In today’s competitive scenario, the main aim of every organization is to earn maximum profit.

The organization’s decision of maximizing profit depends on the behavior of its costs and revenues.

In general terms, cost refers to an amount to be paid or given up for acquiring any resource or service.

In economics, cost can be defined as a monetary valuation of efforts, material, resources, time and utilities consumed, risks incurred, and opportunity forgone in the production of a good or service.

ADVERTISEMENTS:

An organization incurs a number of costs, such as opportunity costs, fixed costs, implicit costs, explicit costs, social costs, and replacement costs. On the other hand, revenue is the income earned by an organization from the sales of goods or services. It excludes deductions of tax, interest, and dividend paid by an organization. The level of profitability of an organization can be determined by analyzing its costs and revenue.

Cost analysis involves the study of total costs incurred by an organization to acquire various resources, such as labor, raw materials, machines, land, and technology. It helps an organization to make various managerial decisions, including determination of price and level of current production.

Apart from this, it enables an organization to decide whether to opt for the available alternative or not. On the other hand, revenue analysis is a process of estimating the total income earned by an organization from different’ sources. An organization is said to be profitable if its total revenue is more than costs incurred by it.

Concept of Cost:

ADVERTISEMENTS:

Cost, a key concept in economics, is the monetary expense incurred ‘by organizations for various purposes, such as acquiring resources, producing goods and services, advertising, and hiring workers. In other words, cost can be defined as monetary expenses that are incurred by an organization for a specified tiling or activity.

According to Institute of Cost and Work Accountants (ICWA), cost implies “measurement in monetary terms of the amount of resources used for the purpose of production of goods or rendering services.” In terms of manufacturing, costs refer to sum total -of monetary value of resources used in producing or manufacturing a product. These resources can be raw material, labor, and land.

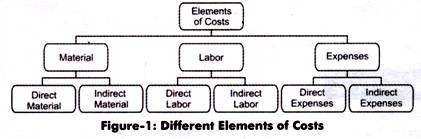

A cost comprises a number of elements, which are shown in Figure-1:

The different elements of cost (as shown in Figure-1) are explained as follows:

i. Material:

ADVERTISEMENTS:

Helps in producing or manufacturing goods. Material implies a substance from which a product is made For example, an organization requires materials, such as bricks and cement for constructing a building.

Material is divided into two categories, which are as follows:

a. Direct Material:

Refers to a material that is directly related to a specific product, job, or process. Direct material becomes an integral part of the finished product.

Some of the examples of direct material are as follows:

1. Timber is raw material for making furniture

2. Sugarcane for making sugar.

3. Textile for garment industry

ADVERTISEMENTS:

4. Gold for making jewellery

5. Cans for tinned food and drink

b. Indirect Material:

Refers to a material that is not directly related to a particular product or activity. Such materials cannot be easily identified with the product.

ADVERTISEMENTS:

The examples of indirect material are as follows:

1. Oils for lubricating machines

2. Printing and stationary items for publishing books

3. Nails for making furniture

ADVERTISEMENTS:

4. Threads for manufacturing garments

ii. Labor:

Acts as an important part of production. An organization requires labor to convert raw materials into finished goods. Labor cost is the main element of cost.

Labor can be of two types, which are discussed as follows:

a. Direct Labor:

Refers to labor that takes an active part in manufacturing a product. This type of labor is also known as process labor, productive labor, or operating labor. The costs related to direct labor are called direct labor costs. These costs vary directly with the change in the level of output, thus it is referred as a variable expense.

b. Indirect Labor:

ADVERTISEMENTS:

Refers to labor that is not directly related to the manufacturing of a product. The indirect labor cost may or may not vary with the change in the volume of output. This type of labor is used in the factory, office, and selling and distribution department.

iii. Expenses:

Refer to costs that are incurred in the production of finished goods other than material costs and labor costs.

Expenses are further divided into two parts:

a. Direct Expenses:

Imply the expenses that are directly or easily allocated to a particular cost center or cost units. These expenses are called chargeable expenses. Some of the direct expenses of an organization include acquiring machinery for special processes, fees paid to architects and consultants, and costs of patents and royalties.

b. Indirect Expenses:

ADVERTISEMENTS:

Refer to expenses that cannot be allocated to specific cost center or cost units. For example, rent, depreciation, insurance, and taxes of building.