Let us make in-depth study of the derivation, reasons for downward slope and shift of IS curve in goods market equilibrium.

Derivation of IS Curve:

The IS-LM curve model emphasises the interaction between the goods and money markets.

The goods market is in equilibrium when aggregate demand is equal to income. The aggregate demand is determined by consumption demand and investment demand.

In the Keynesian model of goods market equilibrium we also now introduce the rate of interest as an important determinant of investment. With this introduction of interest as a determinant of investment, the latter now becomes an endogenous variable in the model. When the rate of interest falls the level of investment increases and vice versa.

ADVERTISEMENTS:

Thus, changes in the rate of interest affect aggregate demand or aggregate expenditure by causing changes in the investment demand. When the rate of interest falls, it lowers the cost of investment projects and thereby raises the profitability of investment. The businessmen will therefore undertake greater investment at a lower rate of interest.

The increase in investment demand will bring about increase in aggregate demand which in turn will raise the equilibrium level of income. In the derivation of the IS curve we seek to find out the equilibrium level of national income as determined by the equilibrium in goods market by a level of investment determined by a given rate of interest.

Thus IS curve relates different equilibrium levels of national income with various rates of interest. With a fall in the rate of interest, the planned investment will increase which will cause an upward shift in aggregate demand function (C + I) resulting in goods market equilibrium at a higher level of national income.

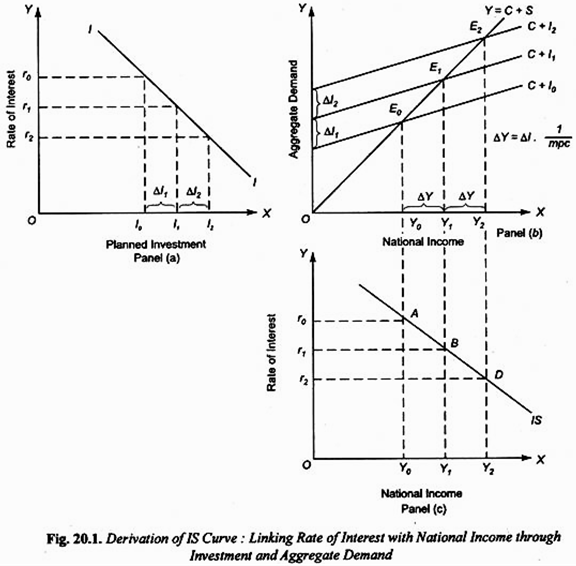

The lower the rate of interest, the higher will be the equilibrium level of national income. Thus, the IS curve is the locus of those combinations of rate of interest and the level of national income at which goods market is in equilibrium. How the IS curve is derived is illustrated in Fig. 20.1. In panel (a) of Fig. 20.1 the relationship between rate of interest and planned investment is depicted by the investment demand curve II.

ADVERTISEMENTS:

It will be seen from panel (a) that at rate of interest Or0the planned investment is equal to OI0. With OI0 as the amount of planned investment, the aggregate demand curve is C + I0 which, as will be seen in panel (b) of Fig. 20.1 equals aggregate output at OY0 level of national income. Therefore, in the panel (c) at the bottom of the Fig. 20.1, against rate of interest Or0, level of income equal to OY0has been plotted. Now, if the rate of interest falls to Or1, the planned investment by businessmen increases from OI0 to OI1 [see panel (a)].

With this increase in planned investment, the aggregate demand curve shifts upward to the new position C + II in panel (b), and the goods market is in equilibrium at OY1 level of national income. Thus, in panel (c) at the bottom of Fig. 20.1 the level of national income OY1 is plotted against the rate of interest, Or1. With further lowering of the rate of interest to Or2, the planned investment increases to OI2 [see panel (a)].

With this further rise in planned investment the aggregate demand curve in panel (b) shifts upward to the new position C +I2 corresponding to which goods market is in equilibrium at OY2 level of income. Therefore, in panel (c) the equilibrium income OY2 is shown against the interest rate Or2.

