interest and profit (R + I + P). Thus, total product gets exhausted. Given the labour supply, now we have determined the reward of labour, i.e., wage. Thus, from the macro point of view, MP theory is a theory of input price determination.

It is thus clear that the Clarkian presentation of the MP theory of distribution has two versions:

From the micro point of view (i.e., from the viewpoint of a firm or an industry) Clark’s theory is an employment theory rather than a wage theory; and, from the macro point of view (i.e., from the viewpoint of an economy), this theory is a wage theory, rather than a theory of employment.

Criticisms of Marginal Productivity (MP) Theory of Distribution:

Several criticisms have been levelled against this theory since most of the assumptions are unrealistic.

ADVERTISEMENTS:

Following are the main criticisms:

In the first place, the MP theory of distribution becomes operative only when perfect competition exists. But, in reality, perfect competition does not exist either in the product market or in the input market. What we find in reality is the imperfect competition in both product and input markets. This theory is inapplicable in the real world. In this sense, this is an unrealistic theory.

However, J. Robinson and E. Chamberlin have shown that Clark’s theory can be applied even in the imperfect market. In an imperfect market, inputs are rewarded less than their value of the marginal products. Thus, inputs are exploited. Inputs will always get their ‘just’ shares provided perfect competition exists.

Secondly, inputs can never be homogeneous. Some inputs must be more efficient than others. Further, inputs are not easily substitutable. For instance, there are some inputs which are used in fixed proportions. In such a situation, no degree of substitution exists.

ADVERTISEMENTS:

Thirdly, full employment of resources is another unrealistic assumption.

Fourthly, this theory assumes that the employer can measure the marginal product of an input in advance. Truly speaking, no employer measures marginal product —either consciously or unconsciously. Further, if inputs are jointly demanded then the calculation of marginal product of an input is virtually impossible.

Fifthly, this theory neglects the supply side of an input and describes only the demand side. Input is demanded because it is productive.

But why an input is supplied cannot be answered from this theory since, at a given price, any amount of an input is supplied. Usually, an input is supplied more if it is remunerated more. This simple idea has not been considered by the authors of this theory. They merely describe why an input is demanded by a firm.

Sixthly, this theory cannot determine price of each and every input. Each input has certain peculiarities not found in others. Thus, the price of every input is not influenced solely by the marginal product. For instance, rent is greatly influenced by the inelasticity in the supply of land rather than its marginal product.

Collective bargaining strength of a trade union has an important bearing on the wage rate. Profit is the result of risk and uncertainty borne by an entrepreneur rather than his marginal product.

ADVERTISEMENTS:

Seventhly, total product gets exhausted if inputs are rewarded according to their marginal products. This is known as the product exhaustion problem of the marginal productivity theory. Such product exhaustion takes place only when constant returns to scale operates.

But constant returns to scale and perfect competition are incompatible. Further, under increasing returns to scale or diminishing returns to scale, total product does not get exhausted—there occurs either deficit or surplus.

Finally, micro-presentation of the Clarkian version fails to determine the price of an input, since, from the micro point of view it is an employment theory rather than a theory of input price determination. However, from the macro point of view, it is a theory of input price determination. Under this condition, the assumption of perfect competition in input market is absolutely redundant.

In view of these criticisms, this theory has been discredited. Today, there are few believers of this theory.