In this essay we will discuss about Industrial Sickness in India. After reading this essay you will learn about: 1. Definition of Industrial Sickness 2. Extent or Magnitude of Industrial Sickness 3. Causes 4. Consequences 5. Remedial Measures 6. Conclusion.

Contents:

- Essay on the Definition of Industrial Sickness

- Essay on the Extent or Magnitude of Industrial Sickness

- Essay on the Causes of Industrial Sickness

- Essay on the Consequences of Industrial Sickness

- Essay on the Remedial Measures to Deal with the Problem of Industrial Sickness

- Essay on the Conclusion to Industrial Sickness

1. Essay on the Definition of Industrial Sickness:

In the post-independence period, when the problem of industrial sickness has gained a serious proportion then various organisations like RBI, SBI and other term-lending institutions defined this problem of sickness in different manner.

Thus, there was lack of unanimity in the definition of sickness. In 1985, the Sick Industrial Companies (Special Provision) Act, 1985 was enacted. This Act has offered a definition of sickness. According to this Act, “Sick Industrial Company” indicates an industrial company (registered for not less than seven years) which is showing accumulated losses equal to or exceeding its net worth at the end of any financial year, and has suffered cash losses also during that financial year and the immediately preceding year.

ADVERTISEMENTS:

Here the “Cash loss” indicates computed loss without making provision for depreciation and net worth means the total amount of capital, and free reserves.

Moreover, a company will be known as ‘incipiently sick’ which has already eroded 50 per cent or even more of its peak net worth during any of the preceding five financial years. However, this Act mentioned number of exceptions also.

Similarly, small scale industrial company is considered as sick which (a) has incurred a cash loss in the previous financial year and was likely to earn losses in the current year and recorded erosions of its peak net worth during the last five years due to cumulative cash losses to the tune of 50 per cent or even more, and/or (b) defaulted continuously in meeting four consecutive instalments of interest or two half yearly instalments of principal amount on term loan and the company recorded persistent irregularities in the operation of its credit limit with the bank.

2. Essay on the Extent or Magnitude of Industrial Sickness:

The extent of the problem of sickness of Indian industry has been growing in serious proportion. Economic Survey 1989-90, in this connection observed that “Growing incidence of sickness has been one of the persisting problems faced by the industrial sector of the country. Substantial amount of loanable funds of the financial institutions is locked up in sick industrial units causing not only wastage of resources but also affecting the heavy growth of the industrial economy”.

ADVERTISEMENTS:

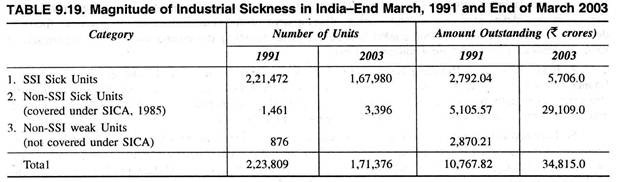

At the end of March 2003, there were nearly 1.71 lakh sick or weak industrial units on the rolls of scheduled commercial banks. More than 1.67 lakh of these units were in the small scale (SSI) sector which constitute about 98 per cent of their total number. Again total number of non-small scale units covered under SICA, 1985 was 3,396 at the end of March 2003.

Total outstanding bank credit locked in all these 1.71 lakh sick units was to the extent of Rs 34,815 crore out of which the amount involved in SSI sick unit was Rs 5,706 crore. Again the amount of outstanding credit locked in non-SSI sick unit was Rs 29,109 crore.

Moreover, the total number of non-SSI weak units (not covered under SICA) stood at 420 at the end of March, 1997 and their amount of outstanding credit was to the extent of Rs 1,564 crore. The RBI statistics shows that at the end of March 1988, every seventh small-scale unit of the country was sick. The table 9.19 shows the relative position of the sick industrial units and their outstanding bank credit.

At the end of March 2003, although small scale industries accounted for 98.0 per cent of the total sick and weak units but their share in the aggregate locked up bank credit was only 16.4 per cent. In respect of sick SSI units, the bank credit outstanding at the end of September 1991, accounted for nearly 16.2 per cent of the total credit to small scale industries. But for sick or weak large and medium scale industrial units, the ratio was 17.9 per cent.

ADVERTISEMENTS:

Out of 2427 non-SSI sick and weak industrial units, 1896 (i.e., about 81 per cent) units were in the private sector which locked 72.7 per cent of the total outstanding bank credit to non-SSI sick or weak units. If we look at industry-group wise then it can be seen that the incidence of sickness and weakness in the non-SSI sector in terms of credit outstanding was highest in textiles (i.e., 25.0 per cent) followed by engineering (18.3 per cent), chemicals (7.0 per cent), iron and steel (6.2 per cent), electrical (5.5 per cent) and paper (4.5 per cent).

