In this article we will discuss about:- 1. Determination of Cost-Plus Price 2. Advantages of Cost-Plus Price 3. Criticisms.

Determination of Cost-Plus Price:

Prof. Andrews in his study, Manufacturing Business, 1949, explains how a manufacturing firm actually fixes the selling price of its product on the basis of the full-cost or average cost.

The firm finds out the average direct costs (AVC) by dividing the current total costs by current total output. These are the average variable costs which are assumed to be constant over a wide range of output. In other words, the AVC curve is a straight line parallel to the output axis over a part of its length if the prices of direct cost factors are given.

The price which a firm will normally quote for a particular product will equal the estimated average direct costs of production plus a costing-margin or mark-up. The costing-margin will normally tend to cover the costs of the indirect factors of production (inputs) and provide a normal level of net profit, looking at the industry as a whole.

ADVERTISEMENTS:

The usual formula for costing-margin (or mark-up) is,

M = P – AVC/AVC …(1)

where M is mark-up, P is price and AVC is the average variable cost and the numerator P-AVC is the profit margin.

If the cost of a book is Rs 100 and its price is Rs 125,

ADVERTISEMENTS:

M = 125 – 100/100 = 0.25 or 25%

If we solve equation (1) for price, the result is

P = AVC (1+M) ….(2)

The firm would set the price,

ADVERTISEMENTS:

P = Rs 100 (1 + 0.25) = Rs125.

Once this price is chosen by the firm, the costing-margin will remain constant, given its organisation, whatever the level of its output. But it will tend to change with any general permanent changes in the prices of the indirect factors of production.

Depending upon the firm’s capacity and given the prices of the direct factors of production (i.e., wages and raw materials), price will tend to remain unchanged, whatever the level of output. At that price, the firm will have a more or less clearly defined market and will sell the amount which its customers demand from it.

But how is the level of output determined? It is determined in either of the three ways:

(a) As a percentage of capacity output; or

(b) As the output sold in the preceding production period; or

(c) As the minimum or average output that the firm expects to sell in the future.

If the firm is a new one, or if it is an existing firm introducing a new product, then only the first and third of these interpretations will be relevant. In these circumstances, indeed, it is likely that the first will coincide roughly with the third, for the capacity of the plant will depend on the expected future sales.

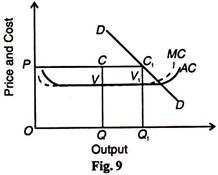

The Andrews version of full-cost pricing is illustrated in Figure 9 where AC is the average variable or direct costs curve which is shown as a horizontal straight line over a wide range of output. MC is its corresponding marginal cost curve. Suppose the firm chooses OQ level of output.

At this level of output, QC is the full-cost of the firm made up of average direct cost QV plus the costing-margin VC. Its selling price OP will, therefore, equal QC.

The firm will continue to charge the same price OP but it might sell more depending upon the demand for its product, as represented by the curve DD. In this situation, it will sell OQ1 output. “This price will not be altered in response to changes in demand, but only in response to changes in the prices of the direct and indirect factors.”

Advantages of Cost-Plus Price:

The main advantages of cost-plus pricing are:

1. When costs are sufficiently stable for long periods, there is price stability which is both cheaper administratively and less irritating to retailers and customers.

ADVERTISEMENTS:

2. The cost-plus formula is simple and easy to calculate.

3. The cost-plus method offers a guarantee against loss-making by a firm. If it finds that costs are rising, it can take appropriate steps by variations in output and price.

4. When the firm is unable to forecast the demand for its product, the cost-plus method can be used.

5. When it is not possible to gather market information for the product or it is expensive, cost- plus pricing is an appropriate method.

ADVERTISEMENTS:

6. Cost-plus pricing is suitable in such cases where the nature and extent of competition is unpredictable.

Criticisms of Cost-Plus Price:

The cost-plus pricing theory has been criticised on the following grounds:

1. This method is based on costs and ignores the demand of the product which is an important variable in pricing.

2. It is not possible to accurately ascertain total costs in all cases.

3. This pricing method seems naive because it does not explicitly take into account the elasticity of demand. In fact, where the price elasticity of demand of a product is low, the cost plus price may be too low, and vice versa.

4. If fixed costs of a firm form a large proportion of its total cost, a circular relationship may arise in which the price would rise in a falling market and fall in an expanding market. This happens because average fixed cost per unit of output is low when output is large and when output is small, average fixed cost per unit of output is low.

ADVERTISEMENTS:

5. Cost-plus pricing method is based on accounting data for total cost and not the opportunity cost that the sale of product incurs.

6. This method cannot be used for price determination of perishable goods because it relates to long period.

7. The full-cost pricing theory is criticised for its adherence to a rigid price. Firms often lower the price to clear their stocks during a recession. They also raise the price when costs rise during a boom. Therefore, firms often follow an independent price policy rather than a rigid price policy.

8. Moreover, the term ‘profit margin’ or ‘costing margin’ is vague. The theory does not clarify how this costing margin is determined and charged in the full cost by a firm. The firm may charge more or less as the just profit margin depending on its cost and demand conditions. As pointed out by Hawkins, “The bulk of the evidence suggests that the size of the ‘plus’ margin varies it grows in boom times and it varies with elasticity of demand and barriers to entry.”

9. Empirical studies in England and the U.S. on the pricing process of industries reveal that the exact methods followed by firms do not adhere strictly to the full-cost principle. The calculation of both the average cost and the margin is a much less mechanical process than is usually thought. As a matter of fact, businessmen are reluctant to tell economists how they calculated prices and to discuss their relations with rival firms so as not to endanger their long-run profits or to avoid government intervention and maintain good public image.

10. Prof. Earley’s study of the 110 ‘excellently managed companies’ in the U.S. does not support the principle of full-cost pricing. Earley found a widespread distrust of full-cost principle among these firms. He reported that the firms followed marginal accounting and costing principles, and the majority of them followed pricing, marketing and new product policies.