The below mentioned article provides an explanation of foreign exchange rate and foreign exchange market in India.

Introduction:

It may be noted that the foreign exchange is the name given to any foreign currency.

Thus US dollars or British pounds are foreign exchange for India. Further, the exchange rate is the price of a country’s currency in terms of another country’s currency. Thus, at present (Aug. 30, 2013) one US dollar is exchanged for about 65.70 rupees of India (the spot exchange rate). Thus 65.70 Indian rupees for one US at present dollar is the exchange rate of a dollar in terms of rupees.

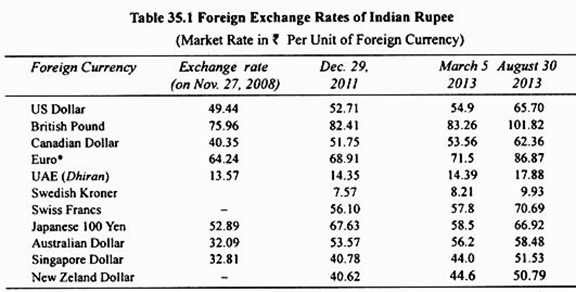

In the above table we give the exchange rates of Indian rupee in terms of currencies of some important countries of the world. It will be seen from the above table that there has been a lot of volatility in the exchange rate of rupee. There had been 15 per cent appreciation of Indian rupee vis-a-vis US Dollar between Oct. 2006 and Dec. 2007. Beyond Jan.2008, rupee started depreciating under pressure of capital outflows by FIIs and it fell to Rs.49.44 to a US dollar on Nov. 27, 2008.

ADVERTISEMENTS:

From later half of2009-10 to Aug. 2011, as a result of return of capital flows to India, rupee started appreciating and its value rose to around Rs. 45 to a US dollar at end-Aug. 2011. However, again from Sept. 2011 due to Eurozone sovereign debt crisis there had been large capital outflows by FIIs from India (and other emerging economies) resulting in drastic depreciation of Indian rupee which fell to even Rs. 54 to a US dollar on Dec. 15, 2011.

But due to intervention of RBI by way of selling dollars in the foreign exchange market from its foreign exchange reserves, the value of rupee fluctuated within range of Rs 52 to Rs.53 to a US dollar between December 16, 2011 and January 13, 2012. It will be seen that Indian rupee depreciated against currencies of all countries in March 5, 2013 except Japan. On March 5, 2013, value of rupee was 54.9 rupees per US dollar.

However, a very large depreciation of rupee has occurred since May 22, 2013. In the month of June 2013, the rupee fell from to around Rs. 56 to a US dollar in the first week of June 2013 to Rs. 60 to a dollar in the end of June 2013 and hit very level of Rs.61.21 to a dollar on July 8, 2013. The RBI intervened by selling US dollars from its foreign exchange reserves and took steps to discourage the import of gold so as to reduce the demand for dollars.

ADVERTISEMENTS:

The Finance Minister also raised the duty on gold, first from 6% to 8% and then to 10% to restrict the imports of gold to check further depreciation of rupee. However, despite these measures, depreciation of rupee continued and the value of rupee hit a record of Rs. 68.83 to a US dollar on Aug. 28, 2013. Then with aggressive intervention by the RBI through sale of dollars from its foreign exchange reserves and as a result the value of rupee rose to Rs.65.70 to a dollar on Aug. 30, 2013. That is, about 18% fall in the value of rupee from early June 2013.

Both domestic and external factors are responsible for this sharp depreciation of rupee since May 2013. The domestic factor responsible for this steep slide of rupee has been the emergence of large current account deficit (CAD) which was estimated at $ 88 billion in 2012-13 (4.8% of GDP of the year) due to sluggish exports and rise in imports causing a net increase in demand for US dollars over their supply.

The external factor which triggered the sharp depreciation of rupee was the announcement by the governor of the US Reserve System in May 2013 that since the US economy had recovered, he would start the unwinding of the policy of quantitative easing (QE) under which it was purchasing bonds worth $ 85 billion per month from the market to revive the US economy. This triggered capital outflows by FIIs from the emerging economies including India. These capital outflows on a large scale from India contributed to the sharp slide in the exchange rate of rupee.

Floating (Flexible) and Fixed Exchange Rate System:

Since exchange rate is a price, its determination can be explained through demand for and supply of currencies. Suppose we consider the transactions between two countries, India and USA. In this case therefore the demand for and supply of dollar is the demand for and supply of foreign exchange from the Indian perspective and the price of a US dollar in terms of Indian rupees or a number of dollars per Indian rupee is the exchange rate.

ADVERTISEMENTS:

The system of exchange rate in which the value of a currency is allowed to adjust freely or to float as determined by demand for and supply of foreign exchange is called a flexible exchange system which is also known as floating exchange system.

On the other hand, if the exchange rate instead of being determined by demand for and supply of foreign exchange is fixed by the Government, it is called the fixed exchange rate system which prevailed in the world under an agreement reached at Bretton Woods in New Hampshire in July 1944. It may be noted that under the fixed exchange rate system, exchange rate is not determined by demand for and supply of foreign exchange but is pegged at a certain rate.

At the fixed exchange rate, if there is disequilibrium in the balance of payments giving rise to either excess demand or excess supply of foreign exchange, the Central Bank of the country has to buy and sell the required quantities of foreign exchange to eliminate the excess demand or supply.

In 1977 USA decided to float its dollar and switched over to the flexible exchange system resulting in the collapse of Bretton Woods System of fixed exchange rate. Both the floating (flexible) and fixed exchange rate system have their merits and demerits.

Appreciation and Depreciation of Currencies:

It is important to explain the meanings of the terms, appreciation and depreciation, of currencies which are often mentioned in the discussion of foreign exchange rate. Let us consider the exchange rate of rupee for dollar. Appreciation of a currency is the increase in its value in terms of another foreign currency.

Thus, if the value of a rupee in terms of U S dollar increases from Rs. 45.50 to Rs. 44 to a dollar, Indian rupee is said to appreciate. This indicates strengthening of the Indian rupee. Note that when Indian rupee in dollar terms appreciates, the dollar would depreciate.

On the other hand, if the value of Indian rupee in terms of US dollars falls, say from Rs. 45.5 to Rs. 46 to a dollar, the Indian rupee is said to depreciate which shows the weakening of Indian rupee. Thus, under a flexible exchange system, the exchange value of a currency frequently appreciates or depreciates depending upon the demand for and supply of a currency.

In a fixed exchange rate system the government has to buy or sell foreign exchange in order to maintain the rate at the controlled level. However, even under the fixed exchange rate system, the value of one’s currency can be changed only occasionally. For instance, in June 1966, the value of rupee in terms of US dollar and U.K’s, pound sterling was lowered. Again in July 1991 India reduced its value of rupee in terms of dollar by about 20 per cent.

Such a one-time lowering of value of its currency in terms of foreign exchange occasionally by a country is called devaluation as distinguished from depreciation which can often take place under the influence of changes in demand for and supply of a currency.

ADVERTISEMENTS:

On the other hand, with a fixed rate exchange system if a country raises the value of its currency in terms of foreign currency, it is called revaluation. It should be noted that since March 1993 India has also now made its rupee convertible into a foreign currency and allowed its value to adjust freely depending upon demand and supply forces.