As per the available information compiled by RBI, the number of sick and weak units as at the end of March 2003, both SSI and non-SSI, declined to 1.71 lakh from 2.65 lakh as at the end of March 1996. However; the amount of outstanding bank credit increased marginally to Rs 34,815 crore as at the end of March 2003 from Rs 13,748 crore as at the end of March 1996.

As on 31st March 2003, 3396 non-SSI sick units accounted for 83.6 per cent of the total outstanding bank credit. SSI sick units accounted for the balance 16.4 per cent.

However, the problem of industrial sickness has been growing over the years. Thus the total number of sick/weak units in the large and medium sector which was 2,269 in 1990 gradually rose to 4,454 at the end of March 2008.

Outstanding bank credit against those units also increased from Rs 6,926 crore to Rs 32,283 crore over the same period. Besides, total number of sick/weak units in the SSI sector which was 2, 18,828 at the end of March 1990 gradually declined to 85,591 at the end of March 2012.

Again the outstanding bank credit against those units rose from Rs 2,427 crore to Rs 6,790 crore during the same period. In the mean time, the Reserve Bank of India revised the definition of sickness of MSE units in November 2012. According, total number of sick/weak small scale units reached to 2, 49,903 at the end of March 2013 and the outstanding amount of bank credit due against these units was Rs 12,800 crore.’

Another serious problem that has been revealed from the viability status of this sick units is that the number of non-viable units is increasing at a very high rate. At the end of March 1991 out of the total number of 22.4 lakh sick units, only 17081 units are identified as viable units which constituted nearly 7.60 per cent of the total and the remaining 91.7 per cent units are identified as non-viable sick units.

It is further found that the viability of sick units was lower in the SSI sector (7.3 per cent) than the non SSI sector (40.3 per cent). Thus about 91.7 per cent of small sick units were not viable and the bank credit blocked in these units was to the extent of 71.5 per cent.

ADVERTISEMENTS:

Again out of the total 2377 non-SSI sick units viability study was completed for 1915 units and out of which 941 were found viable and 974 units were found as non-viable. However, the nursing programme covered about 82 per cent of the viable units of SSI sector and about 61 per cent of the viable units of non-SSI sector.

Recent viability study of these sick industrial units reveals that of the 2, 49,903 sick MSE units at the end of March 2013, only 4,599 units with outstanding bank credit of Rs 3,224 are found viable and another 12,779 MSE units with outstanding bank credit of Rs 3,926 crore are potentially viable. Thereby, the remaining 2, 32,525 MSE units with outstanding bank credit of Rs 5,650 crore are classified as non-viable.

Industry-Wise Study of Sickness:

Industry-wise study of sickness reveals that among the non-SSI weak units, weakness is very much deep rooted among five industries, i.e., textile, electrical, iron and steel, engineering and chemicals. These five industries accounted for more than 58 per cent of the total outstanding bank credit locked in this category of industries.

Among the non-SSI sick and weak units, five industries, i.e., textiles, paper, iron and steel, engineering and chemicals accounted for locked up total bank credit of Rs 5,956 crore. Which was about 59.0 per cent of the total outstanding bank credit locked in this category of units? Moreover, in the entire non-SSI category of industries, total amount of bank credit locked up in 2,368 sick and weak units was Rs 10,178 crore as on 31st March, 1997.

ADVERTISEMENTS:

Sickness in SSI Sector:

As on 31st March, 1999, there were 3.06 lakh sick SSI units. These units were those who obtained loans from banks. An amount of Rs 4,313 crore was blocked in these units. Of these only 18,692 units were considered potentially viable by the banks with their outstanding bank credit amounting to Rs 377 crore. The banks had identified 271,193 units with outstanding bank credit amount to Rs 3,746 crore as non-viable.

State-Wise Study of Industrial Sickness:

It is quite important to study the statewise position of industrial sickness in India. Regarding the non- SSI sick units, Maharashtra is having the maximum number of 340 units followed by West Bengal (216), Andhra Pradesh (225), Gujarat (174), Uttar Pradesh (170), Tamil Nadu (141) and Karnataka (110).

It is also observed that these seven industrially advanced states jointly constitutes 70.6 per cent of the total number of non-SSI sick units and 74.2 per cent (Rs 6,388 crore) of total outstanding bank credit (Rs 8,614 crore) of Non- SSI sick units as on 31st March, 1997.

