In this article we will discuss about the liquidity preference theory of interest. Also learn about the possibility of zero rate of interest.

According to J.M. Keynes interest is not the reward for saving as has been postulated by the classical economists but the reward for partly with liquidity or a specific period. It is a purely monetary phenomenon and is determined by the demand for and the supply of money.

The supply of money refers to the quantity of money in circulation at a fixed point of time. Since it is controlled by the central bank of a country it remains constant per period. So, in order to see how the rate of interest is determined it is necessary to consider the demand for money.

The demand for money does not refer to saving or money required for spending on goods and services but the demand for the actual stock of money to hold as liquid balances. The classical economists believe that money was only held for purposes of making transactions and bridging the time period between income receipts. Keynes added the possibility of the demand for money as an asset, i.e., speculative balances.

ADVERTISEMENTS:

Three ‘motives’ for demanding money balances are identified as follows:

1. Transactions demand:

Transactions balances are needed to bridge the time gap between income receipts and expenditure.

The amount of money demanded for transactions purposes depends on:

ADVERTISEMENTS:

(i) Length of time between income receipts and expenditures, and

(ii) the size of income receipts and expenditure.

Transactions balance would vary directly with income and price level and not rates of interest. If national income rises people will require more money for spending purposes. Similarly, if the price level rises people will require more money to buy that same amount of goods and services.

2. Precautionary demand:

ADVERTISEMENTS:

Money is also held for the purpose of meeting unforeseen emergencies. This motive was not included in classical theory where perfect certainty was assumed. Keynes grouped transactions and precautionary balances together into a single sum which varied directly with the level of income and the general price level.

3. Speculative demand:

The speculative motive was first identified by Keynes. This is also known as the asset motive. In order to understand this concept it is necessary to ask transformation and speculative balances why should people hold money balances over and above when money as an asset which yields no return at all. The answer to this question is that if other financial assets, in particular bonds, are likely to fall in price, then losses on bonds can be avoided by holding money instead.

The basic motive for holding speculative money balances was therefore to avoid losses in a declining securities market. In order to understand this point more clearly, it is necessary to consider the relationship between bond prices and the rate of interest.

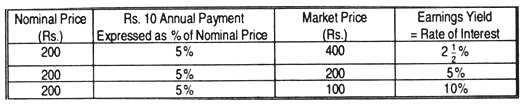

In this context, Keynes was referred to ‘undated government securities’ (called ‘gilts’ or ‘consols’). These bonds pay a fixed annual sum and are bought and sold on the securities market. Their prices, therefore vary with demand and supply. For example, if an undated security has a nominal value of Rs 200 and pays Rs 10 per annum, the nominal interest (or coupon) is 5%.

This is found out by using the following formula:

The price of a bond = Fixed annual return/The prevailing market rate of interest

= Rs 10/5% = RS 10/(1/20) = Rs 200

However, the actual yield or earnings yield, expressed as a rate of interest, will vary inversely with the market price of the security as the following example shows. It can be seen that as the market price of a bond rises to Rs 400 the fixed annual payment of Rs 10 represents the equivalent of an earnings yield of 2½% rate of interest and when the price of the bond falls to Rs 100 the rate of interest rises to 10%. Thus the rate of interest is the reciprocal of the bond price. The market price and the rate of interest, i.e., earnings yield, or fixed interest bonds is therefore inversely related.

Keynes was the first economist to point out that it costs money to hold money and the rate of interest is the opportunity cost of money holding, i.e., by holding money people lose the opportunity to earn interest. So, at low rates of interest people hold as much money as possible and at high rates as less money as possible.

Speculative money balances vary therefore with the anticipated gains or losses on the securities market, and the extent to which individuals prefer holding of money to other financial assets is referred to as liquidity preference. Keeping in mind the (above) relationship between security prices and interest rates we can make the following assumptions.

