The following points highlight the top thirteen types of cost in cost concept analysis.

Some of the types are: 1. Private Cost and Social Cost2. Actual Cost and Opportunity Cost 3. Past Cost and Future Cost 4. Explicit Cost and Implicit Cost 5. Incremental Costs and Sunk Costs 6. Short-run Costs and Long-run Costs and Others.

Type of Cost # 1. Private Cost:

Social Cost:

Private cost refers to the cost of Production to an individual producer. Social Cost refers to the cost of producing commodity to society in the form of resources that are used to produce it.

ADVERTISEMENTS:

From the social point of view, the economy has a certain volume of resources in the form of capital, land etc., which it would be like to put to the best uses.

This depends upon the efficient and full utilisation of resources and also the specific list of commodities to be produced. It would be ideal if the social cost coincided with the private costs of producing commodity.

Type of Cost # 2. Actual Cost and Opportunity Cost:

Actual Costs or Outlay Costs or Absolute Costs mean the actual amount of expenses incurred for producing or acquiring a good or service. These are the costs which are generally recorded in the books of accounts for cost or financial purposes such as payment for wages, raw-materials purchased, other expenses paid etc.

Opportunity Cost or Alternative Costs:

ADVERTISEMENTS:

The Cost of production of any unit of a commodity A’ is the value of the factors of production used in producing the unit.

The value of these factors of production is measured by the best alternative use to which they might have been put had a unit of ‘A’ not been produced.

This concept of cost has been popularized by the American writers.

Type of Cost # 3. Past Costs and Future Costs:

Past Costs:

ADVERTISEMENTS:

Actual costs or historical costs are records of past costs.

Future costs are based on forecasts. The costs relevant for most managerial decisions are forecasts of future costs or comparative conjunctions concerning future situations.

Forecasting of future costs is required for expense control, projection of future income statements; appraisal of capital expenditures, decision on new projects and on an expansion programme and pricing.

For Policy Decisions on Price:

The business enterprise depends upon future cost and not on Past Cost. Past cost or historical cost is relevant only under the assumption that, the cost conditions of the previous period would be duplicated in the future too.

Type of Cost # 4. Explicit Cost and Implicit Cost:

“The total cost of production of any particular goods can be said to include expenditure or explicit costs and non-expenditure or implicit costs.” Expenditure or Outlay or Explicit Costs are those costs which are paid by the employer to the owners of the factor units which do not belong to the employer itself.

These costs are in the nature of contractual payments and they consist of wages and salaries paid; payments for raw materials, interest on borrowed capital funds, rent on hired land and the taxes paid to the Government.

Non-expenditure or Implicit Costs arise when factor units are owned by the employer himself. The employer is not obligated to anyone in order to obtain these factors. Expenditure costs are explicit; since they are paid to factors outside the firm while non-expenditure or implicit costs are imputed costs.

But the latter are costs in the real sense of the term, since the factor units owned by the organizer himself can be supplied to other producers for a contractual sum if they are not used in the business of the organizer.

Type of Cost # 5. Incremental Costs or (Differential Costs) and Sunk Costs:

ADVERTISEMENTS:

Incremental Cost:

Is the additional cost due to change in the level or nature of business activity.

The change may take several forms e.g.,:

(i) Addition of new product line,

ADVERTISEMENTS:

(ii) Changing the channel of distribution,

(iii) Adding a new machine,

(iv) Replacing a machine by a better one, and

(v) The expansion into additional markets etc.

ADVERTISEMENTS:

The question of this type of cost, would not arise when a business has to be set up a fresh. It arises only when a change is contemplated in the existing business.

Sunk Cost:

Is one which is not affected or altered by a change in the level or nature of business activity. It will remain the same whatever the level of activity may be.

For Example:

The amortization of past expenses e.g., depreciation.

Distinction between the Sunk Cost and Incremental Cost:

ADVERTISEMENTS:

It assumes importance in evaluating alternatives. Incremental costs will be different in the case of different alternatives. The incremental costs are relevant to the management in the analysis for decision-making. Sunk costs on the other-hand will remain the same irrespective of the alternatives selected.

Thus, it need not be considered by the management in costs evaluating the alternatives as they are common to all of them.

Type of Cost # 6. Short-Run and Long-Run Costs:

Short-run Costs are costs that vary with output or sales when fixed plant and capital equipment remain the same.

Long-run Costs are those which vary with output when all output factors including plant and equipment vary.

Short-run costs become relevant when a firm has to decide whether to produce more or not in the immediate future and when setting up of a new plant in ruled out and the firm has to manage with the existing plant.

Long-run costs become relevant when the firm has to decide whether to set up a new plant or not. Long-run cost can help the businessman in planning the best scale of plant or the best size of the firm for his purposes.

ADVERTISEMENTS:

Thus, long-run costs can be helpful both in the initiation of new enterprises as well as the expansion of existing ones.

