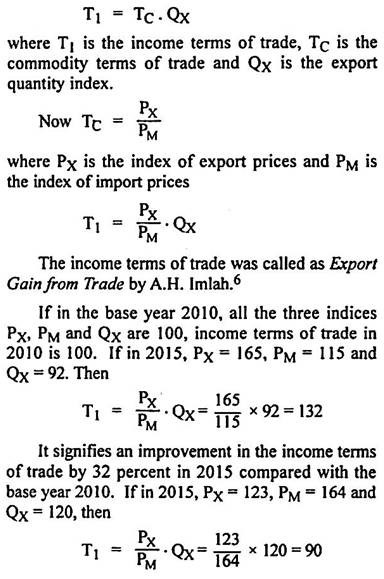

The concept of income terms of trade was developed by G.S. Dorrance and H. Staehle. This concept is an improvement upon the net barter terms of trade. It takes into account the indices of export and import prices and quantity index of exports. The income terms of trade are determined by the product of net barter terms of trade and the quantity index of exports.

These can be stated as:

In this case, there has been deterioration in the income terms of trade by 10 percent between 2010 and 2015.

ADVERTISEMENTS:

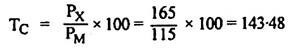

As income terms of trade fall from 100 to 99, the commodity terms of trade (TC) = (PX/PM) × 100 = (123/164) × 100 = 75 in 2015, signifying a deterioration in TC compared with the base year of 2010. In the first illustration, where T1 rises to 132 in 2015, there is an improvement in the commodity terms of trade in that year-

A rise in the income terms of trade implies that a country can import more goods in exchange of its exports and vice-versa.

It is also possible that the income terms of trade of a country show an improvement but the commodity terms of trade get deteriorated. On the opposite, there can also be a possibility that income terms of trade have deteriorated, although the commodity terms of trade have improved between two periods. .

ADVERTISEMENTS:

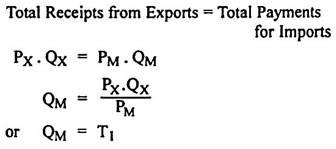

According to Jacob Viner, the income terms of trade reflect the ‘capacity to import’ of a country. If PX, PM, QM and QX represent the absolute magnitudes of price of export, price of import, quantity imported and quantity exported respectively, the equality between total receipts from exports and total payments due to imports can be expressed as below:

The capacity to import of a country will increase if there is:

(i) A rise in export prices,

ADVERTISEMENTS:

(ii) A rise in quantity exported, and

(iii) A fall in the prices of imports and vice versa.

This concept of terms of trade has great relevance for the less developed countries. In these countries, the capacity to import is low on account of lower export prices and quantities of goods exported, while the prices of imports are relatively higher.

Criticisms:

The concept of income terms of trade is criticised on the following grounds:

(i) Not an Accurate Measure of Gain from Trade:

This concept cannot give an exact measure of the gain from trade. An improvement in income terms of trade may show that the capacity of a country to import has increased. It will force the country to raise its exports large enough to pay for imports. If the increased exports involve some depletion of real resources of the country, the long run growth potential and prospect of improving the standard of living are adversely affected.

(ii) Not a Measure of Total Import Capacity:

The income terms of trade measure only the export- based import capacity of a country and not its total import capacity which depends also upon its foreign exchange receipts. It is possible that income terms of trade of a country get worsened but the foreign exchange reserves have risen for some reasons that will mean a larger total import capacity despite adverse income terms of trade.

ADVERTISEMENTS:

(iii) Cannot Replace the Commodity Terms of Trade:

It is sometimes believed that the income terms of trade are superior to the commodity terms of trade. In view of contradictory conclusions given by the two indices, the former alone is clearly inadequate. It can supplement but by no means replace the commodity terms of trade or net barter terms of trade.

(iv) Misleading Indicator of Welfare Gain:

The income terms of trade may prove to be a faulty and misleading indicator of direction of change of the welfare of a country. From this point of view, the net barter terms of trade can serve as a better indicator of welfare gain to a country from the international trade.

ADVERTISEMENTS: