In this essay we will discuss about the Problem of Rural Indebtedness. After reading this essay you will learn about: 1. Meaning of Rural Indebtedness 2. Extent of Rural Indebtedness in India 3. NSSO Study on Farmer’s Indebtedness 4. Causes 5. Consequences 6. Remedial Measures.

Contents:

- Essay on the Meaning of Rural Indebtedness

- Essay on the Extent of Rural Indebtedness in India

- Essay on the NSSO Study on Farmer’s Indebtedness

- Essay on the Causes of Rural Indebtedness

- Essay on the Consequences of Rural Indebtedness in India

- Essay on the Remedial Measures to Solve Rural Indebtedness in India

Essay # 1. Meaning of Rural Indebtedness:

There is an extreme poverty in the rural areas of the country. Thus, the rural people are borrowing a heavy amount of loan regularly for meeting their requirements needed for production, consumption and for meeting social commitments. Thus. debt passes from generation to generation.

Although they borrow every year but they are not in a position to repay their loans regularly as because either loans are larger or their agricultural production is not sufficient enough to repay their past debt. Thus, the debt of farmers gradually increases leading to the problem of high degree of rural indebtedness in our country.

ADVERTISEMENTS:

Thus, it is quite correct to observe with Darling that “Indian farmer is born in debt, lives in debt and dies in debt”.

Essay # 2. Extent of Rural Indebtedness in India:

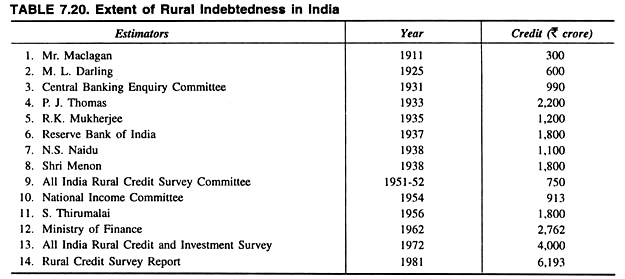

It is quite important to study the extent of rural indebtedness of an agricultural country like India. In the meantime several estimates have already been made on the rural indebtedness in India since its’ pre-independence period. Table 7.20 shows some of those important estimates.

Table 7.20 reveals that the extent of rural indebtedness as per various estimates has been increasing considerably from Rs 600 crore in 1925 (as per M.L. Darling’s estimates) to Rs 1800 crore in 1938 (as per RBI estimate) and to Rs 2,762 crore in 1962 (as per Ministry of Finance’s estimates) and then finally to Rs 6,193 crore in 1981 (as per Rural Credit Survey Report).

ADVERTISEMENTS:

As per the Rural Credit Survey Report in the last two decades, i.e., between 1961 and 1981, the extent of outstanding rural debt has increased from Rs 1,954 crore to Rs 6,193 crore. Further, the rural indebtedness grew by 97 per cent between 1961-71 and by 60 per cent between 1971-81.

The average debt for an indebted cultivator family had also increased from Rs 503 in 1971 to Rs 661 in 1981 indicating a rise of 31 per cent.

Essay # 3. NSSO Study on Farmer’s Indebtedness (2003):

NSSO, in its 59th round of surveys (January-December, 2003) covered indebtedness of farmers in right perspective.

Some of the major observations of the survey were as follows:

ADVERTISEMENTS:

(i) 48.6 per cent of farmers’ households were indebted.

(ii) Of the total number of indebted farmers, 61 per cent had operational holding below 1 hectare.

(iii) Of the total outstanding amount, 41.6 per cent was taken for purposes other than the form related activities. 30.6 per cent of the total loan was taken for capital expenditure purposes and 27.8 per cent was taken for current expenditure in form-related activities.

(iv) 57.7 per cent of the outstanding amount was sourced from institutional channels (including government) and the balance 42.3 per cent from money lenders, traders, relatives and friends.

(v) The expert Group estimate that in 2003 non-institutional channels accounted for Rs 48,000 crore of farmer’s debt out of which Rs 18,000 crore was availed of at an interest rate of 30 per cent per annum or more.

The NSSO report has also made a revelation about Punjab. As per NSSO report, the amount of outstanding loan per farmer household for all classes in Punjab was Rs 41,576 against the all India average of Rs 12,585. Similarly, the number of farmer households having outstanding loan were 12.07 in Punjab against an all India number of 434.24 lakh.

Moreover, in terms of percentage, 65.4 per cent farmer households were indebted in Punjab against an all India average of 48.6 per cent.

Indebtedness or overhang of debt has been both due to the exogenous factors such as weather induced crop uncertainties and endogenous reasons such as consumption needs of the farmers hat have taken precedence over the repayment obligations. For many farmers this could be genuine as incomes from agriculture may not have been sufficient to generate a surplus.

Essay # 4. Causes of Rural Indebtedness in India:

The following are the important causes of rural indebtedness in India:

(i) Poverty:

ADVERTISEMENTS:

Indian farmers are very poor and do not have any past saving to repay their debt or to make improvement on their land. Thus, poverty forces the cultivators to multiply their debt.