ADVERTISEMENTS:

Thus, the degree of industrial sickness also varied between different regions of the country. Industrial sickness is very much acute in the states like Maharashtra and West Bengal. These two states accounted nearly 28.5 per cent of the total number of sick units in the non-SSI category and 30.7 per cent of the total credit outstanding.

Again in respect of SSI sick units, Maharashtra and West Bengal accounted about 30.9 per cent of the total sick units under this category and the total credit outstanding in these two states at the end of March 1997 was to the extent of Rs 1,136 crore.

These regions are facing concentration of sickness because these regions are characterised by the existence of industries in textiles, engineering goods and jute which are generally very much affected by industrial sickness.

Since its inception in May 1987 and till the end of December 2006, BIFR, which was set up to tackle the problem of industrial sickness, has received 6,991 references including 296 Central and State Public Sector Undertaking (CPSUs and SPSUs), under the Sick Industrial Companies (Special Provision) Act, 1985.

Out of the 296 references of public sector undertakings, 213 (91 CPSUs and 122 SPSUs) registered upto December 2006, rehabilitation schemes were sanctioned for only 28 CPSUs and 26 SPSUs. It was recommended that 29 CPSUs and 40 SPSUs be wound up, 9 CPSUs and 14 SPSUs were declared no longer sick.

The gross disposal of cases by BIFR which declined from 188 in 1997 to 141 in 1998 had gone upto 179 in 1999 and further to 385 in 2000 and 293 upto December 31, 2001 due to an increase in the number of Benches to 3 from July 1999. As on March 31, 2006, the gross disposal of cases was 3,426. During 2006-07, as on Sept. 30, 2006, the gross disposal of cases reached the level of 4,115.

ADVERTISEMENTS:

Finally, as per information compiled by RBI from commercial banks, as on 31st March 2001, there were 252,947 sick/weak units consisting of 2,49,630 units in the SSI sector and 3,317 units in the non-SSI sector.

Among these 3,317 units, the private sector, public sector and joint/co-operative sector accounted for 2,942 units, 255 units and 106 units respectively. The number of sick SSI units has decreased from 3, 04,235 units to 2, 49,630 units.

But the number of sick/weak units in the non-SSI sector has increased from 3,164 to 3,317. However, there is an overall increase of 10.4 per cent in total number of non-SSI sick/weak units as compared to that of previous year. The total bank credit blocked in the sick units has increased from Rs 23,656 crore (as on March 31, 2000) to Rs 25,775 crore (as on March 31, 2001).

They accounted for around 6.7 per cent of the total bank credit and 13.3 per cent of the total bank advances to industry. The small scale sector has Rs 4,506 crore (17.5 per cent) blocked in its units while the non-SSI sector has Rs 21,270 crore (82.5 per cent). Bank credit blocked in the non-SSI sector in private, public and joint/co-operative units was Rs17,705 crore, Rs 2,986 crore and Rs 537 crore Rs 42 crore respectively.

3. Essay on the Causes of Industrial Sickness:

The causes which are mostly responsible for industrial sickness in India are broadly classified into (a) external and (b) internal causes.

The following are some of the external and internal causes of industrial sickness:

External Causes:

ADVERTISEMENTS:

The external causes of industrial sickness include:

(a) Power cuts imposed by the state governments;

(b) Scarcity of raw materials and other inputs due to its erratic supply;

(c) Recession in the market resulting from steep fall in the quantum of demand for industrial products aggravated by credit restraints and resulting in unsold stocks and losses to industrial units; and

(d) Frequent changes in the government policy in connection with industrial licensing, taxation, power tariff, imports, exports etc. All these external factors are equally responsible for growing industrial sickness among the industrial units of the country.

Internal Causes:

The internal causes which include various factors related to the industrial units itself include:

ADVERTISEMENTS:

(a) Faulty location of industrial unit;

(b) Faulty planning of the production in the absence of market analysis;

(c) Defective selection of plants and machineries and adoption of obsolete technology particularly in the small scale sector;

(d) Acute financial problem due to weak equity base and lack of adequate support from banks;

(e) Incompetent entrepreneurs having no knowledge about costing, marketing, accounts etc.;

(f) Labour problems like strikes and lock-outs arising from strained industrial relation over the issues like wages, bonus, industrial discipline etc.; and

ADVERTISEMENTS:

(g) Management problems resulting from managerial decisions in connection with production, marketing, finance, materials, maintenance, personnel management etc.

In 1984, the Tiwary Committee submitted its report on industrial sickness in India. In its report he identified the faulty management as the most important cause of sickness. Thus the committee concluded that, “Taking into account the finding of all the studies…… a broad generalisation regarding important causes of industrial sickness emerges.

