In this article we will discuss about the International comparison of India’s services sector.

GDP from Services Sector: An international Comparison:

The performance of the services sector in India is very much comparable with that of some of the top developed countries of the world.

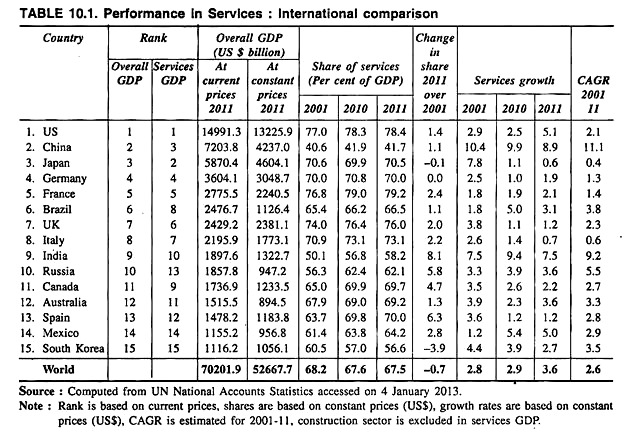

The following table will clarify such position:

It is observed from the table (no. 10.1) that in 2011, the share of services in the US $ 70.2 trillion world gross domestic product (GDP) was around 67.5 per cent as compared to 68.1 per cent in 2001. Again India’s performance in terms of this indicator is not only above that of other emerging developing countries, but also very close to that of the top developed countries of the world.

Among the top 15 countries with highest overall GDP in 2011, India ranked 9th and 10th in overall GDP and services GDP respectively. While developed countries like UK, USA and France have the highest share of services in GDP at above 78 per cent but the share of services in India of 58.2 per cent is much above that of China at 41.7 per cent in 2011.

Again during the period 2001 to 2011, India is the topmost country in terms of increase in its services share in GDP (8 percentage points) followed by Spain and Canada (5.3 percentage points each), the U.K. (4.5 percentage points), and Italy (3.2 percentage points).

In respect of compound annual growth rate (CAGR) of the services sector for the period 2001-11, the growth rate attained by China at 11.1 per cent and India 9.2 per cent show a very high services sector growth. But the same growth attained by Russia at 5.5 per cent and Brazil at 3.8 per cent are holding distant third and fourth position respectively.

ADVERTISEMENTS:

While India’s growth rate of the services sector at 10.1 per cent in 2009 was even higher than that of China at 9.6 per cent but in 2011, it has decelerated to 7.4 while China’s growth rate declined to 8.9 per cent.

All these clearly highlight the prominence of services sector for India. Despite the higher share of services in India’s GDP and China’s dominance in manufacturing over services, the hard fact, however, is to be realised is that in terms of absolute value of services GDP and also in terms of growth of services, China is still, much ahead of India in 2011.

While the growth of absolute value of services in 2011 stands at 8.9 per cent in China as compared to that of 7.4 per cent in India but the compound annual growth rate (CAGR) during 2001-11 stands at 11.1 per cent in China as compared to that of 9.2 per cent in India, 2.3 per cent in U.K., 2.1 per cent in US, 3.8 per cent in Brazil, 5.5 per cent in Russia and 2.7 per cent in Canada.

International Trade in Services:

ADVERTISEMENTS:

Global trade in services has been experiencing a similar tread like merchandise trade and international demand in general. During 2000s decade, world export of services have shown consistent rise along with a healthy overage annual growth of around 9.5 per cent, except in two specific years 2001 and 2009 which are termed as period of global slow-down and economic crises.

After experiencing an increase by 13 per cent in 2008 in respect of world exports of services, it fell sharply to negative growth of 12 per cent in 2009 but then again bounce back to 19 per cent growth rate in 2010. In 2010, the value of services exports was US $ 3,695 billion, slightly lower than the 2008 pre-crisis peak value of US $ 3,842 billion.

The most rapid growth of commercial services has been in Asia, where exports of services rose by 22 per cent in 2010 led by China and India. EU exports grew only by 3 per cent. Exports central and South America and the Caribbean as well as from the Commonwealth of Independent States (CIS) grew 12 per cent and North America and Africa also grew by 9 per cent and 10 per cent respectively.

Taking the EU (27) as a whole by excluding intra-EU trade, the top five exporters and importers of Commercial services are the EU (27), the US, China, Japan and India with the same ranks both in exports and imports of Commercial services. Only China and Japan are net importers of Commercial services in the top five.

Emerging economies like India and China are now playing an increasing role in commercial services trade. In 2010, China’s Commercial services trade totaled US $ 362 billion accounting for a global share of 6.6 per cent, up from 4.4 per cent in 2005 with exports of services expanding by 32 per cent. India has also become an important player in Commercial services trade with its share reaching 4.3 per cent, as compared to 2.8 per cent five years earlier.

India’s exports of services grew by 33 per cent and imports by 45 per cent in 2010, making in the most dynamic exporter of Commercial services. Even if intra-EU trade is not excluded and the EU countries are taken individually, India is included in the top 10 with seventh rank in both exports and imports of commercial services.

Foreign Direct Investment (FDI) in the Services Sector:

Modest and sustainable growth of the services sector has paved the way for smooth flow of foreign direct investment (FDI) into this sector in different countries of the world during the pre-recession period. However, the global economic and financial crisis had a dampening effect on the overall flows of FDI.

FDI in services, which accounted for the bulk of the decline in FDI flows as a result of the crisis, continued on its downward path in 2010.

ADVERTISEMENTS:

Flow of FDI in all main services industries (viz. business services, finance, transport and communications and utilities) fell at different rates. Overall, FDI projects in the services sector declined from US $ 392 billion in 2009 to US $ 338 billion in 2010, resulting decline in its share in sartorial FDI from 33 per cent to 30 per cent in this period.

Compared to pre-crisis level of business, business services declined by 8 per cent as multinational companies, who are basically outsourcing a growing share of their business support functions to external providers downsized their operations considerably due to economic slow-down.

In 2010, transportation and telecommunication services also suffered in the same way as the industry’s restructuring was more or less complete after following the round of large mergers and acquisition deals done before the crisis, especially in developed countries. Besides, FDI in the financial industry also experienced sharpest decline and is expected to sluggish in the medium term.

It is also observed that expansion of the financial industry over the past decade was instrumental in integrating emerging economies into the global financial system, which resulted substantial benefits to the financial system of the host countries in terms of efficiency and stability.

ADVERTISEMENTS:

Again utilities were also affected strongly by the same crisis as some investors were forced to reduce investment or even divest their stake after facing the situation market with lower demand and accumulated losses. However, world services sector FDI rebounded in 2011 after falling sharply 2009 and 2010, reach around US $ 570 billion, registering a growth of 15 per cent over the previous years.

Thus international comparison of the performance of service sector shows the growing importance of services sector in different countries of the world this has been reflected by increasing share of services sector in GDP, CAGR of services sector, growing volume of trade in services and growing FDI flows into services sector if different countries of the world.