(ii) Defective Agricultural Structure:

Rural indebtedness is also resulted from defective agricultural structure which includes defective land tenure system, adoption of outdated techniques, increasing pressure on land, defective marketing, absence of alternative sources of income etc.

(iii) No Past Savings:

Indian farmers have a tendency to borrow fund for the improvement of their land and agricultural operation although they have no past saving.

(iv) Unproductive Expenditure:

Indian farmers are very much accustomed to make huge expenditures for unproductive purposes such as marriage and other social ceremonies. All these have to led to growing indebtedness of the farmers of the country.

(v) Ancestral Debt:

ADVERTISEMENTS:

Indian farmers inherit their father’s debt.

(vi) Unscrupulous Moneylender:

Moneylenders in India are also very much responsible for the growing rural indebtedness in the country as they encourage the Indian farmers to borrow, charge a very exorbitant rate of interest and manipulate their accounts.

(vii) Uncertain Monsoon:

Indian agriculture is very much depending on monsoon. About 65 per cent of the agricultural operations are rainfed. As rain is most uncertain, therefore, agricultural operation has become a gamble in monsoon.

(viii) Illiteracy of Farmers:

Most of the Indian farmers are illiterate. Unscrupulous moneylenders or mahajans are utilizing this weakness of farmers to create a vicious circle of indebtedness.

(ix) Fragmentation:

ADVERTISEMENTS:

There is a growing trend of sub-division and fragmentation of land holdings which has been resulting in a poor level of income for Indian farmers. Such poor income forces the farmers towards growing indebtedness.

(x) Litigation:

There is an increasing tendency of litigation among the Indian farmers which has magnified the problem of indebtedness in the country.

(xi) Defective Marketing:

Agricultural marketing in India is very much defective. This never allows the farmers a remunerative price for their products and sometimes forces them to go for a distress sale. Such a situation is highly responsible for growing poverty and indebtedness among the Indian farmers.

(xii) Natural Calamities:

Natural calamities like floods and droughts and backwardness of agriculture are also widely responsible for growing rural indebtedness in the country.

Thus, all these factors are responsible for growing rural indebtedness in India.

Essay # 5. Consequences of Rural Indebtedness in India:

The consequences of rural indebtedness in India are analysed below:

(i) Pauperization:

ADVERTISEMENTS:

Growing rural indebtedness is highly responsible for growing pauperization of the small and marginal farmers in India.

(ii) Loss of Interest:

Interest in cultivation is gradually being lost by the small farmers as they are deprived of much of their produce by the moneylenders due to their indebtedness.

(iii) Distress Sale:

Indebted small farmers are forced to sell their produce at a very minimum price.

(iv) Bonded Labour:

Indebtedness creates a class of landless labourers and tenants who have very little or nothing to pay to the landlords and moneylenders and become the bonded labour or solves of the landlords. All these have direct social consequences in India.

(v) Poor Livelihood:

The growing rural indebtedness has raised the problem of repayment of loan along with interest which forces the farmers to adopt a poor livelihood.

(vi) Transfer of Land:

The growing burden of indebtedness has forced the farmers even to sell their land to moneylenders and mahajans and thereby become a landless agricultural labourer.

(vii) Evil Social Impact:

ADVERTISEMENTS:

Growing indebtedness usually divides the society into haves and have-not’s leading to a rise of class conflicts in the society. This is really dangerous. In this connection, Prof. Thomas has rightly observed, “A society that sinks into indebtedness is like a volcano.

It erupts in the form of class conflict. The society is inflicted with inefficiency that hinders the pace of growth.” Thus, rural indebtedness have many evil consequences. Thus, steps must be taken to remove it as early as possible.

Essay # 6. Remedial Measures to Solve Rural Indebtedness in India:

The following measures can tackle the problem of rural indebtedness in India in an effective manner:

(i) Settlement of Old Debt:

Proper legislation to enacted to cancel or to reduce the extent of ancestral debts and non-institutional debt held by the small farmers of the country.

(ii) Reducing Dependence on Moneylenders:

Institutional credit network comprising of co-operatives, commercial banks, regional rural banks etc. be expanded for reducing the dependency of the farmers on the money-lenders.

(iii) Control of New Loans:

Proper steps must be taken in such a way so that farmers do not resort to borrowing for non-productive purposes. Thus unproductive loans for the celebration of marriages and births should be completely avoided. By imparting proper education and propaganda, Government can help the farmers of the country to become conscious in this respect.

(iv) Control over Moneylenders:

ADVERTISEMENTS:

In order to control the growing menace of rural indebtedness, activities of the moneylenders should be controlled. In the mean time, various state governments have passed different acts to make it mandatory on the part of moneylenders to obtain licence for their money lending operations and also to maintain proper accounts and also to have a control over the rate of interest charged by them.

(v) Checking Transfer of Land:

In order to have a check on the transfer of land for non-agricultural purposes as a result of non-payment of loan by the farmers the Government has already enacted various laws for protecting the farmers, interest.

(vi) Encouraging Savings:

Farmers should also be encouraged to adopt saving habit on a routine manner. The co-operative credit societies can also play an important role in this regard. In the mean time proper legislation has been enacted in some states to prevent the sale of land by the farmers to the moneylenders.