Read this article to learn about the meaning and models of circular flow of economic activity.

Meaning of Circular Flow of Economic Activity:

It means continual circular movement of money and goods in the economy.

The concept the circular flow of income is a simplification which attempts to illustrate the flow of money and goods from households to business enterprise and back to households.

We know that the economic activities and money have a circular flow. Circular flow of money means that the money spent must not be hoarded and should continue to flow to maintain a certain Level of economic activity and income.

ADVERTISEMENTS:

In order to obtain a clear idea of the relations between the numerous economic units in a country, it is best to reduce them to homogeneous groups.

For example, all households may be taken as one whole, because their activities are more or less ‘of the same type. Enterprises and government agencies too can each be grouped also. Through economic activity (production, consumption, capital formation etc.), these groups are linked up not only with each other but also with other economic problems of the world—by flow of goods and money. All those currents’ make up the circular flow of economic activity.

We see the GNP, GNY and GNE are all identical in values and when depreciation is deducted, they become net—i.e., NNP ≡ NNY ≡ NNE, (the symbol ≡ denotes identity). But the income, output and expenditure approach would not assume such a great importance if they were merely identical to each other; the fact of the matter is that income output and employment are equal to each other functionally also. Keynes was the first to note the fact of the circular flow of economic activity.

Consumers spend their incomes on goods and services produced by business and production units. They pay them (to factors) in the form of wages, rent, interest and profits. This forms the income of the factors which is again spent. Thus, the functioning of the economy consists in the production of goods and the services by the factors of production and production units.

ADVERTISEMENTS:

What are ‘costs’ to business are ‘incomes’ to the factors such as the workers and the resource-owners. Consumers expenditure is income to business. It is expenditure by the consumers that determines the income of the producers. More expenditure means more income and greater production. It will increase the earnings of the (actors and their spending’s and so on.

Once we understand this, we understand the circular flow of economic activity. Keynesian approach of income also tells us the most important condition which must be fulfilled before the economy is said to be in equilibrium, i.e., the important condition of saving being equal to investment.

We know that in a closed economy with no government activity the income (Y) is divided between consumption expenditure (C) and investment expenditure (i) We also know that whatever part of income is not consumed is saved (Y = C + S). Since income (Y) = Expenditure (E), therefore, C + S = C + I, therefore, S = I. Herein lies the greatest importance of Keynesian approach. In the fundamental Keynesian equation Y = C + I, C depends for on Y, therefore, it is essential to understand clearly what Y stands for and what different concepts are that have come to lie associated with it. The definition of income presented good deal of difficulty to Keynes. Today, it has been refined and operationally made more significant.

Thus, one of the important conditions for the economy to be in equilibrium is that its circular flow of economic activities among the different sectors of the economy must be maintained, i.e., whatever is earned in the form of income (10 by the factors of production must be spent by them either on consumption (C) or on investment (I), so that in the ultimate .analysis, theoretically at least, Y – C + I this is the income-expenditure approach, in which the balance between the two sides is maintained—when this is done, it is said that the circular How of economic activity has been maintained and the economy is in a state of macro equilibrium.

ADVERTISEMENTS:

This circular flow of economic activity is maintained not only in two sector closed simple economy but also in three sector economy and four sector open economy in which we take into consideration the foreign trade sector transactions. In order to attain the circular How of economic activity necessary adjustments of transactions in the various sectors of the economy are made. Circular flow model highlights the circular flow of spending and income between business and household sectors of the economy built on the concept that spending creates income.

Two Sector Model:

In a two-sector model of a simple economy we consider Household Sector and Business Sector called Firms etc. Households own all economic resource or factors of production. These resources are either labour force (human resources) or capital stock (non-human resources) or both. Households are not only families, they may be single people and communal groups as well. Households are basically consumer units and their ultimate aim is to satisfy the wants of their members. They are also the controllers of the factors of production.

On the other hand, business sector employs the factors of production or resources (inputs) and produces the final output for sale. Business or firms take economic resources from households and in turn provide them with goods and services. These basic exchanges are known as real flows.

By themselves these real flows would mean barter—but this being very inconvenient—we make use of money—the medium of exchange. Business sector gives money for the purchase of scarce economic resources from the resource markets and also receives money in return for the sale of goods and services produced and supplied through the product market.

