Everything you need to know about the different methods of costing. The term ‘methods of costing’ can be used to refer to the different processes or procedures employed for the determination and presentation of costs.

There are different methods of costing for different industries depending on their nature of work.

The methods of costing can be studied under the following heads:- 1. Methods Based on the Principles of Job Costing 2. Methods Based on the Principles of Process Costing.

Some of the methods based on the principles of job costing are:- 1. Job Costing 2. Contract Costing 3. Batch Costing.

ADVERTISEMENTS:

Some of the methods based on the principles of process costing are:- 1. Process Costing 2. Operation Costing 3. Departmental Costing 4. Single or Unit or Output Costing 5. Operating or Operative or Working or Service Costing 6. Multiple or Composite Costing.

Additionally, few other methods of costing are:- 1. Uniform Costing 2. Multiple or Composite Costing 3. Departmental Costing 4. Cost Plus Method 5. Target Costing Method 6. Farm Costing 7. Activity Based Costing.

Different Types of Costing Methods: Job Costing, Contract Costing, Batch Costing, Process Costing and Operation Costing

Different Methods of Costing – Job Costing, Contract Costing, Batch Costing, Process Costing, Unit Costing, Operating Costing, Operation Costing and Multiple Costing

The method of costing refers to a system of cost ascertainment and cost accounting. Industries differ in their nature, in the products they produce and the services they offer. Hence, different methods of costing are used by different industries. For example, the method of costing employed by a building contractor is different from that of a transport company.

Job costing and process costing are the two basic methods of costing. Job costing is suitable to industries which manufacture or execute the work according to the specifications of the customers. Process costing is suitable to industries where production is continuous and the units produced are identical. All other methods are combinations, extensions or improvements of these basic methods.

ADVERTISEMENTS:

The methods of costing are explained in detail:

Method # 1 Job Costing:

It is also called specific order costing. It is adopted by industries where there is no standard product and each job or work order is different from the others. The job is done strictly according to the specifications given by the customer and usually the job takes only a short time for completion. The purpose of job costing is to ascertain the cost of each job separately. Job costing is used by printing presses, motor repair shops, automobile garages, film studios, engineering industries etc.

Method # 2 Contract Costing:

It is also known as terminal costing. Basically, this method is similar to job costing. However, it is used where the job is big and spread over a long period of time. The work is done according to the specifications of the customer.

The purpose of contract costing is to ascertain the cost incurred on each contract separately. Hence a separate account is prepared for each contract. This method is used by firms engaged in ship building, construction of buildings, bridges, dams and roads.

Method # 3 Batch Costing:

ADVERTISEMENTS:

It is an extension of job costing. A batch is a group of identical products. All the units in a particular batch are uniform in nature and size. Hence each batch is treated as a cost unit and costed separately. The total cost of a batch is ascertained and it is divided by the number of units in the batch to determine the cost per unit. Batch costing is adopted by manufacturers of biscuits, ready-made garments, spare parts medicines etc.

Method # 4 Process Costing:

It is called continuous costing. In certain industries, the raw material passes through different processes before it takes the shape of a final product. In other words, the finished product of one process becomes the raw material for the subsequent process. Process costing is used in such industries.

A separate account is opened for each process to find out the total cost as well as cost per unit at the end of each process. Process costing is applied to continuous process industries such as chemicals, textiles, paper, soap, lather etc.

Method # 5 Unit Costing:

This method is also known as single or output costing. It is suitable to industries where production is continuous and units are identical. The objective of this method is to ascertain the total cost as well as the cost per unit. A cost sheet is prepared taking into account the cost of material, labour and overheads. Unit costing is applicable in the case of mines, oil drilling units, cement works, brick works and units manufacturing cycles, radios, washing machines etc.

Method # 6 Operating Costing:

This method is followed by industries which render services. To ascertain the cost of such services, composite units like passenger kilometers and tone kilometers are used for ascertaining costs. For example, in the case of a bus company, operating costing indicates the cost of carrying a passenger per kilometer. Operating costing is adopted by airways railways, road transport companies (goods as well as passengers) hotels, cinema halls, power houses etc.

Method # 7 Operation Costing:

This is a more detailed application of process costing. It involves costing by every operation. This method is used where there is mass production of repetitive nature involving a number of operations. The main purpose of this method is to ascertain the cost of each operation.

For instance, the manufacture of handles for bicycles involves a number of operations such as cutting steel sheets into proper strips, moulding, machining and finally polishing. The cost of these operations may be found out separately. Operation costing provides a minute analysis of costs to achieve accuracy and it is applied in industries such as spare parts, toy making and engineering.

Method # 8 Multiple Costing:

It is also known as composite costing. It refers to a combination of two or more of the above methods of costing. It is adopted in industries where several parts are produced separately and assembled to a single product.

Different Methods of Costing – Single Costing, Job Costing, Contract Costing, Batch Costing, Process Costing, Operation Costing, Operating Costing and a Few Others

The term ‘methods of costing’ can be used to refer to the different processes or procedures employed for the determination and presentation of costs. There are different methods of costing for different industries depending on their nature of work. For example – the chemical industry follows a continuous production process where raw material is processed at different stages. There are other industries which undertake jobs of different kinds. For example – a motor workshop accepts different jobs.

ADVERTISEMENTS:

In industries like transport, banks or insurance, the whole activity centres around certain service operations. Similarly, many other industries may undertake production of only one product. Since the very nature of production processes and the methods of work differ from industry to industry, it becomes imperative to use different methods of costing.

However, there are two basic methods of costing, which are:

(i) Job costing, and

(ii) Process costing.

ADVERTISEMENTS:

All other methods of costing are either a variation, improvement, extension or combination of these two basic methods:

1. Single Costing, Unit Costing or Output Costing:

Single costing is adopted in concerns where production is continuous and where only one product or a few types of similar products, which vary only in size, shape and quality and whose output can be measured by a common unit, are produced. Under this method, the cost per unit of output, such as per ton, per barrel, per kilogram, per metre, per quintal, per bag, etc. is ascertained. The industries where this method of costing is applied are mines quarries, collieries, breweries, oil drilling companies, steel works, cement factories, paper mills, flour mills, textile mills, etc.

It may be noted that this method is called single costing, as only a single product is costed under this method. It is also called output costing as cost is ascertained for the total output of a product. It is also known as unit costing, as not only the cost of the total output, but also the cost per unit of output is ascertained under this method.

2. Job Costing:

Job costing is adopted in concerns where the work done is analysed into different jobs, each job being considered as separate unit of cost. Under this method the cost of each job and the profit or loss made on each job under- taken is found out separately. A separate account is opened for each job to which all expenses incurred on that job, from the date of commencement till the date of completion, are debited.

ADVERTISEMENTS:

This will enable the concern to know the cost of each job. By comparing the cost of each job against the price charged for each job, the profit or loss made on each job is ascertained. The concerns where this method of costing is applied are printing process, motor workshop, watch repair works, etc.

3. Contract Costing or Terminal Costing:

Contract costing is adopted where a job is very big and takes a long time to complete. Under this method of costing the cost of each contract is ascertained separately. It is suitable for those firms which are engaged in the construction of bridges, roads, buildings, factories etc. on a contract basis.

4. Batch Costing:

Where small components of the same kind are required to be manufactured in large quantities, the method of costing used is called batch costing. Under this method a batch of similar products is treated as a job and the costs are accumulated in respect of a batch. In a bicycle producing factory, if rims are produced in batches of 5,000 each, cost will be determined in relation to a batch of 5,000 rims.

5. Process Costing:

In industries where a continuous process of production is carried and the product is homogeneous, the method of ascertaining the cost of the product is called Process Costing. As distinct from job costing, in these industries the cost of each process is determined for a given period of time. Products lose their individual identity as they are manufactured in a continuous flow. Production Process is usually standardised and quite stable.

Therefore, control is comparatively easier. To determine the cost per unit, the total cost of production is divided by the total output produced during the period. This method of costing is extensively used in steel, sugar, textiles, chemicals, soap, vanaspati, paper and paint manufacturing organisations.

6. Operation Costing:

Operation costing is a more detailed application of Process Costing. Under this method, the cost of each distinct operation of a process, instead of the cost of the process as a whole, is ascertained. This method provides minute analysis of costs and ensures greater accuracy and better control of costs. It is adopted in concerns where the manufacturing process consists of a number of distinct operations. Toy making units, engineering, industries, timber works, leather tanneries etc. adopt this method.

