The term profit has distinct meaning for different people, such as businessmen, accountants, policymakers, workers and economists.

Profit simply means a positive gain generated from business operations or investment after subtracting all expenses or costs.

In economic terms profit is defined as a reward received by an entrepreneur by combining all the factors of production to serve the need of individuals in the economy faced with uncertainties. In a layman language, profit refers to an income that flow to investor. In accountancy, profit implies excess of revenue over all paid-out costs. Profit in economics is termed as a pure profit or economic profit or just profit.

Profit differs from the return in three respects namely:

ADVERTISEMENTS:

a. Profit is a residual income, while return is a total revenue

b. Profits may be negative, whereas returns, such as wages and interest are always positive

c. Profits have greater fluctuations than returns

According to modern economists, profits are the rewards of purely entrepreneurial functions. According to Thomas S.E., “pure profit is a payment made exclusively for bearing risk. The essential function of the entrepreneur is considered to be something which only he can perform. This something cannot be the task of management, for managers can be hired, nor can it be any other function which the entrepreneur can delegate. Hence, it is contended that the entrepreneur receives a profit as a reward for assuming final responsibility, a responsibility that cannot be shifted on the shoulders of anyone else.”

ADVERTISEMENTS:

For understanding the profit as a business objective, you need to learn two most important concepts, such as economic profit and accounting profit.

Types of Profit:

Different people have described profit differently. Individuals have associated profit with additional income revenue, and reward. However, none of the description of profit is said to be right or wrong; it only depends on the field which the word profit is described.

On the basis of fields, profit can be classified into two types, which are explained as follows:

i. Accounting Profit:

ADVERTISEMENTS:

Refers to the total earnings of an organization. It is a return that is calculated as a difference between revenue and costs, including both manufacturing and overhead expenses. The costs are generally explicit costs, which refer to cash payments made by the organization to outsiders for its goods and services. In other words, explicit costs can be defined as payments incurred by an organization in return for labor, material, plant, advertisements, and machinery.

The accounting profit is calculated as:

Accounting Profit= TR-(W + R + I + M) = TR- Explicit Costs

TR = Total Revenue

W = Wages and Salaries

R = Rent

I = Interest

M = Cost of Materials

The accounting profit is used for determining the taxable income of an organization and assessing its financial stability. Let us take an example of accounting profit. Suppose that the total revenue earned by an organization is Rs. 2, 50,000. Its explicit costs are equal to Rs. 10, 000. The accounting profit equals = Rs. 2, 50,000 – Rs. 10,000 = Rs. 2, 40,000. It is to be noted that the accounting profit is also called gross profit. When depreciation and government taxes are deducted from the gross profit, we get the net profit.

ADVERTISEMENTS:

ii. Economic Profit:

Takes into account both explicit costs and implicit costs or imputed costs. Implicit that is foregone which an entrepreneur can gain from the next best alternative use of resources. Thus, implicit costs are also known as opportunity cost. The examples of implicit costs are rents on own land, salary of proprietor, and interest on entrepreneur’s own investment.

Let us understand the concept of economic profit. Suppose an individual A is undertaking his own business manager in an organization. In such a case, he sacrifices his salary as a manager because of his business. This loss of salary will opportunity cost for him from his own business.

The economic profit is calculated as:

ADVERTISEMENTS:

Economic profit = Total revenue-(Explicit costs + implicit costs)

Alternatively, economic profit can be defined as follows:

Pure profit = Accounting profit-(opportunity cost + unauthorized payments, such as bribes)

Economic profit is not always positive; it can also be negative, which is called economic loss. Economic profit indicates that resources of a business are efficiently utilized, whereas economic loss indicates that business resources can be better employed elsewhere.

ADVERTISEMENTS:

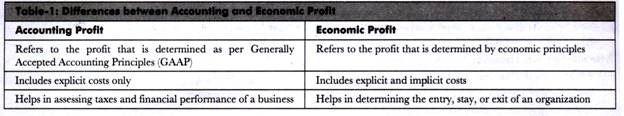

The difference between the accounting profit and economic profit is shown in Table-1:

Theories of Profit:

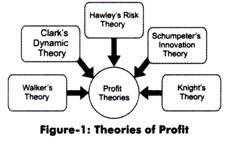

Profits of businesses depend on the successful management of risks and uncertainties by entrepreneurs. These risks can be cost risks due to change in wage rates, prices, or technology, and other market risks. Different economists have presented different views on profit. Some of the most popular theories of profit are shown in Figure-1:

The different theories of profit (as shown in Figure-1).