Business sector pays for factor services and incur—what are called ‘factor costs’ and receives income in return. Thus, flows of goods and services in one direction are always matched by the flows of money in the opposite direction. The model given below shows how circular flow of the two sectors in a simple closed economy is maintained.

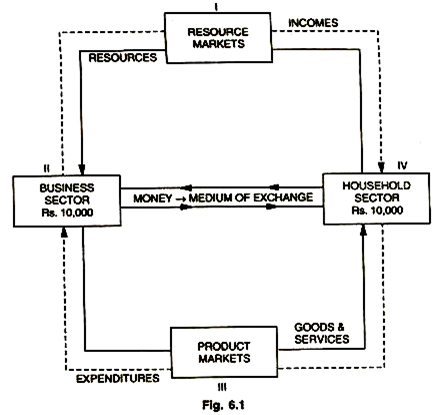

In this model we see that business and household sectors are the principals in the circular flow of real items and money—that takes place in the resource and product markets. In other words, business sector do not buy all the economic resources directly from the households; nor do the households buy goods and services directly from business sector. Both types of transactions are carried through the markets (the resource market and the product market). Starting from the resource market (Box I) household sector supplies economic resources to satisfy the demand of business sector (Box II).

Business sector makes use of these resources (inputs) in the production and in the process supplies final goods and services through product market (Box III) to households (Box IV) for the satisfaction of their wants—through money, being the chief medium of exchange. The size of these flows depends on the amount demanded by the household sector and supplied by the business sector and on the prices of the final output. However, on account of the scarcity of resources and limitation of supplies these flows are finite in nature.

The model depicts circular flow in two-sector simple economy, where household sector earns Rs. 10,000 from the sale of ‘factor services’ to business sector and this business sector makes use of these inputs to produce an output in the economy exactly equal to Rs. 10,000.

ADVERTISEMENTS:

The basic assumption being that income payments to business sector for factor services return to business sector in the form of purchase of output of final goods and services—the circular of income and product not only maintains itself but tends to perpetuate itself, production equals sales—output equals demand—and there will be a tendency to continue operating at the same level—the whole process being described as macroeconomic short period static equilibrium.

Accordingly, the economic agents in the business sector are called ‘producers’ and economic agents in the household sector are called ‘consumers’. As such there are mainly two broad types of transactions that take place between ‘producers’ and ‘consumers’.

From the viewpoint of producers these transactions take the form of:

(i) Purchase of the factor services from the household sector,

ADVERTISEMENTS:

(ii) Sale of final output to household sector.

From the ‘consumers’ viewpoint, these transactions take the form of:

(i) Sale of factor services to business sector,

(ii) Purchase of final output from business sector.

ADVERTISEMENTS:

The circular how of economic activity in the two sector simple economy is, however, based on the following assumptions:

Assumptions:

(a) The economy is a closed economy (no foreign trade sector),

(b) Production takes place only in business sector,

(c) Producers sell all that they produce. In other words, there is no inventory accumulation in the business sector,

(d) Consumers spend all their income on consumption. In other words, there is no saving in the household sector,

ADVERTISEMENTS:

(e) There are no transactions involved like government expenditure on goods and services or taxes etc.

Given the above assumptions, it follows that production should equal sales and income should equal expenditure—the circular flow then is complete. In the real world it is not possible to uphold these assumptions and at times these have to be dropped—in such circumstances the maintenance of circular flow in the economy becomes a bit more complicated. While basic circular flow of spending and income prevails, the real working of the economy adds complications in our simple two sector theoretical structure or model of the economy described above.

These complications are caused by injections and leakages. Injections are factors which increase spending flow; while leakages are factors which tend to reduce spending. The basic mechanism of circular flow remains the same though some adjustments in transactions will have to be made.

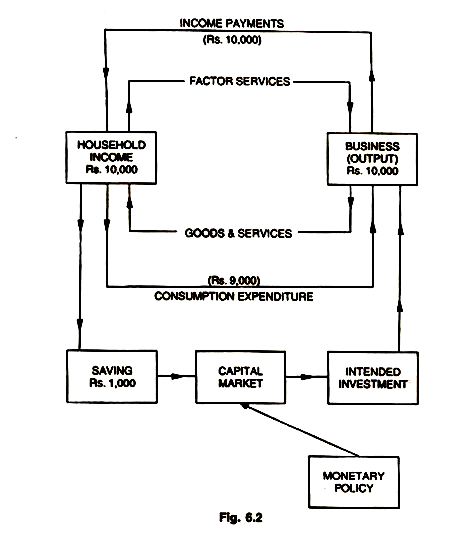

Even in two sector model based on simple assumptions mentioned above there may be leakages from the income stream in the form of savings by the household sector. They may save a fraction of income say, Rs. 1,000 out of Rs. 10,000 (in the above example) and decide not to spend—as a result consumption expenditure will fall to Rs. 9,000. But as the business sector is producing output worth Rs. 10,000—there will be unintended accumulation of goods worth Rs. 1,000 called unwanted inventories.

