Here is a compilation of essays on ‘Debt’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Debt’ especially written for school and college students.

Essay on Debt

Essay Contents:

- Essay on the Introduction to Debt

- Essay on the Types of Debt

- Essay on the Economic Effects of Deficit and Borrowers

- Essay on the Effect of Deficit on Credit Markets

- Essay on Capital Displacement (or Crowding-Out Effect)

- Essay on the Views of Economists on Debt

- Essay on Debt Neutrality (Ricardian Equivalence)

- Essay on Public Debt, National Saving and Economic Growth

- Essay on the Incidence of Borrowing

- Essay on Does an Internal (Public) Debt Impose a Burden on Society?

- Essay on Borrowing Vs. Taxation

- Essay on the Impact of Debt on Future Generations

Essay # 1. Introduction to Debt:

ADVERTISEMENTS:

If the current expenditure of the government exceeds its current tax revenue there is said to be a deficit m the budget. A budget deficit is the excess of government outlays over receipts taken in from taxes, fees and charges levied by government authorities. This is normally covered by market borrowing and, in extraordinary situations, by deficit financing (i.e., borrowing from the Central Bank against foreign exchange reserves or by selling Treasury Bills).

Market borrowing is an alternative to current taxation=as a means of financing government expenditure. Borrowing implies the sale of a security that bears the promise to pay interest on a given number of years and to return the principal on the date of maturity of the loan. No compulsion is involved in the sale of such securities, except in abnormal situations such as war or emergency. Instead, governments compete with other borrowers in the market for loanable funds.

The government pays interest usually at less than the market rate. It is because government bond is free from the risk of default. When the government borrows money from the market it is said to be in debt. Such debt is known as public debt. It is owed to the public, that is, held outside the government itself.

In India, public debt is a part of the total borrowings by the Union Government which include such items as market loans, special bearer bonds, treasury bills and special loans and securities issued by the RBI. It also includes the outstanding external debt.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 2. Types of Debt:

The portion of a government’s indebtedness owed to its own firms and citizens is an internal debt. Repayment of internal debt represents a redistribution of purchasing power from certain group of citizens who pay taxes and the citizens who in the past have been creditors of the Central Government. When a central government borrows mainly from its citizens, the opportunity cost is foregone consumption and investment in the domestic economy rather than from foreign sources.

When a country prolusions from another country, or function the rest of the world, it is in external debt. When external debt is repaid, resources necessarily flow out of the nation, with a consequent loss in productive opportunities.

The external debt varies with interest rates in India relative to these that can be earned on funds abroad and India’s BOP position. The total volume of the gross Central Government debt at any point of time, reflects the past and current debts and accumulated interest burden on the securities issued to cover those deficits.

ADVERTISEMENTS:

Repayment of external debt implies outflow of foreign exchange or export of goods to foreign nations. This reduces society’s consumption possibilities and involves loss of social welfare. Moreover, if the volume of external debt as also the proportion of external debt in total debt increases and if taxes are raised to pay foreigners for past loans of the Central Government, a country’s future growth rate may slow down.

A large volume of external debt implies huge outflows of funds and real losses in productive opportunities rather than mere redistributive effects. However, the bulk of most countries’ debt is internal.

So its repayment does not involve export of economic resources to foreign nations. Interest paid on such debt is not a burden on society because any refunding or payment of interest on the debt at maturity involves merely a redistribution of purchasing power among citizens.

Essay # 3. Economic Effects of Deficit and Borrowers:

Deficits can affect both resource allocation (by influencing the types of government spending) and the overall size of the government sector of the economy. They can also influence prices and interest rates, thereby affecting the distribution of income.

The borrowing method of covering a budget deficit enables the government to keep taxes lower than they otherwise would be. But the people of the country can still enjoy a given quantity and mix of government services. However, borrowing also can allow higher government-spending—either for transfers or for purchases of goods and services without raising taxes.

Because borrowing to finance deficits postpones the burden of taxation to the future, it makes sense to use borrowing to finance government investments that will provide a flow of future benefits. This promotes efficiency because taxes will then be distributed among future generations who will share the benefits of such government investments as roads, structures, transportation and communication networks and environmental protection.

Borrowing to finance a road, school or industrial project that will be used for many years may be quite appropriate. But borrowing to pay for projects that are never completed (or perhaps are never even started), or borrowing to finance this year’s government salaries, poses real problems.