7. Operating Costing:

ADVERTISEMENTS:

The method of costing, which is used in service rendering undertakings is called operating costing. For example – transport, water supply, electric undertakings, telephone services, hospitals, nursing homes, etc. use this method of costing. A special feature of operating costing is that the unit of cost is generally a compound unit. For example the unit of cost in electricity supply is kilowatt hour.

8. Uniform Costing:

When various undertakings, under the same or under different managements in the same industry, use the same principles or practices of costing, they are said to be using the method of uniform costing. In such a situation all costing information is dealt within a similar manner. The use of uniform costing facilitates inter-firm comparison.

9. Multiple or Composite Costing:

This system is applicable to undertakings where a variety of articles are produced, each article differing from other as to prices, material used process of manufacture etc. or where varieties of raw materials pass through very different processes before being assembled into one or more finished product.

Since more than one method of costing have been applied, the method in such a case is known by the name composite or multiple costing method. This method is also applicable if the materials used are the same but the process of manufacture produces commodities differing widely in shape, size and value.

10. Departmental Costing:

This system is applicable where the cost of a department or a cost centre is required to be ascertained. This is similar to operating costing. This system is resorted to where the factory is divided into distinct departments and it is desired to ascertain the cost of production of each department rather than the cost of each article produced. This method is good for a comparative study of the identical costs of different departments.

Under this method, the cost of operating each department is ascertained by allocating the total expenses incurred by a concern to various departments, and the cost per unit of product produced in each department is ascertained by dividing the total cost of the department by the number of units produced in that department. This method is adopted by concerns producing hosiery goods, factories producing cosmetics, footwear manufacturing concerns, etc.

11. Cost Plus Method:

ADVERTISEMENTS:

Where a businessman feels hesitant to quote for a work which is absolutely new to him and new to other persons or contractors and he is unable to estimate the cost of the works offered to him for execution, it is decided with the contractor that he would be paid the total cost of work whatever it be, plus his profit at a certain percent on the total cost. Such type of work is called cost plus method.

12. Target Costing Method:

In big business houses the cost price of the work is ascertained by experts and experienced persons well in advance or even before the commencement of the work. At the time of production the goal of the concern is always kept in mind. That is why this system is called ‘Target Costing Method’. This system is mostly used in big contracts.

13. Farm Costing:

This method of costing helps in calculation of total cost and per unit cost of various activities covered under farming. Farming activities cover agriculture, horticulture, animal husbandry, poultry farming, pisciculture, dairy farming, sericulture, etc.

Farm costing helps to improve the farming practices to reduce the cost of production, to ascertain the profit on each line of farming activity which ensures better control by management and to obtain loans from banks and other financial institutions as they give loans on the basis of proper cost accounting records.

Different Methods of Costing – Job Costing, Contract Costing, Batch Costing, Process Costing, Operating Costing, Operation Costing, Unit Costing and a Few Others

The methods to be used for cost ascertainment depend on nature of industry. Costs of production or service rendered differ from industry to industry. As per I.C.M.A.

ADVERTISEMENTS:

Terminology costing methods can be grouped into two categories, viz.:

(i) Specific order costing (or Job/Terminal Costing), and

(ii) Operation Costing (or Process or Period Costing).

(i) Specific Order Costing (or Job/Terminal Costing):

This method of costing is applicable where the work consists of specific orders or Jobs batches or contracts. Job costing, Batch costing and Contract costing come under this category.

(ii) Operation Costing (or Process or Period Costing):

ADVERTISEMENTS:

This method of costing is applicable where standardised goods or services result from a sequence of continuous operations. Process costing, unit costing, operating costing, operation costing fall under this category.

Various methods of costing are discussed below briefly:

Method # 1 Job Costing:

It is applicable in industries where goods are made against individual orders from customers. It is defined by the terminology of the definitions committee, I.C.M.A., London as, “that form of specific order costing, where work is undertaken to customers’ specific requirements”. In job costing direct costs are traced for specific jobs or orders. Each of the jobs involves different operations. Basic object of costing is to ascertain the cost of each job separately and any profit or loss thereon.