1. When security prices are high (and interest rates are low) speculators will expect bond prices to fall and therefore a capital loss to be made. They will, therefore, attempt to avoid such losses by holding speculative money balances. Low interest rates therefore imply a high liquidity preference In this case; the opportunity cost of holding money is also low.

2. When bond prices are low (and interest rates therefore are high) speculators will anticipate a rise in bond prices and therefore a capital gain. They will attempt to take advantage of the capital gain on bonds by holding bonds rather than money balances. High interest rates therefore imply a low liquidity preference. In this case, the opportunity cost of holding money is

ADVERTISEMENTS:

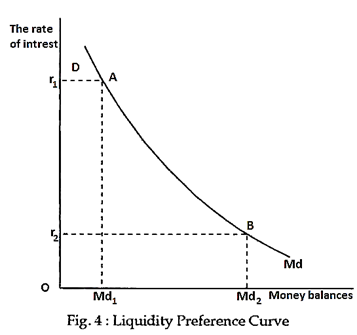

If each individual’s liquidity preference is added together a liquidity preference curve can be drawn, which represents the demand for money. The liquidity preference curve relates the total demand for money to the rate of interest. Although each individual may have different expectations of future events,, by adding them all together we obtain the smooth liquidity preference curve as shown in Fig. 4.

The total demand curve for money is downward sloping due to speculating component much varies inversely with the rate of interest.

When the interest rate is high (r1) bond prices will be low and a rise in bond prices, and therefore capital gains, will be anticipated and speculative balances will be very small (almost equal to zero). So, only transactions and precautionary balances are hold, i.e., Md1. When the rate of interest is low at r2 and bond prices are high capital losses are anticipated and larger speculative money balances are held, i.e., Md2 in order to avoid capital losses on bonds.

ADVERTISEMENTS:

The Supply of Money:

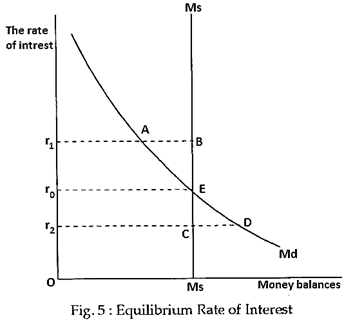

The supply of money at any point of time is fixed by monetary authorities (the central bank) and is therefore independent of the rate of interest. In Fig. 5 the money supply curve is therefore the vertical line Ms.

Money Market Equilibrium and Interest Rate Determination:

The money market reaches Money balances equilibrium when the downward sloping demand curve for money intersects the vertical supply curve and the rate of interest is determined at r0. What is the logic of this equilibrium? If the rate of interest goes above the equilibrium level (to say, r1), there will be excess supply of money (AB), which implies excess demand for bonds (because in Keynes’ model money-holding is the only alternative to bond-holding).

If the demand for bond increases, its price will rise. This is equivalent to a fall in the rate of interest (in this case from n to r0). On the older hand, if the rate of interest falls to r2 there will be excess demand for money (measured by the distance CD).

ADVERTISEMENTS:

This implies excess supply of bonds. People will meet the demand for money by selling bonds. As a result, the price of bonds will fall. This is equivalent to a rise in the rate of interest. So, r0 is indeed the equilibrium rate of interest. Any deviation from it will not last for long. Sooner or later, the rate of interest will have to return to the original level.

Changes in Equilibrium Rate of Interest:

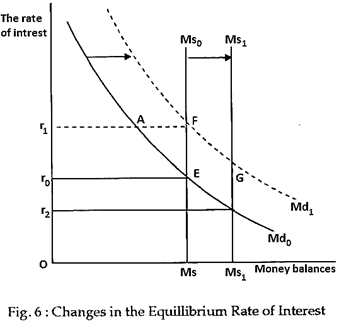

Changes in the interest rate could occur as a result of:

1. A shift of the liquidity preference curve from Md0 to Md1 as shown in Fig. 6 as a result of anticipated changes in bond prices.