Many governments have taken on more debt than they could comfortably pay-off, forcing them to raise taxes sharply and reduce living standards. Others have simply failed to repay, jeopardizing their ability to borrow in the future.

ADVERTISEMENTS:

Financing government expenditures by borrowing rather than by raising taxes results in higher level of consumption in the short-run (since the disposable income is higher). When the economy is at full employment, higher consumption implies that there is less room for investment. To maintain the economy at full employment without inflation, the Central Bank has to increase interest rates. Debt financing leads to lower investment and thus, in the long-run, to lower output and consumption.

As Richard Musgrave has put it:

“The danger inherent in continuing high deficits lies not so much in their effect on the magnitude of debt as in their current impact on the fiscal-monetary mix and economy’s on the rate of saving and hence, growth.”

By borrowing, the government places the burden of reduced consumption on future generations. It does this in two ways. Future output is lowered as a result of lower investment. Moreover, some of the burden of current expenditures is put on to future generations. When the government imposes taxes in future repay the debt, the future generation suffers and the current generation escapes the tax burden.

ADVERTISEMENTS:

Essay # 4. The Effect of the Deficit on Credit Markets:

The effect of borrowing on the economy also depends on how it affects interest rates, national savings and investments. The influence of borrowing on these economic variables depends on how the budget deficit, which requires borrowing, influences the demand and supply of loanable funds in credit markets.

ADVERTISEMENTS:

In essence, a budget deficit adds to the national debt and thus increases the future interest costs to the Central Government. Therefore, each year more and more tax revenues must be devoted to paying interest on the national debt instead of providing goods and services to citizens.

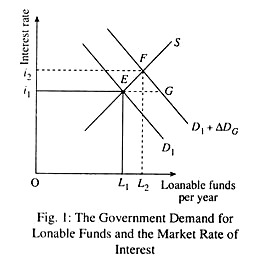

Other things being equal, borrowing contributes to higher interest rates. By doing so, borrowing can choke off private investment, thereby slowing the real rate of growth for the nation. Fig. 1 shows that an increase in demand for loanable funds by the government to finance a deficit can increase market interest rates.

The market demand for loanable funds is composed of the demand for credit by households, business firms, and governments at different levels— central, state and local. When the central government increases the demand for funds it can push up the rates of interest because it borrows a large amount of the total available funds per year. The initial equilibrium is at E where the interest rate is ii, and the total quantity of funds borrowed is L 1L2

Fig. 1 shows that an increase in government demand for funds shifts the market demand curve from D1 to D1 + ∆DG and results in a new market equilibrium at F. The market rate of interest increases to i2 and the quantity of loanable funds supplied increases to L2.

The rise in the market rate of interest decreases the quantity of loanable funds demanded by business firms for investment. It also chokes off borrowing by households to acquire such durable goods as automobiles and homes. At the same time, the higher interest rates encourage more saving, thereby decreasing private consumption in the current year.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 5. Capital Displacement (or Crowding-Out Effect):

Debt finance can have adverse effect on capital formation. When the government initiates a project, whether financed by taxes or borrowing, resources are removed from the private sector. It is usually assumed that when tax finance is used, most of the resources removed come at the expense of consumption.

On the other hand, when the government borrows, it competes for funds with individuals and firms who want the money for their own investment projects. Hence it is generally assumed that debt has most of its effect upon private investment.

Therefore, debt finance will leave the future generation with a small capital stock, ceteris paribus. Its members will, therefore, be less productive and have smaller real incomes than otherwise would have been the case.

The assumption that private investment is reduced when the public draws on the pool of resources available for investment, private investment is crowded out. Crowding out is induced by charger in the interest rate.

When the government increases its demand for credit, the interest rate, which is just the price of credit, must go up. But if the interest rate goes up, private investment becomes more expensive and less of it is undertaken. Thus large public debt is bound to cause some reduction in society’s capital stock.

ADVERTISEMENTS:

ADVERTISEMENTS:

Essay # 6. Views of Economists on Debt:

Musgrave’s View:

However, in Musgrave’s view, taxes raised to service internal debt (i.e. to pay interest along with the principle) imposes a burden on the economy. Taxes, which must be imposed to finance the transfer of funds from one pocket to another, carries a dead weight loss, just as the other taxes do and this places a burden on the economy. This problem may arise even though interest payments are included in taxable income.

