In this article we will discuss about:- 1. Introduction to Optimum Currency Areas 2. Benefits of Optimum Currency Areas 3. Disadvantages.

Introduction to Optimum Currency Areas:

The optimum currency area theory is a relatively recent area of study. The pioneering work in this field was done by J.E. Meade and T. Scitovsky in 1957-58. The main credit for developing this analysis, however, goes to Mundell (1961) and McKinnon (1963).

According to Mundell, optimum currency area is a region which leads automatically to a complete elimination of unemployment and the BOP disequilibrium. In a currency area, either there is a common currency or the currencies of a group of countries are linked through a permanently fixed exchange rate.

The currencies of the member countries of a union could then float jointly with respect to the currencies of the non-member countries. Mundell pointed that there would be an automatic achievement of internal and external equilibria in the countries of a currency area without either the policy of flexible exchange rates or the government intervention through monetary and fiscal policies, provided there were free mobility of labour and capital through the currency area.

ADVERTISEMENTS:

McKinnon, in contrast to Mundell’s emphasis upon cost-price adjustments, laid stress upon the internal price stability as the objective of the currency area. McKinnon believed that the currency area is best suited to open economies rather than closed economies. Higher is the ratio of traded to non-traded goods or higher the ratio of foreign trade to GNP, more beneficial it is to form a currency area.

According to him, the open economies should rely upon the monetary and fiscal policy changes rather than the exchange rate changes to achieve internal and external balances. A closed economy, on the other hand, should rely upon exchange rate changes rather than monetary and fiscal policies to realize the goal of internal and external stability.

Peter Kenen, in his version of optimum currency area theory, pointed out that less open but more diversified economies are best suited to form the currency area. Magnifico (August 1971) and Fleming (September 1971) agreed that the countries with similar propensities to inflation should form currency areas.

If different countries have different Phillips type inflation-unemployment trade off, the formation of a currency area by them is not feasible. The varying rates of inflation may involve them into BOP disequilibria which will require adjustments in exchange rates. So the optimum currency area should include such countries in which the propensities to inflation are similar.

ADVERTISEMENTS:

G.E. Wood (1973) related the issue of the formation of a currency union to the question of costs and benefits. According to him, a currency area is feasible if the benefits from the union exceed the costs. The potential cost of a currency area is measured by the inability to change the rate of exchange to correct the BOP disequilibrium.

The benefits from the formation of currency union include gains from resource saving in the field of banking and foreign exchange dealings, gains from resource reallocation arising mainly from the pooling of reserves, gains from increased trade and reduced uncertainty and gains from the efficient functioning of the monetary mechanism.

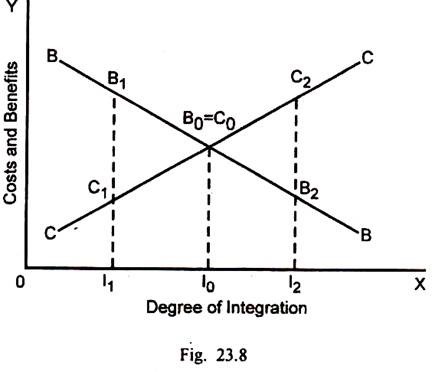

Given the benefits and costs related to currency area, the integration among the members of currency area is optimum or not can be determined through Fig. 23.8.

In Fig. 23.8, the degree or extent of integration among the member countries of currency union is measured along the horizontal scale. Costs and benefits of currency union are measured along the vertical scale. BB is the benefit curve and CC is the cost curve of resource mobility. If the degree of integration is I1, the benefit B1I1 exceed costs C1l1 and there is the need for increasing the degree of integration among the member countries.

ADVERTISEMENTS:

In case the degree of integration is I2, the benefits B2I2 fall short of costs C2l2. Consequently, there is a need to scale down the degree of integration. The I0 degree of integration among member countries is the optimum, when benefits B0I0 become exactly equal to cost C0I0.

The member countries of the currency area need not bring about any changes in the degree of integration among them. On the basis of the above theoretical approaches, it is possible to lay down certain conditions under which the optimum currency area is likely to be beneficial on the balance.

The conditions are:

(i) There should be greater resource mobility among the different member countries.

(ii) There should be close structural similarities among the member countries.

(iii) There should be similar propensities to inflation and BOP disequilibrium among the member countries.

(iv) The benefit-cost ratio of having a fixed or common exchange rate should be the highest possible.

(v) There should be greater willingness among the member countries to co-ordinate their monetary, fiscal and other policies.

Benefits of Optimum Currency Areas:

ADVERTISEMENTS:

The formation of an optimum currency area can result in several benefits for the member countries.

Firstly, the formation of a currency area eliminates the uncertainty that often results from flexible or continuously changing exchange rates.

Secondly, the optimum currency area promotes specialisation in production and expanded flow of trade and investments among the member countries.

Thirdly, the whole region or area having a common currency or fixed exchange rate is treated as a single large market.

ADVERTISEMENTS:

Fourthly, the formation of optimum currency union ensures the benefits accruing from the economies of scale.

Fifthly, the stability of exchange rate leads to a greater stability in prices in the member countries.

Sixthly, the internal price stability encourages the use of money as a store of value and to effect transactions. The inefficient barter deals arising under inflationary conditions get discouraged.

Seventhly, the formation of an optimum currency area saves the cost of official intervention in foreign exchange markets involving the currencies of member countries, cost of exchanging one currency into another and the cost of hedging.

Disadvantages of Optimum Currency Areas:

ADVERTISEMENTS:

Critics have pointed out certain disadvantages of the optimum currency area. Firstly, each member nation cannot pursue independent stabilisation, growth and other policies which it deems appropriate in its special conditions. There can be contradiction in the policies emphasised by the advanced members and required by the depressed regions or backward member countries.

It is for this reason that sometimes the depressed regions want to have their separate currencies or in some extreme case, they even want to secede from an area or country and hope to do better through a separate, independent economic and political structure of their own.

But having a separate currency or a sovereign state cannot by itself remove poverty, unemployment, and inflation and BOP deficits. Secondly, certain benefits expected from an optimum currency area can be obtained even through fixed exchange rates. These benefits do not fully validate the organisation of a number of countries into a straight-jacket economic union.

The European Economic Community (EEC), since early 1970’s, has expressed a strong commitment to form an optimum currency area. This involves permanently fixing exchange rates among the member countries, co-ordinating monetary and fiscal policies, instituting a regional policy for depressed area within the EEC and finally establishing a common currency.

The countries of EEC, which has now got transformed into European Union (EU), have launched a single currency named ‘Euro’ with effect from 1st January, 1999. 21 countries out of presently 27 member countries of EU have accepted it.

Four member countries of the EU, Britain, Denmark, Sweden and Greece have not accepted it for the time being. EU is thus the most prominent instance of the currency area.

ADVERTISEMENTS:

The reasons given for the adoption of Euro are as follows:

First, single currency will facilitate smooth and enlarged volume of trade and investment within Europe.

Second, the single stable and strong currency will give a greater voice to Europe in the global economy.

Third, it will speed up the process of political integration of Europe.