2. A shift of the money- supply curve from Ms0 to Ms1 by the central bank. If the central bank increases the quantity of money in circulation the supply curve of money will shift to the right and the rate of interest will fall. The converse is also true. According to modem economists, the changes in either the quantity of money or in liquidity preference can no doubt bring about changes in interest rates but the outcome of such changes is not always certain.

ADVERTISEMENTS:

New developments may only cause wide differences of opinion leading to increased activity in the bond market without necessarily causing any shift in the aggregate speculative demand for money schedule. If the balance of market expectations is changed, there will be a shift in the schedule. Central bank policy designed to increase the money supply may, therefore, be met by an upward shift of speculative demand function leaving the rate of interest virtually unaffected.

Criticisms of the Liquidity Preference Theory:

The main criticisms of the Keynes’ liquidity of preference theory are the following:

(a) Ambiguity:

Keynes does not explain clearly what he means by “money”. Owing to its vagueness it has been said that the Keynesian theory is indeterminate. Keynes ignored real factors like productivity of capital and thriftiness as determining the interest rate.

As A.H. Hansen has put it:

“In the Keynesian case the supply and demand for money schedules cannot give the rate of interest unless we already know the income level; in the classical case the demand and supply schedules for savings offer no solution until the income is known. Precisely the same is true of loanable funds theory. Keynes’ criticism of the classical and loanable funds theories applies equally to his own theory.”

ADVERTISEMENTS:

(b) Complete neglect of productivity of capital:

Keynes dismisses as irrelevant the marginal productivity of capital. According to him, new investments are determined by the psychology of entrepreneurs and the current rate of interest. But since entrepreneurial activity is based on the productivity of capital it seems hardly proper to ignore it altogether.

(c) No role assigned to saving and waiting:

Keynes ignores the inducements for saving and waiting. Jacob Viner said, “Without savings there cannot be any liquidity to surrender”. According to Keynes, interest is a reward for parting with liquidity and in no way an inducement for saving, but it is ridiculous to think of surrounding liquidity if one has not already saved money.

(d) Biased view:

Keynes places undue emphasis on monetary phenomena. Somers points out that an individual having funds has four choices before him – to invest in securities, to hold cash, to invest in production and to consume. Commercial firms have the first three choices and not the fourth one. The decisions of individuals and firms regarding their choices in each of these areas must influence the rate of interest.

ADVERTISEMENTS:

The choice regarding investment in securities is determined by the demand and supply of securities. The choice regarding the holding of cash is determined by liquidity preference. The choice regarding investment in production is determined by the marginal productivity of capital.

The choice regarding consumption is determined by time preference. Hence, we must say that the demand and supply of securities, liquidity preference, marginal productivity and time preference all play their part in determining the rate of interest. Keynes however, takes into account only liquidity preference and the supply of money and ignores all the other factors.

(e) Partial equilibrium approach:

Somers also points out that strictly speaking the rate of interest is affected by all other prices and economic quantities in the community (“all the elements expressed in the equations of the Walras-Hicks system of general equilibrium”). Hence, both the loanable funds theory and the liquidity preference theory represents a partial equilibrium analysis of the determinants of the rate of interest. While determining the rate of interest, Keynes treated national income as constant.

This implies constancy of transactions and precautionary demand for money. However, in reality national income does not remain constant when the rate of interest varies. In fact, a fall in the rate of interest leads to an increase in investment and an increase in investment, in its turn, leads to an increase in national income through the investment multiplier.

Moreover, the people who take decision regarding the purchase of commodities are the same people who take decision regarding the purchase of bonds. Thus, peoples’ behaviour in the commodity market will determine their behaviour in the money market, too.

If an individual spends more money to buy goods and services, he will be left with less money to purchase income-earning assets like bonds. This is why Hicks and Hansen have pointed out in their famous IS-LM model that the rate of interest and the level of income are to be determined simultaneously in a general equilibrium framework.

