Some of the important types of investment are: (1) Business Fixed Investment, (2) Residential Investment, (3) Inventory Investment, (4) Autonomous Investment, and (5) Induced Investment.

Type 1# Business Fixed Investment:

Business fixed investment means investment in the machines, tools and equipment that businessmen buy for use in further production of goods and services.

The stock of these machines or plant equipment etc. represents fixed capital.

The term ‘fixed’ in it implies that expenditure made on the machines, equipment etc. continues to be used for production for a relatively long time. This is in contrast to inventory investment whose components will be either used shortly for production or sold shortly to others for further production.

ADVERTISEMENTS:

Business fixed investment is important in two respects. First, business fixed investment is an important component of aggregate demand and therefore plays a significant role in the determination of natural income and employment. Business fixed investment is a volatile component of aggregate demand and, as Keynes emphasized, fluctuation in levels of fixed business investment is responsible for business cycles in a free market economy.

Keynes put forward a theory of investment which states that business fixed investment is determined by expected rate of profit (which he calls marginal efficiency of capital) and rate of interest. Since rate of interest in the short run is relatively sticky, it is changes in expectations about earning profits in future that cause fluctuations in business fixed investment.

According to the neoclassical theory, business fixed investment is determined by the marginal product of capital on one hand and user’s cost of capital on the other. The user’s cost of capital merely depends on the price of capital goods, the interest rate and the depreciation rate. According to the neoclassical model, if marginal product of capital exceeds user’s cost of capital, firms will find it profitable to undertake fixed investment.

In this model, rate of interest, which is an important component of the user cost of capital, and taxation of profits play an important role in the determination of business fixed investment.

Type 2# Residential Investment:

ADVERTISEMENTS:

Residential investment refers to the expenditure which people make on constructing or buying new houses or dwelling apartments for the purpose of living or renting out to others. Residential investment varies from 3 per cent to 5 per cent of GDP in various countries.

Two important features of residential investment are worth noting. First, since the average life of a housing unit is of 40 to 50 years, the stock of existing housing units at a point of time is very large as compared to the new residential investment in a year (i.e., flow of residential investment). Second, there is well developed resale market for housing units so that people who construct or own them can sell them in this secondary market.

Residential investment depends on price of existing housing units. The higher the price of existing units, the higher will be investment in constructing and buying new housing units. The price of housing units is determined by demand for housing units which slopes downward and the supply of existing units which is a fixed quantity and its supply curve is therefore vertical straight line.

In the long run demand for housing is determined by rate of population growth and formation of new households. The higher rate of population growth will lead to the increase in demand for housing units. The tendency towards two-member households has led to greater demand for housing units.

ADVERTISEMENTS:

Income is another important factor determining demand for houses and therefore greater residential investment. Since level of income over time fluctuates a good deal, there is strong cyclical pattern of investment in residential construction.

Finally, interest is another important factor that determines demand for dwelling units. Most houses, especially in cities, are purchased by borrowing funds from banks for a long time, say 20 to 25 years. Generally, the houses purchased are mortgaged with banks or other financial institutions who provide funds for this purpose.

The individuals who purchase houses on mortgage borrowing pay monthly installment of original sum borrowed plus interest. Therefore demand for housing units is highly sensitive to changes in rate of interest. Therefore, monetary policy has a substantial effect on residential investment.

Type 3# Inventory Investment:

Firms hold inventories of raw materials, semi-finished goods to be processed into final goods. The firms also hold inventories of finished goods to be sold shortly. The change in the inventories or stocks of these goods with the firms is called inventory investment. Now, why do firms hold inventories? The first motive of holding inventories is smoothing of the level of production.

The firms experience temporary booms and busts in sales of their output. Instead of adjusting their production each time to match the changes in sales of the product they find cheaper to produce goods at a steady rate. With this steady rate of production when sales are low, the firms will be producing more than they are selling and therefore in these periods they will hold the extra goods produced as inventories.

On the other hand, when sales are high with a steady rate of production, they will be producing less than they sell. In such periods to meet the market demand for goods, they will take out goods from inventories to meet the demand.

The second reason for holding inventories is that it is less costly for a firm to buy inputs such as raw materials less frequently in large quantities to produce goods and therefore it is required to hold inventories of raw materials and other intermediate products. Buying small quantities of the materials more frequently to produce goods is a more costly affair.

