In this article we will discus about the reasons for nations trade.

Trade signifies the exchange of commodities and services. This exchange may take place between two individuals, firms or industries within the same country or it may take place between two or more nations or countries. The former type of exchange is termed as internal, domestic or interregional trade, while the latter is regarded as the international trade.

In the case of India, there can be different regions such as northern, eastern, central, western and southern. Suppose the northern region supplies farm products to the other regions and buys mineral and manufactured products from the other regions, such transactions among the different regions of the same country are regarded as the internal or inter-regional trade.

On the other hand, the supply of cotton textile by India to the U.S.A. and the European countries, iron ore to Japan and rice to the Middle East countries and purchase of wheat from the U.S.A., oil from Iran and electronic goods from Japan, are such transactions that take place among the different countries and these transactions constitute the international trade of the country.

ADVERTISEMENTS:

There are two fundamental issues connected with the international trade—why nations trade with one another and why there is a need for a separate theory of international trade.

The basic reason for different nations entering into trade is that no nation has the capacity to produce by itself all the commodities and services that are required by its people. There has been an unequal distribution of productive resources by the nature on the surface of the earth. Countries differ in respect of climatic conditions, availability of cultivable land, forests, mines, mineral products, labour, capital, technological capabilities and managerial and entrepreneurial skills.

Given these diversities, no country has the potential to produce all the commodities in the most efficient manner or at the least cost. For instance, India can produce textiles at the lower cost while Japan can produce electronic goods and automobiles cheaply. Just as there is division of labour in the case of individuals, the countries also adopt this principle at the international level.

Each one of them specializes in the production of only such commodities, which it can produce at comparatively lower cost than the others. They export such products to others and in return import those products in the production of which they have comparative cost disadvantage.

ADVERTISEMENTS:

The existence of cost differences creates price differentials among the various countries. If petroleum is cheaper in Iran than in India, the latter will import it from Iran than producing it by itself. Apart from the cost differences or differences in supply conditions, the price differentials result also from the differences in demand conditions (tastes or preferences pattern).

Suppose in two countries X and Y, it is possible to produce a given commodity at the identical cost. However, if in country X, the demand for the product is strong due to higher incomes and taste pattern existing there than in country Y, the price is likely to be higher in X than in Y. It will create the possibility of country X importing that commodity from country Y rather than producing it by itself.

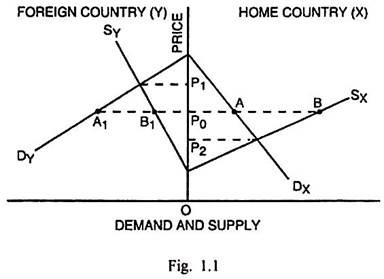

The possibility of international trade can be analyzed through Figs. 1.1 and 1.2. In Fig. 1.1, it is supposed that there is different supply or cost conditions but identical demand conditions in home country (X) and foreign country (Y).

In Fig. 1.1, Dx is the demand curve for the given commodity in the home market and Dy is the demand curve for the same commodity in the foreign country. It is assumed that the demand curves in the two countries have the same elasticity. Sx and Sy are the supply curves in country X and Y respectively. Sx is more elastic than Sy indicating that the supply conditions or cost conditions are different in the two countries.

ADVERTISEMENTS:

Price of the commodity in home country P2 is lower than the price P1 in the foreign country in the absence of international trade (P1 > P2). If trade takes place and the price is agreed as P0, there is excess demand A1B1 for this commodity. Thus the price differential (P1 > P2) creates the possibility of trade between the two countries.

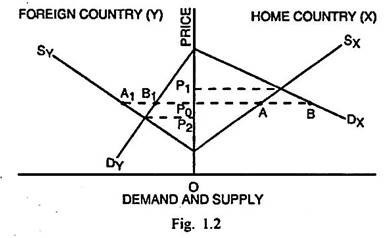

The price differential can arise also if the cost conditions are identical but demand conditions are different in the two countries. It is assumed that the elasticity of supply is the same in both the countries but demand is less elastic in foreign country than in the home country. This situation can be explained through Fig. 1.2.

