Everything you need to know about the types of employee benefits. Employee benefits or indirect compensations are group membership rewards that provide security for employees and their family members.

Benefits are indirect financial and non-financial payments employees receive for continuing their employment with the company. They constitute an important part of every employee’s compensation.

Benefits and services are alternatively known as supplementary compensations, service programmes, non-wage payments, employee benefits and hidden payrolls.

Generally, they are known as fringe benefits. In the broadest sense, such “fringes” can be constructed to include all expenditures designed to benefit employees over and above regular base pay and direct variable compensation related to output.

ADVERTISEMENTS:

In this article we will discuss about the different types of employees benefits, which can be categorised as follows-

A: Highly Desirable Employee Benefits:- 1. Professional 2. Recreational and Social 3. Conveniences & 4. Auxiliary

B: Most Important Employee Benefits:- 1. Fringe and 2. Retirement

C: Fringe Benefits Offered by Various Organisations in India:- 1. Payments for Time Not Worked 2. Payments Aimed at Ensuring Security to Employees 3. Payments Aimed Ensuring Employee’s Safety and Health 4. Payments Made to Ensure Welfare and Recreational Benefits and 5. Old Age and Retirement Benefits.

Types of Employee Benefits: Professional, Social, Auxiliary, Fringe, Retirement and a Few Other Benefits

Types of Employee Benefits – 4 Broad Categories of Benefits which are Highly Desirable by Employees: Professional, Recreational, Social, Conveniences and Auxiliary Benefits

Employee benefits or indirect compensations are group membership rewards that provide security for employees and their family members. Benefits are indirect financial and non-financial payments employees receive for continuing their employment with the company. They constitute an important part of every employee’s compensation.

ADVERTISEMENTS:

Benefits and services are alternatively known as supplementary compensations, service programmes, non-wage payments, employee benefits and hidden payrolls. Generally, they are known as fringe benefits. In the broadest sense, such “fringes” can be constructed to include all expenditures designed to benefit employees over and above regular base pay and direct variable compensation related to output.

For the success of employee benefits and services programmes, the management should ensure the following:

(i) To provide employees meaningful choices of benefits that exactly matches their needs.

ADVERTISEMENTS:

(ii) To keep the costs of these programmes under control.

(iii) To ensure that employees are fully informed regarding the various options of these benefits and services.

Employee benefits and services are also provided by the organization at no cost to the employee or at a significant reduction from what he might have to pay without the organization’s support.

Such employee benefits which are found to be highly desirable by employees are of several types and for the sake of discussion, they could be divided into four broad categories as follows:

1. Professional

2. Recreational and Social

3. Employee conveniences

4. Auxiliary

Type # 1. Professional:

Professional benefits are offered to employees in various aspects like legal aid, vocational guidance, employee counselling, health and safety promotion, etc.

Type # 2. Recreational and Social:

ADVERTISEMENTS:

Recreation and social activities play an important part in an individual’s life and they enhance a sense of relaxation, team-spirit and togetherness. They include social get-together, informal associations, clubs, athletics and sports, picnics, welfare centres, cultural activities, libraries, reading rooms etc.

Type # 3. Employee Conveniences:

In order to promote employee comfort and convenience, there are numerous employee services offered on management initiative, some are required by law whereas some are demanded by unions.

Canteens on a non-profit basis are required to be provided by factories Act, 1948, in all the organizations employing more than 250 employees. Thus, employee services are provided in the area of eating facilities, which include the provision of restaurants, cafeterias, canteens, lunch rooms, and fully or partially subsidised food.

Housing Services include company owned housing projects and subsidised housing. Housing assistance is provided in the form of loans, financial assistance and pay-role deductions.

ADVERTISEMENTS:

Transportation Services include Bus Service facility, assistance to employees in the purchase of their own transport, parking lots etc.

Purchasing Services include discounts on company products and services, company stores or co-operative stores etc.

Medical Services include clinics, physical examinations, hospitals, health counselling services etc.

Educational Services include sponsorship for off-duty courses, educational leave, tuition fee refunds, educational film shows, scholarships for employees and their children.