The tax-rate ‘t’ requires to finance interest is given by:

t =

where i’ is the interest rate and d’ is the ratio of debt to the national income y. y + idy 1 + id

The severity of such effects is likely to rise as the ratio of tax revenue (needed to service the debt) to GNP increase conceivably, it becomes so large as to pose a serious burden and disincentive problem.

ADVERTISEMENTS:

Domar’s View:

In the view of E. Domar continuous expansion of the debt combined with a constant GNP would lead to an infinite debt-to-GNP ratio. But, GNP, like internal debt, is not a fixed quantity. GNP expands over time and a constant ratio of deficit to GNP combined with a constant growth rate of GNP will cause both the ratio of debt to GNP and that of interest to GNP to approach a constant. More specifically, the debt-to-GNP ratio approaches α/r, where a is the growth rate of GNP and r is the ratio of deficit to GNP. The interest-bill-to-GNP ratio approaches , where ‘i’ is the ratio of interest bill to debt.

Essay # 7. Debt Neutrality (Ricardian Equivalence):

David Ricardo and other classical economists did not accept the view that borrowing (internal debt) can increase interest rates and choke off investment. In their view, interest rates, current economic activity and economic growth would be unaffected by the way the government financed its expenditures. Ricardo (1772-1832) argued that increased government borrowing can result in increased saving by forward-looking taxpayers.

These taxpayers know that the government will have to raise taxes in the future to pay back what it borrowed and the interest on those funds. To be able to meet their higher future tax liability, they will increase their current saving by an amount exactly equal to the deficit. When the government is in debt, according to Ricardo, households will cut their consumption so that they can save more and prepare for the higher taxes that they will be required to pay in future.

In economic theory, public debt is taken as asset of its holders. The larger the debt, the larger these assets and, other things being equal, the richer people feel and, hence, the more they spend. However, according to Ricardian equivalence proposition, the public debt is not properly viewed as a net wealth of the private sector.

ADVERTISEMENTS:

The reason is that financing government expenditure by borrowing and taxes are essentially equivalent because people know that if they are spared taxes now they will only have to pay them later to pay off justice debt.

Most modern economists have rejected the above view and have argued that debt will never be paid off but rather rolled over and repeatedly increased in line with the growth of the economy. And people will feel richer when they hold more government securities. Hence they will spend more and so debt will not have a neutral effect on the economy.

If an increase in government borrowing to finance a deficit causes a sufficient increase in private saving to keep the level of interest rates in the economy fixed, Ricardian equivalence prevails. The basic point is that both tax finance and debt finance have the same importance on current aggregate spending and economic growth.

If Ricardian equivalence prevails, an increase in government borrowing will be exactly offset by an equal reduction in consumption as households seek to save to be able to pay higher taxes in future. As a result of debt neutrality there is no increase in aggregate current spending, no effect on interest rates, no crowding out of private investment, and therefore no slowdown of future growth rate.

The Barro-Ricardo proposition or Ricardian equivalence is that debt financing by bond issue merely postpones taxation and therefore in many instances, is strictly equivalent to current taxation. The government bonds are net wealth.

The reason is that bonds will have to be paid off with future increases in taxes. If so, an increase in the budget deficit unaccompanied by cuts in government spending should lead to an increase in saving that precisely matches the deficit. This point may be explained further.

Since the same idea has been endorsed by the Harvard Professor Robert Barro, this novel hypothesis is popularly known as the Barro-Ricardo Equivalence Hypothesis. In an influential article published in 1974, Barro has argued that when the government borrows, members of the ‘old’ generation realise that their heirs will be made worse off.

He further supposes that the old people care about the welfare of their descendants and therefore do not have their descendants’ consumption level reduced. So the old increase their bequests by an amount sufficient to pay the extra taxes that will be due in the future. Private individuals, thus, can undo the intergenerational effects of government debt policy. Therefore, the form of government finance is totally irrelevant.

However, two points may be noted in this context:

(i) Information on the implications of current deficit or future tax burdens is not easy to obtain,

(ii) There may not be all that much altruistic feeling between generations.

Criticisms:

There are two main criticisms of the Barro-Ricardian proposition. First, given that people have finite lifetimes, different people will pay off the debt than those who are deriving the benefit of today’s tax cut. This argument is based on the assumption that people now alive do not take into account the higher taxes their descendants’ will have to pay in the future. Secondly, many people cannot borrow, and so do not consume, according to their permanent income.

They would like to consume more today, but because of liquidity constraints – their inability to borrow—they are forced to consume less than they would want according to their permanent income. A tax cut for these people eases their liquidity constraint and allows them to consume more.

