The below mentioned article provides an overview on the Law of Diminishing Marginal Utility.

One of the characteristics of human wants is their limited intensity. As we have more of anything in succession, our intensity for its subsequent units diminishes. This generalization of satiable wants is known as the Law of Diminishing Marginal Utility.

Hermann Heinrich Gossen was the first to formulate this law in 1854 though the name was given by Marshall. Jevons called it Gossen’s First Law.

Gossen stated it thus:

ADVERTISEMENTS:

“The magnitude of one and the same satisfaction, when we continue to enjoy it without interruption, continually decreases until satiation is reached.”

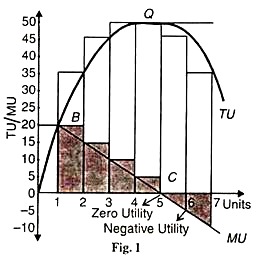

Taking the example of apples as shown in column (3) of Table 1, when our hypothetical consumer takes the first apple he derives the maximum satisfaction in terms of 20 utils. As he continues to consume the second, third and the fourth units in succession, he derives less and less satisfaction 15, 10 and 5 utils respectively.

With the consumption of the 5th apple he reaches the satiety point because the satisfaction derived from that unit is zero.

Diagrammatically, the curve MU is the diminishing utility curve in Figure 1. It shows that marginal utility diminishes as more and more units of the commodity (apple) are consumed till the satiety point С is reached. Consumption of further units gives disutility, as shown by the movement of the MU curve from point С downward below the X-axis.

Its Limitations:

This is a universal law and holds true in the case of physiological, social or artificial wants. It is another thing that in the case of certain commodities the limit of satiety is soon reached, while others take some time.

But the law holds only under certain conditions given below:

(1) Homogeneous Units:

ADVERTISEMENTS:

There should be a single commodity with homogeneous units wanted by an individual consumer. All units of the commodity should be of the same weight and quality. If, for example, the first apple is sour and the second sweet, the second will give greater satisfaction than the first.

(2) No Change in Tastes:

There should be no change in the tastes, habits, customs, fashions and income of the consumer. A change in any one of them will increase rather than diminish utility.

(3) Continuity:

There should be continuity in the consumption of the commodity. Units of the commodity should be consumed in succession at one particular time. Pieces of bread taken at random may increase utility.

(4) Suitable Size Units:

Units of the commodity should be of a suitable size. Giving water to a thirsty person by spoons will increase the utility of the subsequent spoons of water.

(5) Constant Prices:

Prices of the different units and of the substitutes of the commodity should remain the same.

ADVERTISEMENTS:

(6) Indivisible Goods:

The commodity should not be indivisible. In the case of durable consumer goods it is not possible to calculate their utility because their use is spread over a period of time. Moreover, a consumer does not buy five scooters, six television sets or even three sewing machines for his personal consumption.

(7) Rational Consumers:

The consumer should be an economic man, who acts rationally. If he is under the influence of an intoxicant, say wine or opium, the utility of the latter units will rise. But this exception is not wholly true. In the beginning the marginal utility of each peg rises but ultimately it starts falling and even becomes negative when a drunkard starts vomiting.

ADVERTISEMENTS:

(8) Ordinary Goods:

Goods should be of an ordinary type. If they are commodities, like diamonds and jewels, or hobby goods like stamps, coins or paintings, the law does not apply. The utility of the additional coins or jewels may be greater than the earlier pieces. But this view is not correct.

For the law also applies in their case. The collector of coins or jewels will never like to have innumerable pieces of the same coin or jewels. Similarly, the marginal utility of the second set of a particular issue of stamps will diminish for the stamp collector if he already possesses one.

(9) MU of Money not Constant:

ADVERTISEMENTS:

Our intensity for money increases as we have more of it. No doubt the marginal utility of money does not become zero, but it definitely falls as a person acquires more and more money. The marginal utility of money for a rich man is less while it is high for a poor man. If it were not so, the rich would not spend extravagantly on luxuries and ostentatious living.

Importance of the Law:

This law is of great importance in economics.

1. The Law of Diminishing Marginal Utility is the basic law of consumption. The Law of Demand, the Law of Equi-marginal Utility, and the Concept of Consumer’s Surplus are based on it.

2. The changes in design, pattern and packing of commodities very often brought about by producers are in keeping with this law. We know that the use of the same good makes us feel bored; its utility diminishes in our estimation. We want variety in soaps, toothpastes, pens, etc. Thus this law helps in bringing variety in consumption and production.

3. The law helps to explain the phenomenon in value theory that the price of a commodity falls when its supply increases. It is because with the increase in the stock of a commodity, its marginal utility diminishes.

ADVERTISEMENTS:

4. The famous “diamond-water paradox” of Smith can be explained with the help of this law. Because of their relative scarcity, diamonds possess high marginal utility and so a high price. Since water is relatively abundant, it possesses low marginal utility and hence low price even though its total utility is high. That is why water has low price as compared to a diamond though it is more useful than the latter.

5. The principle of progression in taxation is also based on this law. As a person’s income increases, the rate of tax rises because the marginal utility of money to him falls with the rise in his income.

Lastly, this law underlies the socialist plea for an equitable distribution of wealth. The marginal utility of money to the rich is low. It is, therefore, advisable that their surplus wealth be acquired by the state and distributed to the poor who possess high marginal utility for money.