Profit maximization is the most important assumption used by economists to formulate various economic theories, such as price and production theories.

According to conventional economists, profit maximization is the only objective of organizations.

Therefore, profit maximization forms the basis of conventional theories. It is regarded as the most reasonable and productive business objective of an organization. Apart from this, profit maximization helps in determining the behavior of business organizations as well as the effect of various economic factors, such as price and output, in different market conditions.

The total profit (Π) of a business organization is calculated by taking the difference between Total Revenue (TR) and Total Cost (TC).

ADVERTISEMENTS:

Π = TR – TC

The profit would be maximum when the difference between the total revenue and total cost is maximum. There are two conditions that must be fulfilled for profit maximization, namely, first order condition and second order condition.

First order condition requires that Marginal Revenue (MR) should be equal to Marginal Cost (MC). Marginal revenue is defined as revenue obtained from sale of last unit of output, whereas marginal cost is the cost incurred due to production of one additional unit of output. Both TR and TC functions involve a common variable, which is output level (Q).

The first order condition states that first derivative of profit must be equal to zero.

ADVERTISEMENTS:

We know Π = TR – TC

Taking its derivative with respect to Q,

∂Π/∂Q = ∂TR/ ∂Q – ∂TC/∂Q = 0

This condition holds only when ∂TR/ ∂Q = ∂TC/ ∂Q

ADVERTISEMENTS:

∂TR/∂Q provides the slope of TR curve, which, in turn, gives MR. On the other hand; ∂TC/∂Q gives the slope of TC curve, which is same as MC. Thus, the first-order condition for profit maximization is MR=MC.

Second order condition requires that first order condition must be satisfied in case of decreasing MR and rising MC.

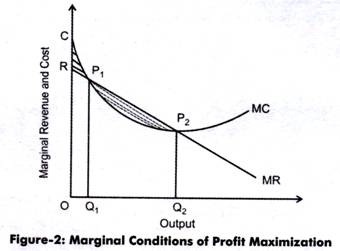

This condition is shown in Figure-2:

As shown in Figure-2, MR and MC curves are derived from TR and TC functions. It can be seen from Figure-2 that MR and MC curves intersect at points P1 and P2. MR is less than MC at point P2, thus, the second order condition is satisfied at point P2.

Numerically, the second order condition is given as:

∂2Π/∂Q2 = ∂2TR/∂Q2 — ∂2TC/∂Q2

∂2TR/∂Q2 — ∂2TC/∂Q2 < 0

∂2TR/∂Q2 < ∂2TC/∂Q2

ADVERTISEMENTS:

Slope of MR < Slope of MC

From aforementioned equation, it can be concluded that MC must have a steeper slope than MR or MC must intersect from below. Thus, profit is maximized when both first and second order conditions are satisfied.

Controversy over Profit Maximization:

The conventional theory of economics assumes profit maximization as the sole objective of organizations. However, in the real world, there are various other objectives fulfilled by organizations. Some other important objectives of organizations include sales maximization, growth rate maximization, managerial utility function maximization, and retention of market share.

Apart from this, the conventional theory also assumes that organizations have perfect knowledge of the business environment, demand, and cost conditions. However, according to modern economists, organizations do not possess perfect knowledge of business environment and their price and output decisions are based on probability.

ADVERTISEMENTS:

The arguments against maximization of profit does not imply that theory of profit has no relevance or of less importance for business organization. Economists have considered profit maximization as one of the important business objective of organizations. Therefore, they have made certain hypotheses mentioning the importance of profit maximization.

These hypotheses are shown in Figure-3:

The hypotheses given by economists in favor of profit maximization (as shown in Figure-3) are discussed as follows:

ADVERTISEMENTS:

i. Profit is indispensible for organization’s survival:

Implies that profit acts as a necessary condition for the success of an organization. Once the profit is achieved, organizations try to maximize it. Higher profits generated by organizations help them in their further growth and development.

ii. Profit helps in achieving other objectives:

Implies that alternative objectives of organizations, maximization of growth rate, maximization of sales, and high market share, can be achieved with the help of profit.

iii. Profit maximization has a greater predicting power:

Implies that profit act as a powerful basis for predicting certain aspects of organization’s behavior.

ADVERTISEMENTS:

iv. Profits acts as measure for organization’s efficiency:

Implies that profit is the most reliable measure of efficiency of the organization. It acts as a major source of internal finance for an organization. According to a study, in developed countries, internal sources of finance contribute more than three fourth of the total profit.