ADVERTISEMENTS:

Out Placement Services include contacts with other employers in the area, help in writing up resumes, secretarial help etc.

Type # 4. Auxiliary:

There are several other miscellaneous services included in this category.

Some of the most common are:

i. Loan Services:

For providing loans for employees who need them for a variety of reasons like illness, accident, death in the family, any financial emergency, marriage, child birth, home repairs, home purchase, etc.

ii. Employee Publications:

ADVERTISEMENTS:

Including house journals for internal circulation, several brochures, pamphlets and bulletins containing information on several matters of interest to employees.

iii. Community Service Activities:

These include participating and cooperating in Blood Donation Programmes, Red Cross and Community Chest Drive, Prime Minister’s Relief Fund, Famine or Draught Relief Fund, and other charity drives and providing assistance in community celebrations and festivals etc.

iv. Gifts:

Employees are given gifts on certain occasions like Deepavali, Dusshera, employee’s birth-day, employee’s marriage or retirement etc.

v. Music:

ADVERTISEMENTS:

catering to employee tastes in music and providing music at some regular intervals during coffee breaks or lunch – breaks has been found to be useful in many organizations since employees enjoy the relaxed and rhythmic atmosphere and overcome fatigue, boredom and monotony.

vi. Credit Unions:

These are voluntary co-operative savings and loan organizations somewhat like a bank where employees become members by buying shares and can deposit their savings, withdraw them when they need the money and obtain loans from the credit union.

Types of Employee Benefits – 2 Important Benefits: Fringe and Retirement Benefits

In addition to dearness allowance, house rent allowance, city compensation allowances, the following benefits are also available.

Let us discuss some of the important benefits in detail:

Type # 1. Fringe Benefits:

Employees are paid several benefits in addition to wages, salaries, allowances and bonus. These benefits and services are called Fringe benefits as these are offered by the employer as a fringe. The International Labour Organisation has described fringe benefit as follows- “wages are often augmented by special cash benefits, by the provision of medical and other services or by payments in kind that form part of the wage for expenditure on the goals and services.”

ADVERTISEMENTS:

In addition, workers commonly receive such benefits as holidays with pay, low cost moils, low rent housing etc. such additions to the wage proper are sometimes referred to as fringe benefits. Benefits that have to relation to employment or wages should not be regarded, as fringe benefits even though they may constitute a significant part to the worker’s total income.

Fringe benefits are a supplement to regular wages or salaries. Obtained by the employees at the cost of the employers. These benefits are called wage extra, hidden payments, non-wage labour costs and supplementary wage practices. These benefits are statutory or voluntary. Provident fund is a statutory benefit whereas housing for workers is a voluntary benefit these benefits increase the living standard of the worker.

It also improve employer-employee relation, minimise excessive labour turnover costs and provide a sense of individual security. These benefits can be most effective if they are geared to the preferences of the employee as determined by research programme.

Fringe benefit also known as non-pecuniary incentive i.e. visualizing beyond money wages. These benefits are described as welfare expenses, wage supplements, perquisites other wages and sub-wages.

Types of Fringe Benefits:

Fringe benefits includes these ideas such as:

ADVERTISEMENTS:

(a) Retirement benefit e.g., provident fund, pension, gratuity etc.

(b) Health benefits such as accidental insurance, like insurance, medical care, hospitalization etc.

(c) Safety benefit includes unemployment, layoff pay, holiday pay, etc.

(d) Payment without work includes sick leave, maturity leave, paid vacations, etc.

(e) Child care, counselling, educational, recreational facilities.

(f) Consumer cooperative stores, interest-free loans, holiday homes etc.

(g) Subsidized housing, transport, lunch, free dress etc.

All these Fringe benefits are provided to the employee for their improvement and security. It also offered to recruit and retain the best employees, to improve work environment and industrial relations to provide health, safety and welfare of employees, to satisfy the demand of the trade union, to motivate the employee towards the industrial work to protect employees against certain hazards to improve the public image of the industry, to develop a sense of belonging and loyalty among workers and also to meet statutory requirements.