Method # 2 Contract Costing:

It is applied in concerns involved in construction work, like laying of roads, bridges and buildings, etc. For each of the contracts a separate account is opened and the total cost incurred is identified with it. The contracts may take a long time for completion. It is also known as terminal costing.

Method # 3 Batch Costing:

It is applied where orders for identical products are placed in convenient lots or batches. I.C.M.A. defines it as “that form of specific order costing which applies where similar articles are produced in batches either for sale or for use within an undertaking. In most cases, the costing is similar to job costing”. Cost per unit is ascertained by dividing the total cost of the batch by number of units of the batch.

Method # 4 Process Costing:

This method of cost ascertainment is used where the input is processed through several distinct processes to be converted into a finished product. The processes are carried out in a continuous sequence where the raw material is introduced in the first process and the finished product of each process becomes raw material for the subsequent process until the last process where from the finished product is transferred to finished stock account. In process costing a separate account is maintained for each process.

Method # 5 Operating Costing:

This method is applicable to service industries where no product is produced but some service is rendered. Examples- Transport, Lodging, Houses, Cinema theatres, Hospitals, etc.

Method # 6 Operation Costing:

This method is applicable where there is mass production and several processes are involved with different operations to be carried out to complete the process of production. It is similar to process costing but cost details are maintained for every minute operation and costs are more accurate.

Method # 7 Unit or Output Costing:

This method is applicable where output is uniform in all respects and production is continuous. Under this method cost per unit is ascertained by dividing the cost by number of units produced.

Method # 8 Multiple Costing:

This is a system where two or more methods of costing like job costing unit costing and operation costing are applied to find the cost of production. It is the application of combination of two or more methods to ascertain the cost of the work done. It is applied in industries where different parts are produced separately and assembled into a final product.

Method # 9 Activity Based Costing:

ABC is an accounting methodology that assigns costs to activities rather than products and services.

Costs are initially assigned to activities based on their resources. Then the costs are absorbed by products and services based on their use of activities.

CIMA defines ABC as “Cost attribution to cost units on the basis of benefit derived from indirect activities e.g., ordering, setting up, assuring quality”.

According to Horngren, Foster and Datar, “ABC is not an alternative costing system to Job costing or process costing; rather ABC is an approach to developing the cost numbers used in job or process costing systems. The distinctive feature of ABC is its focus on activities as the fundamental cost objects. The ABC approach is more expensive than traditional approach. ABC has the potential however, to provide managers with information they find more useful for costing purposes.”

Kaplan and Cooper of Harward Business school who have developed ABC approach to ascertain product costs, have classified the costs as ‘short term variable costs’ and ‘long term variable costs’. The approach relates overhead costs to the forces behind them which are named as ‘cost drivers’. Thus ‘cost drives’ are those activities or transactions which are significant determinants of costs.

ABC system is based on the belief that activities caused costs and a link should therefore be made between activities and products by assigning costs of activities to products based on individual product’s demand for each activity.

Different Methods of Costing – Contract Costing and Job Costing: With Formula

Contract Costing:

Contract is an agreement enforceable by law. The contractor agrees to complete the work and to mention the price known as contract price. Contract costing is the technique of ascertaining the cost of a contract.

A contract ledger book is kept in which a separate account is opened.

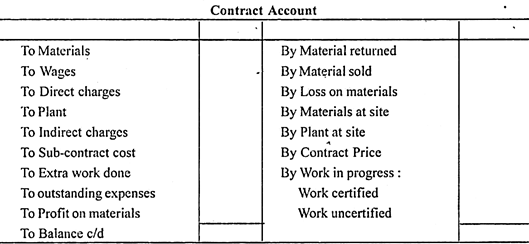

The format of contract account is as under:

Work Certified – Work is certified by the contractee and advance is given to the contractor. Full payment is not made but money is retained known as retention money. Where the contract is incomplete and profit is to be ascertained on the basis of contract.

Work done but not certified – Work done by the contractor but which is not certified by the contractee is known as work done but not certified.

Contract Price – It is the value of the contract agreed to be paid to the contractor on the satisfactory completion of the contract. On completion of the contract, the contract A/C is credited with the contract price.