This will interrupt the circular flow because business sector is still producing worth Rs. 10,000 and all that can be sold is worth Rs. 9,000—so production levels will have to be cut back in the second round, reducing, in turn, the flow of income to household sector. It shows that leakages in any form would reduce the production and income level and would also interfere with the smooth flow of circular activity.

However, should the business sector decide to buy the leftover output worth Rs. 1,000 for any reason (because it wishes to add to its stock of inventories) total expenditure can still remain equal to output despite the saving leakage. Thus, if intended or desired business investment equals saving—equilibrium, flow can still be maintained at the original level of income and output.

ADVERTISEMENTS:

This is shown in the model given below:

The model shows that the household sector saves Rs. 1,000 and spends Rs. 9,000 on consumption— business sector purchases goods and services worth Rs. 1,000 for its own use, thereby helping the economy lo maintain the circular (low. But the model shows that there is a capital market also between S and I flow. Just as factor services or resources flow through resource market and the final output through product market S and I flow through capital market.

According to classical capital market is always acted in a manner that will make saving equal lo investments automatically through the mechanism of the rate of interest. But modern economists believe that there is no automatic capital market mechanism making S = I. Some outside force or action or mechanism must be geared into action to make S = I. This outside action, force or mechanism is monetary policy, which can stimulate or retard investment spending. The model shows that monetary policy helps the capital market to bring savings (Rs. 1,000) equal to investments (Rs. 1,000).

Three Sector Model:

The three sector model of a simple economy shows the circular flow of economic activity involving government transactions. Government incurs expenditure on goods and services and gets receipts in the form of taxes. Taxes which are levied by the government constitute an important source of leakage apart from savings; whereas government expenditure on the purchase of goods and services constitutes an important source of injection.

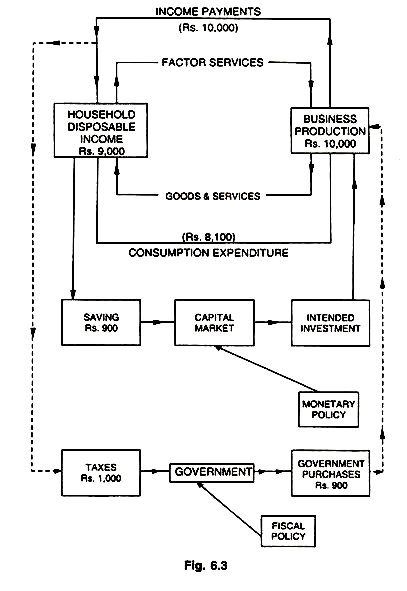

When we give money to governments (Central, State, Local) in the form of taxes, our ability to spend is reduced but the government can offset the effect of this leakage through taxes by spending more on the purchase of goods and services called injection. This act on the part of the government to levy taxes and to spend more is called fiscal action. The working of the three sector model involving government transactions, taxes and expenditure is shown in the model given in Fig. 6.3.

The model shows that the government collects Rs. 1,000 of the household income in the form to taxes. This will reduce the household consumption as well as saving, which in turn, will reduce business sales. But if there is a new source of injection in the form of government purchase and expenditure on goods and services, it will offset the affects of the tax leakage.

If the government purchases (expenditure) from the business sector are equal to the amount by which the taxes reduce consumption, total business sales will again equal production and the circular flow of the economy involving three sectors will be Maintained. In the model the total output is worth Rs. 10,000 before taxes.

The government levies taxes worth Rs. 1,000 reducing the disposable income of the household sector to Rs. 9,000. This causes the households to reduce consumption by Rs. 900 and saving by Rs. 100, as such the new level of saving is Rs. 900 and the level of consumption expenditure is Rs. 8,100. If intended investment remains as before (Rs. 1,000) total expenditure on C and I will be Rs. 9,100.