Definition of Workman:

Generally, government staff covered by the definition of ‘worker’ as defined under Section 2(1) of the Factories Act, 1948 and workman as defined under Section 2(5) of the industrial Disputes Act, 1947, are classified as Industrial staff. Those who do not fed within these definitions are called non-industrial staff.

Industrial staff are governed by labour law. They have right to form trade unions and also raise industrial disputes. But the non-industrial staffs are governed by the rules of Central Government servants.

Demand for Parity:

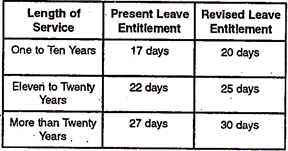

Industrial employees of the Central Government have always demanded for equality or parity with the non-industrial employees in matters like, holidays, leave encashment, leave entitlement and working hours. The Fourth Central Pay Commission listened this demand and recommended parity in leave entitlement and its encashment in the railway and other sectors of Central Government.

Although there is similarity between the non-industrial workers and industrial workers in the field of leave entitlement and its encashment, the non-industrial workers, works more hours than the industrial workers. Therefore, the government did not accept these recommendation of the commission, and sent these matters to the Board of Arbitration in 1989.

According to Board the prerequisite of 240 days service for grant any leave with wages and the restriction and carry forward of leave only up to 30 days were removed. And the maximum leave of a worker are 120 days.

Recent Position:

Now, there is complete equality or parity between the industrial and non-industrial employees in matter of entitlement to and accumulation of leave on half pay, extra ordinary leave, casual leave, and certain special kind of leaves like maternity leave and hospital leave.

But difference seen in the field of leave. The industrial employees get leave only on six occasions in a year where as there is no such restriction in the part of non-industrial employees. On the other hand, unlike non-industrial employees holidays intervening during spells of leave of industrial employees are not counted towards leave.

Difference between the Two Categories:

The duties and responsibilities of industrial and non-industrial employees are totally different. Their way and salary structure, their terms and conditions of services as well as the nature of services are so different these two categories are subjected to different types of stresses, strains and hazards in the performance of their duties, Industrial employees are enjoyed benefits like overtime allowance, with trouble rates in Sunday and holiday. On the other hand, non-industrial employees don’t get such benefit, they get higher rate of pension or superannuation.

The Board of Arbitration has refused absolute parity in holiday and leave entitlement between industrial and non-industrial employees of the Central Government All the earlier Central Pay Commission, (CPQ has also opposed such demands. Besides, the changing economic climate of the country also has taken in to account while evaluating this demand, with the onset of liberalisation, all government sectors, including the industrial sectors, has to complete with the private sector directly.

Even at present, productivity and efficiency in the govt. sector cannot desirable. In this situation, if any increase in the leave entitlement of industrial workers, means loss of production, thus, placing the industrial sector of the government at the private sector.

Reduction of Work Hours:

Work hours of industrial employees are longer than the non-industrial employee. Because differences are shown in the service condition of two categories of workers. The industrial employees are governed by the provision of the Factories Act, which permits them to work 48 hours in a week. The industrial staffs working in the central government are not worse off than the non-industrial staff either in the state-owned public enterprises or in the private sector.

The public enterprises or private enterprises follow the provision of the Factories Act in regard to their industrial employees. Regarding the work hours different countries have prescribed different hours, for work. Industrial worker in Thailand work for as many as 13 hours more per week than non- industrial staff. Similarly differences are also seen in other countries like Belgium, Canada, Israel, Japan, Malaysia, and Netherland, Portugal, United States of America etc.

The question of ensuring uniformity in the working hours in all Government establishments had been considered by the Second, Third and Fourth Pay Commissions. They did not recommend any uniformity as it was opined that working hours had evolved overtime in individual organisation as per requirements and convention. It would not be advisable to interfere with any organisations schedule.

The Fifth Pay Commission adopted two policy guidelines in this respect:

i. Complete parity-equality may not be justified

ii. Some revision could be suggested incorporating the best features of both the systems.

iii. Changes may be so designed as to reduce absenteeism and improve productivity.

