Aggregate Demand: it’s Meaning and Components!

(a) Meaning:

Aggregate demand refers to the total demand for final goods and services in the economy.

Since aggregate demand is measured by total expenditure of the community on goods and services, therefore, aggregate demand is also defined as ‘total amount of money which all sectors (households, firms, government) of the economy are ready to spend on purchase of goods and services.

Alternatively, it is the total expenditure which the community intends to incur on purchase of goods and services. Thus, aggregate demand is synonymous with aggregate expenditure in the economy. If the total intended (i.e., ex-ante) expenditure on buying all the output is larger than before, this shows a higher aggregate demand.

ADVERTISEMENTS:

On the contrary, if the community decides to spend less on the available output, it shows a fall in the aggregate demand. In simple words, aggregate demand is the total expenditure on consumption and investment. It should be noted that determination of output and employment in Keynesian framework depends mainly on the level of aggregate demand in short period.

(b) Components of AD:

Thus, the main components of aggregate demand (aggregate expenditure) in a four sector economy are:

1. Household (or private) consumption demand. (C)

2. Private investment demand. (I)

ADVERTISEMENTS:

3. Government demand for goods and services. (G)

4. Net export demand. (X-M)

Thus,

AD = C + I + G+(X-M)

ADVERTISEMENTS:

Mind, all the variables represent planned (ex-ante) and not actual (ex-post).

We discuss below each of the above components:

1. Household (or Private) Consumption Demand (C):

It is defined as ‘Value of goods and services that households are able and willing to buy.’ Alternatively, it refers to ex-ante (planned) consumption expenditure to be incurred by all households on purchase of goods and services. For instance, households’ demand for food, clothing, housing, books, furniture, cycles, radios, TV sets, educational and medical services will be called household consumption demand. Consumption (C) is a function (f) of disposable income (Y), i.e., C =J(Y) (for detail refer Section 8.6).

As disposable income increases, consumption expenditure also increases but by how much? It depends upon propensity to consume. The relationship between income and consumption is called ‘propensity to consume’ or consumption function. Consumption function is represented by the equation. (For details see Section 8.6)

2. Private Investment Demand (I):

This refers to planned (ex-ante) expenditure on creation of new capital assets like machines, buildings and raw materials by private entrepreneurs. Remember, investment in Keynesian sense does not imply purchase of existing shares or securities but means expenditures on creation of new capital assets such as plants and equipment, inventories, construction works, etc. that help in production. Investment is made not only to maintain present level of production, but also to increase production capacity in future.

An economy grows through investment. Among three categories of investment, namely, purchase of new buildings, addition to stock and investment in fixed plant or machinery, the investment demand is focussed on last category, i.e., machinery.

The relationship between investment demand and rate of interest is called investment demand function. There is inverse relationship between rate of interest and investment demand. Investment is of two types—Autonomous and Induced (see Section 8.11) but all private investment expenditure is assumed as induced investment.

What determines investment in private enterprise economy? Just as household consumption demand depends on disposable income of households, investment demand in private enterprise economy depends mainly on two factors, namely, MEI {Marginal Efficiency of Investment) and Rate of Interest. In other words, the investors Judge whether the expected rate of return on new investment is equal to or greater than or less than the market rate of interest.

Suppose a businessman makes an additional investment by taking loan. He has to pay interest on it which is his expenditure on new investment. Before making investment, he would compare the interest he has to pay on loan and the profit he is expected to get on this investment. According to Keynes, the net return expected from a new unit of investment is called Marginal Efficiency of Investment (MEI).

ADVERTISEMENTS:

Thus, three elements which are important in understanding investment are:

(i) Revenue (i.e., rate of return on new investment)

(ii) Cost (i.e., rate of interest)

(iii) Expectations (of profit)

ADVERTISEMENTS:

Investment demand function:

Of the three elements which affect investment, rate of interest is the most important. The relationship between investment demand and rate of interest is called investment demand function. There is inverse relationship between the rate of interest and investment demand, i.e., higher the rate of interest, the lower will be the investment demand.

3. Government Demand for Goods and Services (G):

It refers to government planned (ex-ante) expenditure on purchase of consumer and capital goods to fulfill common needs of the society. The level of government expenditure is determined by government policy Present-day states are by and large welfare states wherein government participation in economic welfare of the people has increased manifold.

Government demand may be for satisfying public needs for roads, schools, hospitals, water works, railway transport or for infrastructure (like roads, bridges, airports), maintenance of law and order and defence from external aggression. Investment can be induced and autonomous.

ADVERTISEMENTS:

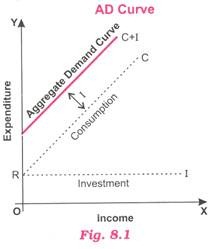

It needs to be noted that whereas investment in private sector is made with profit motive and, therefore, called induced investment, government investment is guided by people’s welfare motive and, therefore, called autonomous investment. Since investment expenditure is assumed to be autonomous, graphically investment curve is a horizontal line parallel to x-axis as shown as RI in Fig. 8.1.

4. Net Exports (Exports-Imports) Demand:

Net export is the difference between export of goods and services and import of goods and services during a given period. Net exports reflect the demand of foreign countries for our goods and services over our demand for foreign countries’ goods and services. Thus, net exports show expected (ex-ante) net foreign demand.

This strengthens the income, output and employment process of our economy. As against it, imports from abroad drive out the earning of the economy and, therefore, they do not encourage domestic output and employment.

There are many factors which influence the volume of net foreign demand such as foreign exchange rates, terms of trade, trade policy of the importing and exporting countries, relative prices of goods, incomes of the nations, balance of payment position, types of exchange control, etc. Since net exports or foreign expenditure on our goods and services constitute a small proportion of the total expenditure (or aggregate demand), this constituent of net exports is usually ignored.

In sum, aggregate demand is the sum of the above- mentioned four types of demand (expenditure), i.e., AD = C + 1 + G + (X-M). Since determination of income (output) and employment is to be studied in the context of a two sector (Household and Firm) economy we shall, therefore, include in aggregate demand (AD) only two broad components of demand such as consumption demand (C) and investment demand (I). Put in symbols:

ADVERTISEMENTS:

AD = C + I

This has been depicted in Fig. 8.1. Aggregate demand curve has been shown as sum of consumption (C) and investment (I).

Following are noteworthy points of the diagram:

(i) AD curve has a positive slope which means when income increases, AD (expenditure) also increases.

(ii) AD curve does not originate at point O which shows that even at zero level of income, some minimum level of consumption (equal to OR in the Fig. 8.1) is essential.

(iii) Investment curve is a straight line parallel to X-axis because according to Keynes, level of investment remains constant at all levels of income during short period.