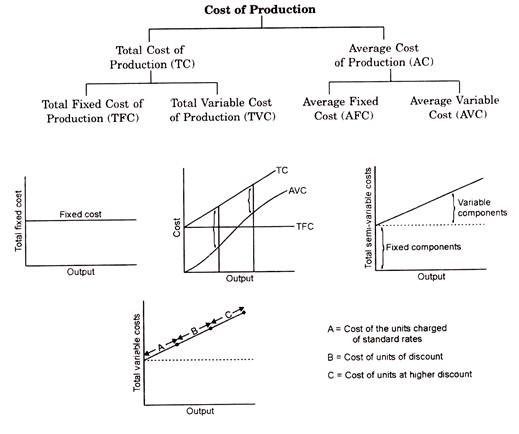

Type of Cost # 7. Fixed and Variable Costs:

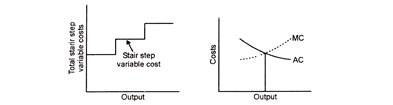

Fixed Costs remain constant in total regardless of changes in volume of production and sales, up to certain level of output. There is an inverse relationship between volume and fixed costs per unit. If volume of production increases, the fixed costs per unit decreases. Thus, total fixed costs do not change with a change in volume but vary per unit of volume inversely.

Variable Costs vary in total in direct proportion to changes in volume. An increase in the volume means a proportionate increase in the total variable costs and a decrease in volume results in a proportionate decline in the total variable costs.

There is a linear relationship between volume and variable costs. They are constant per unit. Many costs fall between these two extremes. They are called as semi-variable costs. They are neither perfectly variable nor absolutely fixed in relation to changes in volume.

They change in the same direction as volume but not in direct proportion there to. For Example— Electricity bills often include both fixed charge and a charge based on consumption.

This is known as two part Tariff:

ADVERTISEMENTS:

Distinction:

The distinction between fixed and variable cost is very important in forecasting the effect of short-run changes in the volume upon costs and profits. This distinction has given rise to the concepts of Break-Even chart; Direct costing and Flexible Budgets.

Type of Cost # 8. Direct and Indirect Costs or Traceable and Common Costs:

A Direct or Traceable Cost is one which can be identified easily and indisputably with a unit of operation, i.e., costing unit/cost centre. Indirect or Common Costs are not traceable to any plant, department or operation as well as those that are not traceable to indirect final products.

For example:

The salary of a Divisional Manager, when a Division is a costing unit, will be a direct cost. The monthly salary of the General Manger when one of the divisions is a costing unit would be an indirect cost.

Cost of Multiple Products:

ADVERTISEMENTS:

In some manufacturing enterprises two or more different products emerge from a single raw material.

For example:

A variety of petroleum products are derived from the refining of crude oil. In a cigarette factory different parts of the tobacco leaves are used for different qualities and products. They are identifiable as separate products only at the conclusion of common processing generally known as the SPLIT OFF POINT.

Common Costs:

The costs incurred up to the Split off Point are common costs. Costs which cannot be traced to separate products in any direct or logical manner. These costs should not be identified with individual products if it is not meaningful and useful to identify them.

In this existing product line some common costs are unaffected by the change that how to be decided upon i.e., cost of factory building. Fixed common costs need not be allocated since they are irrelevant for any decision and will remain constant. Common costs that vary with the decision must be allocated to individual products.

Type of Cost # 9. Sunk, Shut-Down and Abandonment Costs:

(i) Sunk Cost:

A Past Cost resulting from a decision which can no more be revised is called a Sank Cost. It is usually associated with the commitment of funds to specialised equipment or other facilities not readily adaptable to present or future e.g., brewing plant in times of prohibition.

(ii) Shut-down Costs:

Are these costs which would be incurred in the event of suspension of the plant operation and which would have been saved if the operations had continued, e.g., for storing exposed property. Further additional expenses may have to be incurred when operations are re-started.

(iii) Abandonment Costs:

Are the costs of retiring altogether a plant from service. Abandonment arises when there is complete cessation of activities. These costs become important when management is faced with the alternatives of either continuing the existing plant or suspending its operation or abandoning it altogether.

Type of Cost # 10. Out of Pocket and Book Cost:

Out of Pocket Costs:

Refer to costs that involve current cash payments to outsiders. On the other hand book costs such as depreciation, do not require current cash payments. Book costs can be converted into out of pocket costs by selling the assets and having them on hire. Rent would then replace depreciation and interest, while understanding expansion; book costs do not come into the picture until the assets are purchased.

Type of Cost # 11. Historical Costs and Replacement Costs:

Historical Costs:

Mean the cost of an asset or the price originally paid for it. Replacement cost means the price that would have to be paid currently for acquiring the same plant. The assets are usually shown in the conventional financial accounts at their historical costs.

But during the period of changing price levels historical costs may not be correct basis for projecting future costs. Historical costs must be adjusted to reflect current or future price levels.

Type of Cost # 12. Controllable and Non-Controllable Costs:

A Controllable Cost is one which is reasonably subject to regulation by the executive with whose responsibility that cost is being identified.

Un-controllable Cost:

Un-controllable cost is that cost which is uncontrollable at one level of responsibility may be regarded as controllable at some other higher level. The controllability of certain costs may be shared by two or more executives. The distinction is important for controlling the expenses and efficiency.

Type of Cost # 13. Average Cost, Marginal Cost and Total Cost:

(i) Average Cost is the total cost divided by the total quantity produced.

(ii) Marginal Cost is the extra cost of producing one additional unit. It may at times be impossible to measure marginal cost. For example, if a firm produces 10,000 metres of cloth, it can become impossible to determine the change in cost involved in producing 10,001 metres of cloth. The difficulty can be solved by taking units of significant size. In general, economist’s marginal cost is cost account cost.

(iii) The Total Costs of a firm are the sum of total fixed costs and total variable costs.

Symbolically:

Total Cost or TC = TFC + TVC

Average Cost or AC = TC + TQ

Marginal Cost or MC = TCn -TCn-1