We may now explain few increased private savings a result of government borrowing can offset the impact of increased demand for funds on interest rates as the government borrows more to finance its deficit.

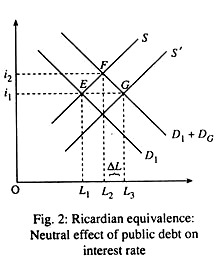

Fig. 2 shows that the increase in government borrowing to cover the deficit increases the demand for loanable funds. However, as a direct result of this borrowing, the supply of savings increases from S to S’ to provide funds to enable sources to meet higher anticipated tax liabilities in the future.

The increase on the supply of loanable fund results in a new equilibrium at point G. At that point, an additional. ∆ L rupees of loanable funds are made available per year to finance private investment. The equilibrium amount of loanable funds is now L3 rupees per year. If these extra funds exactly equal the amount of funds required to finance the deficit, the interest rate under the equilibrium is i1 the initial level.

Thus government borrowing to cover deficits does not increase the market rate of interest. It causes no crowding out of private investment or of consumer borrowing for durable goods. Government budgetary deficit and the consequent borrowing do not really matter. This means that changes in the deficit will not affect aggregate demand, because changes in government borrowing will be offset by changes in private saving.

Increased private saving caused by government deficits can lead to increased bequests, or intergenerational transfers, between citizens who are living now and their heirs. The increased saving by those who currently pay taxes that results from debt induced saving allows them to increase their own voluntary private bequests to their children beyond the amounts that would be possible if tax finance were used.

These bequests help the future generation to pay the higher taxes that will be necessary to cover the interest payments on the debt in the future. Similarly, the reduced tax burden on the current generation made possible by debt finance implies that these taxpayers in their old age will need transfers from their children. The compensating intergenerational transfer therefore decreases the burden of the debt on the future generation.

Essay # 8. Public Debt, National Saving and Economic Growth:

A nation’s rate of economic growth, the expansion of its capacity to produce goods and services, is largely a matter of investment. Investment is linked to saving and saving requires a sacrifice of current consumption so that the resources used to produce consumer goods for today can be reallocated to the production of capital goods.

When a nation saves more, it can allocate more resources to the development of new technology, the production of new machinery and to investment in human capital. The more a nation saves today, the greater will be its future rate of growth of output. Conversely, the less it saves, the smaller will be its future potential to grow.

National saving is the sum of personal saving by households, business saving, and saving by the government sector. The government sector contributes to an increase in national saving when it spends less than it takes in.

In other words, in order for government to help increase national saving, it would have to run a budget surplus instead of a deficit. When the government runs a deficit, it spends more than it takes in and therefore must borrow instead of saving.

The net contribution of the government sector to national saving is the combined deficit or surplus of the governments at all levels – central, state and local. When the government runs a deficit, it contributes to a decline in national saving. In effect, a government deficit amounts to negative saving that absorbs loanable funds rather than making them available for investment.

Essay # 9. The Incidence of Borrowing:

If government borrowing bids up interest rates and contributes to both a reduction in national saving and investment, then borrowing leads to a fall in the rate of saving and a slowdown in the rate of economic growth. This, in its turn, implies that the rate of growth of income will be slower in the future so that future taxpayers (younger people) will have lower future incomes than otherwise would be possible. Unfortunately, these young people also will be subject to higher taxes and greater portions of their tax payments will be used to finance interest costs of growing internal debt.

Thus, internal debt is likely to redistribute the burden of financing government expenditure from the current generation to future generations of taxpayers. If, on average, these taxpayers have lower income than that of the current generation partly because of the undesirable effects of taxes on economic growth, then this incidence could be regressive.

However, to assess the full incidence of debt finance we have to look at the hypothesis of Ricardian equivalence. If the current generation of taxpayers realizes that deficit finance implies higher taxes for themselves and their descendants, they could increase their current saving.

This increase in saving increases the supply of loanable funds in credit markets and could offset both the negative saving of the debt itself and any possible crowding out of private investment. In short, debt neutrality implies absence of intergenerational wealth effect.

It is also possible that more government spending is allocated to investment in infrastructure and other spending that will yield a stream of benefits to future generations. Under these circumstances, even if private investment is crowded out due to higher interest rates, future economic growth rates need not decline as long as the government investment is at least as productive as the private investment that it displaces.

