The below mentioned article provides an overview on the Circular Flow of Economic Activity. After reading this article you will learn about: 1. Introduction to the Circular Flow of Economic Activity 2. The Circular Flow in a Two-Sector Economy 3. The Circular Flow in a Three-Sector Economy 4. The Circular Flow in a Four-Sector Economy.

Introduction to the Circular Flow of Economic Activity:

The all pervasive economic problem is that of scarcity which is solved by three institutions (or decision-making agents) of an economy. They are households (or individuals), firms and government. They are actively engaged in three economic activities of production, consumption and exchange of goods and services. These decision-makers act and react in such a manner that all economic activities move in a circular flow.

First, we discuss their nature and role in decision-making.

Households:

ADVERTISEMENTS:

Households are consumers. They may be single-individuals or group of consumers taking a joint decision regarding consumption. They may also be families. Their ultimate aim is to satisfy the wants of their members with their limited budgets.

Households are the owners of factors of production—land, labour, capital and entrepreneurial ability. They sell the services of these factors and receive income in return in the form of rent, wages, and interest and profit respectively.

Firms:

The term firm is used interchangeably with the term producer in economics. The decision to manufacture goods and services is taken by a firm. For this purpose, it employs factors of production and makes payments to their owners. Just as household’s consumer goods and services to satisfy their wants, similarly firms produce goods and services to make a profit.

ADVERTISEMENTS:

The term ‘firm’ includes joint stock companies like DCM, TISCO etc., public enterprises like IOC, STC, etc., partnership concerns, cooperative societies, and even small and big trading shops which do not manufacture the commodities they sell.

Government:

The government plays a key role in all types of economic systems—capitalist, socialist and mixed. In a capitalist economy, the government does not interfere. It simply establishes and protects property rights. It sets standards for weights and measures, and the monetary system.

In a socialist economy, the role of the government is very extensive. It owns and regulates the entire production and consumption processes of the economy, and fixes prices of goods and services. In a mixed economy, the government strengthens the market system.

ADVERTISEMENTS:

It removes its defects by regulating the activities of the private sector and by providing incentives to it. The government also uses resources to produce goods and services itself which are sold to households and firms. These decision-making agents take economic decisions to produce goods and services and to exchange them in order to consume them for satisfying the wants of the whole economy.

Production, consumption and exchange are the three main activities of the economy. Consumption and production are flows which operate simultaneously and are interrelated and interdependent. Production leads to consumption and consumption necessitates production.

In other words, production is a means (beginning) and consumption is the end of all economic activities. Both production and consumption, in turn, depend upon exchange. Thus these two flows are interrelated and interdependent through exchange.

The Circular Flow in a Two-Sector Economy:

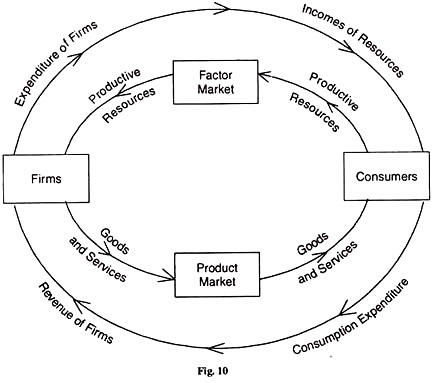

In a simplified economy with only two types of economic agents, households or consumers and business firms, the circular flow of economic activity is shown in Figure 10. Consumers and firms are linked through the product market where goods and services are sold. They are also linked through the factor market where the factors of production are sold and bought.

Consumers and firms have a dual role, and exchange with one another in two distinct ways:

(1) Consumers or households own all the factors of production, that is, land, labour, capital and entrepreneurship, which are also called productive resources. They sell them to firms for producing goods and services.

In the diagram, the sale of goods and services by firms to consumers in the product market is shown in the lower portion of the inner circle from left to right; and the sale of their services to firms by households or consumers in the factor market is shown in the upper portion of the inner circle from right to left. These are the real flows of goods and services from firms to consumers which are linked with productive resources from consumers to firms through the medium of exchange or barter.

(2) In a modem economy, exchange takes place through financial flows which move in the reverse direction to the “real” flows. The purchase of goods and services in the product market by consumers is their consumption expenditure which becomes the revenue of the firms and is shown in the outer circle of the lower portion from right to left in the diagram.

ADVERTISEMENTS:

The expenditure of firms in buying productive resources in the factor market from the consumers becomes the incomes of households, which is shown in the outer circle of the upper portion from left to right in the diagram.

The Circular Flow in a Three-Sector Economy:

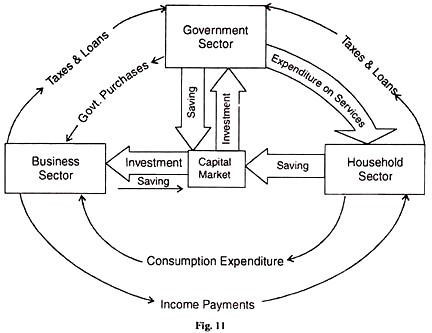

So far we have been working on the circular flow of a two-sector model of an economy. To this we add the government sector so as to make it a three-sector closed model of circular flow of economic activity. For this, we add taxes and government purchases (or expenditure) in our presentation.