Ascertainment of Profit on Contract:

As per accounting standard AS7 contract issued by the two methods are used to determine the profit on contract done by the contractor:

(i) On year to year basis

(ii) On completion of the contract.

On Completion of Contract – The excess of credit over the debit side of the contract A/C is known as profit. In case of loss, the whole amount is transferred to P/L A/C.

On Incomplete Contract – Where a contract takes more than one year in completion, a part of the profit is transferred to P/L account.

The excess of credit over the debit items in case of incomplete contract is not treated as true profit. A reserve has to be created for the unseen future until the contract is not completed.

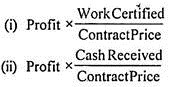

The general rule of profit are as under:

(1) If the value of certified work is less than 1/4th of contract price, no profit is taken into account. The balance of contract A/c is transferred to work in Progress A/C.

(2) If the certified work is more than 1/4th of contract price, but less than 1/2 of the contract price, only 1/3 of the computed profit should be credited to P/L A/C.

The balance of computed profit is a reserve and is transferred to work in progress A/C.

(3) If the value of certified work is 1/2 or more than 1/2 of the contract price, 2/3 of the computed profit is credited to P/L A/C.

(4) If the contract work has done sufficiently advanced, the profit is ascertained as under –

When contractor and contractee are new in the trade, they may agree that the payment would be made as total cost of work plus a rate of percentage on total cost. Such a contract is known as cost plus contract.

As the contractor will get a rate percent on the total cost as his profit, he may feel interested in increasing the cost as much as possible.

To avoid it, the contractor and contractee may agree not to include the following items in arriving the total cost:

1. Rent of self-owned building.

2. Charitable donations.

3. Expenses not related to contract.

4. Interest on owned capital.

5. Salary of the contractor.

6. Fines and Penalties.

Job Costing:

Job costing is the method of costing used to determine the cost of non-standard jobs carried out. In this method, cost units are identified. Under each order placed with the firm remain quite different from other orders. Job costing is applicable to job printers, builders, contractors etc.

Procedure for Job Costing:

The procedure in job costing is as follows:

(1) Estimation – The cost of each job has to be estimated separately and prices are to be quoted separately.

(2) Production order – A production order is issued to proceed with the work regarding the job. This order contains all relevant production information. Each production order is given a number. It is prepared in three copies.

(3) Accounting – The costs of all the jobs are written in work in progress account on completion of a job this account is credited.

(4) Planning – On accepting the order, the planning department prepares a suitable design for the job and prepare requirements of material, labour etc.

(5) Job cost sheet – The costing department prepares job cost sheet for each job. It is a document in which details of the cost of job etc. It is prepared for a specific job.

(6) Completion of job – On completion of job completion report is submitted. This report is an indication that further expenses are closed.

The cost of materials labour and overheads are recorded according to the principles of recording. Expenses of materials, labour and overheads etc. are written in it.

Cost Control:

Cost control over costs may be used by comparison of actual costs with the estimates worked out. The cost sheet of the preceding period of the same job may help in detecting the variations. The budgets prepared for common jobs helps in controlling costs.

Different Methods of Costing – Job Costing and Process Costing

Cost accounting is a process of ascertaining or estimating costs. Hence, it consists of a body of methods and techniques by which cost of products and services are determined and presented. These could be regarded as the tools of cost accountants.

Methods of cost accounting signify the systems used to assign cost elements to cost objects. These are the procedures by which product costs are accumulated. Different methods of cost finding are used because businesses vary in their nature and the type of products or services they produce. There are two main types of costing systems/methods based on actual cost.

These are:

1. Job costing

2. Process costing

1. Job Costing:

Job costing is one of the two basic systems of cost accounting. It is designed to accumulate cost data for a manufacturing firm that produces goods to specific orders.

The features of a job costing are:

(i) Each job is of a comparatively short duration,

(ii) Work is undertaken to customer’s special requirements,

(iii) Each job moves through stages as an identifiable unit. Examples are, repair job in a garage, printing orders in a printing press.

The important variant of job costing are:

(a) Contract costing; and

(b) Batch costing.

