In this article we will discuss about the assumptions and evaluation of Linder’s theory of demand and trade pattern.

Staffan B. Linder, a Swedish economist attempted to explain the pattern of international trade on the basis of demand structure. This theory was propounded by him in 1961. According to Linder, a manufactured product will not generally be exported until after there is demand for it within the home country. The products are, in fact, produced basically to meet the domestic requirements. It is only subsequently that the product is exported to other countries. The theory maintains that the countries having identical levels of income have similar demand structure and propensity to trade with other countries.

Assumptions of Linder’s Theory:

This theory is based upon the assumptions given below:

(i) The potential trade of a country is confined to these goods that have domestic demand.

ADVERTISEMENTS:

(ii) Two trading countries are engaged in the trade of such goods the demand for which exists within their domestic markets.

(iii) The domestic demand for goods is determined by the level of per head income.

(iv) Broadly, similar levels of income influence the potential trade between two countries.

According to S. Linder, the trade in primary products is governed essentially by the relative abundance of natural resources. Trade in manufactured products, on the other hand, is governed by a complex of factors such as economies of scale, managerial skills, availability of capital and skilled labour, technological excellence etc. Linder has not dwelt upon the composition of trade between the two countries. His theory is connected essentially with the volume of trade in manufactured goods between them.

ADVERTISEMENTS:

The major emphasis in this theory has been placed upon the prime condition that the countries will trade in those manufactured goods for which domestic demand is present. It happens because foreign trade has always been regarded as an extension of domestic trade.

Moreover, the possibilities of exports arise an account of the domestic demand. Since the foreign market is viewed as more risky than the home market, it is often considered not prudent to depend exclusively upon foreign market. A large domestic market induces an expansion in output ensuring the economies of scale and consequent reduction in costs. In these conditions, it is very opportune for the country to enter the foreign market.

A country, in the opinion of Linder, will export its products largely to such countries, as have similar patterns of demand and levels of income. He terms it the ‘preference similarity’. As a result of preference similarity, the country will have overlapping demands. According to Linder, just as within a country consumers in high income groups demand the products of high quality and these in low income group demand products of low quality, in the international trade also, the low income country, on an average, will be inclined to demand products of low quality and high income countries will be inclined to demand high quality products.

This, however, does not mean that low quality products will not be demanded by high-income countries and vice-versa. In view of disparities in income distribution in all the societies, some measure of preference similarity and overlapping of demand patterns cannot be ruled out. The different varieties of manufactured products are produced by the different countries for meeting the domestic demand and same products are exported to the foreign countries.

ADVERTISEMENTS:

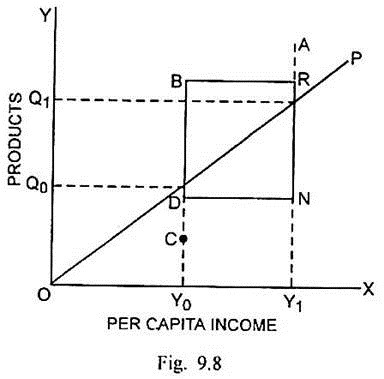

The preference similarity or overlapping demand pattern can be discussed through Fig. 9.8.

In Fig. 9.8., the per capita income is measured along the horizontal scale. Products are measured along the vertical scale. The line OP starting from origin expresses the relation between products and per capita incomes. Country A has higher per capita income Y1 and it demands the higher quality product Q1. Country B has lower per capita income Y0 and it demands the lower quantity product Q0.

Since income distribution is unequal in the two countries, each one of them has demand for both the products. Let us suppose income distribution in country A leads to the demand for two products taken together in the range of AN. The range of demand for products in country B is BC. The range of overlapping demand in the two countries is BD = RN. The existence of overlapping demand creates the possibility of trade between them.

There will be export of higher quality product Q1 from country A to meet the demand of high-income group in country B. Similarly the latter will export lower quality product Q0 to meet the demand for it from lower income group of people in country A. The larger and smaller magnitude of demand overlap will determine correspondingly the larger or smaller potential and actual volume of trade and the levels of income in the two trading countries.

Evaluation of Linder’s Theory:

The H-O theory had specified that trade would take place between the trading countries, if their factor proportions were different. Linder’s theory made an improvement upon the H-O theory as it specified that trade would take place between the countries even if the factor proportions were identical, provided they had similar demand preferences.

However, Linder’s theory of trade has the following shortcomings:

(i) This theory fails to explain why a country should develop the home market for a product which it has to export ultimately.

(ii) The concept of ‘quality’ of the product has not been precisely explained in this theory.

ADVERTISEMENTS:

(iii) No attempt has been made by Linder to measure the quality of the product in a specific way.

(iv) This theory does not explain why there is co-variation between per capita income and quality of the product.

(v) Linder recognised that the volume of trade was affected by demand overlap but he failed to specify the conditions under which demand overlap would affect volume of trade in a specific way.

(vi) The impact of demonstration effect on the volume of trade was not explained by Linder in this theory.

ADVERTISEMENTS:

(vii) The empirical evidence has not provided much support to Linder’s demand structure hypothesis. Linder found support for his hypothesis in Sweden but the attempts to confirm it with the evidence from other countries have not met with success. There is great demand for expensive motor cars in the oil-rich countries, but they have not undertaken the production of this commodity either for meeting domestic consumption or for exports.

In case of petroleum, the domestic demand in the oil-rich countries is extremely limited. Almost entire production there is meant for exports. Similarly Japan has built up extensive export industries that do not produce for the domestic market.

(viii) This theory has given a conclusion, which is of a doubtful validity. It is argued that the countries, having the same level of per capita income can have greater scope of international trade. The differences in per capita incomes have than been viewed as a potential obstacle to trade. The factor endowments of the rich and the poor countries, on the contrary, suggest that there is actually much scope for the trade among the developed and the less developed countries.