The various measures taken by the government to control and regulate the private sector to bring its activities in alignment to economic goals.

The main aim of these measures is to attain economic growth, economic stability, and equitable employment.

However, there are certain socio-economic problems that always exist in the economy. These socio economic problems include growth of monopolies, labor exploitation, and unethical trade practices.

The main reasons behind these problems are conflicts between the private sector and the government related to private and social interests and social responsibilities that are generally ignored by private businesses. Therefore, the government has enacted certain acts and laws known as economic legislations to cope with these socio-economic problems.

ADVERTISEMENTS:

Some of the economic legislations enacted by the government for private businesses are shown in Figure-4:

The different economic legislations (as shown in Figure-4) are explained in detail.

Monopolies and Restrictive Trade Practices (MRTP) Act:

ADVERTISEMENTS:

In capitalist economy, the existence of monopolies is very common. The main concerns of the government related to monopolies are to eradicate the evils of monopoly, monitor the existing economy, and avoid the further growth of monopolies. Almost all industrialist economies have enacted various laws to monitor the prices of monopolies and restrict their further growth. In India, the concept of monopoly came into existence at the time of colonial rule in the country.

After independence, the economic and industrial structure of India was characterized by the growth of monopolies and concentration of the economy. However, various provisions were made in the Directive Principles of the Indian Constitution for the reduction of economic concentration, but no particular action was taken till 1970.

Consequently, the monopolies and economic concentration kept on increasing at a rapid pace. This further resulted in the emergence of private monopolies and confinement of economic power in the hands of few people and organizations.

The growth of monopolies hampers economic development in the following manner:

ADVERTISEMENTS:

(a) Limiting the level of production:

Refers to the fact that private monopolies limit their capacity of production below their potential. In this way, these private monopolies confine the supply of goods and services below their efficiency. In such a situation, private monopolies sell their goods and services relatively at higher prices to earn maximum profit. This hampers the economic welfare of the society.

(b) Limiting the level of output:

Hampers the welfare of the economy to a large extent. Private monopolies, by limiting the level of output, also reduce employment opportunities and generation of income in the society. This leads to the reduction of consumer surplus and welfare of economy.

(c) Limiting the level of competition:

Refers to the fact that monopolies restrict competition by concentrating economic power in few industries. This further reduces the production capacity that can be achieved in a competitive business environment. For reducing the effects of monopoly, Monopoly Inquiry Commission was setup by the Indian government in 1965 under the chairmanship of Shri K.C. Dasgupta. The main function of the commission is to estimate the extent of economic concentration and effects of monopolies on the economy and formulate related measures. For analyzing the effects on monopoly, the commission has to analyze the distribution of power in terms of product and industry wise concentration.

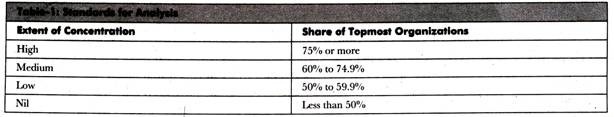

The standards selected by Monopoly Inquiry Commission for analysis is shown in Table-1:

The commission has analyzed the concentration of 100 products and has provided the following conclusions related to product-wise concentration:

ADVERTISEMENTS:

(a) High Concentration:

Includes 65 products that are mostly of basic use, such as kerosene, milk food, toothpastes, dry batteries, and motor vehicles

(b) Medium concentration:

Includes 10 products, such as biscuits, fans, radio receivers, and cement

ADVERTISEMENTS:

(c) Low Concentration:

Includes 8 products, such as worsted knitting, papers and pencils, pipes and stove-ware

(d) Nil Concentration:

Includes 17 products, such as sugar, tea, coffee, coal, and vegetables. The country-wise concentration shows top five business houses that have the maximum power. They are Birla’s, Bangurs Surajmal Nagarmal, Bird Heilders, and Tata’s with the number of organizations 151, 81, 76, 64, and 53, respectively. The top 75 business houses are accounted for 44.1% of share in the total money supply of the market. Therefore, today also monopolies do exist in the economy having a large market share.