(a) Contract (Terminal) Costing:

It is a method of costing in which each contract is taken as a separate costing unit for the purpose of cost ascertainment and control. The objective is to find out the profit or loss on each contract separately. The terms of the contract usually allow for progress payment during the course of construction. This method is employed by firms engaged in ship-building, civil engineering for roads, bridges, dams, industrial estates, heavy engineering, factory construction, etc.

(b) Batch Costing:

It is a form of job costing in which a batch of identical products is taken as the cost unit. The manufacture of wooden pencils may be by batch so that a batch includes pencils of different colours, size or lead softness. Other examples include drugs, cigarettes, footwear, clothing, printing, engineering equipment, etc.

2. Process Costing:

It is a method of costing in which costs are accumulated by single processes for selected period of time.

The features of process costing are:

(i) Manufacturing activity is carried on continuously.

(ii) The output of one process becomes the input of the next process.

(iii) When there are more than one process, costs flow from one process to the other process.

(iv) It is not possible to trace the identity of a particular lot of output to any particular lot of input.

(v) The end product is usually units.

(vi) Joint products/by-products occur in the process.

Each process is treated as a cost centre and a separate account is opened for it. All costs relating to each process are debited to the respective process account. The output passing through the process is also recorded. The total cost for a period divided by the units processed in that period gives the cost per unit in that process. This method is suitable for chemical works, sugar, paint manufacturers, oil refineries, bottling companies, breweries, rubber and tanning industries.

The important variants of process costing are:

(a) Single or output costing,

(b) Operation costing and

(c) Service costing.

(d) Multiple (Composite) Costing.

(a) Single or Output or Unit Costing:

It is a method of costing in which cost is ascertained in convenient units of product turned out by continuous manufacturing activity. The unit of costing is chosen according to the nature of the product.

If the number of articles produced are a few, costs are accumulated for each unit of production, e.g. automobile in an assembly plant. In case of bulk production, the unit of cost is conveniently fixed, e.g. a tonne of coal, a gallon of oil, a metre of textile fabric, a bale of cotton, a thousand bricks, a thousand cigarettes, etc. This method is applied in case of automobiles, refrigerators, typewriters, television and radio sets, mines and quarries, steel plants, brick works, paper manufacture, etc.

(b) Operation Costing:

Here the cost unit is an operation rather than the whole process (a process consists of a sequence of operations). Yarn spinning is a process but it does involve a series of operations. It is employed by concerns where standardised goods or services are produced from a sequence of repetitive and more or less continuous operations. The concerns could be those engaged in the manufacture of bicycles, ceiling fans, weighing machines, etc.

(c) Operating Costing:

Also known as service costing, it is a distinct type of costing where services are being provided rather than goods manufactured. Since here costs are computed for a period, it is treated as a variant of process costing. This method is employed by undertakings like transport, electricity, gas, hospitals, hotels, educational institutions, etc. Naturally, the cost unit depends upon the service provided, e.g. tonne-km, passenger-km, patient-day, student-hour, etc.

(d) Multiple (Composite) Costing:

In the real world, companies hardly use pure job costing or pure process costing. They employ a hybrid or a mix of the two systems. What is common is a blend of the two systems, combining the elements of both. For example, Favreluba or Citizens companies, no doubt, produce a wide variety of gents and ladies watches on a mass scale.

But within these watches, they make wide distinctions on the basis of jewels, gold plating, quartz, digital, etc. The same holds good in respect of soft drinks, television sets, automobiles, and the like.

Different Methods of Costing – According to CIMA Terminology: Specific Order Costing and Operation Costing

The various methods may be used in costing which depend upon the nature of industry. In different industries, Nature of products, manufacturing process and output measurement are different.

According to CIMA Terminology, there are mainly two methods of costing:

(A) Specific Order costing (Job costing)

(B) Operation costing (Process costing)

In the (a) category – Job costing, batch costing and contract costing are included where work is done on the basis of specific order.

In the (b) category – Comes process costing where there is continuous flow of production.

All other methods of costing come under these two categories:

(A) Specific Order Costing:

1. Job Costing – In Job costing each job is treated as cost unit and costs are accumulated and calculated for each job separately. It is applied in those industries where production is done on the basis of specific order. For example, engineering or construction industries.