The following was recommended:

(a) Entitlement to Earned Leave:

Indicated revisions have been recommended-to be carried out-

This would represent an increase of three days over the present entitlements. Simultaneously, Sunday and other holidays intervening during spells of leave should be counted as leave availed of by the employee and debited to the leave account. These two measures would cancel each other out and not have any net impact on the whole leave entitlement.

(b) Accumulation of Earned Leave:

Industrial employees are permitted to accumulate up to 300 days of earned leave at par with non-industrial employees and to encash, out of the leave so accumulated, leave of upto 60 days earned by them during their entire service, while availing of leave travel concession for travel anywhere in the country.

Leave that can be taken on any one occasion should be reduced in the case of non-industrial, employees from 180 days to 60 days as such leave is, often abused by workers in the vent of undesired transfer and also for the simple reason that such a long spell of leave on one occasion is not required.

In the same vein, the maximum number of occasions on which earned leave can be availed of in calendar year by non-industrial employees should also be reduced to six as in the case of industrial employees.

The above steps are expected to achieve the twin objectives of rough parity and also enhance productivity of industrial employees as the proposed increase in the quantum of earned leave that can be accumulated combined with the introduction of the facility of in service encashment of leave in addition to encashment on superannuation is likely to reduce absenteeism and improve overall productivity.

Types # 2. Retirement Benefits:

The age at which the productivity, efficiency and health of an employee begins to decline can be considered as the retirement age. In this age an employee needs rest. He cannot work efficiently. Actually, most of the employees are join government service at a young age and retire at the age decided by the government. The Fifth Central Pay Commission has fixed 60 years for retirement of central government employees and 62 years for university teachers.

Most of them serve the government for thirty to forty years. It is a duty of the government to look after their retired employees when they are not in a position to work. They need be compensated during this period, so that they securely discharge their duties.

The main purpose of the retirement benefits is to provide certain fund to the hard working employee live peacefully, without any tension.

There are three forms of retirement benefits:

(a) Non-contributory, where the government is responsible for the retirement benefit.

(b) Partly contributory, where the government and employee share the cost of retirement

(c) Wholly contributory, wherein the employees contribute.

While determining the retirement age of employees, some of the important factors are taken into consideration, which are life expectancy, health, morbidity, labour, market conditions, stage of economic development, financial implication, social dimensions etc. In India there are two schemes for employees retirement benefits namely, the pension scheme and the contributory provident fund.

Types of Employee Benefits – Types of Fringe Benefits Offered by Various Organisations in India

The fringe benefits offered by various organisations in India may be broadly classified and discussed under the following major heads:

Type # 1. Payments for Time not Worked:

This category includes:

(a) Hours of work,

(b) Paid holidays,

(c) Shift premium,

(d) Holiday pay and

(e) Paid vacation.

(a) Hours of Work:

Section 51 of the Factories Act, 1948, specifies that no adult worker shall be required to work in a factory for more than 48 hours in any week. Section 54 of the Act restricts the working hours to 9 on any day. In some organisations, the numbers of working hours are less than the legal requirements.

(b) Paid Holidays:

According to the Factories Act, 1948, an adult worker shall have weekly paid holidays, preferably Sunday. When a worker is deprived of weekly holidays, he is eligible for compensatory holidays of the same number in the same month. Some organisations allow the workers to have two days’ holidays in a week.

(c) Shift Premium:

Companies operating second and third shifts, pay a premium to the workers who are required to work during the odd hour’s shift.

(d) Holiday Pay:

Generally, organisations offer double the normal rate of the salary to those workers, who work during holidays.

(e) Paid Vacation:

Workers in manufacturing, mining and plantations who worked for 240 days during a calendar year are eligible for paid vacation at the rate of one day for every 20 days worked in case of adult workers and at the rate of one day for every 15 days worked in case of child workers.

Type # 2. Payments Aimed at Ensuring Security to Employees:

Physical and job security to the employee should also be provided with a view to ensure security to the employee and his family members. When the employee’s services get confirmed, his job becomes secure. Further, a minimum and continuous wage or salary gives a sense of security to the life. The Payment of Wages Act, 1936, the Minimum Wages Act, 1948, The Payment of Bonus Act, 1965, provide income security to the employees.