ADVERTISEMENTS:

The recommendations given by Monopoly Inquiry Commission are as follows:

a. Building up more strong commission, such as MRTP Commission

b. Reducing barriers on industries license, so that small and medium enterprises would be encouraged to enter in the market

c. Providing import licenses to the actual user of imported goods instead of limited importers

d. Supporting monopolies where they can prove productive for the economic growth

As a result of the recommendations given by Monopoly” Inquiry Commission, the MRTP Act was 1969 by the Indian government. MRTP is applicable in all the states of India except Jammu and Kashmir. The major pals of MRTP Act are to monitor the concentration of economic power in the society and restrict monopolies and evil trade practices.

ADVERTISEMENTS:

In MRTP Act, 1969 has defined monopolies, monopolistic trade practices, and restrictive trade practices in the following ways:

a. According to MRTP Act, 1969, the monopolies are the companies that have assets of Rs. 20 crore, group of companies having total assets of Rs. 20 crore, companies whose supply of product is equal to the one-third of total supply, and interlinked companies with total assets equal to Rs. 1 crore or more.

b. According to MRTP Act, 1969, monopolistic trade practices refer to trade practices that are used by organizations and group organizations to show their power and are harmful for the society. These practices include keeping high prices of products, decreasing the level of production, and lowering the supply of products in the market. These practices are followed to maintain the high level price, reduce the level of competition in the market, and limit the capital investment and technical progress to reduce the quality of products.

c. According to MRTP Act, 1969, restrictive trade practices refer to practices of a group of monopolies to prevent an increase in competition by cumulative agreement. It is also termed as cartelization of industry. The restrictive trade practices are large in number. Some of them are limiting exchange of goods from particular individuals, buying goods to get other goods, limiting the target market, and reducing the discount.

Industrial Relation and Disputes Act:

Apart from economic concentration, another major problem in developing countries, such as India, is strained relationships between industrialists and industrial workers. This leads to labor unrest and loss of output. The main reasons for d-harmony between industrialists and industrial workers are issues related to wages, working conditions, bonus leaves, working hours, security and safety and growth perspective.

ADVERTISEMENTS:

On the contrary, a healthy industrial relation results in an increase in production and supply of goods and services as well as reduction in the rate of attrition. Moreover, congenial relationships between industrialists and industrial workers increase the level of employment and work ethos.

However, there is a huge gulf between the expectations of industrial workers and the facilities provided by industrialists to industrial workers. This affects the industrial relations adversely and leads to industrial disputes. In India, industrial relations have been disturbed since post-independence.

This has led to a significant increase in industrial disputes, such as strikes, lock-outs, and gheraos, from 1961 to 1995. Consequently, the probability of confrontation between industrialists and labor unions has increased.

These disputes are associated with a number of reasons, which are explained as follows:

(a) Economic Factors:

Includes salary and incentives earned by an employee in an organization. These factors become more prominent due to rise in inflation. At the same time, the rate of real wages decreases with increase in the rate of inflation.

ADVERTISEMENTS:

As a result, the employees demand increment in their wages and salaries to meet their needs. In addition, the employees develop a feeling of being exploited as they do not get wages as per their skills. Therefore, such issues can result in major conflicts.

(b) Conflicts of Interest:

Arise due to differences in the interests of workers and organizations. Generally facilities such as wages, safety, security, working conditions, and working hours, provided by organizations are not as per the expectations of workers.

Moreover, organizations strive to minimize their costs, while workers always desire hike and increments in wages and benefits. Apart from this, another conflict of interest takes place when organizations desire maximum output without taking into consideration the workers’ point of view.

(c) Non-economic Factors:

Include moral, ethical, and political issues. Poor personnel management in which workers are maltreated and are deprived of their rights and dues, gives rise to feeling of frustration and discontentment among workers.

ADVERTISEMENTS:

This further result in low motivation level of workers and the output. Consequently, the situations, such as confrontation between management and labor unions, lock-outs, and strikes, take place.

Taking into consideration these industrial disputes, the Indian government enacted Indian Disputes Act in 1947. Over the passage of time, lots of amendments have been made in the act.

The industrial disputes settlement system of the Indian government includes the following:

(a) Grievance Settlement Authority (GSA):

Refers to a group of specialists or consultants to solve disputes in organizations. In simple terms, GSA, also known as Works Committee, is a team of internal employees formed by organizations. This committee is the first source of settling disputes in organizations.