Walker’s Theory:

ADVERTISEMENTS:

An American economist, Prof F. A. Walker propounded the theory of profit, known as rent theory of profit. According to him “as rent is the difference between least and most fertile land similarly, profit is the difference between earnings of the least and most efficient entrepreneurs.” He advocated that profit is the rent of exceptional abilities that an entrepreneur possesses over others.

According to Walker; profit is the difference between the earnings of the least and most efficient entrepreneurs. An entrepreneur with the least efficiency generally strives to cover only the cost of production. On the other hand, an efficient entrepreneur is rewarded with profit for his differential ability.

Thus, profit is also said to be the reward for differential ability of the entrepreneur. While formulating this theory, Walker assumed the condition of perfect competition in which all organizations are supposed to have equal managerial ability. In this case, there is no pure profit and all the organizations earn only managerial wages known as normal profit.

The rent theory was mainly criticized for its inability to explain the real nature of profits.

Apart from this, the theory failed on the following aspects:

a. Provides only a measure of profit. The theory does not focus on the nature of profit, which is of utmost importance.

ADVERTISEMENTS:

b. Assumes that profits arise because of the superior or exceptional ability of the entrepreneur, which is not always true. Profit can also be the result of the monopolistic position of the entrepreneur.

Clark’s Dynamic Theory:

Clark’s dynamic theory was introduced by an American economist, J.B. Clark. According to him, profit does not arise in a static economy, but arise in a dynamic economy. A static economy is characterized as the one where the size of population, the amount of capital, nature of human wants, the methods of production remain the same and there is no risk and uncertainty. Therefore, according to Clark, only normal profits are earned in the static economy. However, an economy is always dynamic in nature that changes from time to time.

A dynamic economy is characterized by increase in population, increase in capital, multiplication of consumer wants, advancement in production techniques, and changes in the form of business organizations. The dynamic world offers opportunities to entrepreneurs to make pure profits.

According to Clark, the role of entrepreneurs in a dynamic environment is to take advantage of changes that help in promoting businesses, expanding sales, and reducing costs. The entrepreneurs, who successfully take advantage of changing conditions in a dynamic economy, make pure profit.

There are internal and external factors that make the world dynamic. The internal changes are changes that take place within the organization, such as layoff and hiring of employees, product changes, and changes in infrastructure. The external changes are of two kinds, namely, regular changes and irregular changes.

ADVERTISEMENTS:

Regular changes involve fluctuations in trades that affect profits On the other hand; irregular changes include contingencies, such fire, earthquake, floods, and war. Thus, according to Clark, profits are a result of changes and no profit is generated in case of static economy.

However Prof Knight criticized the dynamic theory on the basis that only those changes that cannot be foreseen yield profits. He further says, “It cannot, then, be change, which is the cause of profit, since if the law of change is known, as in fact is largely the case, no profits can arise. Change may cause a situation out of which profit will be made, if it brings about ignorance of the future.”

Hawley’s Risk Theory:

The risk theory of profit was given by F. B. Hawley in 1893. According to Hawley, “profit is the reward of risk taking in a business. During the conduct of any business activity, all other factors of production i.e. land, labor, capital have guaranteed incomes from the entrepreneur. They are least concerned whether the entrepreneur makes the profit or undergoes losses.”

Hawley refers profit as a reward for taking risk. According to him, the greater the risk, the higher is the expected profit. The risks arise in the business due to various reasons, such as non-availability of crucial raw materials, introduction of better substitutes by competitors, obsolescence of a technology, fall in the market prices, and natural and manmade disasters. Risks in businesses are inevitable and cannot be predicted. According to Hawley, an entrepreneur is rewarded for undertaking risks.