By joining points A, B, D representing various interest-income combinations at which goods market is in equilibrium we obtain the IS curve. It will be observed from Fig. 20.1 that the IS curve is downward sloping (i.e., has a negative slope) which implies that when rate of interest declines, the equilibrium level of national income increases.

Why does IS Curve Slope Downward?

What accounts for the downward-sloping nature of the IS curve. As seen above, the decline in the rate of interest brings about an increase in the planned investment expenditure. The increase in investment spending causes the aggregate demand curve to shift upward and therefore leads to the increase in the equilibrium level of national income.

Thus, a lower rate of interest is associated with a higher level of national income and vice versa. This makes the IS curve, which relates the level of income with the rate of interest, to slope downward.

Steepness of the IS curve depends on:

(1) The elasticity of the investment demand curve, and

(2) The size of the multiplier.

The elasticity of investment demand signifies the degree of responsiveness of investment spending to the changes in the rate of interest. Suppose the investment demand is highly elastic or responsive to the changes in the rate of interest, then a given fall in the rate of interest will cause a large increase in investment demand which in turn will produce a large upward shift in the aggregate demand curve.

A large upward shift in the aggregate demand curve will bring about a large expansion in the level of national income. Thus when investment demand is more elastic to the changes in the rate of interest, the investment demand curve will be relatively flat (or less steep). Similarly, when investment demand is not very sensitive or elastic to the changes in the rate of interest, the IS curve will be relatively more steep.

The steepness of the IS curve also depends on the magnitude of the multiplier. The value of multiplier depends on the marginal propensity to consume (mpc). It may be noted that the higher the marginal propensity to consume, the aggregate demand curve (C + I) will be more steep and the magnitude of multiplier will be large.

In case of a higher marginal propensity to consume (mpc) and therefore a higher value of multiplier, a given increment in investment demand caused by a given fall in the rate of interest will help to bring about a greater increase in equilibrium level of income. Thus, the higher the value of multiplier, the greater will be the rise in equilibrium income produced by a given fall in the rate of interest and this makes the IS curve flatter.

ADVERTISEMENTS:

On the other hand, the smaller the value of multiplier due to lower marginal propensity to consume, the smaller will be the increase in equilibrium level of income following a given increment in investment caused by a given fall in the rate of interest. Thus, in case of smaller size of multiplier the IS curve will be more steep.

Shift in IS Curve:

It is important to understand what determines the position of the IS curve and what causes shifts in it. It is the level of autonomous expenditure which determines the position of the IS curve and changes in the autonomous expenditure cause a shift in it. By autonomous expenditure we mean the expenditure, be it investment expenditure, the Government spending or consumption expenditure, which does not depend on the level of income and the rate of interest.

The government expenditure is an important type of autonomous expenditure. Note that the Government expenditure, which is determined by several factors as well as by the policies of the Government, does not depend on the level of income and the rate of interest.

Similarly, some consumption expenditure has to be made if individuals have to survive even by borrowing from others or by spending their savings made in the past year. Such consumption expenditure is a sort of autonomous expenditure and changes in it do not depend on the changes in income and rate of interest. Further, autonomous changes in investment can also occur.

ADVERTISEMENTS:

In the goods market equilibrium of the simple Keynesian model the investment expenditure is treated as autonomous or independent of the level of income and therefore does not vary as the level of income increases. However, in the complete Keynesian model, the investment spending is thought to be determined by the rate of interest along with marginal efficiency of investment.

Following this complete Keynesian model, in the derivation of the IS curve we consider the level of investment and changes in it as determined by the rate of interest along with marginal efficiency of capital. However, there can be changes in investment spending autonomous or independent of the changes in rate of interest and the level of income.

For instance, growing population requires more investment in house construction, school buildings, roads, etc., which does not depend on changes in level of income or rate of interest. Further, autonomous changes in investment spending can also take place when new innovations come about, that is, when there is progress in technology and new machines, equipment, tools etc., have to be built embodying the new technology.

Besides, Government expenditure is also of autonomous type as it does not depend on income and rate of interest in the economy. As is well known, government increases its expenditure for the purpose of promoting social welfare and accelerating economic growth. Increase in Government expenditure will cause a rightward shift in the IS curve.