In this article we will discuss about National Agricultural Insurance Scheme (NAIS). After reading this article you will learn about: 1. Introduction to National Agricultural Insurance Scheme 2. Seed Crop Insurance 3. Livestock Insurance.

National Agricultural Insurance Scheme # Introduction:

The National Agricultural Insurance Scheme (NAIS) was introduced from 1999-2000 replacing the erstwhile Comprehensive Crop Insurance Scheme (CCIS). The main objective of the scheme is to protect the farmers against crop losses suffered on account of natural calamities such as drought, flood, hailstorm, cyclone, fire pests and diseases.

The new scheme is now available to all the farmers—loanee and non-loanee—irrespective of their size of holding. It envisages coverage of all the food crops (cereals, millets and pulses), oilseeds and annual horticultural/commercial crops, in respect of which past yield data is available for adequate number of years.

Among the annual commercial/horticultural crops—seven crops, namely, sugarcane, potato, cotton, ginger, onion, turmeric and chilies, are presently covered. All other annual horticultural and commercial crops will be placed under insurance cover in the third year subject to the condition of availability of past yield data.

ADVERTISEMENTS:

The new scheme would operate on the basis of an Area Approach i.e. defined areas for each notified crop for widespread calamities and on an individual basis for localised calamities such as hailstorm, landslide, cyclone and flood.

Individual based assessment in case of localised calamities would be implemented in limited areas, on experimental basis initially and, shall be extended in the light of operational experience gained. Under the new scheme, each participating State/UT is required to reach the level of Gram Panchayat as the unit of insurance in a period of three years.

The Government has also decided to set up an exclusive organisation for implementation of the new scheme in due course. Until such time as the new set up is created, the General Insurance Corporation of India (GIC) will continue to function as the Implementing Agency.

The premium rates for Bajra and Oilseeds are 3.5 per cent of sum insured or actuarial rates whichever is less while for cereals, other millets and pulses, the premium rates are 2.5 per cent of sum insured or actuarial rates whichever is less.

ADVERTISEMENTS:

In the case of commercial and horticultural crops, actuarial rates will be charged. Small and marginal farmers will be entitled to subsidy of 50 per cent of the premium charged from them to be shared equally by State/UT and Central Government. The subsidy in premium will be phased out over a period of five years.

During Rabi 1999-2000, 16 States/UTs—Assam, Goa, Gujarat, Himachal Pradesh, Kerala, Madhya Pradesh, Maharashtra, Orissa, Pondicherry, Andhra Pradesh, Bihar, Meghalaya, Uttar Pradesh. Karnataka, Andaman Nicobar Islands and Tamil Nadu, have joined the scheme.

Two more States—Sikkim and West Bengal—have shown their willingness to join the scheme w.e.f. 2000-2001 season. At present, the scheme is being implemented by 26 states/UTs.

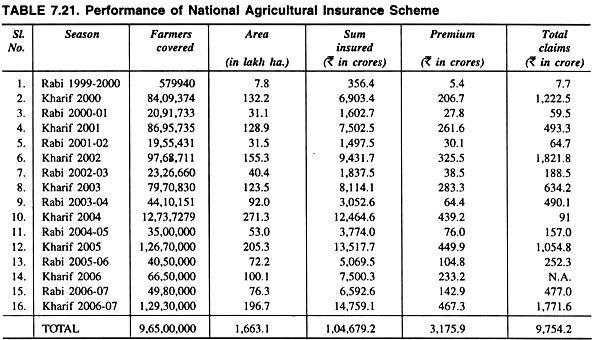

Performance under the scheme is given in Table 7.21.

Table 7.21 reveals that total number of farmers covered under National Agriculture Insurance Scheme (NAIS) which was only 5.80 lakh in Rabi 1999-2000, at the end of Kharif 2006-07 it increased to 965.0 lakh. Total sum insured under NAIS which was Rs 356.40 crore in Rabi 1999-2000 gradually rose to Rs 1,04,679.2 crore at the end of Kharif 2006-07.

