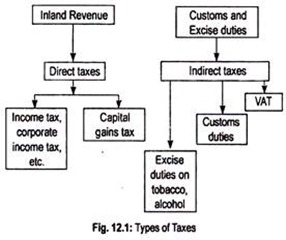

Let us learn about the Direct and Indirect Types of Tax Systems.

Taxes are usually classified into two categories. These are direct tax and indirect tax. According to J. S. Mill, a direct tax is “one which is demanded from the very persons who, it is intended or desired, should pay it. Indirect taxes are those which are demanded from one person in the expectation and intention that he shall indemnify himself at the expense of another.”

Normally, taxes which are imposed on income and wealth are known as direct taxes, those which are imposed on commodities are regarded as indirect taxes. Or direct taxes are taxes on one’s earnings, while indirect taxes are taxes on spending.

Indirect taxes can be general or specific. VAT (Value Added Tax) is a general tax as it is levied on a wide range of goods and services. Sometimes, specific or selective tax is levied on certain commodities only. Indirect taxes may have a flat rate or an ad valorem rate.

ADVERTISEMENTS:

Former is imposed as an absolute sum of each unit of goods sold. Suppose, a tax of Rs. 10 is imposed on a bottle of wine, irrespective of the price of the bottle. This is an example of flat rate tax. On the other hand, if a tax of 8 p.c. on the price of a bottle of wine is imposed then it is called ad valorem tax. As price increases the amount of tax paid would increase. VAT is an example of ad valorem tax.

The following illustrates types of taxes that the Union Government of India imposes:

One can also define these two taxes on the basis of impact and incidence of a tax. Every tax has a burden. By the impact of the tax we mean the initial burden of a tax and by the incidence of a tax we mean the ultimate burden of a tax. A direct tax is one whose impact and incidence fall upon the same person. A tax on income is a direct tax.

ADVERTISEMENTS:

An income taxpayer cannot shift the burden of his tax on someone’s shoulder. That is why the initial and ultimate burden of an income tax fall upon the same taxpayer. On the other hand, a tax on the consumption of a commodity is an indirect one.

Suppose, a tax on cigarette has been imposed upon the manufacturer. So the initial burden of a tax falls upon the manufacturer. But, by raising the price of cigarette, the manufacturer collects the taxed amount from the smoker. So, ultimately, the burden of tax is borne by the smokers themselves. Thus, an indirect tax is one whose impact and incidence fall upon different persons.