The sources of funds refer to the mediums by which an organization raises its long-term capital and working capital.

The organization can select any of the sources of funds depending upon the need and gestation period of the project to be financed.

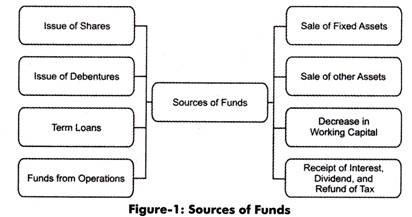

Figure-1 shows various sources of funds:

The explanation of these sources of funds (as shown in Figure-1) is given as follows:

ADVERTISEMENTS:

(a) Issue of Shares:

Involve the public issue of equity and preference shares in the stock exchange. Issuing shares is the most common method of raising long-term capital because there are various many investors who are ready to invest in the capital market. Therefore, shares are used to finance projects having long gestation period.

(b) Issue of Debentures:

ADVERTISEMENTS:

Involve the collection of funds by issuing debentures in the stock exchange. When an organization issues debentures, it needs to pay a fixed rate of interest to debenture holders.

(c) Term Loans:

Refers to the funds that are raised from financial institutions for financing long-term projects. The rate of interest on term loans is higher than the rate of interest on debentures.

(d) Fund from Operations:

ADVERTISEMENTS:

Refers to the fund raised by the organization’s own operations. It is the accumulated profit of an organization; therefore, can be used to finance various short-term and long-term projects.

(e) Sale of Fixed Assets:

Helps in generating funds by selling fixed assets, such as land, buildings, plants, and machineries to finance short-term and long-term projects. However, the usage of this method may hamper the goodwill and creditworthiness of the organization.

(f) Sale of Current Assets:

Involves selling assets, such as bills receivables and stocks. These assets are generally sold by an organization to meet short-term fund requirements.

(g) Decrease in Working Capital:

Refers to the reduction in the working capital either by decreasing current liabilities or increasing current assets. The increase in current assets or decrease in current liabilities provides funds for financing short-term projects.

(h) Receipt of Interest, dividend, and refund of tax:

Helps in financing short-term projects or meeting the working capital needs. This type of funds does not create any liability, as these are income of the organizations. Capital budgeting is performed by using various techniques. These techniques help in measuring the actual cost and returns generated from a project and comparing multiple projects with respect to their profitability. However, the actual cost and returns of a project cannot be forecasted without understanding the concept of TVM.