Public debt can also contribute to increased government purchases that keep the economy from having severe recessions and help keep it on a steady path of economic growth near its potential. If this is the cse, the deficit can actually increase private investment by contributing to economic stability. A stable economy with few severe downturns not only encourages investment by domestic producers but also can encourage inflow of foreign saving and investment.

Essay # 10. Does an Internal (Public) Debt Impose a Burden on Society?

Many economists held the view that no burden exists in case of an internal debt because it is held by a country’s own citizens rather than by foreigners. Since we owe the debt to ourselves, payment of interest and principal of the debt merely transfers income from taxpayers to bondholders.

The burden of an internal debt is the redistribution effect of bond financing of government expenditure. Future generations either retire the debt, or else refinance it. In either case, there is a transfer from future taxpayers to bondholders. It would appear that future generations must bear the burden of the debt.

According to A. P. Lerner, an internal debt creates no burden for the future generation. Members of the future generation simply owe it to each other. When the debt is paid off, there is a transfer of income from one group of citizens (who do not hold bonds) to another (bondholders).

However, the future generation as a whole is not worse off in the sense that its consumption level is the same as it would have been otherwise. As Melon has put it: “the right hand owes to the left.”

The story is quite different when a country borrows from abroad to finance current debt. This is referred to as an external debt. Let us suppose the money borrowed from overseas is used to finance current consumption. In this case, the future generation certainly bears a burden because its consumption level is reduced by an amount equal to the loan plus the accrued interest which must be sent to the foreign lender.

If, on the other hand, the loan is used to finance capital accumulation the outcome depends upon the project’s productivity. If the marginal return on the investment is greater than the marginal cost of funds obtained abroad, then the combination of debt and capital expenditure actually make the future generation better off. To the extent that the project’s return is less than the marginal cost, the future generation is worse off.

Essay # 11. Borrowing Vs. Taxation:

In this context we may make comparison between tax financing and bond financing. When a government raises funds to finance public expenditure by selling bonds, no compulsion is involved, unlike tax financing. Instead, the bonds (securities) issued by government authorities are purchased voluntarily by individuals and financial institutions (mainly banks and investment companies).

The individuals who purchase such securities surrender present consumption opportunities for future consumption opportunities, or they substitute public debt for private securities in their portfolio. They make this voluntary sacrifice because the return they expect to receive on their foregone consumption exceeds their estimated cost of a sacrificing current consumption opportunities. At the same, time borrowing makes it unnecessary to increase current taxes, thereby avoiding the need to force citizens to curtail current consumption and saving.

Under borrowing, private market is ‘choked off only to the extent to which increased government borrowing causes, by increasing the demand for credit, the general level of interest rates to rise. Thus, compared to tax financing, borrowing increases the consumption opportunities of the current generation over its lifetime than could be enjoyed if taxes were used.

To pay interest on the debt and return the principal, the government usually increases taxes. If so, other things being equal, taxpayers in the future undergo reductions in consumption or saving. The increased tax revenues necessary to pay interest on the debt redistribute income from the taxpayers to the holders of government bonds.

Since the bulk of the public debt in India is issued to Indian citizens, its retirement would not represent a drain of resources from the country. Therefore, the effect of such retirement would be to redistribute income among citizens.

Essay # 12. Impact of Debt on Future Generations:

Some economists argue that the burden of debt cannot be transferred to future generations but must be borne by the present generation, because resources are withdrawn from the private sector at the time the government makes the loan. This definition of burden implies that borrowing merely involves foregone private consumption in the current period.

It neglects the fact that this sacrifice of consumption is completely voluntary on the part of the private economic units and is compensated by greater opportunities for future consumption as a result of interest payments on the government securities.

If we assume that the future generation must be taxed to pay the interest burden on the debt, then it must undergo a real reduction of income, with no compensation in the form of increased future consumption. In this sense, the burden of the debt falls on future generation; it bears the brunt of compulsory taxes.

The burden of the debt, therefore, is a reduction in welfare for future taxpayers who do not hold or inherit government securities that are paid-off in the future. Future generations will pay more in taxes to enable the government to service the debt instead of receiving public goods and services in return for those taxes.

Future generations also will have to tolerate a fall in their living standards as a result of the debt if past debts cause interest rates to rise and reduce private investment. A reduction in private investment implies slower growth of the nation’s capital stock than could be experienced in the absence of public debt.