As per Industrial Disputes Act 1947, this committee can be created by organizations employing 50 or more workers. If both the parties, which are having disputes, are not satisfied with the decisions or suggestions given by GSA, then the matter is taken to other sources.

(b) Conciliation Officers:

Refer to individuals charged with the responsibility of settling disputes in industries. As per Industrial Disputes Act 1947, the government can appoint individuals by providing a notification in the Official Gazette.

A conciliation officer is responsible for enquiring the causes of disputes between both the parties. If he/she is unable to solve disputes, then he/she approaches to the government for the same.

(c) Board of Conciliation:

Involves a chairman, an independent person, and one or two representatives of each party. This board is established by the government to settle disputes in the same way as in case of conciliation officers.

(d) Court of Inquiry:

Investigates the causes of dispute, observes and records statements of both the parties, and presents these findings to the government. However, the court is not responsible for settling disputes between the parties.

(e) Adjudication Bodies:

Refers to the third party employed by the government to resolve industrial disputes. It has three tiers- labor courts, industrial tribunals, and national tribunals. Labor court refers to the court having a single individual who is an ex- judge of the high court. It deals with issues, such as proprietary, legality of order, dismissal of employee, and denial of accustomed benefits.

Similarly, in industrial tribunal, there is only one person who is the ex-judge of high court. It deals with issues, such as wages, mode of payment, working hours, and other allowances. On the other hand, national tribunal handles national level issues.

Foreign Exchange Regulation Act (FERA):

The Foreign Exchange Regulation Act (FERA), 1973 was established at the time when India was not earning enough foreign exchange. As per this act, all the foreign exchange earned by any resident of India was to be reserved and surrendered to the government. The rules under FERA were very stringent and the violation of any rule was considered as a criminal offence.

The act laid down by the government is given as follows:

1. This Act may be called the Foreign Exchange Regulation Act, 1973.

2. It extends to the whole of India.

3. It applies also to all citizens of India outside India and to branches and agencies outside India of companies or bodies corporate, registered or incorporated in India.

4. It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint in this behalf:

Provided that different dates may be appointed for different provisions of this Act and any reference in any such provision to the commencement of this Act shall be construed as a reference to the coming into force of that provision.

Definitions:

In this Act, unless the context otherwise requires:

a. “Appellate Board” means the Foreign Exchange Regulation Appellate Board constituted by the Central Government under sub-section (1) of section 52;

b. “authorised dealer” means a person for the time beingauthorized under section 6 to deal in foreign exchange;

c. “bearer certificate” means a certificate of tide to securities by the delivery of which (with or without endorsement) the tide to the securities is transferable;

d. “certificate of tide to a security” means any document used in the ordinary course of business as proof of the possession or control of the security, or authorizing or purporting to authorize, either by an endorsement or by delivery, the possessor of the document to transfer or receive the security thereby represented;

e. “coupon” means a coupon representing dividends or interest on a security;

The provisions of F.E.R. (Amendment) Act, 1993 (hereafter referred to as Act 29 of 1993) came into force on the 8th day of January 1993.

f. “currency” includes all coins, currency notes, banks notes, postal notes, postal orders, money orders, cheques, drafts, traveller’s cheques, letters of credit, bills of exchange and promissory notes;

g. “foreign currency” means any currency other than Indian currency;

h. “foreign exchange” means foreign currency and includes –

i. all deposits, credits and balances payable in any foreign currency, and any drafts, traveller’s cheques, letters of credit and bills of exchange, expressed or drawn in Indian currency but payable in any foreign currency;

j. any instrument payable, at the option of the drawee or holder thereof or any other party thereto, either in Indian currency or in foreign currency or partly in one and partly in the other;

k. “foreign security” means any security created or issued elsewhere than in India, and any security the principal of or interest on which is payable in any foreign currency or elsewhere than in India.

Under FERA even the gifts received of goods purchased from abroad were considered as violation of the act, and therefore was punishable offense. It was only after liberalization that these laws were made less stringent and FERA was renamed to FEMA.