It is observed that the factor most often responsible for industrial sickness can be identified as ‘management’. This may take the form of poor production management, poor labour management, lack of professionalism, dissensions within management, or even dishonest management.

The Economic Survey, 1996-97, while underlining the causes of industrial sickness, observed that “The reasons for industrial sickness are internal factors such as project appraisal deficiencies, project management deficiencies and several external factors like shortage of raw materials, power crisis, transport and financial bottlenecks, changes in Government policy, increase in overhead cost etc. Marketing problems in the form of market saturation, product obsolescence and demand recession are also to be held responsible.”

4. Essay on the Consequences of Industrial Sickness:

Industrial sickness has been resulting in serious consequences in an under-developed labour-surplus economy like India,

These consequences of industrial sickness include:

(a) Aggravating unemployment problem through the closure of industrial units;

(b) Widespread labour unrest due to closure, threatening industrial environment of the country;

(c) Wastage of huge resources invested in these sick units;

(d) Creating disincentive among the entrepreneurs and investors due to widespread closure of units;

(e) Creating adverse impact on the other related units through backward and forward linkages;

(f) Causing huge financial losses to banks and other term lending institutions and locking up huge funds into these sick industrial units; and

(g) Resulting huge loss of revenue to both Centre, State and Local governments.

5. Essay on the Remedial Measures to Deal with the Problem of Industrial Sickness:

Industrial sickness is a serious problem faced by the country at present. This has affected the health of industries working under both public and private sector. Thus in the meantime various incentives, conclusions, doles etc. have been offered to these sick units for their revivals.

These measures for revival and rehabilitation are as given below:

(i) Measures Taken by Banks:

In order to revive and rehabilitate the sick industrial units, the commercial banks granted various concessions of these units which include:

(a) granting additional working capital;

(b) recovering proper moratorium on payment of interest and

(c) freezing a part of the understanding in the accounts of these units.

Besides, banks have also taken various steps on the organisational front by setting up sick industrial undertaking cell, state-level inter-institutional committees, a standing coordinating committee (constituted by RBI) from coordinating various issues related to commercial banks and term-lending institutions and a special cell within rehabilitation finance division of IDBI.

(ii) Measures Taken by the Government:

In order to deal with the problem of industrial sickness, the government laid down various guidelines in October, 1981 for the guidance of administrative machineries.

The main features of these guidelines are:

(a) The administrative ministries in the government have been given specific responsibility for taking remedial action and preventing industrial sickness.

(b) In order to take corrective action for preventing incipient sickness, the financial institutions will strengthen the monitoring system and may take over the management of unit for its revival,

(c) Whenever the banks and other financial institutions fail to prevent sickness of a sick unit thereafter reporting the matter to the government they recover their outstanding dues with normal banking procedures.

(d) In order to nationalise the undertaking, the management of the unit may be taken over under the provisions of Industries (Development and Regulation) Act, 1951 for six months period.

In order to provide management support and financial assistance through different banks and financial institutions, the Government has taken over management of 15 industrial undertakings on January 1, 1989 under the provision of Industries (Development and Regulation) Act. But this measure failed to revive these sick units.

Concession Provided by the Government:

The Government has also made provision for certain concessions for assisting the revival process of sick units.

These includes:

(a) amendment of Income Tax Act in 1977 by adding the section 72A for giving tax benefit to healthy units taking over sick units for its revival;

(b) introduction of margin money scheme for the revival of sick units in January 1982.

Later on in June 1987, a liberalised margin money scheme was introduced for reducing the sickness of small scale sectors where the amount of assistance was raised from Rs 20,000 to Rs 50,000.

Industrial Reconstruction Bank of India:

In order to revive and rehabilitate sick units, the Industrial Reconstruction Corporation of India (IRCI) was set up by the Government with its authorised capital of Rs 2.5 crore. This corporation was set up for providing financial assistance, managerial and technical assistance to the sick units directly and also for securing financial assistance from other financial institutions and government agencies for the revival of sick units and also to provide merchant banking services for amalgamation, merger etc.

Again on March 20, 1985 the IRCI was converted into a statutory corporation and renamed it as Industrial Reconstruction Bank of India (IRBI) for rehabilitating sick units with the authorised capital of Rs 200 crore and paid up capital of Rs 50 crore. At the end of March 1991, total amount of assistance sanctioned by IRBI was Rs 1,262 crore out of which Rs 923 crore was disbursed.

Steps for Early Detection of Sickness:

In order to detect sickness of those companies not covered under SICA, 1985 at an early stage, the Reserve Bank has taken various corrective steps such as advising “the banks to take necessary steps in respect of any industrial units and monitoring certain industries through its standing committees where sickness is widespread.