2. Batch Costing – Batch means extension of job work. Batch costing is the method of costing in which each batch is treated as a cost unit and costs are accumulated and ascertained for each batch separately. For example, Biscuit manufacturing unit, Readymade Garment Industry, Manufacturing, Drug Industries.

3. Contract Costing – Contract is actually a big job work. Contract costing is the method of costing where each contract is treated as cost unit and cost are accumulated and ascertained for each contract. For example, Construction of Road, Bridges etc.

(B) Operation Costing:

1. Process Costing – This method is used where production is done on continuous basis. The finished product (output) of one process becomes the input of (Subsequent) next process. In process costing costs are accumulated for each stage or process of production and cost per unit is ascertained for each process separately. A separate account is opened for each process.

2. Unit (Single Output/Operation) Costing – Unit costing is also used in those industries where production is continuous and units are identical. In Unit costing costs are accumulated and ascertained for each element of cost and cost per unit is calculated by dividing the total cost by the number of units produced. For example, steel manufacturing, Brick making, Cement Industry, etc.

3. Operating (Service) Costing – This method is used in industries where service is provided in place of manufacturing goods. For example, Power supply, Railways, Hotels, Hospitals etc. In this method cost of providing service is ascertained.

4. Multiple/Composite Costing – It means the application of more than one method of costing in respect of same product. This type of costing is used in industries where a number of component part are separately produced and then assembled into a final product. For example, Bicycle, Television and Cars etc.

Different Methods of Costing – Based on the Principles of Job Costing Process of Costing

Methods of Costing (Types):

I. Based on the Principles of Job Costing:

(a) Job costing

(b) Contract costing

(c) Batch costing

II. Based on the Principles of Process Costing:

(a) Process costing

(b) Operation costing

(c) Departmental costing

(d) Output, Single or Unit costing

(e) Operating or operative or working or service costing

(f) Multiple or composite costing

I. Based on the Principles of Job Costing:

(a) Job Costing:

It is adopted in concerns where the work done is analysed into different jobs, each job being considered as a separate unit of cost. Under this method, the cost of each job and the profit or loss made on each job undertaken is found out separately. A separate account is opened for each job to which all expenses incurred on that job, from the date of commencement till the date of completion are debited.

(b) Contract Costing:

It is also known as Terminal costing which is adopted by concerns undertaking big construction works or jobs called contracts. Under this system, the cost of each contract undertaken and the profit or loss on each contract is ascertained separately. A separate account is opened for each contract to which all the expenses incurred on that contract are debited.

(c) Batch Costing:

Business concerns which undertake the production of components or parts in batches adopt batch costing. Under this system, the cost of each batch is ascertained separately. (Batch means of group of similar products/ identical products). The cost per unit of each batch is ascertained by dividing the cost of each batch by the number of units produced in that batch. Shoe factories, Drug factories, Biscuit factories, readymade garments toy manufacturing concerns etc. adopt this method.

II. Based on the Principles of Process Costing:

(a) Process Costing:

It is adopted in industries where the products pass through different processes or stages before completion. Under this method, the cost of a product at each process is ascertained. This method is adopted by automobile industries, Soap factories, chemical works, oil refineries, Sugar mills etc.

(b) Operation Costing:

Operation costing is a mere detailed application of process costing. Under this method, the cost of each different operations of a process is ascertained. It is adopted in concerns where the manufacturing process consists of a number of different operations.

For example- Timber works, Toy making units, engineering industries etc.

(c) Departmental Costing:

It is adopted where a concern or factory is divided into many departments. Under this method, the cost of the product come from each department or the cost of operating each department is ascertained separately.

(d) Single or Unit or Output Costing:

Under this method, the cost per unit or output like per ton, per barrel, per kg, per meter, per quintal etc., is ascertained. The cost per unit of output is ascertained by dividing the total costs incurred on a product during a given period of time. This method is applied in mines, queries, beverages, steel works, cement factories etc.

(e) Operating or Operative or Working or Service Costing:

It is adopted in concerns providing services. Under this method, the cost per unit of service rendered by a concern is ascertained.

For example- Transport undertaking ascertains the cost per tonne-kilometer, Electricity Supply Company ascertains the cost per kilowatt hour.

(f) Multiple or Composite Costing:

Multiple costing represents the application of more than one method of costing for ascertaining the cost of the same product.