Total insurance charges which were only Rs 5.42 crore gradually rose to Rs 3,176 crore at the end of Kharif 2006-07. Total area covered under NAIS which was 7.80 lakh hectares in Rabi 1999-2000 gradually rose to 1,633.1 lakh hectares at the end of Kharif 2006-07. Finally, total insurance claims paid under NAIS which was only Rs 7.68 crore gradually rose to Rs 9,754.2 crore at the end of Kharif 2006-07.

Again, during the period from rabi 1999-2000 to rabi 2010-11, 1,762 lakh farmers over an area of 2,685 lakh hectare have been covered insuring a sum of Rs 2,21,307 crore.

The Agriculture Insurance Company of India Ltd. implements the National Agricultural Insurance Scheme (NAIS). At present the scheme is being implemented by 24 states and 2 UTs. Up to March 2012, since inception, claims of about Rs 24,246 crore have been paid against premium income of about Rs 7,580 crore benefitting about 511 lakh farmers of the country.

National Agricultural Insurance Scheme # Seed Crop Insurance:

The Scheme for Seed Crop Insurance has been introduced for identified crops viz. paddy, wheat, maize, jowar, bajra, gram, red gram, groundnut, soya bean, sunflower and cotton in the states of Andhra Pradesh, Gujarat, Haryana, Karnataka, Madhya Pradesh, Maharashtra, Orissa, Punjab, Rajasthan and Uttar Pradesh with a view to strengthen confidence in the existing seed breeders/growers and to provide financial security to Seed Breeders/growers in the event of failure of seed crop, w.e.f. Rabi 1999-2000 season.

‘Breeder’, ‘Foundation’ and ‘Certified’ seeds of the crops of the scheme cover all natural risks at the following stages:

(i) Failure of seed crop either in full or in part due to natural risk;

(ii) Loss in expected raw seed yield;

(iii) Loss of seed crop after harvest; and

ADVERTISEMENTS:

(iv) At seed certification stage.

Sum insured is equivalent to the average of preceding three/five years’ Foundation and Certified seed yield of the identified unit area multiplied by ‘Procurement Price’ of the seed crop variety prevailing in the previous season by National Seed Corporation/State Seed Corporations.

The premium rates for the seeds of wheat and groundnut are 2 per cent of the sum insured, 2.5 per cent for sunflower, 3 per cent for paddy, 3.5 per cent for jowar and 5 per cent for gram, red gram, cotton, bajra, soya bean and maize.

National Agricultural Insurance Scheme # Livestock Insurance:

Cattle insurance programme is being implemented by the General Insurance Corporation of India (GIC). Under the various livestock insurance policies, cover is provided for the sum insured or the market value of the animal at the time of death whichever is less. Animals are insured up to 100 per cent of their market value normally.

ADVERTISEMENTS:

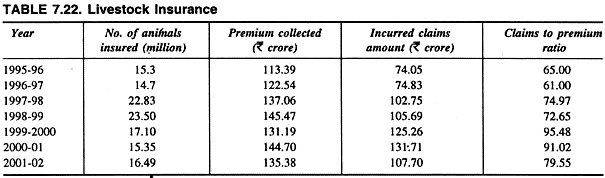

Progress in respect of number of cattle covered, premium collected and claims paid since 1995-96 is listed in Table 7.22.

Table 7.22 reveals that total number of animals insured has increased from 15.3 million in 1995-96 to 23.5 million in 1998-99 and then rose to 17.1 million in 1999-2000 and then again declined to 16.3 million in 2001-02.

The fall in the number of animals insured in last few years is mainly due to reduction in the number of low value animals such as sheep, calves and goats which at present constitute about 25.0 per cent of the animals covered.

ADVERTISEMENTS:

Moreover, the total premium collected under livestock insurance has increased from Rs 113.39 crore in 1995-96 to Rs 145.47 crore in 1998-99 and then declined to Rs 135.38 crore in 2001-02. Again, total amount of incurred claims has increased from Rs 74.05 crore in 1995-96 to Rs 105.69 crore in 1998-99 and then declined to Rs 107.7 crore in 2000-2001.

Accordingly, the total amount of claims as in proportion of premium collected gradually increased from 65 per cent in 1995-96 to 80 per cent in 2001-02.