In Fig. 1.2, Dx and Sx are the demand and supply curves of a particular commodity in the home country (X). Dy and Sy are the demand and supply curves of the same commodity in foreign country (Y). The supply curves have, it is supposed, the same elasticity in the two countries but there are differences in demand conditions and the demand curve Dy is less elastic than Dx.

In the absence of trade, price in country X is P1, determined by the intersection of Dx and Sx and the price in country Y, determined by the intersection of Dy and Sy, is P2. Thus there is price differential (P1 > P2) which will create the possibility of international trade. If in their trade, the agreed price is P0, the country X has excess demand AB whereas the country Y has an excess supply A1B1. In this case country Y will export A1B1 surplus quantity of the given product to the home country.

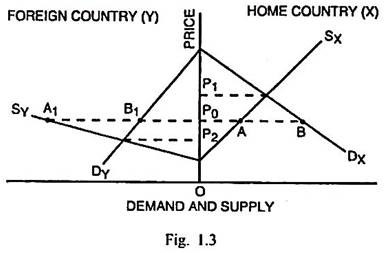

The price differential can arise if both demand and supply conditions are different in the two countries at the same time. It is assumed that the supply in country X is less elastic than the supply in country Y. On the opposite, the demand in country Y is less elastic than in country X. The possibility of trade in this case can be analysed through Fig. 1.3.

In Fig. 1.3, Dx and Sx are the demand and supply curves of the given commodity in the home country (X). Dy and Sy are the demand and supply curves of the same commodity in country Y. Dx is more elastic than Dy while Sy is more elastic than Sx. In the absence of trade between two countries, price of the commodity will be P1 in country X and P2 in country Y.

ADVERTISEMENTS:

The foreign country has price advantage over the home country. The price differential (P1 > P2) will create the possibility of international trade. If trade takes place between them at the agreed price P0, the foreign country has excess supply A1B1 whereas the home country has excess demand AB. The country Y will export the surplus produce to the home country X.

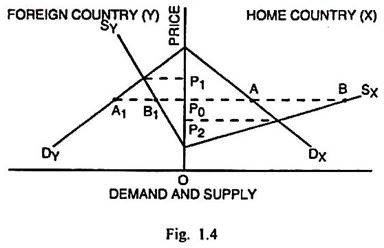

There can be still another case leading to price differential and consequent international trade if the demand in home country is less elastic than in the foreign country and supply is more elastic in home country than in the foreign country. This case is explained through Fig. 1.4.

In Fig. 1.4, Dx is less elastic than Dy and Sx is more elastic than Sy. In the absence of international trade, price of the given commodity in the home country is P2 and price in the foreign country is P1. The price differential (P1 > P2) creates the possibility of international trade. As the trade commences at the price P0, country X has the excess supply AB while country Y has the excess demand A1B1. In this situation, the home country will export surplus produce AB to the foreign country Y.

ADVERTISEMENTS:

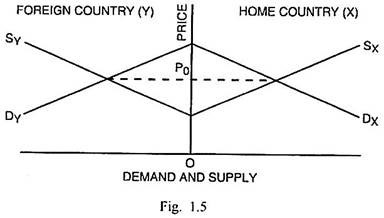

If there are exactly same demand and supply conditions in the two countries, the price differential does not exist and there is no possibility of international trade. It can be shown through Fig. 1.5.

In Fig. 1.5, the demand curve Dx and Dy have the same elasticity. Similarly Sx and Sy have the same elasticity. In the absence of trade, the price of the commodity in each country is P0. Since there is no price difference, no country can make any gain from trade and there is no basis for international trade.

From the above analysis, it follows that the international trade is governed by the same principles as the inter-regional trade. Just as trade among different regions of the same country is governed by the demand and cost conditions, price differentials and prospect of profits, the trade among the different nations, exactly in the same way, is governed by the similar factors.