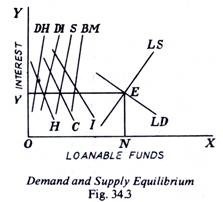

The rate of interest will be determined by the equilibrium between the total demand for loanable funds and the total supply of loanable funds, as has been shown in Fig. 34.3.

In Fig. 34.3, LS is the total supply curve of loanable funds which has been derived by the lateral summation of the savings curve S. dishoarding cur DH.

The curve LD of total demand for loanable funds and curve LS of the total supply of loanable funds intersect each other at the rate of interest OR (=NE). At this rate, the loanable funds lent or supplied are equal to the loanable funds borrowed or demanded. Hence, OR is the equilibrium rate of interest which will tend to settle in the loan market.

ADVERTISEMENTS:

Criticism:

Most of the criticism made against the classical theory of interest is valid also in case of loanable funds theory. In fact, there is not much difference in the classical and loanable funds theories. The difference lies only in the meanings of saving. In the classical theory, ‘saving’ is in fact the same thing as the “loanable funds” of the loanable funds theory.

In classical theory, savings mean savings out of the current income, which in loanable fund theory; savings mean savings out of the income of the previous period. In the loanable funds theory, loanable funds consist of savings out of the income of the previous period plus borrowed bank deposits plus activated idle balances.

In the classical theory, savings out of current income may well exceed the savings of loanable funds theory because current income is increased by bank loans or the injection of idle balances. Thus, the supply schedule of savings of the classical theory amounts to the same thing as the supply schedule of loanable funds of the loanable fund theory.

ADVERTISEMENTS:

Further, Loanable Funds Theory like the Classical Theory is indeterminate. According to this theory, the rate of interest is determined by the intersection of the demand curve for loanable funds with the supply curve. But since the ‘savings’ part of the supply curve varies with the level of income, it follows that the total supply curve of loanable funds will also vary with income.