Let us make an in-depth study of the Life-Cycle Theory of Consumption:- 1. Explanation to the Theory of Consumption 2. The Reconciliation 3. Critics of the Life Cycle Hypothesis.

Explanation to the Theory of Consumption:

The life-cycle theory of the consumption function was developed by Franco Modigliani, Alberto Ando and Brumberg.

According to Modigliani, The point of departure of the life cycle model is the hypothesis that consumption and saving decisions of households at each point of time reflect more or less a conscious attempt at achieving the preferred distribution of consumption over the life cycle, subject to the constraint imposed by the resources accruing to the household over its life time.

An individual’s or household’s level of consumption depends not just on current income but also, and more importantly, on long-term expected earnings.

ADVERTISEMENTS:

Individuals are assumed to plan a pattern of consumer expenditure based on expected earnings over their lifetime.

To see the implications of this theory for the form of the consumption function, we first look at a simplified example.

Consider an individual of a given age who is in the labour force, has a life expectancy of T years, and plans to remain in the labour force for N years. Our representative consumer might, for example, be 30 with a life expectancy of 50 (additional) years, plan to retire after 40 years, and, therefore, have expected years in retirement equal to (T – N), or 10. We make the following assumptions about the individual’s plans.

The individual is assumed to desire a constant consumption flow throughout life. Further, we assume that this person intends to consume the total amount of lifetime earnings plus current assets and plans no bequests. Finally, we assume that the interest paid on assets is zero; current saving results in dollar-for-dollar future consumption. These assumptions are purely to keep the example simple and are relaxed later.

ADVERTISEMENTS:

These assumptions imply that consumption in a given period will be a constant proportion, 1/T, of expected lifetime resources. The individual plans to consume lifetime earnings in T equal installments. The consumption function implied by this simple version of the life cycle hypothesis is:

Ct is consumption in time period t. The term is brackets in expected lifetime resources, which consist of

Yt1 = the individual’s labour income in the current time period (t)

ADVERTISEMENTS:

Y-1e = the average annual labour income expected over the future (N – 1) years during which the individual plans to work

At = the value of presently held assets

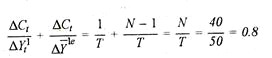

It can be seen from Equation (1) that according to the life cycle hypothesis, consumption depends not only on current income but also on expected future income and current asset holdings (i.e., current wealth). In fact, the life cycle hypothesis suggests that consumption would be quite unresponsive to changes in current income (Y,1) that did not also change average expected future income. From equation (1), for example, we can compute

An increase in income that was expected to persist throughout the work years would mean that y-le also rose and that the effect on consumption would be much greater:

A one-time or transient change in income of, say, Rs. 100 will have the same effect as a change in wealth (note that ΔCt/ΔYt1 = ΔCt/ΔAt = 1/T) of the same amount. Lifetime resources will go up by Rs. 100, and this will be spread out in a planned consumption flow of 100/T = 100/50 = 2 per period in our example of an individual who expects to live for 50 additional years.

A permanent increase in income of Rs. 100 will lead to an increase of consumption of Rs. 80 in each of the remaining periods, including the 10 planned periods of retirement. The increase of Rs. 80 in each of these 10 retirement years, a total of Rs. 800, is financed by a saving of Rs. 20 (100 – 80) in each of the, 40 remaining working years.

The life cycle hypothesis accounts for the dependence of consumption and saving behaviour on the individual’s position in the life cycle. Young workers entering the labour force have relatively low incomes and low (possibly negative) saving rates. As income rises in middle-age years, so does the saving rate. Retirement brings a fall in income and might be expected to begin a period of dissaving (negative saving rates).

