The following points highlight the two major elements affecting inducement to invest. The elements are: 1. Rate of Interest 2. Marginal Efficiency of Capital of a Capital Asset.

Inducement to Invest Element # 1. The Rate of Interest:

The first element affecting inducement to invest is the rate of interest. Keynes gave an entirely monetary theory of the rate of interest called Liquidity Preference Theory.

According to this theory, the rate of interest is determined by the demand for and supply of money.

This theory is easily explained with the help of the following diagram. In this figure the LP curve shows the demand for money arising from the three motives.

ADVERTISEMENTS:

The LP curve starts down vertically because at high rates of interest there is only a demand for money from the first two motives-the transactions and the precautionary motives. This demand for money is interest-inelastic. But as the LP curve slopes down it becomes more and more interest-elastic.

If the money supply is given as OM, then the equilibrium rate of interest is r as this rate equates the demand for money with its supply. If money supply is increased to OM1, the rate of interest falls to the level r0. This is the lowest rate of interest which can prevail. At this the LP curve becomes horizontal. Even if money supply is increased to the level M2, the rate of interest does not fall.

Inducement to Invest Element # 2. Marginal Efficiency of Capital of a Capital Asset:

Marginal efficiency of capital, MEC, refers to the anticipated rate of profitability of a new capital asset. It is the expected rate of return over cost from the employment of an additional unit of capital asset. Marginal efficiency of capital depends upon the expected rate of return of a capital asset over its life time (called Prospective Yield by Keynes) and the Supply Price of the capital asset.

If must be remembered that a businessman, while investing in a new capital asset will always weigh the expected rates of net return over the life time of the capital asset (say a machine) against its supply price also called the “replacement cost.”

ADVERTISEMENTS:

If the former is greater than the later, businessmen will consider whether it is worthwhile to invest in it against the rate of interest prevailing in the market, otherwise hot. Let us study the two determinants of MEC in detail.

Prospective Yield:

Prospective yield refers to total net return (net of all costs, such as maintenance expenses, depreciation, raw material except interest charges) expected from the asset over its life time. If we divide, the total expected life of the new capital asset into a series of time periods, say years, we may refer to annual returns as a series of annuities represented by Q1 Q2, O3…… Qn. We have to calculate the discounted total value of the return for all these years to arrive at the prospective yield. Suppose a machine has a life of three years. The investor entrepreneur hopes to obtain Rs. 1050, Rs. 3528 and Rs. 9261 as the annual income from the use of the machine.

These sums are the annual yields from the machine written as Q1, Q2, Q3. It is, however, very difficult to estimate correctly the expected return from a capital asset over its life time, (because, it is difficult to estimate correctly the life of the capital assets). At best, we can guess, intelligently perhaps, but only guess. “An estimate of what an investment will earn in five; ten or twenty years hence is based largely on guess work, on animal spirits, on adapting estimates to the average estimate, which in turn, is based on uninformed guesses:”

ADVERTISEMENTS:

Moreover, the expected return each year is not the same (except in a static society). In a changing world, the returns from the capital asset are likely to vary from year to year.

Supply Price means the cost of the asset (not of the existing asset but of the new unit of the asset), also called replacement cost. Suppose the machine is a small printing press and the entrepreneur hopes to get a new machine after three years by spending Rs. 12,200 on it. Then this is the supply price of this asset and is written as Cr. Thus,

MEC is the ratio of these two elements: prospective yield and the supply price. In other words, marginal efficiency of capital refers to rate of discount at which the prospective yield of an asset is discounted so as to make it just equal to the supply price of the asset.

Keynes says – “More precisely, I define the marginal efficiency of capital as being equal to that rate of discount which would make the present value of the series of annuities given by the return expected from the capital asset during its life just equal to its supply price.” A numerical example will make the concept clear.

A Simple Example of MEC Calculation:

Suppose an investor feels that a given investment in a new capital asset (say a machine) will cost him Rs. 10,000. Suppose this machine (unit of capital asset) is expected to yield over is life time assumed to be infinite, a net return (net of all costs like maintenance, depreciation, raw material except interest charges) of Rs. 500 per annum.

To find out the MEC, of the new capital asset, we would simply calculate the ratio (expressed as a percent) of the expected annual net return of Rs. 500 (prospective yield) divided by Rs. 10,000 which is the same as the Supply Price.

Here, Rs. 500 (prospective yield) divided by Rs. 10,000 (supply price) results in a value of 5% as is clear (500/10,000 x 100/1 = 5%) 2 .The MEC is 5%3 i.e., the expected annual net return on the investment of Rs. 10,000 is 5%. It may, however, be noted that in a dynamic economy it is not so easy to find out the expected rate of return because of the widespread uncertainty of returns. Anyway businessmen do try to make such calculations.

The Numerical Example of MEC Calculation:

ADVERTISEMENTS:

The examples of MEC calculation given above relate to simple cases.

We can define the MEC of a capital asset in a simple way as follows:

MEC is the expected rate of return of capital asset with which if we discount and then add the Prospective yields of the asset, we get the Supply Price of the capital asset Thus.

Supply Price = Sum of the Discounted Prospective Yields

ADVERTISEMENTS:

We know that commonly the annual yield or annuity of a capital asset cannot be expected to be constant throughout its life. Nor do we expect the life of a capital asset to be infinite. It depreciates and wears out over a few years. For such common cases, a formula was given by Keynes. The relevant formula for MEC calculation is

where Cr stands for supply price (replacement cost) of the new capital asset; Q1, Q2, Q3 , Qn denote expected annual rates of return each year from the capital asset (also called series of the prospective annual yields); and r stands for the rate of discount which will make the present value of the series of annual returns just equal to the supply price of the capital asset.

Thus, r denotes the unique rate of discount which equates the sum of discounted prospective yields with the supply price of the capital costs.

ADVERTISEMENTS:

To take a concrete illustration, let us suppose that the prospective annual yields from the use of a new capital asset whose life is 3 years only are as follows:

1st year 2nd year 3rd year

Rs. 1050 Rs.3528 Rs.9261

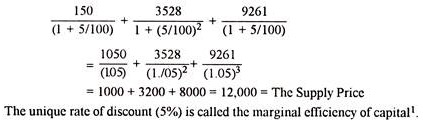

Suppose further that current supply price or the replacement cost of the capital asset is Rs. 12,200. Now 5% is unique rate of discount which will equate the sum of the discounted values of the prospective annual yields to the current supply price of the capital asset.

This is readily clear by the use of the simple discounting formula: D = SI (I + r) 1’ where S is the amount to be discounted r is the rate of discount and t is the time period for which the discounting is to be done. The unique rate of discount (MEC) in the above numerical example is 5% because

ADVERTISEMENTS:

Marginal Efficiency of Capital in General:

The marginal efficiency of a particular type of capital asset is the highest rate of return over cost expected from an additional, or marginal unit of that type of asset. But such a calculation is appropriate only in the micro context of a decision by a businessman. For the economy as a whole the relevant concept is MEC in general.

The marginal efficiency of capital in general is “the highest rate of return over cost expected from producing an additional or marginal unit of the most profitable of all types of capital assets.” In other words:

The marginal efficiency of capital in general is the marginal efficiency of that particular asset of which the economy finds it most worthwhile to produce another or additional unit.