Excise Loan:

In October 1989, the Government introduced a scheme for the grant of excise loan to sick and weak industrial units which were further liberalised in September 1990. As per this scheme the selected sick units will become eligible for excise loan upto 50 per cent of the excise duty paid by the unit for last 5 years.

Board of Industrial and Financial Reconstruction (BIFR):

The Board for Industrial and Financial Reconstruction (BIFR) was set up in January 1987 under the sick Industrial Companies (Special Provision) Act, 1985 (SICA) in order to revive potentially viable companies. The decision of BIFR is final as it has its binding on all concerned.

From 15th May 1987, the Board became operational. In December 1991, public sector enterprises were brought within the purview of BIFR through an amendment of the SICA.

Since the inception of Board and upto the end of September-2006, the BIFR has received 6,991 references under section 15 of SICA. Out of these 1,573 cases were rejected on scrutiny. Of the 5,418 references registered, 1,707 cases were dismissed as not maintainable, revival schemes were also sanctioned or approved in 760 cases and 1,303 cases were recommended to the concerned high Courts for winding up. 485 companies are declared no longer sick and discharged from the purview of SICA on their net worth turning positive after implementation of their scheme.

The Board also ordered the sale of one unit. Moreover, draft schemes were formulated and circulated in 36 cases and show cause notices were issued for winding up in respect of 65 cases. At the end of September 2006, the proportion of cases effectively decided to those registered by the BIFR was about 78.5 per cent and the ratio of companies on the revival path to those on the path of liquidation was estimated at 2: 1.

Since its inception in May 1987 and till the end of September 2006, the BIFR has received 6,991 references under SICA, 1985. The gross disposal of cases by BIFR declined from 188 in 1997 to 141 in 1998. Moreover it rose to 3,318 in 2004. As on March 31, 2006, the gross disposal of cases was 3,426. During the year 2006-07, as on September, 30, 2006, the gross disposal of cases reached to 4.115.

The BIFR has so far received 7,158 references under the SICA, 1985. These references include 297 from Central and State public sector undertakings (CPSUs and SPSUs). Out of the total references received, 5,471 were registered under Section 15 of the SICA, 1,857 references were dismissed as non-maintainable under the Act, 825 rehabilitation schemes were sanctioned and 1,337 companies were recommended to be wound up. Of the 297 references for public sector undertakings, the references of 92 CPSUs and 122 SPSUs were registered upto December 31, 2007.’

The review further observed that the maximum sick companies registered were from the western region (563), followed by southern region (558 cases), the northern region (447 cases) and the eastern region (285 cases). Among the States, Maharashtra had the majority of cases at 290, followed by Andhra Pradesh (250), Uttar Pradesh (191) and West Bengal (177).

About 47 per cent of the sick companies registered with the board were from these four states. According to the review, the maximum impact of industrial sickness is felt in the textile sector with 301 cases being reported from that sector alone, followed by paper and pulp sector with 138 and chemicals with 118 cases.

The Reserve Bank has been placing emphasis on a systematic approach to the detection of industrial sickness at the incipient stage and timely formulation of rehabilitation packages in respect of those sick/weak non SSI units which are found to be potentially and commercially viable.

The RBI continues not only to monitor the performance of individual banks through their half-yearly returns but also guide the banks and financial institutions in implementation of sanctioned rehabilitation packages.

6. Essay on the Conclusion to Industrial Sickness:

Thus considering the gravity of the problem of industrial sickness, the government has taken various measures. However, some critics observed that the coverage of SICA 1985 is not adequate and some unscrupulous entrepreneurs are trying to turn their units; sick deliberately for extracting various concessions and reliefs.

Thus government agencies should be careful in detecting in genuine sick industrial units and to start revival process in right time.

The BIFR was recently under fire from the Parliamentary Standing Committee on Industry for “having failed to serve the purpose for which it was created.” It has called for immediate restructuring of the BIFR as well as National Renewal Fund (NRF) so both could deal with growing industrial sickness in an effective manner.

The committee is of the opinion that because of delayed decisions taken by the BIFR, banks stopped giving working capital to these PSUs, thus compounding the crisis. The Committee observed that 26 loss making PSUs were referred to BIFR. It added that the board took too much time to take decisions on these companies.

The sub-committee has called for speeding up work of the BIFR to make it cost effective. It has found that at present the process followed by the BIFR was time consuming and thus was proving costly for workers and trade unions. It has suggested decentralising the BIFR with the creation of regional branches in the states, where the incidence of industrial sickness is quite high.