Therefore, the government must purchase and spend on goods and services Rs. 900 to make the total demand equal to the total value of the output i.e., Rs. 10,000. What is important is that total expenditure must equal total output—which is equivalent to saying that total leakages must equal total injections.

We see in the model that government expenditure is not equal to taxes and savings are no longer equal to intended investments but the macroeconomic equilibrium or the circular flow of the economy obtains nevertheless because total expenditure is equal to the value of total output. In the model taxes and savings (leakages) have reduced consumption to Rs. 8,100—what is therefore, required is some source of demand (injections) worth Rs. 1,900 to obtain the equality between income and expenditure.

It could be in the form of intended investment or government purchase or a combination of the two but it must add up to Rs. 1,900. If I < S, then government should compensate the economy by spending more than it taxes. All this involves once again an action or a mechanism which in this case is in the form of fiscal policy on the part of government. It is, therefore, clear that the monetary policy and the fiscal policy are necessary instruments of maintaining circular flows in the economy—in case it is temporarily disrupted by leakages in the form of savings in two sector model or taxes in the three sector model or imports in the four sector model.

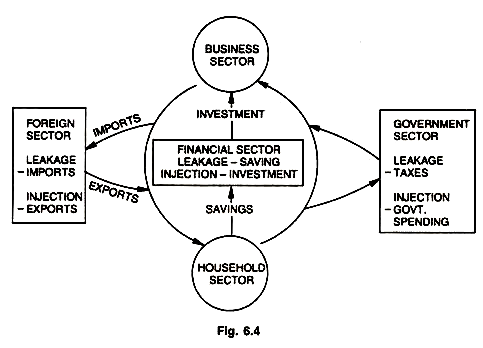

Four Sector Model:

ADVERTISEMENTS:

The two sector or three sector models given above of a simple closed economy can be extended to four sector open economy by waiving the assumption of closed economy. The four sector model includes foreign trade and transactions taking place in foreign trade sector. When the household sector purchases goods abroad and imports them into the economy—the expenditure represents a leakage from the circular flow. This leakage (import expenditure) has to be offset—offsetting this are the expenditures incurred by foreigners on domestic goods and services (exports) and give rise to injections (export expenditure) into the domestic circular flow.

When these flows are added in our four sector model we treat imports as leakages and exports as injections. These flows pass through a sector called ‘balance of payments’ sector—which is influenced by various types of foreign trade policies (say, like free trade or protection). The equilibrium condition for maintaining the circular flow would still be that total leakage must equal total injections. However, in the four sector open model leakage would consist of imports besides savings and taxes and injections would consist of exports besides investment and government expenditure.

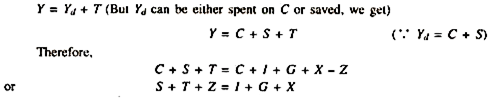

In the symbolic form the four sector model of circular flow can be shown as follows:

Let us put NNP = Y, consumption expenditure including imports = C, intended investment = I, government purchase of goods and services = G, exports = X, and imports = Z. The supply of output available to an economy consists of its domestic production NNP or Y plus the level of imports (Z). In macroeconomic equilibrium condition when circular flow is maintained this Supply must exactly equal the sum of demands of the household, business, government and foreign trade sectors for exports (denoted by X).

As such we may rewrite the condition:

Z + Y = C + I + G + X

or

Y = C + I + G + (X – Z)

Where X – Z represents the net trade balance (the difference between exports and imports).

Denoting savings by S and taxes by T and net disposable income of households by Yd—we rewrite the above equation as follows:

It shows that injections must equal leakages to maintain the circular flow of economic activities in the four sector open economy. As we move from two sector simple model of a closed economy to three sector or four sector model of an open economy the adjustments become necessary. The mechanism of the circular flow for the maintenance of macroeconomic equilibrium remains the same—only the nature of transactions and their adjustments undergo a change as is shown by a generalized picture of a model is given below.

The model shows the various kinds of transactions which originate and take place in different sectors of the economy and cause complications but once the necessary adjustments between leakages and injections like saving and investment in two sector model—taxes and government expenditure in three sector model and imports and exports in four sector model are made—the circular How of economic activity of the macroeconomic; static equilibrium is obtained irrespective of the fact whether these minor constituents (activities) are equal to each other or not what is required at the macro level is that the circular flow of activities must be so adjusted that the aggregate income generated must equal the aggregate value of the final output.