ADVERTISEMENTS:

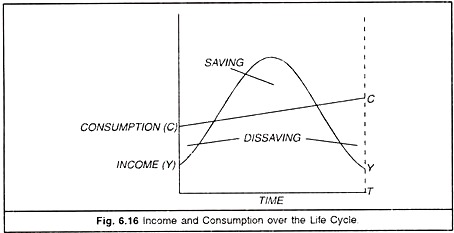

This lime profile of consumption and saving is depicted in Figure 6.16. Here the desired pattern of consumption is taken to rise mildly with time instead of maintaining the constant desired consumption pattern assumed in our individual example. The pattern of income rises more sharply, though, and the typical individual smoothest out consumption flow by a short period of early dissaving, a period of positive saving, then a longer period of dissaving in retirement.

The general form of the aggregate consumption function implied by the life cycle hypothesis is:

where the variables Ct,Y1t,Y-le, and At, arc as defined for Equation (1) but should now be interpreted as economy-wide averages. If the simplifying assumptions made previously of no bequests, zero interest on saving, and a uniform consumption pattern over time are relaxed, the parameters b1, b2and b3 will no longer be simple functions of N and T as were the coefficients in Equation (1).

ADVERTISEMENTS:

Still, in the aggregate consumption function (2), as in the case of Equation (1), consumption depends not just on current labour income (Yt1) but also on average future expected labour income (Y-le) and wealth (At). It will also be true in the aggregate, as in the simplified individual example, that the response to a transient or one-time increase in labour income (an increase in Ytl) will be quite small, much less than the response to a permanent income change (an increase in Y1t and Y-le).

Consumption is shown as rising gradually over the life cycle. Income rises sharply over the early working years, peaks, and then declines, especially with retirement. This pattern of consumption and income results in periods of dissaving in the early working years and the late stage of the life cycle, with positive saving over the high-income middle period of the life cycle.

To use Equation (2) to study actual consumer behaviour, we must make some assumption about the way in which individuals form expectations concerning lifetime labour income. In a study for the United States, Ando and Modigliani make the assumption that expected average future labour income is just a multiple of current labour income:

ADVERTISEMENTS:

According to this specification, individuals revise their expectation of future expected labour income Y-1e by some proportion β of a change in current labour income. Substitution of Equation (3) for Y-1e in the aggregate consumption function (2) yields

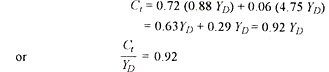

A representative statistical estimate of the equation based on the work of Ando and Modigliani is the following:

An increase in current labour income of Rs. 100 with the assumed effect on future labour income will increase consumption by Rs. 72. An increase in Wealth of Rs. 100 will increase consumption by Rs. 6. As noted previously, an increase in income that was known to be temporary and therefore would not affect future expected labour income would have the same effect as an increase in wealth. Thus, according to this estimate, the MPC out of such a transient income flow is of the order of 0.06, the MPC out of wealth.

The Reconciliation:

ADVERTISEMENTS:

The life cycle hypothesis can explain the puzzles that emerged from the early empirical work on consumption functions. According to the life cycle hypothesis, the relationship between consumption and current income would be non-proportional, as seems to be the case in short-run time series estimates.

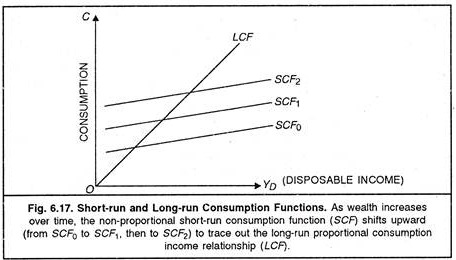

The intercept of the function measures the effect of wealth [0.06/1, in Equation (5)]. But the intercept is not constant over time; such short-run consumption functions shift upward over time as wealth grows. These upward shifts in the short-run consumption function (SCF) are illustrated in Figure 6.17. The shifting short-run consumption functions trace out a long-run consumption function (LCF).

If the ratios of wealth and labour income to disposable personal income are relatively constant over time, the life cycle consumption function [Equation (5)] is also consistent with the evidence from long-run time series data that the long-run consumption-income relationship (LCF in Figure 6.17) is proportional, with the APC(C/Yd) relatively stable in the neighborhood of 0.9. To see this relationship, first note that the ratio of labour income to disposable personal income has been approximately 0.88; that is, Yt1 = 0.88 YD. The ratio of wealth to disposable income is approximately 4.75; A, = 4.75 YD. Substitution of these expressions for At and Yt1 in the estimated aggregate consumption function (5) yields which is approximately the average value of the APC over the post-World War II period.