There is a criticism against this theory that profits arise not because risks are borne, but because the superior entrepreneurs are able to reduce them. The profits arise only because of better management and supervision by entrepreneurs. Another criticism is that profits are never in the proportion to the risk undertaken. Profits may be more in enterprises with low risks and less in enterprises with high risks.

ADVERTISEMENTS:

Knight’s Theory:

Prof Knight propounded the theory known as uncertainty-bearing theory of profits. According to the theory, profit is a reward for the uncertainty bearing and not the risk taking. Knight divided the risks into calculable and non-calculable risks. Calculable risks are those risks whose probability of occurrence can be easily estimated with the help of the given data, such as risks due to fire and theft.

The calculable risks can be insured. On the other hand, non-calculable risks are those risks that cannot be accurately calculated and insured such as shifts in demand of a product. These non-calculable risks are uncertain, while calculable risks are certain and can be anticipated.

According to Knight, “risks are foreseen in nature and can be insured”. Thus, risk taking is not a function of an entrepreneur, but of insurance organizations. Therefore, an entrepreneur gets profit as a reward for bearing uncertainties and not for risks that are borne by insurance organizations.

The theory of uncertainty bearing is criticized on the following grounds:

a. Assumes that profit is the result of uncertainty bearing ability of an entrepreneur, which does not always hold true. The profit can also be the reward for other aspects, such as strong co-ordination and market share.

b. Fails to show any relevance with the real world.

Schumpeter’s Innovation Theory:

Joseph Schumpeter propounded a theory called innovation according to which profits are the reward for innovation He advocated that innovation is the introduction of a new product, new technology, new method of production, and new sources of raw materials. This helps in lowering the cost of production or improving the quality of production. Innovation also includes new policy or measure by an entrepreneur for an organization.

In general, innovation can take place in two ways, which are as follows:

a. Reducing the cost of production and earning high profit. The cost of production can be reduced by introducing new machines and improving production techniques.

b. Stimulating the demand by enhancing the existing improvement or finding new markets.

According to innovation theory, profit is the cause and effect of innovations. In other words, it acts as a necessary incentive for making innovation.

Schumpeter’s innovation theory is criticized on two aspects, which are as follows:

a. Ignores uncertainty as a source of profit

b. Denies the role of risk in profit

Functions of Profit:

Profit is the primary objective of all business organizations. The expectation of earning higher profits of business organizations induces them to invest money in new ventures. This results in large employment opportunities in the economy which further raises the level of income. Consequently, there is a rise in the demand for goods and services in the economy. In this way, profit generated by business organizations play a significant role in the economy.

According to Peter Ducker, there are three main purposes of profit, which are explained as follows:

i. Tool for measuring performance:

Refers to the fact that profit generated by an organization helps in estimating the effectiveness of its business efforts. If the profits earned by an organization are high, it indicates the efficient management of its business. However, profit is not the most efficient measure of estimating the business efficiency of an organization, but is useful to measure the general efficiency of the organization.

ii. Source of covering costs:

Helps organizations to cover various costs, such as replacement costs, technical costs, and costs related to other risks and uncertainties. An organization needs to earn sufficient profit to cover its various costs and survive in the business.

iii. Aid to ensure future capital:

Assures the availability of capital in future for various purposes, such as innovation and expansion. For example, if the retained profits of an organization are high, it may invest in various projects. This would help in the business expansion and success of the organization.

Apart from aforementioned functions, following are the positive results of high profits:

i. Investment in research and development:

Leads to better technology and dynamic efficiency. An organization invests in research and development activities for its further expansion, if it earns high profit. The organization would lose its competitiveness, if it does not invest in research and development activities.

ii. Reward for shareholders:

Includes dividends for shareholders. If an organization earns high profits, it would provide high dividends to shareholders. As a result, the organization would attract more investors, which are crucial for the growth of the organization.

iii. Aid for economies:

Implies that profits are helpful for economies. If organizations generate high profits, they would be able to cope with adverse economic situations, such as recession and inflation. This results in stability of economies even in adverse situations.

iv. Tool to stimulate government finances:

Implies that if the profits generated by organizations are high, they are liable for paying high taxes. This helps government to earn high revenue and spend for social welfare.