Taxes are outflows from the circular flow and government purchases are inflows into the circular flow. The circular flow in a three-sector economy is illustrated in Figure 11.

ADVERTISEMENTS:

First, take the circular flow between the household sector and the government sector. Taxes in the form of personal income tax and commodity taxes paid by the household sector are outflows (or leakages) from the circular flow. But the government purchases the services of the households, makes transfer payments in the form of old age pensions, unemployment relief, sickness benefit, etc., and also spends on them to provide certain social services like education, health, housing, water, parks and other facilities.

All such expenditures by the government are inflows (injections) into the circular flow. Next take the circular flow between the business sector and the government sector. All types of taxes paid by the business sector to the government are leakages from the circular flow.

On the other hand, the government purchases all its requirements of goods of all types from the business sector, gives subsidies and makes transfer payments to firms in order to encourage their production. These government expenditures are injections into the circular flow.

Now we take the household, business and government sectors together to show their inflows and outflows in the circular flow. As already noted, taxes are a leakage from the circular flow. They tend to reduce consumption and saving of the household sector. Reduced consumption, in turn, reduces the sales and incomes of the firms.

ADVERTISEMENTS:

On the other hand, taxes on business firms tend to reduce their investment and production. The government offsets these leakages by making purchases from the business sector and buying services of the household sector equal to the amount of taxes. Thus inflows (injections) equal outflows (leakages) in the circular flow.

Figure 11 shows that taxes flow out of the household and business sectors and go to the government. The government purchases goods from firms and also factors of production from households. Thus government purchases of goods and services are an injection in the circular flow and taxes are leakages in the circular flow.

If government purchase exceeds net taxes then the government will incur a deficit equal to the difference between the two, i.e., government expenditure and taxes. The government finances its deficit by borrowing from the capital market which receives funds from the household sector in the form of saving.

On the other hand, if net taxes exceed government purchases the government will have a budget surplus. In this case, the government reduces the public debt and supplies funds to the capital market which are received by the business sector.

The Circular Flow in a Four-Sector Economy:

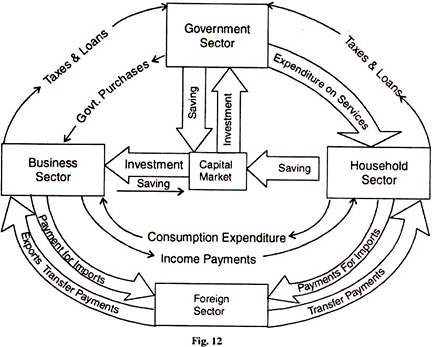

So far the circular flow has been shown in the case of a closed economy. But the actual economy is an open one where foreign trade plays an important role. Exports are an injection or inflows into the circular flow of money. On the other hand, imports are leakages from the circular flow.

They are expenditure s incurred by the household sector to purchase goods from foreign countries. These exports and imports in the circular flow are shown in Figure 12.

ADVERTISEMENTS:

Take the inflows and outflows of the household, business and government sectors in relation to the foreign sector. The household sector buys goods imported from abroad and makes payment for them which is a leakage from the circular flow of money. The householders’ ma receives transfer payments from the foreign sector for the services rendered by them in foreign countries.

On the other hand, the business sector exports goods to foreign countries and its receipts are an injection in the circular flow or money. Similarly, there are many services rendered by business firms to foreign countries such as shipping, insurance, banking, etc. for which they receive payments from abroad.

They also receive royalties, interests, dividends, profits, etc. for investments made in foreign countries. On the other hand, the business sector makes payments to the foreign sector for imports о capital goods, machinery, raw materials, consumer goods, and services from abroad. These are the leakages from the circular flow of money.

Like the business sector, modern governments also export and import goods and services, and lend to and borrow from foreign countries. For all exports of goods, the government receives payments from abroad.

Similarly, the government receives payments from foreigners when they visit the country as tourists and for receiving education, etc., and also when the government provides shipping, insurance and banking services to foreigners through the state-owned agencies.

ADVERTISEMENTS:

It also receives royalties, interests, dividends, etc. for investments made abroad. These are injections into the circular flow of money. On the other hand, the leakages are payments made to foreigners for the purchase of goods and services.

Figure 12 shows the circular flow of money of the four sector open economy with saving, taxes and imports shown as leakages from the circular flow on the right hand side of figure, and investment, government purchases and exports as injections into the circular flow, on the left side of the figure.

Further, imports, exports and transfer payments have been shown to arise from the three domestic sectors—the household, the business and the government. These outflows and inflows ass through the foreign sector which is also called the “Balance of Payments Sectors”.