The life cycle hypothesis also explains the evidence from cross-sectional family budget studies showing that higher-income families consume a smaller proportion of income (have a lower APC) than do lower-income families. A larger proportion of high-income families might be expected to be those in their peak earning years, that is, in the “humped” portion of Figure 6.16.

ADVERTISEMENTS:

It is in this range, according to the life cycle hypothesis, that income should exceed consumption by the greatest amount and the APC should be lowest. Conversely, a sample of low-income families would have a high proportion of new entrants to the labour market and retirees, groups that tend to disserve. These groups with high A PCs would push up the APC for the sample of low-income families.

Finally, the life cycle hypothesis explains why quarter-to-quarter movements in consumption do not closely mirror quarter-to-quarter movements in income, the other anomalous finding of early research on the consumption function. The change in income from any given quarter to the next will be the result, in large part, of onetime factors that will not affect individuals’ perceptions of lifetime average income. We have seen that transient income changes have little impact on consumer behaviour according to the life cycle hypothesis.

Critics of the Life Cycle Hypothesis:

Although the life cycle hypothesis explains several features of the consumption- income relationship, the approach is not without its critics. Gardner Ackley for example, points out that the life cycle theory assumes that each household in making consumption decisions has at all times a definite, conscious vision of the family’s future size and composition, including the life expectancy of each member; of the entire lifetime profile of the income from work of each member after the then applicable taxes ; of the present and future extent and terms of any credit available to it; of the future emergencies, opportunities, and social pressures which will impinge upon its consumption spending.

Further, each household must hold such a vision with enough certainty that it would be worthwhile to use this vision as a basis for rational planning of consumption decisions. Ackley finds these assumptions to be unrealistic. In essence, Ackley will not accept the point of departure for the life cycle hypothesis ; that is, Modigliani’s statement that consumption and saving decisions of households “reflect a more or less conscious attempt at achieving the preferred distribution of consumption over the life cycle.”

Another criticism of the life cycle approach is that it fails to recognize the presence of liquidity constraints. Even if a household possessed a concrete vision of future income, there is little opportunity in real-world capital markets for borrowing for a long period on the basis of expected future income.

As a result, consumption may be much more responsive to changes in current income, whether temporary or not, than would be predicted on the basis of the life cycle hypothesis. The response of consumption to current income, however, may not be the simple mechanical one predicted by the “absolute income” hypothesis. The consumption pattern of younger households facing liquidity constraints may be very responsive to changes in current income.

ADVERTISEMENTS:

The consumption of older households with more accumulated wealth may not be responsive to temporary variations in current income. Small temporary changes in income may be financed out of a buffer of liquid assets, but larger changes may cause liquidity constraints to become binding and begin to affect consumption behaviour. Consideration of liquidity constraints on households therefore leads one to believe that current income may be a more important influence on consumption than would be predicted on the basis of the life cycle hypothesis, but the consumption-to-current-income relationship may be more complex than that implied by Keynes’s absolute income hypothesis. Statistical work does in fact suggest the importance of liquidity constraints in explaining the considerable response of consumption to current income.

Other research emphasizes the importance of bequests in determining saving, rather than the life cycle motive, which emphasizes saving to finance consumption in retirement. A study by Laurence Kotlikoff and Lawrence Summers concluded that the desire to make bequests was the most important motive for saving. Franco Modigliani has disputed the evidence. To him, the data suggest that only 15 to 20 percent of saving is for bequests. The bulk is life cycle saving.

Conclusion:

From the review of the theories of consumption function, we conclude that there have been laudable attempts at integrating the micro behaviour of households with macro level consumption function. But empirical research tells us that these theories are not the last word.