(i) Retrenchment Compensation:

The Industrial Disputes Act, 1947, provides for the payment of compensation in case of lay-off and retrenchment. The non-seasonal industrial establishments employing 50 or more workers have to give one month’s notice or one month’s wages to all the workers who are retrenched after one year’s continuous service.

The compensation is paid at the rate of 15 days wage for every completed year of service with a maximum of 45 days wage in a year. Workers are eligible for compensation as stated above even in case of closing down of undertakings.

(ii) Lay-Off Compensation:

In case of lay off, employees are entitled to lay-off compensation at the rate equal to 50% of the total of the basic wage and dearness allowance for the period of their lay-off except for weekly holidays. Lay-off compensation can normally be paid upto 45 days in a year.

Type # 3. Payments Aimed at Ensuring Employee’s Safety and Health:

Employee’s safety and health should be taken care of in order to protect the employee against accidents, unhealthy working conditions and to protect the worker’s productive capacity. In India, the Factories Act, 1948, stipulated certain requirements regarding working conditions with a view to provide safe working environment.

These provisions relate to cleanliness, disposal of waste and effluents, ventilation and temperature, dust and fumes, artificial humidification, overcrowding, lighting, drinking water, latrine, urinals and spittoons.

Provisions relating to safety measures include fencing of machinery, work on or near machinery in motion, employment of young persons on dangerous machines, striking gear and devices for cutting off power, self-acting machines, casing of new machinery, prohibition of employment of women and children near cotton openers, hoists and lifts, lifting machines, chains, ropes and lifting tackles, revolving machinery, pressure plant, floors, excessive weight, protection of eyes, precautions against dangerous fumes, explosive or inflammable dust, gas, etc.

Precautions in case of fire, power to require specifications of defective parts or test of stability, safety of buildings and machinery, etc. In addition to safety and health measures, provision for the payment of compensation has also been made under Workmen’s Compensation Act, 1923.

The Act is intended to meet the contingency of invalidity and death of a worker due to an employment injury or an occupational disease specified under the Act at the sole responsibility of the employer. The Act covers the employees whose wages are less than 500 per month.

Amount of compensation depends on the nature of injury and monthly wages of the employee. Dependants of the employee are eligible for compensation in case of death of the employee.

Today, various medical services like hospital, clinical and dispensary facilities are provided by organisations not only to employees but also to their family members. Employees’ State Insurance Act, 1948, deals comprehensively about the health benefits to be provided. This Act is applicable to all factories, establishments running with power and employing 20 or more workers. Employees in these concerns and whose wages do not exceed RS.1,000 per month are eligible for benefits under the Act.

Benefits under this act include:

(i) Sickness Benefit:

Insured employees are entitled to get cash benefit for a maximum of 56 days in a year under this benefit.

(ii) Maternity Benefit:

Insured women employees are entitled to maternity leave for 12 weeks (six weeks before the delivery and six weeks after the delivery) in addition to cash benefit of 75 paise per day or twice of sickness benefit, whichever is higher.

(iii) Disablement Benefit:

Insured employees, who are disabled temporarily or permanently (partial or total) due to employment injury and/or occupational diseases are entitled to get the cash benefit under this head.

(iv) Dependant’s Benefit:

If an insured person dies as a result of an employment injury sustained as an employee, his dependants who are entitled to compensation under the Act, shall be entitled to periodical payments referred to as dependant’s benefit.

(v) Medical Benefit:

This benefit shall be provided to an insured employee or to a member of his family where the benefit is extended to his family.

This benefit is provided in the following forms:

a. Outpatient treatment, or attendance in a hospital, dispensary, clinic or other institutions; or

b. By visits to the home of the insured person; or

c. Treatment as in-patient in a hospital or other institution.

An insured person shall be entitled to medical benefits during any week for which contributions are payable, or in which he is eligible to claim sickness or maternity benefit or eligible for disablement benefit. However, most of the large organisations provide health services over and above the legal requirements to their employees free of cost by setting up hospitals, clinics, dispensaries and homeopathic dispensaries.