The third reason for holding inventories by the firms is to avoid ‘running out of stock’ possibilities when their sales of goods are high and therefore it is profitable to sell at that time. This requires them to hold inventories of goods.

Determinants of Inventory Investment:

ADVERTISEMENTS:

The inventories of raw materials and goods depend on the level of output which a firm plans to produce. An important model that explains the inventories of raw materials and goods is the accelerator model. Though the accelerator model applies to all types of investment, it applies best in case of inventory investment. According to the accelerator model, the firms hold the total stock of inventories of raw materials and goods that is proportional to their level of output.

When manufacturing firms’ level of output is high, they require to keep more inventories of materials and of goods in process of being converted into finished products. When the economy is booming, retail firms would like to hold more inventories so that the goods they are selling may not go out of stock and their customers go away disappointed. Thus, if N stands for the stock of inventories and Y for level of output, then

N = βY

where β is proportion of output (Y) that the firms want to hold as inventories.

ADVERTISEMENTS:

Now, since inventory investment (I) means the change in stock of inventories, it can be written as follows:

In = ∆N = β∆Y

The accelerator model predicts that given the parameter β when output of firms increases, inventory investment will increase and when output falls, the inventory investment by firms will decline. In fact, when output of goods falls due to slackening of demand, the firms will allow the inventories to run down which implies negative inventory investment.

The empirical macroeconomic studies made in United States indicated that for every dollar increase in GDP, there is 0.20 of inventory investment. That is, value of β in the accelerator model is 0.2. In quantitative terms, the accelerator model of inventory investment can be written as

ADVERTISEMENTS:

In = 0.2 ∆Y

Type 4# Autonomous Investment:

By autonomous investment we mean the investment which does not change with the changes in the income level and is therefore independent of income.

Keynes thought that the level of investment depends upon marginal efficiency of capital and the rate of interest. He thought changes in income level will not affect investment. This view of Keynes is based upon his preoccupation with short-run problem. He was of the opinion that changes in income level will affect investment only in the long run.

Therefore, considering it as the short-run problem he treated investment as independent of the changes in the income level. In fact the distinction between autonomous investment and induced investment has been made by post-Keynesian economists. Autonomous investment refers to the investment which does not depend upon changes in the income level.

This autonomous investment generally takes place in houses, roads, public undertakings and in other types of economic infrastructure such as power, transport and communication. This autonomous investment depends more on population growth and technical progress than on the level of income. Most of the investment undertaken by Government is of the autonomous nature.

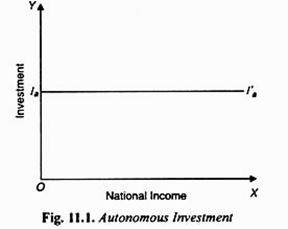

The investment undertaken by Government in various development projects to accelerate economic growth of the country is of autonomous type. The autonomous investment is depicted in Fig. 11.1 where it will be seen that whatever the level of national income, investment remains the same at la. Therefore the autonomous investment curve is a horizontal straight line.

ADVERTISEMENTS:

Type 5# Induced Investment:

Induced investment is that investment which is affected by the changes in the level of income. The greater the level of income, the larger will be the consumption of the community. In order to produce more consumer goods, more investment has to be made in capital goods so that greater output of consumer goods becomes possible.

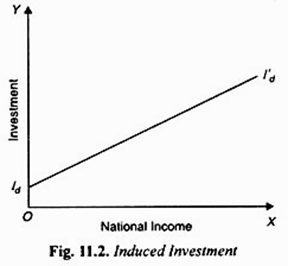

Keynes regarded rate of interest as a factor determining induced investment but the empirical evidence gathered so far suggests that induced investment depends more on income than on the rate of interest. Induced investment is shown in Fig. 11.2 where it will be seen that with the increase in national income, induced investment is increasing. Increase in national income implies that demand for output of goods and services increases.

To produce greater output, more capital goods are required to produce them. To have more capital goods more investment has to be undertaken. This induced investment is undertaken both in fixed capital assets and in inventories.

The essence of induced investment is that greater income and therefore greater aggregate demand affects the level of investment in the economy. The induced investment underlines the concept of the principle of accelerator, which is highly useful in explaining the occurrence of trade cycles.