The following points highlight the seven main Implications of the Classical Equilibrium Model. The Implications are: 1. Fiscal Policy 2. Crowding out Effect 3. Neutral Demand-Side Effect of Tax Policy 4. Favourable Supply-Side Effects 5. Importance of Money 6. Neutrality of Money 7. Classical Dichotomy.

Policy Implication # 1. Fiscal Policy:

Like an individual the government also operates under a budget constraint. It is expressed as

G = T + Δ B + Δ M … (21)

where G is the government’s current expenditure on goods and services, T is tax revenue, ΔB is market borrowing (funds raised by selling bonds to the public) and ΔM is deficit spending (financed by creating/printing new money through central bank). Equation (21) may be expressed as

ADVERTISEMENTS:

G – T – ΔB + ΔM … (22)

If we assume that T remains fixed, and money supply (M) also remains fixed (we rule out any monetary policy change at this stage), then it logically follows that the increased government expenditures are financed by making bond issues.

In the classical model a bond-financed increase in government spending will have no effect on the equilibrium values of output or the price level due to nature of both aggregate demand and aggregate supply curves.

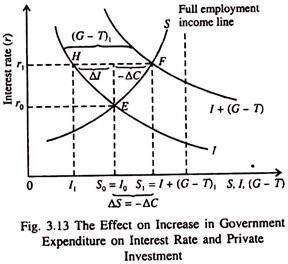

These two curves together determine output and the price level, irrespective of the level of government expenditure or its changes. This point becomes clear if we examine the effect of a change in government spending on the interest rate. At the equilibrium rate of interest (r0), shown by point E, the demand for loanable funds is equal to its supply.

ADVERTISEMENTS:

Due to deficit spending by the government by selling bonds, the demand curve for loanable funds shifts to the right to I + (G – T)j. The equilibrium rate of interest rises from r0 to r1, as shown by point F.

As a result two things happen at the same time. The volume of investment decreases from I0 to I1 and the volume of saving increases (or consumption falls) from S0 to S1. The fall in investment and consumption just balances the increase in (G- T)1, the government deficit spending (because tax collections remain fixed).

Policy Implication # 2. Crowding out Effect:

So government spending is at the cost of private spending (C + I). This is known as the crowding out effect. The increase in government spending financed by selling bonds to the public raises the interest rate from r0 to r1 and chokes off private consumption and investment demand by an equivalent amount. A higher rate of interest discourages households to consume more.

ADVERTISEMENTS:

In other words, it encourages people to save more by sacrificing current consumption. Investment falls because fewer investment opportunities appear to be profitable at higher cost of borrowing funds. Because of this crowding out effect aggregate demand does not increase even if government expenditure financed by taxes increases. Consequently the general price level remains unchanged.

If, instead of borrowing, the government prints paper money (currency notes) to finance its new spending, the general price level will rise proportionately, as has been suggested by the quantity theory of money. In this case, the aggregate demand curve shifts to the right. Since the aggregate supply curve is a vertical straight line, the price rise is exactly proportional to the increase in money supply.

Thus, in the classical model, inflation is always a purely monetary phenomenon, as has been postulated by the quantity theory of money. The source of the increase in money supply does not matter.

A certain change in the money supply has the same effect where it is due to an increase in government expenditure (G) or an increase in private consumption (C) or investment (I) To be more specific, fiscal policy in the form of an increase in government spending has neutral effect on aggregate demand.

Policy Implication # 3. Neutral Demand-Side Effect of Tax Policy:

Like government expenditure, a policy of tax cut will also have no effect on aggregate demand. A cut in tax rates or tax total will increase disposable income and stimulate household consumption. But if the government sells bonds to recover the revenue loss arising from tax cut, the same crowding out effect will be observed as is found in case of bond-financed increase in government spending.

Investment will fall as usual if the rate of interest rises.

The increase in saving, caused by a rise in the rate of interest, will lead to a fall in consumption. So consumption will rise to its original level. Thus aggregate demand will remain unchanged because the increase in government expenditure will be offset by a cut in I and C taken together.

If, however, revenue loss due to tax cut is recovered by printing new money, then aggregate demand will increase. In this case a policy of tax cut would lead to proportional rise in the price level. However, tax cut will have no direct effect (or independent) effect on aggregate demand.