Type # 4. Payments made to Ensure Welfare and Recreational Benefits:

Welfare and recreational benefits include:

(a) Canteens,

(b) Consumer societies,

(c) Credit societies,

(d) Housing,

(e) Legal aid,

(f) Employee counselling,

(g) Welfare organisations,

(h) Holidays homes,

(i) Educational facilities,

(j) Transportation,

(k) Parties and picnics and

(I) Miscellaneous

(a) Canteens:

Perhaps, no employee benefit has received as much attention in recent years as that of canteens. Some organisations have statutory obligation to provide such facilities as Section 46 of the Factories Act, 1948, imposes a statutory obligation to the employers to provide canteens in factories employing more than 250 workers.

Others have provided such facilities voluntarily. Foodstuffs are supplied at subsidised prices in these canteens. Some companies provide lunchrooms when canteen facilities are not available.

(b) Consumer Stores:

Most of the large organisations located far from the towns and which provide housing facilities near the organisation set up the consumer stores in the employees colonies and supply all the necessary goods at fair prices.

(c) Credit Societies:

The objective of setting up of these societies is to encourage thrift and provide loan facilities at reasonable terms and conditions, primarily to employees. Some organisations encourage employees to form co-operative credit societies with a view to fostering self-help rather than depending upon money lenders, whereas some organisations provide loans to employees directly.

(d) Housing:

Of all the requirements of the workers, decent and cheap housing accommodation is of great significance. The problem of housing is one of the main causes for fatigue and worry among the employees and this comes in the way of discharging their duties effectively. Most of the large factories organisations, e.g., sugar mills, are located very far from towns, at places where housing facilities are not available.

Hence, most of the organisations have built quarters nearer to factory and have thus provided cheap and decent housing facilities to their employees, whilst a few organisations provide and / or arrange for housing loans to the employees and encourage them to construct houses.

(e) Legal Aid:

Organisations also provide assistance or aid regarding legal matters to the employees as and when necessary through company lawyers or other lawyers.

(f) Employee Counselling:

Organisations provide counselling service to the employees regarding their personal problems through professional counsellors. Employee counselling reduces absenteeism, turnover, tardiness, etc.

(g) Welfare Organisations, Welfare Officers:

Some large organisations set up welfare organisations with a view to provide all types of welfare facilities at one centre and appoint welfare officers to provide the welfare benefits continuously and effectively to all the employees fairly.

(h) Holiday Homes:

As a measure of staff welfare and in pursuance of government’s policy, a few large organisations established holiday homes at a number of hill stations, health resorts and other centres with low charges of accommodation, so as to encourage the employees to use this facility for rest and recuperations in a salubrious environment.

(i) Educational Facilities:

Organisations provide educational facilities not only to the employees but also to their family members. Educational facilities include reimbursement of tuition fees, setting up of schools, colleges, hostels, providing grants-in-aid to the other schools where a considerable number of students are from the children of employees. Further, the organisations provide rooms and libraries for the benefit of employees.

(j) Transportation:

Many large companies provide conveyance facilities to employees, from their residence to the place of work and back, as most industries are located outside town and all the employees may not get quarter facility.

(k) Parties and Picnics:

Companies provide these facilities with a view to inculcating a sense of association, belongingness, openness and freedom among the employees. These activities help employees to understand others better.

(l) Miscellaneous:

Organisations provide other benefits like organising games, sports with awards, setting up of clubs, community service activities, Christmas gifts, Diwali, Pongal and Pooja gifts, birthday gifts, leave travel concession annual awards, productivity / performance awards, etc.

Type # 5. Old Age and Retirement Benefits:

Industrial life generally breaks joint family system. The saving capacity of the employees is very low due to lower wages, high living cost and increasing aspirations of the employees and his family members. As such, the employers provide some benefits to the employees, after retirement and during old age, with a view to create a feeling of security about the old age. These benefits are called old age and retirement benefits.

These benefits include:

(a) Provident fund,

(b) Pension,

(c) Deposit linked insurance,

(d) Gratuity and

(e) Medical benefit.