The effect will be slower growth of the economy. A shortage of capital will reduce the productivity of workers in the private sector. This will lower their wages and incomes. This implies a growing national debt as measured by the deficit-income ratio. If deficit continues to increase but national income fails to increase at the same rate the burden of debt will rise and this will lead to a fall in future living standards.

If resources are fully employed, an increase in public services shifts the resources from private to public sector, leaving for the production of public goods. In this case the burden must be borne by the present generation. But it is not necessarily so if the transfer of burden is viewed in terms of its current consumption.

Reduced capital formation is the primary mechanism through which the burden is transferred. Let us assume, in terms of the framework of classical system, that investment adjusts itself automatically to the level of saving at a full-employment level of income. In such a situation, any transfer of resources from private to public use leaves the private sector with fewer resources. In this sense, the burden of today’s public expenditures has to be borne by the present generation.

But the resource withdrawal from the private sector may be from consumption or capital formation. In the first case the welfare of the present generation, as measured by its consumption, is reduced and the income of the future generation is unaffected. In the second case, the welfare of the present generation, in terms of its consumption level, remains unchanged while the future generation will inherit a smaller capital stock and thus, suffer a loss of potential income.

It is in this sense that the future generation is burdened. If we further assume that tax finance comes out of consumption while loan finance originates from saving (hence, under the assumption of a classical system, few resources out of investment) it then follows that- loan finance burdens future generations.

This burden, however, can be offset if increased saving by the current generation of taxpayers results from the use of debt financing. This, in its turn, will result in increased bequests to future taxpayers that offset the burden of the debt (the Ricardian equivalence).

Given this Ricardian equivalence it can no longer be argued than loan finance serves to secure burden transfer whereas tax finance does not, but this is hardly a realistic assumption.

If we accept the principle that public services should be financed on a benefit basis, the nature of the expenditure to be financed becomes crucially important. In the case of capital expenditure, the benefits will extend into the future, in which case transfer of burden is necessary to ensure intergenerational equity. This is the rationale for dividing the budget to current and capital components; while the former is tax financed, the latter is loan financed.

The burden of the debt can also offset if the resources raised by issuing government bonds is used to finance projects that yield future benefits. The benefit principle of taxation suggests that it is efficient to transfer the burden of present expenditures to future generations if certain types of expenditure are expected to benefit them. For example, it is reasonable to postpone until the future the burden of taxes for financing war, because the benefits of a successfully completed (that is, won) war will accrue to those living in the country in the future.

The benefit received principle suggests that the beneficiaries of a particular government spending programme should have to pay for it. Thus, to the extent that the programme creates for future generations, it is appropriate to shift the burden to future generations via loan finance.

The choice between tax and debt finance is just a choice between the timing of taxes and tax finance, due large payment is made at the time the expenditure is undertaken with debt finance, many small payments are made over time to finance the interest due on the debt. The present values of tax collections must be the same in both cases.

The implication is that debt finance, which results in a series of relatively small tax rates, is superior to tax finance on efficiency grounds. The ‘crowding out’ effect which is so important in the context of the intea-generational burden of the debt, is also central to the efficiency issue.

According to intergenerational alterism model, there is no crowding out. Thus only labour supply choices can be distorted and debt finance is unambiguously superior on efficiency grounds. However, to the extend that crowding out is important, tax finance becomes more attractive.

As far as economic justice (fairness) is concerned, the State has an important role to pay in protecting the vulnerable and ensuing an equitable distribution of income between people, between groups in society, between regions and across generations. There is not only a moral case for the state to help those in absolute poverty but also a strong political and economic one.

The weak, poor, vulnerable and depressed people can be a major cause of civil unrest and political instability. This deters investment and growth. It is also important for the state to keep an eye on the welfare of future generations, which may require altering the balance between consumption and investment in the present.

The government can intervene in various ways to discourage present consumption and raise the level of intervention for higher future consumption, e.g., taxation, subsidized interest rates and public investment on society’s behalf.

Conclusion:

In the ultimate analysis it seems that the choice between tax and debt finance (borrowing) is a moral one. Morality requires self-restraint: deficits are indicative of a lack of restraint; therefore, deficits are immoral. This normative view seems to rest heavily on the unproven positive hypothesis that the burden of the debt is shifted to future generations.

A perhaps more compelling non-economic argument against borrowing is a political one. Some have pointed out a tendency for the political process to underestimate the costs of government spending and to overestimate the benefits. The discipline of a balanced budget may produce a more careful weighing of benefits and costs, thus preventing the public sector from growing beyond its optimal size.