It will affect the price level independently — by inducing the government to borrow money from the central bank to cover the budget deficit.

Policy Implication # 4. Favourable Supply-Side Effects:

ADVERTISEMENTS:

If the tax cut were simply a lump-sum one, then it would have only demand-side effect. But if the tax cut were in the form of reduced income tax rates in the classical model, then it would have a favourable incentive effect on the supply of labour. In this case employment and aggregate output will increase.

If we include an income tax in the classical model, the labour supply function becomes:

This means that for a given pre-tax real wage (W/P), a cut in the income tax represents an increase in the after-tax real wage and this, therefore, leads to an increase in labour supply.

ADVERTISEMENTS:

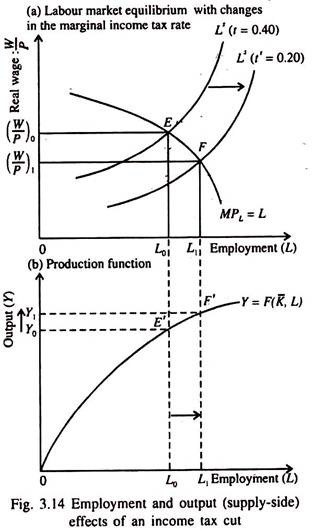

Fig. 3.14(a) illustrates the effect of a cut in the marginal income tax rate from 40% to 20% in the context of the classical model. In part (a), a cut in the marginal income tax rate (from 0.40 to 0.20) increases the after-tax real wage for a given value of the pre-tax real wage.

As a result the labour supply curve shifts to the right and equilibrium employment rises from L0 to L1.

This, in its turn, leads to an increase in output, in the classical model, through the production function in Fig. 3.14(b).

ADVERTISEMENTS:

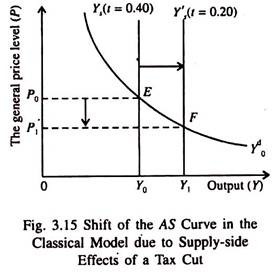

The end result is a rightward shift of the vertical aggregate supply curve, as shown in Fig. 3.15. Since output is supply-deter- mined, a rightward shift of the aggregate supply curve from Ys (corresponding to a tax rate of 40%) to Ys (corresponding to a tax rate of 20%) leads to an increase in output from Y0 to Y1.

Since the aggregate demand curve is downward sloping, the general price level falls from P0 to P1. Thus, in the classical model, where the level of aggregate demand remains unchanged because it is determined by the money supply (there is only movement along the aggregate demand curve, no shift of the curve), an increase in aggregate supply due to tax cut and fall in real wage leads to a fall in the price level.

Policy Implication # 5. Importance of Money:

How important is money in the classical model? In one sense, money is very important in the classical model. In another sense, it has neutral effect on the key macroeconomic variables.

In the classical system, the quantity of money determines the general price level and, for a given real income, the level of nominal income. In this sense, monetary policy is a potent instrument of classical macroeconomics. So the stability of money supply is important for ensuring price level stability. If M rises, P will also rise proportionately.

Policy Implication # 6. Neutrality of Money:

In another sense, money is a ‘veil’ in the classical model. It is not at all important. The quantity of money does not affect the equilibrium values of any of the real variables, viz., output, employment, and the interest rate. In the classical model employment and output are supply determined. The theory of equilibrium interest rate is also a real theory, not a monetary theory.

ADVERTISEMENTS:

While discussing the equilibrium rate of interest the classicists did not make any mention of the quantity of money. In the classical model the rate of interest is determined by the real forces of ‘productivity and thrift’ such as real investment demand, real saving and the real value of the government deficit.

Policy Implication # 7. Classical Dichotomy:

Due to neutrality of money there is a dichotomy between the factors determining real and nominal variables. In the classical theory, real (supply-side) factors determine real variables’. Employment and output depend primarily on the size of the population, capital formation and technology.

Interest rate is determined by productivity and thrift. But monetary factors (such as the demand for and the supply of money) do not play any role in determining these real quantities.

In short, money determines only the normal values in which quantities are measured. But it has no effect on real quantities such as employment, output and the interest rate.