(a) Provident Fund:

This benefit is meant for economic welfare of the employees. The Employees’ Provident Fund, Family Pension Fund and Deposit Linked Insurance Act, 1952, provides for the institution of Provident Fund for the employees in factories and establishments. Provident Fund Scheme of the Act provides for monetary assistance to the employees and/or their dependants during post-retirement life. Thus, this facility provides security against social risks and this benefit enables the industrial worker to have better retired life.

Employees in all factories under Factories Act, 1948, are covered by the Act. Both the employee and the employer contribute to the fund. The employees on attaining 15 years of membership are eligible for 100% of the contributions with interest. Generally, the organisations pay the Provident Fund amount with interest to the employee on retirement or to the dependants of the employee, in case of death.

(b) Pension:

The Government of India introduced a scheme of Employees’ Pension Scheme for the purpose of providing Family Pension and Life Insurance benefits to the employees of various establishments to which the Act is applicable. The Act was amended in 1971 when Family Pension Fund was introduced in the Act.

Both the employer and the employee contribute to this fund. Contributions to this fund are from the employee contributions to the Provident Fund to the tune of 1.1/3 % of employee wage.

Superannuation / retirement pension under the new scheme will be payable on fulfilling- Minimum 10 years eligible service and attaining age of 58 years. On ceasing employment earlier than 58 years, pension may be availed of by a member at his option, before attaining the age of 58 years but not below 50 years. Such early pension will be subject to discounting factor.

However, no such age restriction or eligibility requirement shall apply for pension entitlement on disablement or pension payable to the family members on death of the member. Membership with one contribution is enough in such cases.

(c) Deposit Linked Insurance:

Employees deposit linked insurance scheme was introduced in 1976 under the PF Act, 1952. Under this scheme, if a member of the Employees Provident fund dies while in service, his dependents will be paid an additional amount equal to the average balance during the last three years in his account. (The amount should not be less than Rs.1000 at any point of time). Under the employee’s deposit linked insurance scheme, 1976 the maximum amount of benefits payable under the deposit linked insurance is Rs.10,000.

(d) Gratuity:

This is another type of retirement benefit to be provided to an employee either on retirement or at the time of physical disability and to the dependents of the deceased employee. Gratuity is a reward to an employee for his long service with his present employer. The Payment of Gratuity Act, 1972, is applicable to the establishments in the entire country.

The act provides for a scheme of compulsory payment of gratuity by the managements of factories, plantations, mines, oil fields, railways, shops and other establishments employing 10 or more persons to their employees, drawing the monthly wages up to Rs.1,600 per month.

Gratuity is payable to all the employees who render a minimum continuous service of five years with the present employer. It is payable to an employee on his superannuation or on his retirement or on his death or disablement due to accident or disease.

The gratuity payable to an employee shall be at the rate of 15 days wage for every completed year of service on part thereof in excess of six months. Here, the wage means the average of the basic pay last drawn by the employee. The maximum amount of gratuity payable to an employee shall not exceed 20 months’ wage.

(e) Medical Benefit:

Some of the large organisations provide medical benefits to their retired employees and their family members. This benefit creates a feeling of permanent attachment with the organisation to the employees even when they are no longer in service.

Fringe benefits are one of the means to ensure, maintain and increase the material welfare of employees. The physical and mental strain of workers in an industry is considerably alleviated by tax benefits through creating an environment that insulates them from fatigue and monotony. Employees who get fringe benefits are stimulated to give of their best so as to increase productivity and to develop a sense of belongingness to the organisation.

Research studies, however, could not establish proof of any relationship between the amount spent on fringe benefits and level of productivity. All organisations may not provide all the benefits discussed above due to financial stringencies. Moreover, the list of benefits given above is not an exhaustive one and some organisations offer benefits which are not included in the list owing to their need and the financial ability of the organisations. Human resource management does not end with salary administration.

It should also deal with human aspects of personnel management. Human aspects of personnel management include understanding and maintaining human relations. Hence, understanding and maintaining human relations can be treated as a function of Human Resource Management.