(f) Ignorance of real factors:

On accounts of above shortcomings it has been said that Keynes ignores the real factors of determination of interest.

In the construction of the total demand curve for money only the speculative demand is assumed to vary and the other two sources of demand for money are assumed to remain constant. But they will so only when national income is in equilibrium, i.e., Y = C + I or S = I. According to Keynes, interest is not the reward for saving or thriftiness or waiting but for parting with liquidity for a specific period.

Keynes pointed out that it is not the rate of interest which equates saving with investment but this equality is brought about through income changes. Hence, liquidity preference theory requires as a pre-condition of saving-investment equality, already postulated by classical economists. Hence, the rate of interest is neither a purely monetary phenomenon nor a purely real phenomenon.

So far as the main content of the Keynesian interest theory is concerned it is the determination of the rate of interest through equality between demand for, and supply of, money. But one of the components of total money demand known as speculative demand is assumed to depend on rate of interest. Hence, the logical circularity in the model can be mentioned as one of principal sources of its weakness.

Possibility of Zero Rate of Interest:

A zero (or even a negative) rate of interest can be imagined under certain circumstances but in real life neither event is likely to occur.

A negative rate of interest is possible in a society where there is absence of law and order. In such a society, savings (if any) have to be kept in the custody of men having the power to protect the savings. The payment made for such safe custody may be regarded as “negative interest”.

A zero rate of interest is conceivable in the following cases:

(1) When the whole income of a community is spent on consumption, there being no savings and no investment; and,

(2) When the amount of capital in a community is so large that the marginal productivity of capital is zero.

The first case is that of a primitive economy where the question of paying interest does not arise because there is no saving in such an economy and there is no investment either. But no such economy exists today.

The second case is theoretically possible in a mature economy in the long run. The classical economists thought that in the long run the rate of interest would fall. Keynes agreed with this view on the ground that in course of time capital accumulation would grow large and the yield from new investments would tend to diminish.

The progressive diminution of yield would lead to a progressive fall in the rate of interest and ultimately it might be zero. Such a course of events can be described as secular stagnation or long-run sluggish was caused by lack of capital investment due to low, about zero return.

It is very unlikely that the marginal productivity of capital will fall to zero in any community. There are certain dynamic economic forces which operate in almost every community and ensure that the demand price of capital as determined by its MPP is always positive.

These are as follows:

(i) New inventions and discoveries;

(ii) Growth of population; and

(iii) Destruction of capital assets by war and natural calamities like earthquakes.

Moreover, Keynes pointed out that the actual rate of interest cannot fall to zero because the expected rate cannot fall to zero. This is due to complete elasticity of the liquidity preference curve at a very low rate of interest. This is known as absolute liquidity preference or liquidity trap, a term coined by Denis Robertson.

In a liquidity trap situation, the rate of interest cannot fall below a certain low figure. There is no way of reducing the rate of interest further even though it may be desirable for ensuring recovery. In fact, an important implication of perfect elasticity of the liquidity preference schedule at a very low rate of interest is that the rate of interest cannot fall to zero.

We can conclude that the rate of interest may tend to fall but will never be zero.

In the words of Paul Samuelson:

“As long as any increase in time-consuming process could be counted on to produce any extra product and dollars of revenue, the yield of capital could not be zero. Also, as long as any land or other asset exists with a sure perpetual net income and as long as people are willing to give only a finite amount of money today in exchange for a perpetual flow of income spread over the whole future, we can hardly conceive of the rate of interest as falling to zero”.

Conclusion:

According to Keynes, therefore, the rate of interest depends on the liquidity preference and the supply of money. The expected profitability of new investment (or the marginal efficiency of capital, as Keynes calls it) does not determine interest but is determined by it. Which investments will be profitable depends on the rate of interest. Income does not determine interest but influences it indirectly because the amount of money required to be held for the transactions motive depends on income.